One week later, Wallet of Satoshi is gone from the USA app stores. Were you ready, anon? Are you still “onboarding” people with a banking app they may not be able to access in the future? View quoted note →

Andrew M. Bailey

resistancemoney@resistance.money

npub1yezu...awc7

I’m here to chew bubblegum and talk about bitcoin and I’m all out of bitcoin

Folks who continue to use Wallet of Satoshi (and recommend its use) would do well to write down some guesses about these three scenarios (rug, shotgun, honeypot). How likely is each, and how does the sum probability of those three dire scenarios compare to a graceful WoS exit or ongoing functionality?

It’s called risk management. You either do this, or reality does it for you. View quoted note →

Common argument:

1. Halvings introduce no new information about supply.

2. If so, halvings cannot influence price.

3. Therefore, halvings cannot influence price (1 and 2).

I think halvings are priced in, but reject both premises.

Against 1: halvings can introduce new information about supply. They show, with certainty, what was before only expected to some high degree -- that new supply coming to market will soon dramatically click downward.

Against 2: halvings can also introduce new information, not about supply, but about demand. What if you discover, time and again, that people quite stupidly respond to halvings by buying? The first few times, that's new information! And when it stops, that's new information too!

Why do I think halvings are still priced in? Because they're *now* priced in. These effects are known, and known to be known, and negligible after the first few halvings.

I knew the Bank of Lebanon was no good. But until today, I didn't know quite how no good. They didn't just print too much money. Officials embezzled from the bank, invested in Ponzi schemes, and then lied and printed to cover it all up. Result: Lebanese Pound down 98% vs. USD.

There are a lot of sources that go into more detail on this, and the story isn't over yet. For one recent overview, see:  When the World Bank released a report about your monetary and fiscal system entitled "Ponzi Finance?" you know you messed up:

When the World Bank released a report about your monetary and fiscal system entitled "Ponzi Finance?" you know you messed up:  One interesting element of this particular case is how authorities across monetary, banking, financial, and fiscal systems conspired to create a crisis. And 'create' is not an exaggeration, according to the World Bank. They call it a ‘Deliberate Depression’.

One interesting element of this particular case is how authorities across monetary, banking, financial, and fiscal systems conspired to create a crisis. And 'create' is not an exaggeration, according to the World Bank. They call it a ‘Deliberate Depression’.

dw.com

How Lebanon was plundered by its own central bank – DW – 08/25/2023

The 30-year tenure of the former governor of the Bank of Lebanon Riad Salameh culminated in controversy, inquiries and sanctions. What role did the...

World Bank

Lebanon’s Ponzi Finance Scheme Has Caused Unprecedented Social and Economic Pain to the Lebanese People

Public finance in post-civil war Lebanon has been an instrument for systematic capture of the country’s resources, as it served the interests of ...

“Whoever knowingly makes or intentionally spends counterfeit money shall be separated from the communion of the faithful as one accursed, an oppressor of the poor and a disturber of the state”

Lateran 1, Canon 13 (15 in some numberings), 1123 AD

What’s interesting to me isn’t just that counterfeiting is singled out for condemnation — it’s that one of the reasons given is that it amounts to oppression of the poor. These guys were onto something.

“How, exactly, do counterfeit bills oppress the poor?” is a good question. Think about it, and you may come to some unexpected conclusions!

I'm working on a taxonomy of digital goods — especially rivalrous, excludable ones that can be transferred. What are paradigm cases or important kinds to keep track of? How would you add to a list like this?

- domain names

- digital dollars, debts, bonds

- NFTs

- gaming assets (skins, etc.)

- bitcoin (of course)

- ether

Some key properties I'm keeping track of include marginal cost of production, non-monetary (use) value, cash flow, aesthetic value, possible Veblen status, mode of issuance/creation, and self-custody.

What else comes to mind?

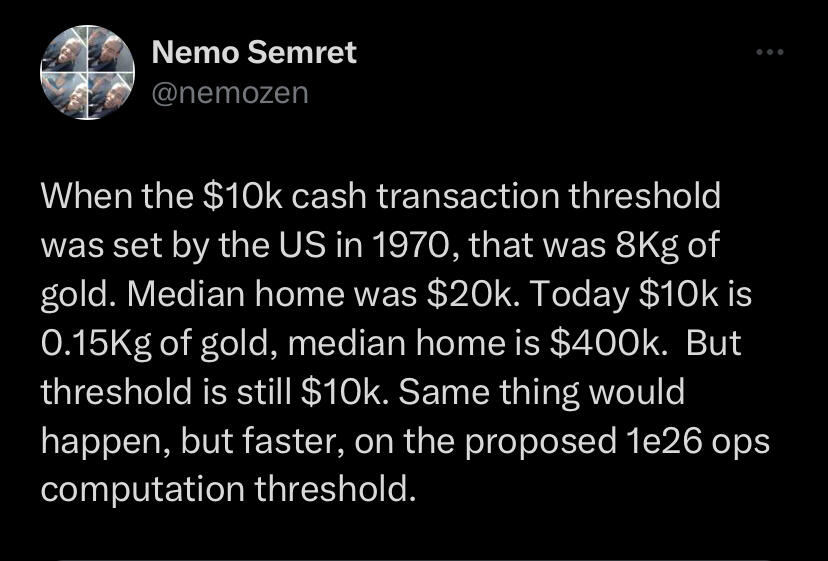

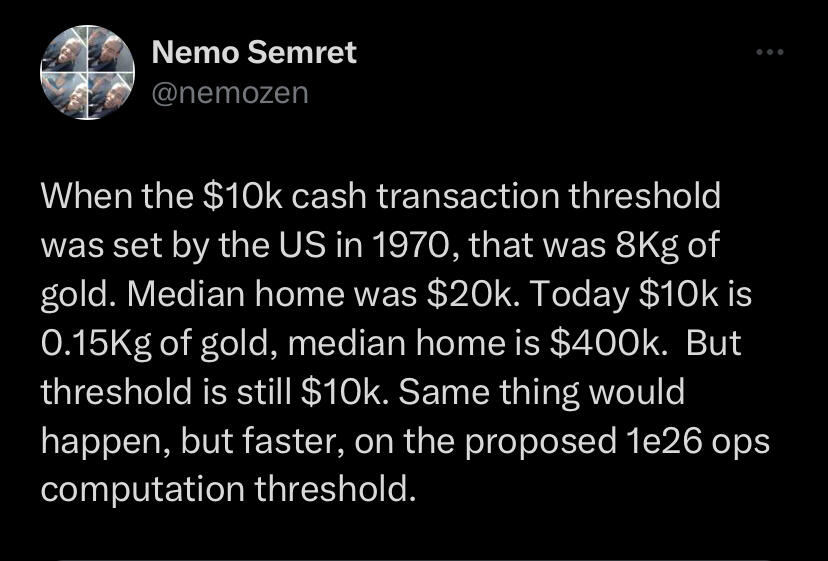

Make Cash Great Again — pentuple reporting thresholds and bring back or mint new supernotes ($500, $1,000, even $10,000 denominations)

Academia matters to bitcoin because a sewage pipe is feeding misinformation into the public sphere. And the only way to fight lies is with the truth. Bitcoin is too important to not study with care, and with all the tools we have.

Bali, for Indonesia Bitcoin. If you’re here too, drop me a line and let’s hang out!

Just got off a call with a bitcoiner working with some cutting edge projects — L2s and more. We agreed on this: the greatest threat to bitcoin isn't the state, or anything like that. It's complacency.

Suffering is probably the only way we overcome.

Price pumps in the near future may be dangerous for bitcoin's long term future. They'll boost complacency. When we're fat and happy, we don't invest in scaling and privacy and extensibility.

Unfortunately, near term price pumps are also the most obvious path to better funding for bitcoin research and development. We have no token to print at zero marginal cost, no foundation, no company, no lawyers, no marketing office, no trademark holders, no CEO.

A real dilemma!

What kind of suffering could do the job here? I'm afraid many of my readers will hate the answer. It can be expressed in one word. No, not 'dump'. It's 'flippening'.

Imagine the seething, the cope, the fury, the wild cognitive dissonance, were eth to flip bitcoin.

Now that's suffering.

Suffering sucks, of course.

But if I learned anything from all those Greek tragedies, it's that suffering is also the only path to wisdom.

Some will be quick to add that eth has already flipped bitcoin — in daily fee revenue, in L2 proliferation, in TVL, in daily volume (when measured in just the right way).

I reply: sure, but we always had the market cap cope ready to hand. What if that were gone?

Suffering.

When someone prints a token for free, and sells it to you for something else, they reveal a preference to hold that something else, rather than their own invented token. What does this tell us?

Curious if anyone else is in this boat: I’m more cautious about saying things on Nostr than on Twitter — because deletion is much more straightforward on Twitter.

I feel this way even though I know that deleting on Twitter doesn’t actually remove it (the internet never forgets), and even though I know there’s a much smaller audience on Nostr.

Pick two:

1. The United States should ban TikTok

2. The United States cannot ban TikTok without expanding capacity for overreach, surveillance, and censorship

3. The United States should not expand capacity for overreach, surveillance, and censorship

- Digital authoritarians pick 1 and 2 and reject 3; this is wicked.

- The starry-eyed dreamer picks 1 and 3 and rejects 2; this is silly and naive.

- The lover of liberty picks 2 and 3 and rejects 1; this is the way.

True or false: there is no known way to cryptographically prove that you've deleted some data.

Few things* give me greater joy than overconfident prognosticators getting punished by markets. Especially when bitcoin is involved.

*actually many things; but this joy remains special

It's easy to focus on buying power — number go up, number go down — which messes with your peace of mind.

This is a cost. I find that self-custody compensates for it, and more. I sleep better knowing that my money isn't someone else's liability and can't be rugged.

As usual, this is not financial advice. It is spiritual advice. Self-custody is self-discipline. It is also freedom.

What a 24 hours it's been, and it still doesn't top FTX day in November:

- Ether a security

- 30% tax proposed on bitcoin mining

- Silvergate, dead

- Another big bank, dead

Me, a crypto person: bored, unstimulated, hoping for more.

Seems like a fine time to meditate on Satoshi's words: "The root problem with conventional currency is all the trust that's required... Banks must be trusted to hold our money... but they lend it out in waves of credit bubbles with barely a fraction in reserve."

Dude drops some gross antisemitism on Nostr. Relays drop him. But if you really want to tune in, you totally can — exactly as one would hope for with a protocol rather than a platform. Nostr is working as designed, in other words. Very cool.