this year, going long Treasuries might have gotten a trader or two fired

next year, there will be asset managers fired for not locking in 5% Treasury yields during 2023

market shifts are much easier seen in hindsight

Nik Bhatia

npub1qw6e...2v52

thebitcoinlayer.com

BLOODBATH IN US TREASURIES CONTINUES

dollar squeeze as well, especially in Japan

somebody is getting liquidated, or perhaps this is the blowup of the basis trade that many have been warning about, including the BIS most recently:

Margin leverage and vulnerabilities in US Treasury futures

Box extracted from Overview chapter "Resilient risk-taking in financial markets", BIS Quarterly Review September 2023.

there rates go ↗️

and the Treasury deluge hasn’t even really quite started

ever seen the crowding out effect in action?

Q4 shaping up to be a wild one!

midterm tonight…don’t show my students

good morning

count your blessings!

I have the great honor and privilege to begin my 5th year as an adjunct professor @ USC Marshall tomorrow.

I’ll be teaching bitcoin this semester to grad students as it approaches its 15th birthday and 4th halving.

Blessed!

Jobless claims are creeping up. Highest in almost two years. Lagged effects of tightening hitting labor market NOW.

This year’s Bilderberg topics, banking system top of mind 👀

A.I.

Banking system

China

Energy transition

Europe

Fiscal challenges

India

Industrial policy and trade

NATO

Russia

Transnational threats

Ukraine

U.S. leadership

covered by CNBC now 🤷🏽♂️👇🏽

CNBC

A secretive annual meeting attended by the world's elite has A.I. top of the agenda

OpenAI CEO Sam Altman will join forces with key leadership from Microsoft, DeepMind and Google on Thursday as the secretive Bilderberg Meeting kick...

While many obsess over the debt ceiling fight, markets ponder what an agreement will bring in terms of liquidity drain, as the Treasury refills its general account at the Fed. Money used to buy T-bills means money not hitting the system elsewhere (until govt spends it). We wait.

I am very excited to announce “Layered Money Goes to DC”! In June, I’ll head to the Capitol to meet with members of Congress, give them copies of my book Layered Money, and represent bitcoin as an American ideal. Please consider throwing some sats toward supplying books!

Geyser | Bitcoin Crowdfunding Platform

A Bitcoin crowdfunding platform where creators raise funds for causes, sell products, manage campaigns, and engage with their community.

REGIME SHIFT

something we have been watching closely

the chart shows how strongly positive the correlation is now between 10-year Treasury yields and stocks

when yields head lower, it won't be supportive to stocks as it was last year

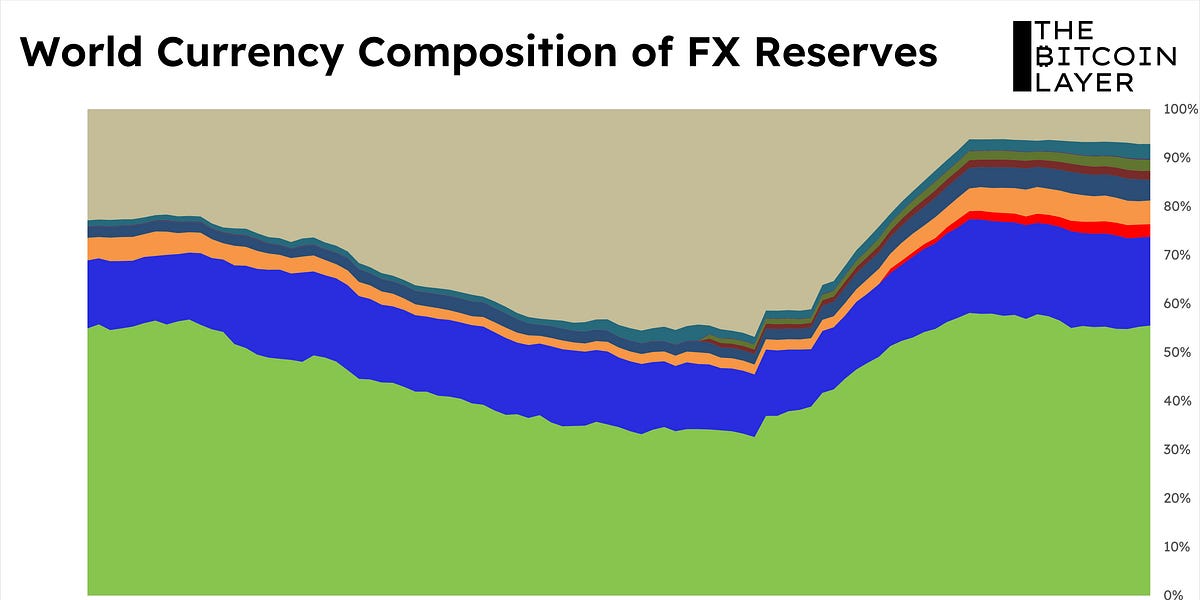

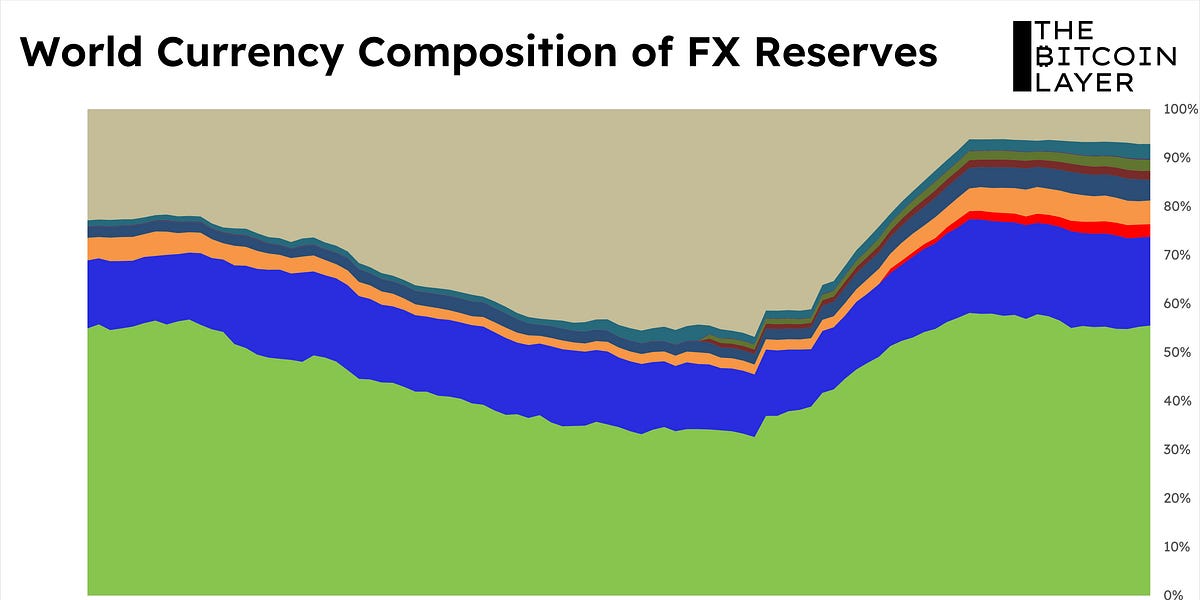

Everywhere you look, it’s dedollarization. Headlines and narratives, of course. Because on the ground and within the banking system, it seems that all anybody wants is dollars. How realistic is dedollarization, though? Not very, especially when you look at the hard numbers. In today’s free post, we’ll explore how hopes of a euro-, yuan-, or gold-centric monetary system are intangible. We’ll also explain how bitcoin adoption is the only competitor with promising, albeit early, momentum.

Bitcoin’s adoption trend calls into question any momentum the euro, yuan, or gold might have in challenging the dollar. The dollar remains dominant and entrenched, but the internet’s currency is just beginning to strengthen its running legs. Let’s see before how long it enters a full sprint.

Dollar Challengers: Euro, Yuan, Gold, and Bitcoin

Four competitors lurk, but which is likely to emerge?

The reason I started a substack in the first place, September 2021, was that I was generally sick of relying on twitter to reach readers

Here’s our latest update, all weekly updates are free to everybody!

Objects In The Mirror Are Closer Than They Appear: TBL Weekly #39

"Robust" jobs data closed out the week — but after many weeks of contractionary economic data, commodity prices, and investor positioning, do not...

Banks under fire for more than poor hedging and low-interest deposit rates. JPMorgan and Deutsche Bank are both being sued by Epstein accusers.

Just published "Jamie Dimon to be interviewed under oath in Epstein sex trafficking case" for #[0]

Jamie Dimon to be interviewed under oath in Epstein sex trafficking case

Banks under fire for more than poor hedging and low-interest deposit rates. JPMorgan and Deutsche Bank are both being sued by Epstein accusers.

Treasury curve in full bull steepen mode. This only occurs when front-end yields collapse. This only happens when rate cuts are priced in. This only happens in recession or financial crisis.

It’s here.

Layered Money just crossed 49,000 total books sold. I would be lying if I said I wasn't really looking forward to 50k. It has been a long journey. Epic timing as I start to clear the deck for deep work on book #2. Beyond blessed. #bitcoin

UBS / Credit Suisse rescue talks are going down to the wire. Doesn’t look like CS is able to open on Monday without a savior.

Wow, even though the slow demise has been apparent to us all for years, still crazy to think about this ship going under.

Next week gon’ be 🔥

Bitcoin adoption happens one use case at a time. It seems that, unbelievably, many are learning about fractional reserve banking for the first time today.

Enter: bitcoin.

To give you a sense of just how differently the front end and long end of the yield curve are behaving.

2s are 13 bps ABOVE their levels from Thursday 3/2, six days ago.

10s are 10 bps BELOW their 3/2 levels.

Expectations are firm for higher policy rates, followed by lower rates. 2s trade with a 5 handle, yet 10s struggle to stay above 4%. It shows the unwillingness of investors to part with their Treasuries despite the higher discount rates.

This is typical late cycle fixed income market behavior.

Just on here zapping myself from my Wallet of Satoshi to my ZBD lnurl #[0]

Lightning 🤝 Nostr