Post about football, and everyone argues.

Post about politicians, and everyone argues.

Post about money, and no one cares.

Post about Bitcoin, the best form of money, and still, no one cares.

This is exactly what I see in my WhatsApp family and friends groups.

Nuno Duarte

npub1qr87...c9xm

The same people who say Bitcoin at $100k is too expensive will be the ones claiming it’s going to zero during a major correction.

And this cycle will keep repeating until they stop viewing #Bitcoin through the lens of a currency that only goes down.

If you haven’t started yet, make 2025 the year to build your own #Bitcoin strategic reserve.

My 2024 Through the Lens of #Bitcoin …

- Started running my own Bitcoin node and Lightning node.

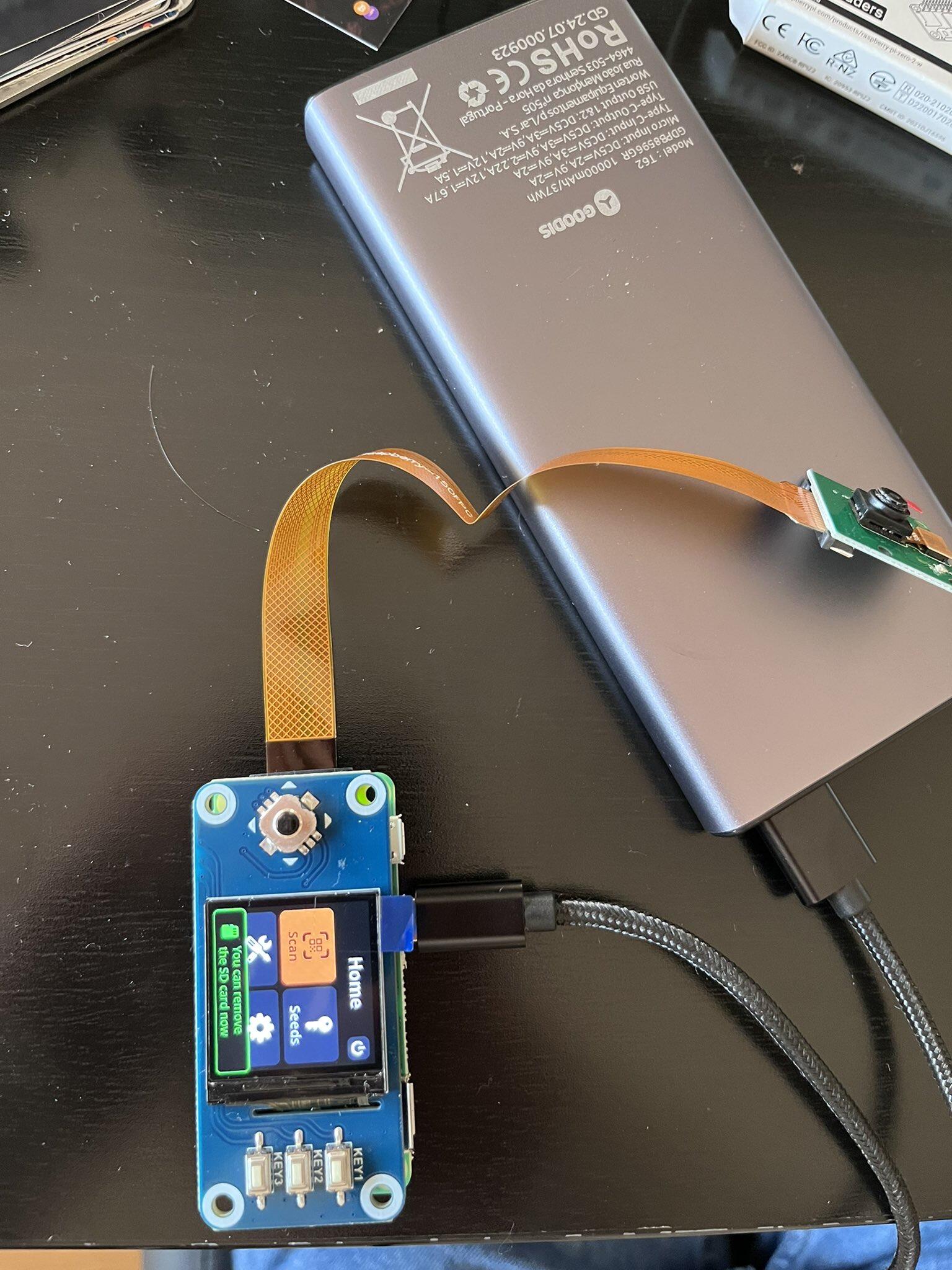

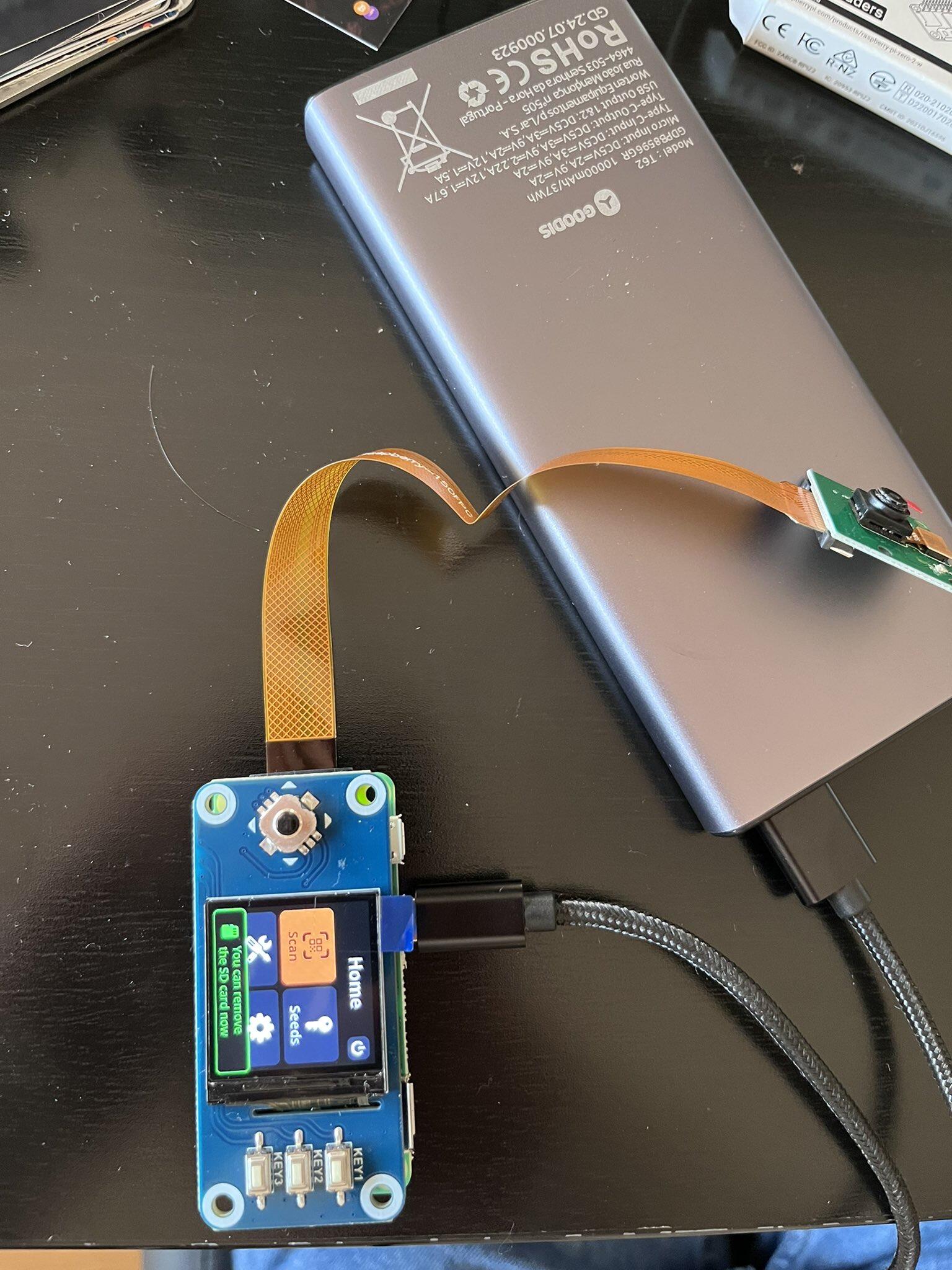

- Built my own open-source hardware Bitcoin wallet.

- Launched @usatoshi_ to help others understand Bitcoin.

- Made Bitcoin my go-to gift for weddings, newborns, and Christmas.

- Took my first steps into mining with a Bitaxe.

- Onboarded friends, family, and even a coffee shop in Krabi, Thailand, to Bitcoin.

- Attended my first Bitcoin conference

Step by step, block by block, through the lens of Bitcoin, 2025 looks even brighter.

Spending the last days of the year in the beautiful city of Bruges and paying for my lunch with the best form of money ever created, #Bitcoin !

No fiat money involved, no banks, and no third parties standing in the way.

Just my Umbrel at home in Portugal, running my Bitcoin and Lightning node, giving me complete financial sovereignty.

This is what freedom looks like, a global, borderless, decentralised and permissionless form of money that gives back the power to the people.

Like @Bart Mol said in one of the most important talks I heard about Bitcoin at Bitcoin Amsterdam: ‘Use it or lose it.’ And I’m doing my part!

Central banks print money out of thin air while you break your back to earn it.

Your time and energy deserve to last. #Bitcoin is the way.

HODL tight, and have a wonderful ₿itcoin Christmas!

Whether you like it or not, agree with it or not, #Bitcoin is inevitable.

Sooner or later, everyone will use it in one way or another.

Study #Bitcoin 🟠⚡️

Whether you like it or not, agree with it or not, #Bitcoin is inevitable.

Sooner or later, everyone will use it in one way or another.

Study #Bitcoin 🟠⚡️

Houses are expensive in euros, cheaper in gold, and cheapest in #Bitcoin.

If you understand why, you’re already ahead of the curve.

The journey from $0 to $100k was harder than the journey from $100k to $1M will be.

Study hashtag#Bitcoin ⚡️🟠

Se tens 35 anos e começaste a trabalhar aos 22, já acumulaste 13 anos de trabalho.

Agora faz as contas comigo:

Excluindo fins de semana, feriados e os 22 dias de férias anuais, já trabalhaste cerca de 3200 dias.

Com uma média de 8 horas por dia (e em muitos casos, mais), isso dá mais de 26.000 horas.

26 mil horas a trocar o teu tempo e energia por dinheiro.

E mesmo assim…

- Comprar casa parece impossível.

- Pagar uma renda custa cada vez mais.

- Constituir uma família? Um sonho adiado.

Porquê?

Porque o dinheiro deveria desempenhar três funções essenciais e apenas desempenha duas delas:

1️⃣ Ser uma moeda de troca – algo que usamos para trocar por bens e serviços. ✅

2️⃣ Ser uma unidade de conta – um padrão para medir e comparar o valor das coisas. ✅

3️⃣ Ser uma reserva de valor – ou seja, o dinheiro que ganhas hoje deveria preservar, ou até aumentar o teu poder de compra no futuro. ❌

É nesta ultima função que o dinheiro falha redondamente.

Desde 1971, com o fim do padrão-ouro no famoso Nixon Shock, o dinheiro deixou de proteger o teu poder de compra.

Com o fim dessa ligação ao ouro, os bancos centrais passaram a poder emitir dinheiro sem limites, aumentando a oferta monetária sem qualquer responsabilidade. Essa desvalorização contínua do dinheiro teve e tem consequências profundas.

A inflação é o resultado direto deste sistema. Um "imposto invisível" que corrói o valor do que ganhaste com o teu esforço e trabalho, fazendo com que as tuas poupanças sejam sugadas, ano após ano.

Tal como investiste mais de 26.000 horas a ganhar dinheiro, porque não investir apenas 0.5% desse tempo a estudá-lo?

- 0.5% de 26.000 horas dá 130 horas.

- Para investir essas 130 horas num 1 ano, bastam 22 minutos por dia.

- 22 minutos por dia é o suficiente para entenderes o porquê do sistema financeiro falhar.

- É o suficiente para perceberes o motivo pelo qual #Bitcoin é parte da solução.

22 minutos é uma pausa para o almoço, são as viagens de metro para o trabalho, são as pausas para o cigarro.

Não é o dinheiro que te prende. É o que não sabes sobre ele.

Qual é o preço do Dinheiro?

A lei da oferta e da procura é o que determina o preço. Quando a procura por um bem aumenta, o preço tende a subir, quando a procura diminui, o preço tende a baixar.

Este mesmo princípio aplica-se ao dinheiro: se a procura por dinheiro é maior do que a sua oferta, o “preço” do dinheiro aumenta, se a oferta de dinheiro é maior do que a procura, o “preço” do dinheiro diminui.

Mas o que é o “preço” do dinheiro? Simples, é o seu poder de compra!

Assim, se há muita procura para uma oferta limitada de dinheiro, o poder de compra do dinheiro aumenta, ou seja, o dinheiro vale mais e permite comprar mais bens com a mesma quantia.

Pelo contrário, quando a oferta de dinheiro é abundante e a procura é baixa, o poder de compra do dinheiro cai, sendo necessário mais dinheiro para adquirir os mesmos bens.

Esta é a grande diferença entre #Bitcoin e todas as restantes formas de dinheiro que existem ou já existiram.

Há 16 anos, Satoshi Nakamoto partilhou o whitepaper do #Bitcoin, a maior e melhor inovação que a humanidade já viu, resumida em apenas 9 páginas.

Obrigado Satoshi Nakamoto 🟠🙏

Há 16 anos, Satoshi Nakamoto partilhou o whitepaper do #Bitcoin, a maior e melhor inovação que a humanidade já viu, resumida em apenas 9 páginas.

Obrigado Satoshi Nakamoto 🟠🙏Do not be like the Dodo. Use #Bitcoin...

The Dodo was a bird native to the island of Mauritius that lost its ability to fly due to the favorable conditions of the island, which eventually led to its extinction. The island where the Dodo lived had few predators, which meant that the Dodo did not need to take refuge in the treetops for protection. Additionally, the abundance of fruits and seeds allowed it to feed with little effort.

Flying is an activity that consumes a lot of energy, and since the Dodo had everything it needed on the ground, the need to fly gradually disappeared. Following the concept of the use/disuse theory, the Dodo eventually lost the ability to fly; its wings stopped developing, making it a terrestrial animal. With the arrival of humans and the introduction of new predators, such as pigs and rats, Dodo eggs became easy prey. Without the ability to fly up and build nests in trees, Dodos and their eggs became vulnerable targets, leading to their extinction.

The Dodo had no incentive to fly because it had everything it needed: food and safety. It didn't need to expend energy to survive. The same can happen with Bitcoin if it is not used. If we stop using it, it will become useless and eventually fade away.

Bitcoin’s Monetary Premium: Perfectly Aligned Incentives

The Bitcoin protocol thrives on a monetary system where incentives are perfectly aligned. Miners, who are responsible for validating transactions and securing the network, consume large amounts of electricity to generate new blocks and are rewarded for their work. This reward consists of two elements: the block subsidy and transaction fees.

The block subsidy is a fixed amount of new bitcoins created and given to the miner who discovers a new block, serving as an incentive to keep the network secure. If miners work, they get rewarded; if they don’t, they don’t. In addition to the subsidy, they also receive the fees paid by those making Bitcoin transactions. In other words, the more people transact in BTC, the greater the compensation for miners.

The system is designed so that any miner attempting to add a fraudulent transaction would need to expend an immense amount of computational power and energy. The cost of trying to deceive the network is so high that it becomes economically unfeasible. Following the rules is the only rational choice, which ensures that the incentives for honest behavior are perfectly aligned across the network.

Approximately every 210,000 blocks, or about every 4 years, the block subsidy is halved, an event known as the halving. This reduction will continue until the subsidy reaches zero, at which point miners will be rewarded solely by transaction fees.

If no one uses Bitcoin for its intended purpose, there will be fewer transactions, lower fees, and less return for miners, leading to a misalignment of incentives. Why would miners spend so much energy for such low rewards? The same thing happened to the Dodo, and the same can happen to Bitcoin if we don’t use it.

From “Don’t Sell” to “Use Your Bitcoin”

By actively using Bitcoin, you help maintain its value, increase its utility, and keep the incentives aligned for everyone in the network — from miners to users.

Here are a few practical ways you can start using Bitcoin today:

Shop at merchants who accept Bitcoin: Use resources like BTCmap to find nearby businesses that accept BTC, and make your payments with Bitcoin instead of traditional currencies. Supporting these businesses encourages more adoption.

Offer your services or products for Bitcoin: If you run a business, provide freelance services, or sell goods, make Bitcoin a payment option. The Strike wallet is an easy-to-use solution to start accepting Bitcoin payments.

Run your own Bitcoin node: By running a node, you validate your transactions and contribute to the network’s security and decentralization. Solutions like Umbrel make it easy to set up your own Bitcoin node.

Do your own custody: Take control of your Bitcoin by securing your funds in a non-custodial waet, rather than leaving them on exchanges. Hardware wallets like Trezor or BitBox are excellent choices for self-custody.

Use a home miner: If possible, set up a miner at home and contribute to the decentralization of the network’s computational power. Bitcoin Brabant is a reliable merchant where you can purchase BitAxes for home mining.

Bitcoin, a superior form of money

Gresham’s Law states that strong money drives weak money out of circulation because people prefer to spend quickly the money that is worth less and save the money that retains value over time. And that’s what’s happening with Bitcoin.

Bitcoin has all the characteristics of strong money: it is the best form of money that has ever existed, has a limited supply, does not favor friends of the king (because there is no king), no one can increase its issuance, it is predictable, accessible to all, without geographic, political, or ideological boundaries. It is censorship-resistant and unconfiscatable. What’s missing? We need to continue adopting Bitcoin, not just as a store of value but also as a medium of exchange!

Using Bitcoin

At The Bitcoin Conference in Amsterdam, I bought my first miner for around 220 euros. My first instinct was to pay with my credit card, but I remembered the Dodo, and instead, I converted euros to Bitcoin and paid via the Lightning Network.

Gresham’s Law was confirmed. I took euros out of circulation by converting them to BTC, I used Bitcoin and gave it utility. And by paying with Bitcoin, I paid fewer fees than if I had used euros.

Now, I’m taking my commitment to Bitcoin further. I’m running an Umbrel node, securing the network and validating transactions. I practice self-custody, keeping my Bitcoin safe in my own hands. I even run my own miner, contributing to the decentralization of the network’s computational power. Whenever I can, I pay with sats using my Strike wallet — step by step, block by block, I’m building the future of money.

Transferred €220 with traditional banking and paid €1.5 in fees (0.682%).

Did the same transfer to buy this Bitaxe from Bitcoin Brabant using #Bitcoin Lightning and paid just 2 sats (~€0.00112).

That’s 1,345x cheaper using Bitcoin!

#Bitcoin is a moral choice. What will you teach your kids, max out on debt or save for the future?

#bitcoinamsterdam

They break countries, manipulate interest rates, and watch societies crumble. Then they swoop in like saviors with the IMF, offering ‘rescue’ loans that only deepen the cycle of debt and dependency. Crisis, chaos, and control—all by design.

Bitcoin is public infrastructure for money, like the internet is public infrastructure for communication, no roadmap, no CEO, no fundraising, no team.

All other cryptos? Some with their own pros, but they are just high-tech startups, complete with CEOs, roadmaps, and VC funding. Simple as that.