Bitcoin wealth holders are growing, in numbers and in wealth!

According to Henley & Partners‘s most recent report, these are the numbers:

-85,400 fiat millionaires (1 year growth 112%)

-156 centi-millionaires (1 year growth 100%)

-11 billionaires (1 year growth 83%)

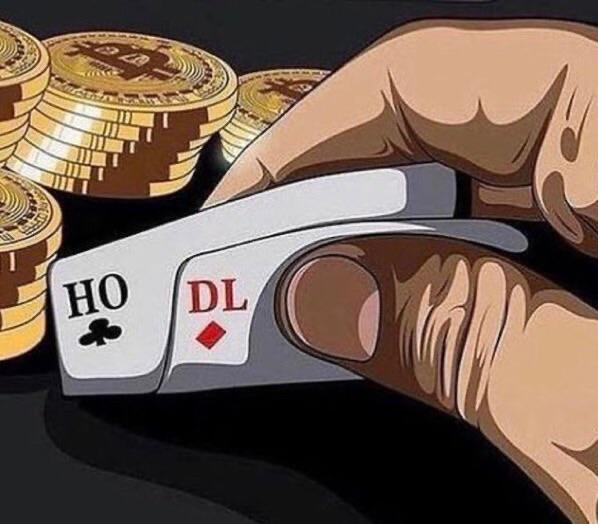

The implications of #bitcoinaires supplanting today's fiat cantillonaires is something most people do not give enough thinking power to.

With #Bitcoin increasing in price, much of what we take for granted today will change. This change will be driven by the ones arbitraging the understanding of Bitcoin's ascent.

Here are a few thoughts:

-Banking and financing landscape will change as financial institutions will increasingly align their products with the demands of bitcoiners.

-Regulations will change in many different areas as bitcoiners will have the power to lobby successfully. Because of their influence (financially and culturally), politicians will increasingly suck up to bitcoiners.

-Global Power dynamics will change as the influence of wealthy Bitcoiners will have geopolitical consequences across the spectrum of nations.

-Money funding innovation will be channeled into the areas that are dearest and nearest to bitcoiners. Study their values and ethics to anticipate where this money is headed.

-Architecture and sceneries are going to change in accordance with the long-term, low-time preferences of bitcoiners.

-Wealth inequality between the top 0.1 % of bitcoiners and the recent will increase as information disseminates and information distribution is not equal, leaving too many Bitcoins for the ones stacking today!

Would love to hear, what others think. Anecdotes and concrete examples showing us a glimpse of the future would be very much welcomed!

Link to report:

Henley & Partners

Crypto Wealth Report 2024

The Crypto Wealth Report 2024 is Henley & Partners’ second annual publication for those following cryptocurrency, private wealth, and investment ...