@Pierre Rochard to the Texas State Senate: "#Bitcoin will continue to accrue long term value, so now is the perfect time to make a strategic investment."

Bitman

bitman@nostrplebs.com

npub1z204...mxwn

Follow the money.

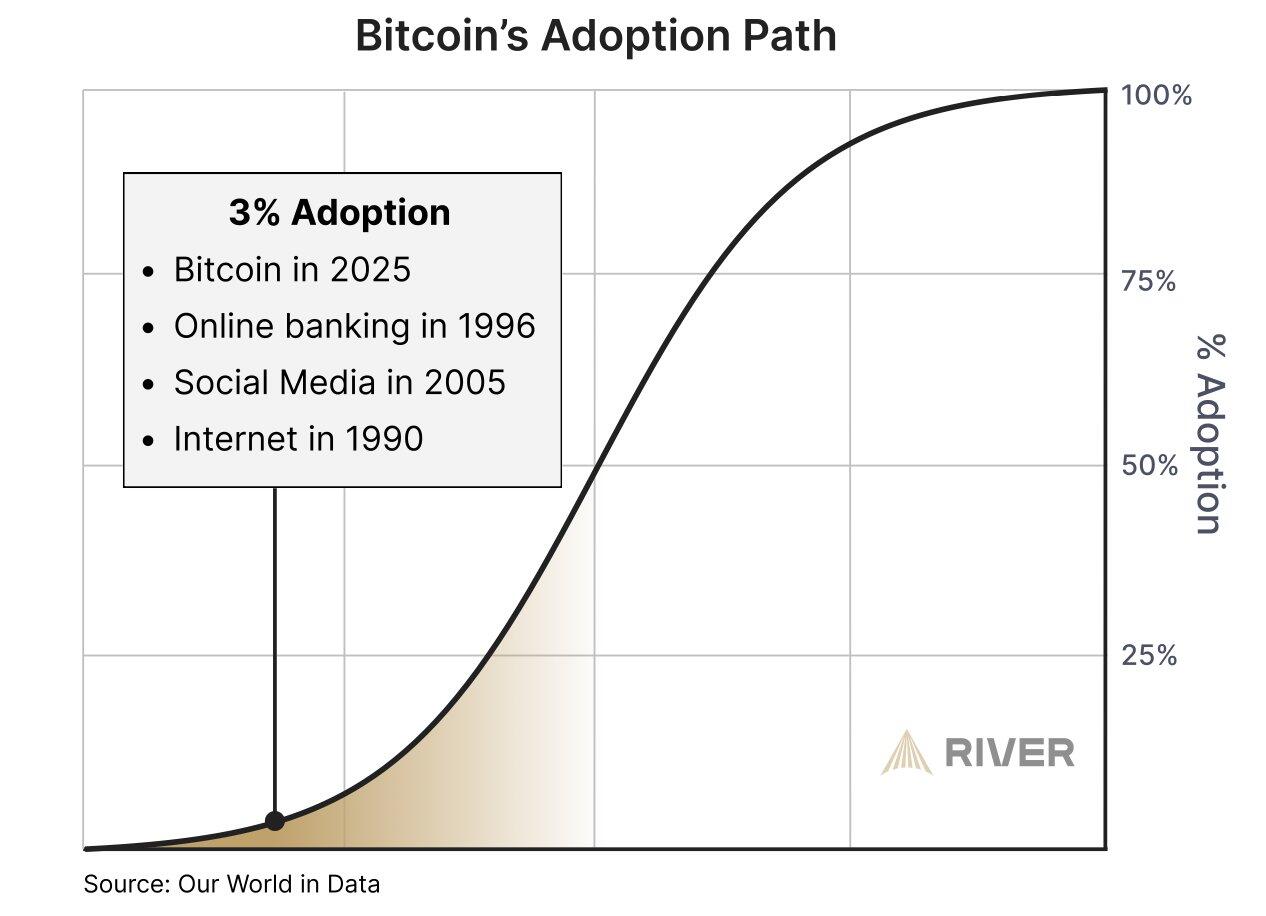

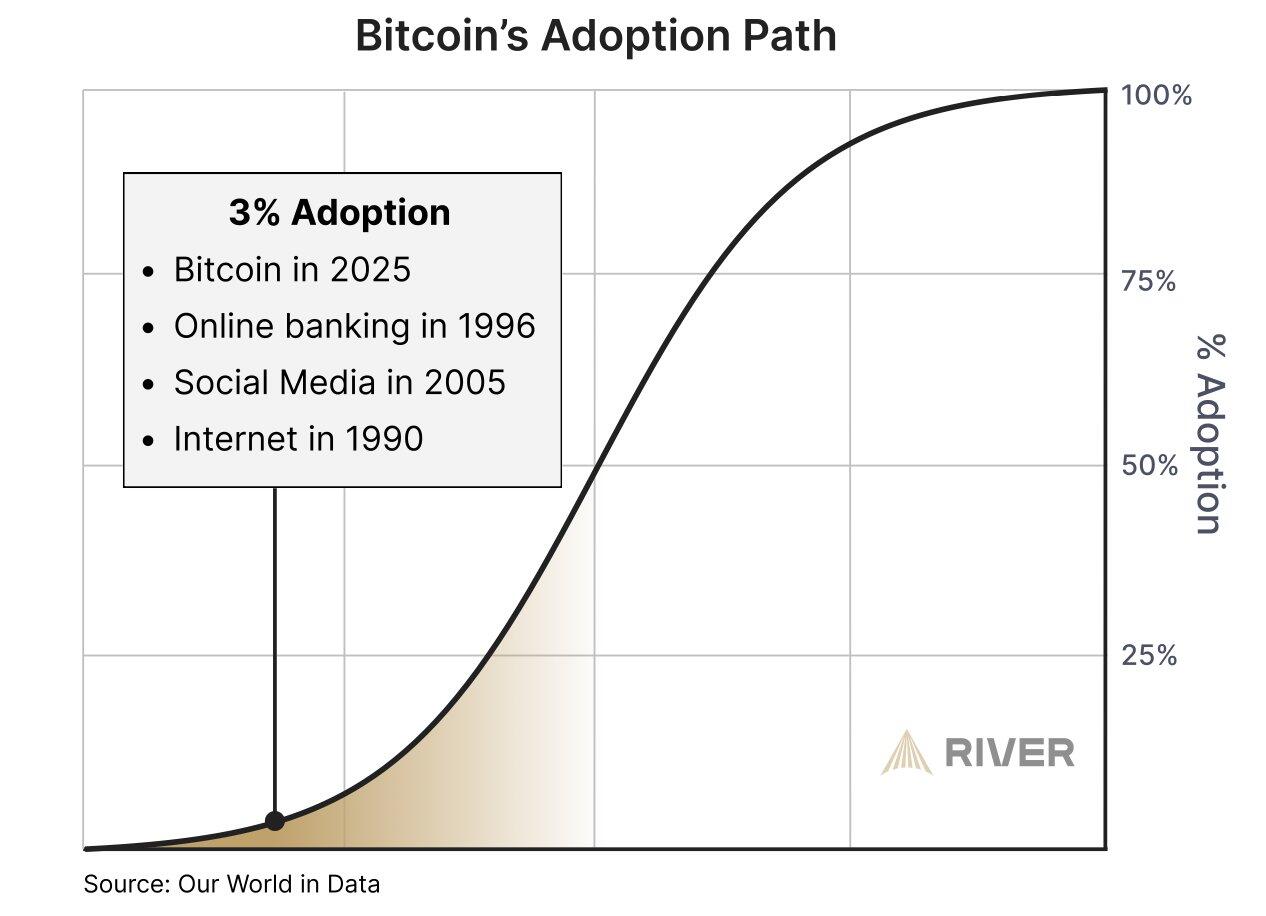

Send this to people who think it's too late to buy #Bitcoin 👀

“Their debt is your problem until you own bitcoin. The moment you own #bitcoin, their debt is your greatest asset.”

— Porter Stansberry

🥃

It seems that the 3rd richest man in Mexico has allocated 70% of his $11 billion fortune into BTC.

There are over 3,000 (formal) billionaires.

There isn't enough BTC for everyone.

This isn't the opportunity of a generation—it’s the opportunity of human history.

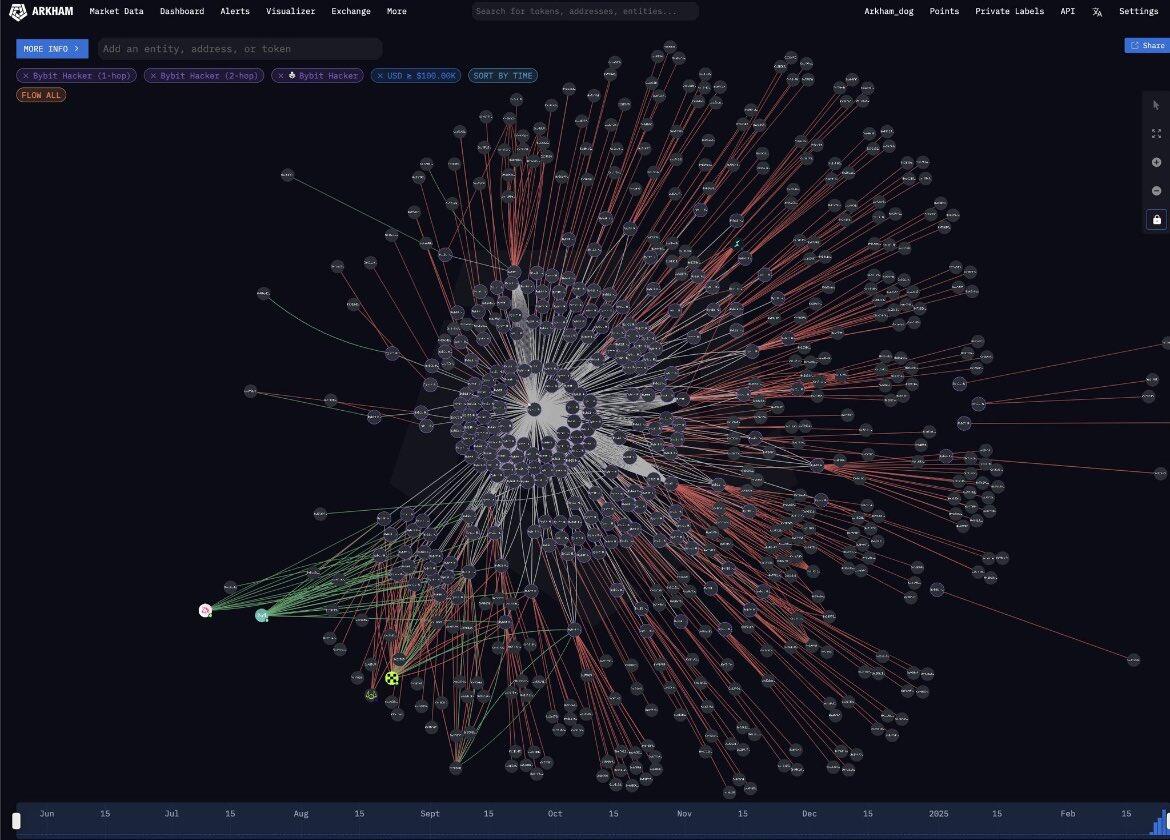

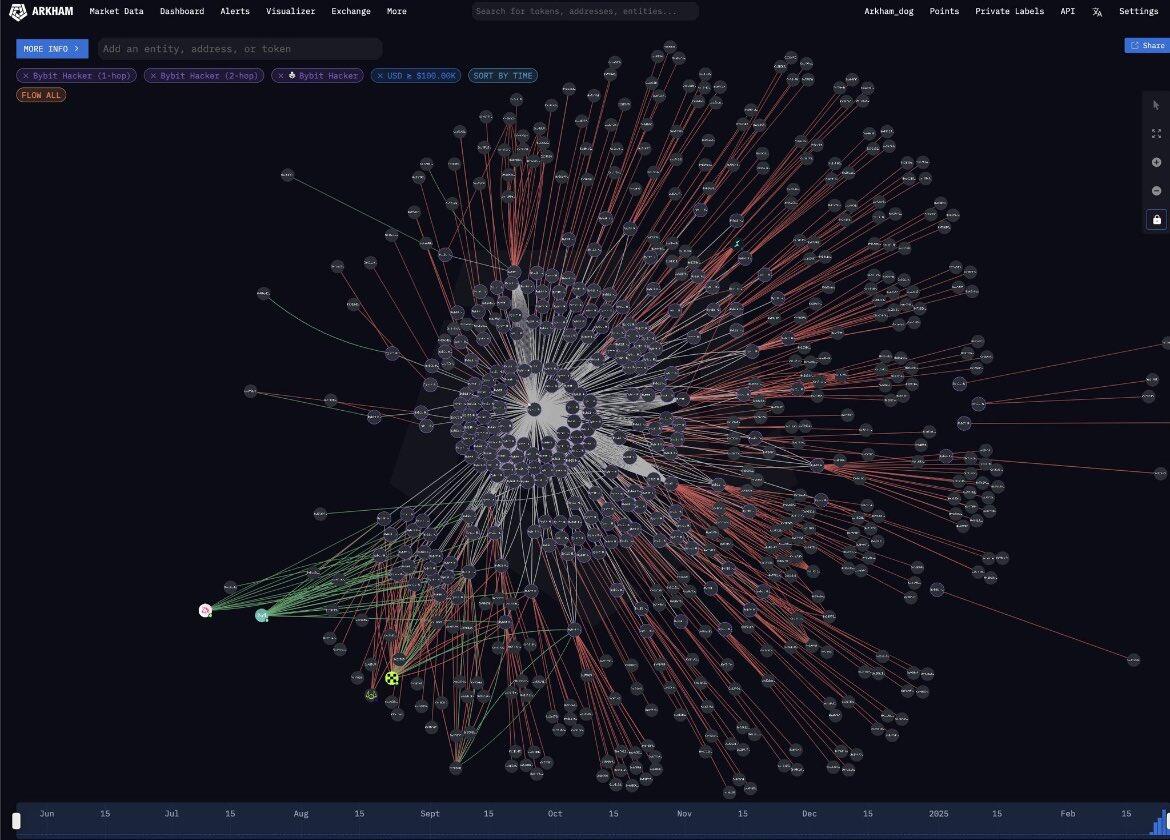

BYBIT HACKERS (LAZARUS GROUP) HAVE ALREADY SWAPPED 96% OF THE STOLEN ETH FOR BITCOIN.

Most of the transactions were carried out through THORchain in over 2,000 transfers.

Jay-z

Dmx

50 cent

Eminem

Dr. Dree…

Make RAP great again…

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

This high volatility isn’t just a result of macro uncertainty.

After the Bybit hack, market depth (order book depth) dropped significantly due to one of the biggest “bank runs” since FTX.

Lower liquidity also means increased “manipulation.”

🥃

"Stay focused. Work hard. Earn more than you spend. Stack sats. Stay humble."

— Jack Ballers (@jackmallers)

Wise words from Jack—great clip below:

#bullishbounty

This is the moment when you ask yourself, "Did I do something wrong?"

With Bitcoin down over 28% from its all-time high—something that would be considered a bear market in traditional finance—many people grow impatient or even discouraged.

This usually happens due to a lack of understanding of the fundamental principles that brought us here.

While macroeconomic factors influence short-term market sentiment, and tariffs impact U.S. inflation expectations, pushing capital away from risk assets, Bitcoin is much more than that.

Bitcoin will continue to rise in the long term because it is a mathematical inevitability driven by the government's inability to control excessive spending and the systematic erosion of purchasing power.

Personally, I don’t care if the bottom is now, next week, or later.

I believe any ordinary individual should focus on accumulating more sats over time.

Work, produce, live, save in BTC, and repeat. 🔁

This turns the process of navigating market cycles into a consistent method of outperforming traditional investors and institutions.

But two factors are essential for making this work: patience and emotional control.

If you aim to build generational wealth, understand that the way you perceive the world will directly influence your allocations and market positioning.

Reduce the noise, focus on fundamentals, and accumulate sats.

Bitcoin isn’t just about having more money—it’s about achieving freedom. And this freedom isn’t just financial (though that’s inevitable), but also geographic, mental, and spiritual.

Embrace the opportunities that volatility presents. The greatest risk is taking no risk at all. 🚀

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡

Regarding Trump’s $5 million GOLD CARD:

Living in the U.S. equates to tax slavery, with exit taxes, penalties, and heavy rates for individuals.

With $100,000, one can pay for a five-year course and stay there without paying anything additional or even arrange a marriage.

The $5 million option only makes sense if it includes at least 10 years of personal exemptions and allows one to leave whenever they want without paying exit tax.

If it isn’t designed to compete with Zug’s lump sum option, it will flop embarrassingly.

View quoted note →

Bybit has just released the security audit report, revealing that the failure occurred in the SAFE servers, not at Bybit. This situation calls into question the collaborative custody strategy with ETH. The attack on SAFE’s servers, along with the breach of one of the developers’ PCs, highlights the associated risks. The combination of an improvised multisig setup, third-party keys, and the use of a ledger proved to be a recipe for serious issues. To protect yourself, opt for BTC in a native multisig.

There's an old saying among Bitcoin enthusiasts: "Shitcoins exist only to steal Bitcoin."

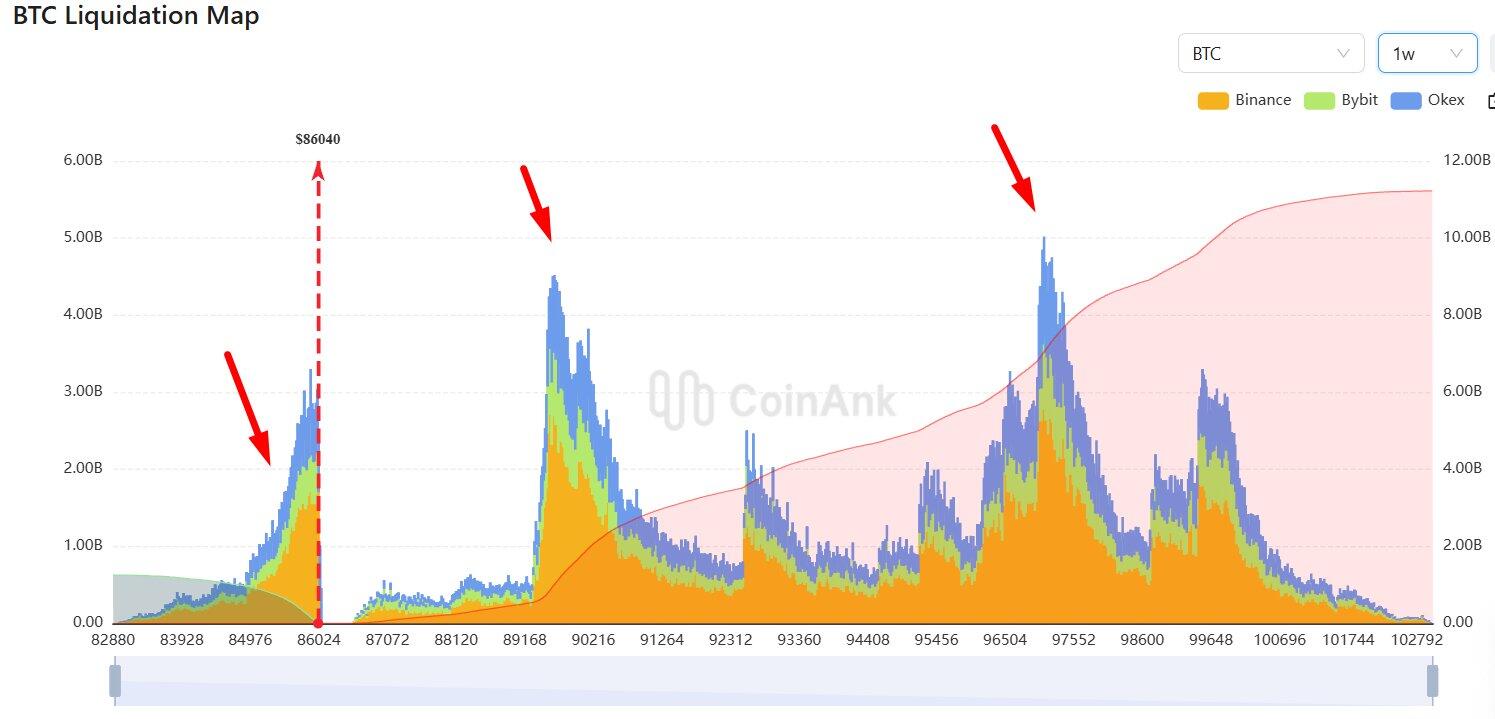

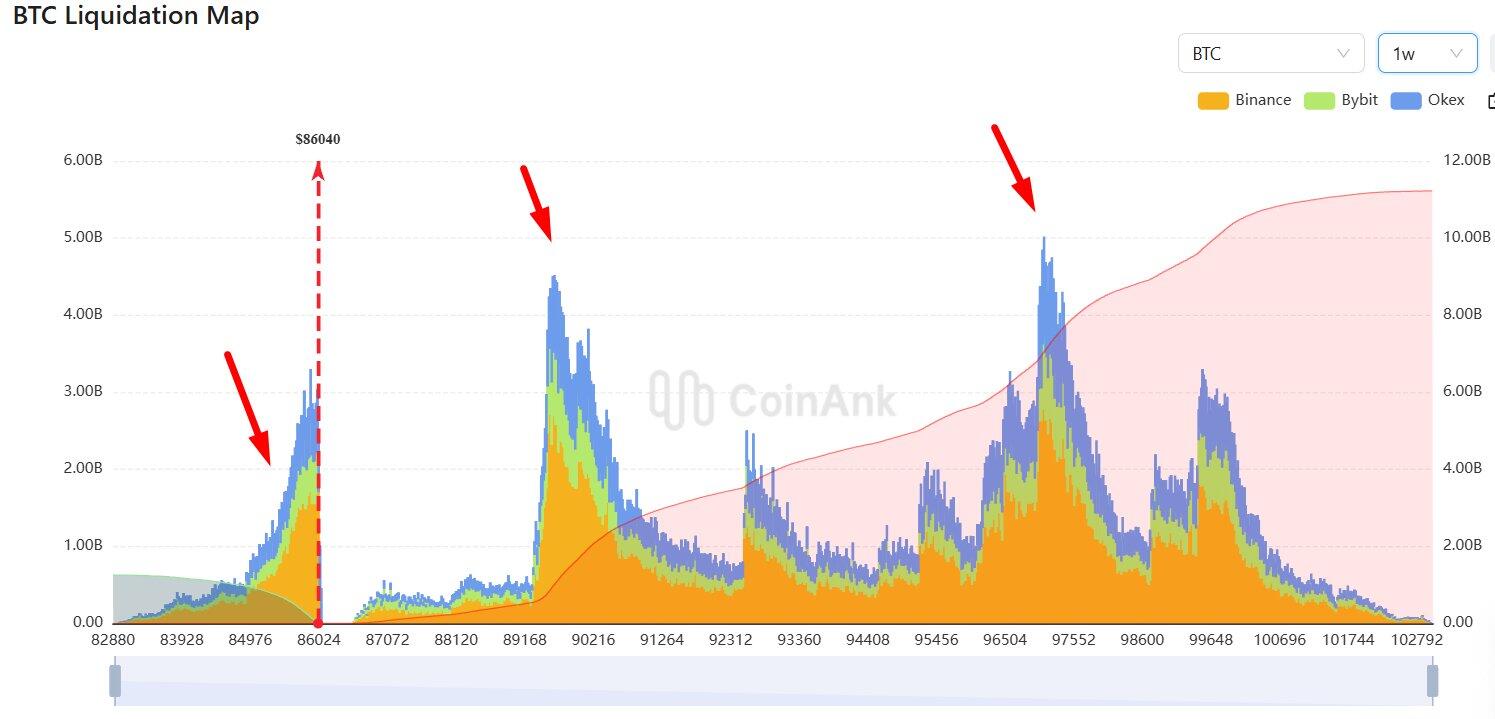

The liquidity of purchased contracts is nearing exhaustion.

Now, up to $100K, there are over $10 BILLION in liquidated short contracts.

For now, the bears have taken control. For now...

GOOD MORNING NOSTR, STAY HUMBLE AND STACK SATS 🫡