Time is money.

Inflation steals your money.

Therefore, inflation is time theft.

Steven Yang

stevenyang@getalby.com

npub1zet0...rzl6

Learning and building conviction with every block.

Could the FED not increase the interest paid for Reverse Repos tomorrow?

The FED has been increasing the interest rate for reverse repos at the same rate as their FED funds rate. This has been sucking a ton of liquidity into the reverse repo facility.

What if during the FOMC tomorrow, they stopped doing so, and instead started to drop the rate for the reverse repo facility?

This could lead to up to $2 trillion worth of liquidity gushing out into the system.

I spoke to a friend who works at RBC today. She told me the consensus is to claim victory once CPI reaches <5%.

I asked her why, she told me because there was so much money printed last time, it’s extremely difficult to get CPI back to 2%.

So I guess it’s just as everyone was saying. Central banks will allow inflation to run hot just so that they can deal with the record levels of debt in the system.

It's my friend's daughter's first birthday tomorrow.

Instead of buying a toy for her, I have decided to give her $100 worth of sats.

I wonder how much it will be worth in dollar terms when she turns 18.

GM ☀️PV 🤙

With all the uncertainty in the world right now, the only certain thing is Bitcoin’s monetary policy.

I’m so glad that no matter what happens at the central banks, there is nothing they can do about Bitcoin’s protocol.

They can print as much money as they want, Bitcoin will always produce one block every ten minutes.

QE infinity for all I care.

Tick-tock next block.

What’s that good old saying?

You can’t taper a Ponzi.

X (formerly Twitter)

Lyn Alden (@LynAldenContact) on X

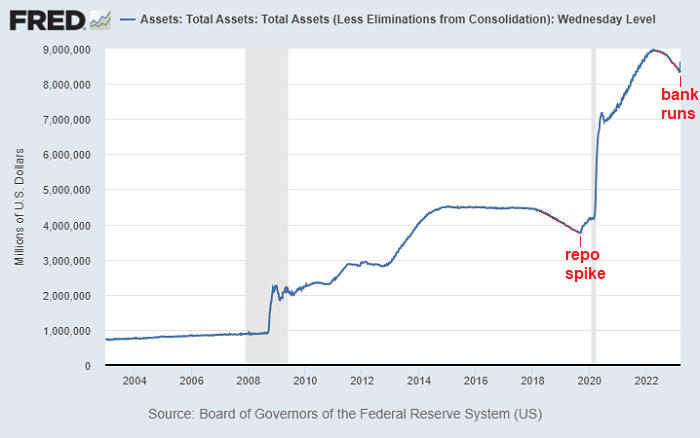

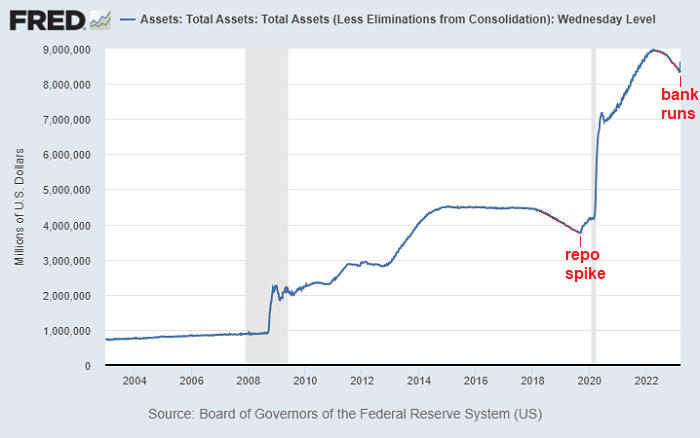

The numbers are in. The Fed's balance sheet increased by nearly $300 billion last week.

Let me get this straight…

1. Central banks are basically backstopping any entity that may cause systemic risk. But if you’re not big enough to cause systemic risk, you’re SOL.

2. Big banks who have ample access to capital due to their position are now stepping in to prop up the smaller banks.

3. The FED wants to cause unemployment, but they’re unwilling to have those unemployment come from large entities that are actually mismanaging their risk.

My question is, where is this unemployment going to come from?

It feels like in the end, small to medium businesses will continue to suffer as the FED continues to raise rates. But when they go down, no one will come to see he rescue because they’re not big enough to cause systemic risk.

Isn’t this the same as what happened in 2008? Too big to fail vs everyone else.

Testing out the image upload feature 😜

Stacked my first sats exactly three years ago. Back then, we were simply talking about how fucked up our financial system really is, and how central authorities will simply print money to get out of the hole that they have dug for themselves.

Three years ago, it was the infamous Covid liquidity crash. Today, three banks have failed in the US, and Bitcoin is stronger than ever.

What happened over this weekend only further strengthens my conviction.

GM ☀️ PV 🤙

Run your own node.

Be your own bank.

This is why we Bitcoin.

Straight to ice cold storage. These sats sure won’t be moving anytime soon.

When you listen to the FED talk, just remember what they said right before they started to pump the rates.

Don’t think for a second they will keep rates high when the economy comes crashing down.

Higher for longer?

Honey badger don’t give a fuck!

This new lock screen widget from Block Screen is 🔥

Now I will always know how many blocks we are from the next halving.

60246 Blocks and counting.

Tick-tock, next block.

GM ☀️ PV 🤙

Keep stacking sats ♾️/21

Having a relationship means making compromises.

One person being happy is better than no one being happy.