ETH Update 🚀: The Ethereum network is on the brink of the Dencun Upgrade, marking another significant milestone in its continuous evolution. This upgrade promises to enhance network efficiency, scalability, and sustainability, opening up a new realm of opportunities for developers, investors, and users alike. #ETHDencunUpgrade

While the upgrade heralds exciting developments, such as improved transaction speeds and reduced gas fees, it also brings forth challenges. Navigating the transition, ensuring backward compatibility, and maintaining network security are critical areas requiring careful attention.

The Dencun Upgrade is a testament to Ethereum's commitment to innovation and its pursuit of a more scalable, accessible blockchain. As we step into this new phase, let's discuss the potential impacts—how will this upgrade influence the ecosystem? What are the key challenges we should anticipate, and how can we address them?

Join the conversation as we delve into the opportunities and hurdles ahead for Ethereum. Your insights and analyses are invaluable as we navigate these changes together. #EthereumUpgrade #BlockchainEvolution #CryptoCommunity

Michael J Burgess

beitmenotyou@lifpay.me

npub1ytnq...x7a5

Hi, I'm Michael J. Burgess, a dedicated photographer, technology aficionado, and Web3 enthusiast.

Breaking News 🚨: In a landmark decision, a judge has ruled that Craig Wright is not the creator of #Bitcoin and, consequently, is not Satoshi Nakamoto. This verdict puts to rest one of the crypto world's most enduring controversies, reaffirming the anonymous and mysterious nature of Bitcoin's origins.

The ruling not only clarifies Wright's non-association with the creation of Bitcoin but also highlights the importance of preserving the foundational principles of decentralization and anonymity that Bitcoin espouses.

As the Bitcoin community continues to grow and evolve, this decision serves as a reminder of the core values that make Bitcoin unique. What are your thoughts on this development? How do you think this ruling impacts the broader narrative of Bitcoin's creation story? Let's discuss. #CraigWright #SatoshiNakamoto #CryptoNews

Breaking News 🚨: In a landmark decision, a judge has ruled that Craig Wright is not the creator of #Bitcoin and, consequently, is not Satoshi Nakamoto. This verdict puts to rest one of the crypto world's most enduring controversies, reaffirming the anonymous and mysterious nature of Bitcoin's origins.

The ruling not only clarifies Wright's non-association with the creation of Bitcoin but also highlights the importance of preserving the foundational principles of decentralization and anonymity that Bitcoin espouses.

As the Bitcoin community continues to grow and evolve, this decision serves as a reminder of the core values that make Bitcoin unique. What are your thoughts on this development? How do you think this ruling impacts the broader narrative of Bitcoin's creation story? Let's discuss. #CraigWright #SatoshiNakamoto #CryptoNews Market Insight 🔥: Fred Krueger recently shared his perspective on why #Bitcoin is poised to be the standout asset of the next decade. Amidst a backdrop of financial uncertainty, Bitcoin shines as a beacon of potential for investors, according to Krueger.

His conviction runs deep, suggesting that many are currently underinvested in Bitcoin given its prospective journey to $1,000,000. 'If I think it’s going to $1,000,000, I don’t wanna sell it at $300,000 or $200,000. I wanna wait till it gets to $1,000,000,' Krueger asserts, embodying the true HODL spirit. 🐂

This long-term vision underscores a confidence in Bitcoin not just as a speculative instrument but as a fundamental pillar of future wealth generation. As we navigate the volatile waters of the crypto market, Krueger's outlook offers a compelling case for patience and belief in Bitcoin's value proposition.

Do you share Fred Krueger's bullish sentiment on Bitcoin's future? How does this perspective shape your investment strategy? Let's discuss the potential paths and strategies for navigating Bitcoin's ascent. #FredKrueger #BitcoinOutlook #CryptoInvestment"

Future Forecast 🚀: Jeff Booth has recently made waves with his audacious prediction—believing #Bitcoin is on its trajectory to hit $42 Million. While this figure may seem staggering at first glance, Booth's analysis is grounded in a deep understanding of economic principles, technology's exponential growth, and the deflationary nature of Bitcoin.

This prediction is not just a number; it's a vision of a future where Bitcoin redefines wealth, value, and economic structures. It challenges us to think beyond traditional financial paradigms and consider the impact of digital scarcity in a world awash with fiat currency inflation.

What do you think of Jeff Booth's bold forecast? Is a $42 Million Bitcoin a feasible endpoint of our current technological and economic trajectory, or is it an optimistic stretch? Let's explore the underlying assumptions and implications of this prediction. #JeffBooth #BitcoinPrediction #CryptoFuture

Insightful Perspective 🌉💡: @Lyn Alden Lyn Alden offers a compelling analogy for understanding the role of Bitcoin ETFs within the financial ecosystem. She describes them as 'basically an API for the fiat system,' highlighting how ETFs serve as a conduit, enhancing the connectivity between the traditional fiat system and #Bitcoin.

This viewpoint sheds light on the significance of ETFs in fostering a smoother integration of Bitcoin into mainstream finance. By providing a familiar structure for traditional investors to engage with Bitcoin, ETFs can significantly lower the barrier to entry, paving the way for broader adoption and understanding.

Alden's analogy emphasizes the transformative potential of Bitcoin ETFs, not just as investment vehicles but as essential tools in the ongoing evolution of financial systems. What are your thoughts on the impact of Bitcoin ETFs on the relationship between fiat and crypto? Let's dive into the discussion. #LynAlden #BitcoinETF #FiatToCrypto #FinancialInnovation

Breaking News 🚀: Elon Musk has once again stirred the crypto waters with a promising update for the Dogecoin community. He announced that Tesla will, "at some point," accept $DOGE for payments, sending a strong signal of support for the beloved meme coin. "Dogecoin to the moon," he added, echoing the rallying cry of $DOGE enthusiasts around the globe.

This move not only highlights the growing acceptance of cryptocurrencies in mainstream commerce but also underlines Dogecoin's potential beyond just being an internet sensation. With Tesla's backing, Dogecoin's journey from a meme to a viable payment method takes a significant leap forward.

What are your thoughts on this development? Could this be the trigger that launches Dogecoin to new heights, or is it another twist in the volatile narrative of crypto? Let's discuss the implications of Tesla's embrace of $DOGE payments. #ElonMusk #Tesla #DOGE #CryptoNews

Reflecting Back: 4 years ago, #Bitcoin hovered around $8,000, surrounded by a sea of skepticism. Doubters questioned its value, stability, and future. Yet, here we are, standing witness to its remarkable journey and resilience. 🚀💡

The future may always hold a degree of uncertainty, but for those who looked beyond the skepticism, the probabilities were always leaning towards something revolutionary. Bitcoin's ascent is more than a story of price; it's a testament to the enduring belief in the potential of decentralized finance and the vision of a future where financial sovereignty is accessible to all.

As we look ahead, let's remember the lessons learned from this journey—about innovation, conviction, and the collective power of a community that dares to reimagine the world. The skeptics were many, but the visionaries were steadfast. #BitcoinJourney #HODL #CryptoFuture

Insightful Unpacking 🚀: Over the years, Michael Saylor has been subtly hinting at MicroStrategy's grand vision through parables of "Digital Energy" and a "Magic Hotel." It's time to decode these cryptic messages and understand the monumental business plan that's largely been under the radar.

@Michael Saylor envisions Bitcoin not just as an asset but as "Digital Energy" - a foundational pillar for establishing Bitcoin as the planet's most trusted store of value. The real challenge? Mature markets demand robust risk management tools for large holders to manage collateral and mitigate risk. Here, MicroStrategy's role becomes pivotal.

Unlike traditional finance (TradFi), where tools like options exist to de-risk, the Bitcoin market's maturation necessitates a similar infrastructure. With its massive Bitcoin treasury, MicroStrategy aims to fill this void, providing the liquidity and pristine collateral needed in a market fraught with liquidity issues and tainted assets.

When Saylor talks about a "Magic Hotel," he's not just weaving a tale. He's laying out a blueprint for a future where MicroStrategy becomes indispensable in a digital property market, craving stability and trust. By holding Bitcoin through fluctuations, MicroStrategy is a cornerstone for risk tools and collateral in the evolving digital landscape.

Dive deeper into these ideas by watching the full episode What Bitcoin Did by @Peter McCormack, featuring Saylor. For more bullish perspectives on MicroStrategy's strategy, watch discussions by Punter Jeff and Ryan McGinnis.

This isn't just about a company holding Bitcoin; it's about shaping the future of digital asset markets. #MichaelSaylor #DigitalEnergy #MagicHotel #MicroStrategy #BitcoinVision

https://www.web3wizkids.xyz/post/what-is-a-seed-phrase-a-parent-s-guide-to-your-wallet-s-secret-recovery-phrase 🌱 New Blog Alert for Parents: In our latest post at Web3 WizKids, we tackle an essential topic every digital parent should know about: 'What is a Seed Phrase? A Parent's Guide to Your Wallet's Secret Recovery Phrase.' With the rise of digital assets, ensuring the security of our digital wallets has never been more critical, especially for families navigating the web3 space.

This guide demystifies the concept of seed phrases—those crucial strings of words that act as the master key to your cryptocurrency wallets. Understanding seed phrases is foundational for anyone looking to safely manage and recover their digital assets.

We break down why seed phrases matter, how to securely store them, and the role they play in safeguarding your family's digital future. This is vital reading for parents who are digital pioneers, ensuring that as you explore the vast potentials of web3, you're also equipped to protect your journey's treasures.

Head over to our blog to dive into this essential guide and share it with fellow parents. Let's empower our families with the knowledge to navigate the digital world securely. #DigitalParenting #SeedPhrase #CryptoSecurity #FamilyFinance

Exciting Discovery 🌐✨: I just stumbled upon something quite promising— @6dhu8q4fq0e4rjpxe2fxe5x87y2w6xpm70gh9qh5tt66kqkgkx8j is on the brink of transforming into Open Vibe, aiming to revolutionise how we engage with decentralised social media. Imagine being able to post seamlessly across #Nostr, #Mastodon, #Bluesky, and #Threads with a single action, broadening our reach and simplifying our digital interactions.

This move could be a game-changer, connecting us with diverse communities across multiple platforms without the hassle of juggling apps. And here's hoping it's not just limited to an app but expands into a website, making it accessible whether moving or at home.

The potential for Open Vibe to become a pivotal tool in our online world is immense, bridging gaps and fostering a more interconnected, decentralised social sphere. What are your thoughts on this development? The prospect of broader, more efficient engagement across platforms is on the horizon, and it's looking bright. #OpenVibe #DecentralizedSocial #UnifiedPosting"

Market Reflections 👀: In a surprising turn of events, Peter Schiff, known for his critical stance on #Bitcoin, has expressed clear regret for not purchasing the digital asset when he first encountered it back in 2010. 😮 This revelation offers a poignant reminder of Bitcoin's remarkable journey and the evolving perspectives of even its staunchest skeptics.

Schiff's acknowledgment highlights the unpredictable nature of investment decisions and the wisdom of hindsight. It sparks a broader conversation about the opportunities missed and seized within the cryptocurrency space and the importance of keeping an open mind in the face of innovation.

What are your thoughts on Peter Schiff's admission? Does this change how you view opportunities within the crypto market? Let's discuss the impact of hindsight in our investment journeys and the potential for changing opinions in the ever-evolving world of #Bitcoin. #PeterSchiff #CryptoReflections #InvestmentRegrets

https://www.microstrategy.com/press/microstrategy-announces-proposed-private-offering-of-500-million-of-convertible-senior-notes_03-13-2024 @Michael Saylor Breaking News 📈: MicroStrategy has just announced a proposed private offering of $500 million in convertible senior notes, under the ticker $MSTR. This bold financial strategy highlights the company's ongoing commitment to leveraging the financial markets to fuel its ambitions, potentially including further investments in #Bitcoin.

As one of the leading corporate investors in Bitcoin, MicroStrategy's actions in the financial market are closely watched by both the cryptocurrency and traditional finance communities. This move could have implications for the company's balance sheet and the broader crypto market, depending on how these funds are allocated.

What do you think this means for the future of MicroStrategy and its relationship with Bitcoin? Could this signal more aggressive investment strategies or a new direction for the company? Let's dive into the discussion. #MicroStrategy #ConvertibleNotes #CryptoInvestment

Eye-Opener Alert 🚨: Just came across a video that hammers home why we need #nostr now more than ever. In an era where digital communication is often filtered, moderated, or even censored, the value of an open, decentralized platform for free expression becomes increasingly clear.

#Nostr stands as a beacon for those seeking a space where voices can be heard without interference, promoting a truly global dialogue. This video serves as a powerful reminder of the challenges we face in preserving free speech online and the role platforms like Nostr can play in ensuring that future.

Let's not take for granted the platforms we have for open communication. It's time to support and contribute to spaces that uphold our values of freedom and openness. What are your thoughts on the significance of Nostr in today's digital landscape? #FreedomOfSpeech #Decentralization #OpenWeb

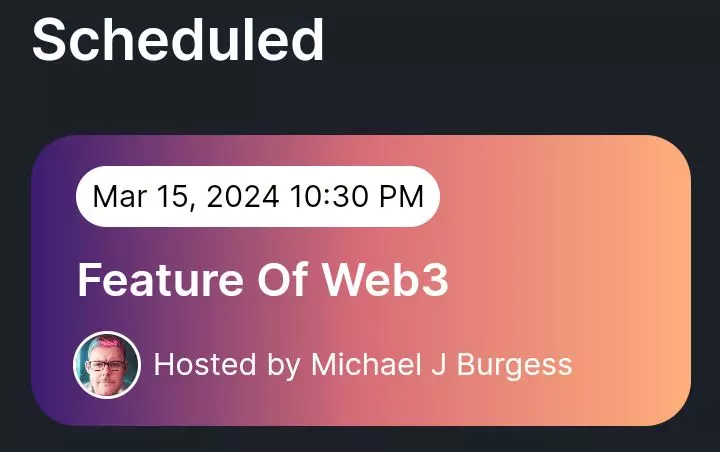

Event Invitation 🌟: This Friday at 10pm GMT, I'm hosting a vibrant discussion on

Event Invitation 🌟: This Friday at 10pm GMT, I'm hosting a vibrant discussion on Nostr Nests

Join this audio Space

Couldn't Stay Away 🌙✨: Despite my intentions to take a brief hiatus this week, the excitement of sharing #web3 discoveries with my #nostr fam proved too irresistible. There's just something about diving into the depths of web3 each day and bringing back treasures to discuss that keeps me coming back for more. 🚀🔍

So, here I am, having shared today's finds, feeling fulfilled yet ready to recharge for another day ahead. But now, it's time to hit pause and say goodnight. Off to bed I go, with dreams of what tomorrow's explorations might unveil.

Thanks for being such an engaging and curious community. Can't wait to share more with you all tomorrow. Sleep well, everyone, and let's gear up for another day of discovery and discussion in the boundless world of #web3. 🌌 #Goodnight #SeeYouTomorrow

🚀 #CryptoWeeklyRoundup 🌐

- #Bitcoin surges past $70K, sparking debates on future corrections vs. continued growth. 📈

- #Ethereum eyes $4K as the #DenuneUpgrade nears, amidst rising speculation on spot ETFs. 🔄

- #MemeCoinMania sees unprecedented rallies, with new entrants making waves alongside giants like #ShibaInu. 🐕

- #NvidiaStock takes a hit, dropping 10% and raising questions about a potential market crash. 💻

- A look at last week's top cryptos: #GalaGames, #Pepe, #FloyShinu, and #FetchAI, and their potential directions. 🚀

The community watches closely as #BitcoinETFs draw in record inflows and the crypto market teeters on the brink of a pivotal moment. Will the upcoming #BitcoinHalving and #Ethereum's upgrade set the stage for a new era of growth, or are we due for a correction? Meanwhile, meme coins continue their unpredictable journey, capturing the imagination (and wallets) of investors worldwide.

Stay tuned for more updates and insights in the ever-evolving world of crypto. 🌍💼

#CryptoNews #Blockchain #DigitalAssets #MarketTrends

The #BitcoinHalving 2024 is on the horizon, estimated for April 21, 2024. Historically, halvings have been precursors to bull runs, sparking immense interest in the #crypto community. But what can we expect this time?

A #BitcoinHalving is when miner rewards are cut in half, reducing new Bitcoin supply and potentially pushing prices up if demand remains steady or increases. With three halvings in the past, each has seen a rally in price, with cycle bottoms forming 11-15 months before and tops 1-2 years after the halving.

The first halving in 2012 saw a monumental 10,058% gain post-halving. The second in 2016 led to a 2,869% increase, and the third in 2020 resulted in a 687% gain, with each cycle experiencing significant corrections.

As we approach the 2024 halving, the question remains: will history repeat itself? The scarcity of Bitcoin will increase, and demand could surge with US spot Bitcoin ETFs' approval. However, the Fed's interest rate decisions will be crucial in Bitcoin's performance alongside other risk assets.

While the halving sets the stage for potential rallies, it's essential to remember that past performance does not indicate future results. Stay informed, and don't bet the farm on predictions.

#CryptoNews #Bitcoin2024 #Investing #Blockchain

Exploring the frontier of #Ethereum scaling with over $22 billion in TVL, #Layer2 solutions are pivotal. With 39 active L2s, the competition is fierce, yet #Arbitrum and #Optimism lead. The emerging narrative of #ReStaking, pioneered by #Enjin, introduces a game-changer, allowing ETH to be reused to secure other chains, boasting over $3.2 billion in stake.

Enter #AltLayer, blending #ReStaking with L2s to offer native and re-stake #OptimisticRollups and #ZKRollups. This innovation promises to alleviate congestion, reduce gas fees, and enhance security, offering a diverse ecosystem of rollups tailored for various needs, from general-purpose to application-specific.

#AltLayer's ecosystem thrives with projects spanning #gaming, #DeFi, #NFTs, and the #metaverse, leveraging scalability, security, and interoperability. For instance, #KTH, a DeFi-powered space game, and #Oasis, a decentralized metaverse platform, integrate AltLayer's rollups for improved performance and cross-chain interoperability.

With a fixed supply of 10 billion tokens, #ALT is the utility and governance token within AltLayer's ecosystem, enabling governance, staking, fee payment, and access to services.

As AltLayer forges ahead, its roadmap includes expanding rollup stacks and ecosystem projects, aiming to lead in blockchain scalability and Web3 application adoption.

#Blockchain #Web3 #Scalability #Innovation

Ethereum's Leap Towards Scalability: The Impact of EIP-4844 🚀

Ethereum's journey towards unparalleled scalability takes a significant leap with the introduction of EIP-4844, also known as proto-dank sharding. This Ethereum Improvement Proposal is set to revolutionize Layer 2 (L2) solutions by drastically reducing operational costs and enhancing efficiency, potentially lowering transaction fees on L2s by over 90%. EIP-4844 introduces a new transaction type that supports "blobs" of data, laying the groundwork for a more scalable Ethereum and paving the way for full danksharding. With its mainnet launch anticipated on March 13th, EIP-4844 marks a pivotal moment in Ethereum's scaling roadmap, promising a brighter future for decentralized applications and the broader Ethereum ecosystem.

#Ethereum #EIP4844 #BlockchainScalability #Layer2Solutions #CryptoInnovation #DecentralizedFinance #EthereumScaling #BlockchainTechnology #CryptoNews #Danksharding #BlockchainUpgrade #EthereumNetwork #DeFi #NFTs #CryptoCommunity #EthereumFuture #TechUpdate #BlockchainDevelopment

Bitcoin's 2024 Rally: Unpacking the Phenomenal Surge 🚀

In 2024, Bitcoin shattered records, reaching new all-time highs, driven by a mix of regulatory approvals, institutional investments, and its intrinsic deflationary mechanisms. The SEC's nod to spot Bitcoin ETFs marked a pivotal moment, inviting heavyweights like BlackRock and Fidelity into the crypto space, significantly boosting Bitcoin's liquidity and investor base. This institutional embrace, coupled with the anticipatory buzz around the Bitcoin halving event, has propelled prices to unprecedented levels.

Moreover, Bitcoin's foray into DeFi and NFTs has expanded its utility and appeal, attracting a diverse range of investors and solidifying its position in the digital asset revolution. Record trading volumes and open interest further signal a robust, bullish market sentiment, fueled by macroeconomic factors like inflation fears and the quest for alternative investments.

As Bitcoin navigates through 2024 with remarkable momentum, the community's optimism is palpable, with some predicting prices could soar beyond $100,000. This rally is not just about numbers; it's a testament to Bitcoin's enduring potential and its pivotal role in reshaping the financial landscape.

#Bitcoin2024 #CryptoRally #BitcoinETF #DeFi #NFTs #Cryptocurrency #DigitalAssets #InvestmentTrends #BlockchainInnovation #MarketDynamics #BitcoinHalving #InstitutionalInvestment