nostranger

burntdroid@nostrplebs.com

npub19l5l...mhtg

“There are a thousand hacking at the branches of evil to one hacking at the root” - Henry David Thoreau

Let’s be the one

This is ludicrous. Where are the fucking idiot brains that support these moronic policies being incubated? There’s little that can be done about the sociopaths that initiate them but they wouldn’t get off the ground if it wasn’t for these weird zombie armies voting against the will of the people they’re supposedly representing

View quoted note →

Bitcoin is the analog of digital money…

Well maybe not literally, but recent comments by Peter Schiff left me scratching my head about how little he still seems to understand. There was his usual retort about Bitcoin not having intrinsic value, but it was his comparison of Bitcoin to the digital version of music, saying that at least digital music has substance, that I find puzzling. If you think about an LP on vinyl, that has some unique, one-of-a-kind property to it that its digital counterpart does not. Digitalisation immediately removes the uniqueness of something, as it can be perfectly duplicated indefinitely henceforth. Bitcoin otoh flips this concept on its head, attaining and maintaining the uniqueness of its ledger by bootstrapping this perfect duplicability property to enable all users to share a single source of truth, in turn ensuring the uniqueness of each holder’s Bitcoin. As the ledger is secured by real-world energy, the uniqueness of the Bitcoin would start to crumble without this proof-of-work, as it would soon start to be double-spent and would quickly become worthless. In this respect, Bitcoin is an analog form of money. It cannot exist as a static arrangement of 1’s and 0’s solely in the digital realm. This is what sets it apart from mere digital representations of things, and is its greatest strength. It’s certainly ironic that the first real contender to become the native currency of the Information Age and the internet is more analog than most of the payments systems currently in use today. This is clearly lost on Peter along with his sheer blindness to the fact that Bitcoin’s intrinsic value is the purity of its function as a monetary medium itself, unobscured and undiluted by other non-monetary properties such as jewellery, industrial uses and paper aeroplanes

The Federal Reserve has 3 official mandates, as follows: -

1. Maximise long-term US employment

2. Maintain stable prices (the arbitrary 2% inflation)

3. Maintain long-term interest rates

In her book “Broken Money”, Lyn Alden argues there’s a fourth informal mandate to maintain US financial stability, which is a pre-requisite for the other three.

It’s well known by those who’ve studied the history of money that the US dollar has been world reserve currency since at least 1958, and that the levers pulled by The Fed have trickle-down effects on the rest of the world as a result. What’s less apparent to many, no doubt, is the disconnect between the fact that the Fed’s mandates were designed specifically for the US yet have far-reaching impacts on the rest of the world. This is because the mandates were formed over 45 years before the USD became world reserve currency but were never updated to suit. So in attempting to maintain stability of their own financial system, they end up pushing volatility to many other dollar-dependent countries, sometimes with devastating effects. Here is an excerpt from Lyn’s book

The reader should notice that despite being the issuer of the world reserve currency, none of the Federal Reserve’s mandates say anything about foreign countries. As the issuer of the world reserve currency, U.S. monetary policy decisions affect almost everyone in the world, but the Federal Reserve only officially cares about foreign impacts if those impacts can bounce back and affect the United States’ economy

Excerpt from: "Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better" by Lyn Alden. Scribd.

This material may be protected by copyright.

Read this book on Everand:

Everand

Broken Money by Lyn Alden (Ebook) - Read free for 30 days

A Comprehensive Overview of the Past, Present, and Future of Money

Broken Money explores the history of money through the lens of technology....

Happy New Year of the Dragon 2024

Happy New Year of the Dragon 2024

My daughter Keisha and her band playing some of her original songs at The Undergound HK's 20th anniversary show at AIA Carnival

Encourage ppl to look into RGB (Really Good Bitcoin!), Prime and Abraxas, which use client-side validation which will negate the need for the blockchain to store all transactions, instead requiring only the parties to the specific transaction histories to validate their part of the timechain using merkle trees and storing the bulk of data off-chain. This is great for both privacy and scaling on Bitcoin

View quoted note →

Encourage ppl to look into RGB (Really Good Bitcoin!), Prime and Abraxas, which use client-side validation which will negate the need for the blockchain to store all transactions, instead requiring only the parties to the specific transaction histories to validate their part of the timechain using merkle trees and storing the bulk of data off-chain. This is great for both privacy and scaling on Bitcoin

View quoted note →

Sticking it to the WEF! Klaus must be squirming. Pretty cool AI conversion of the original speech in Spanish, made to look like he’s speaking in English and with his own accent

it's all relative

https://www.reddit.com/r/Bitcoin/s/B1AmthGXNM

Here's a list of all the dumb things Dipstick Dimon fits into this 2-minute video:-

"This is the last time I’ll tell this to CNBC" - highly unlikely unless he gains a few braincells

"Blockchain is real, it’s a technology" - no shit Sherlock, it stores the Bitcoin ledger

"We use it, it’s going to move money, it’s going to move data, it’s efficient" - it's not "going" to move money, Bitcoin is a form of money and is already being moved from wallet to wallet within the blockchain, secured by mining work. It's NOT efficient when compared with a centralised ledger so there's no point using a blockchain for anything unless it requires decentralisation and high security.

"We’ve been talking about that for 12 years too and it’s very small, we’ve wasted too many words on that" - he's describing his long journey leading to little understanding of Bitcoin

"Cryptocurrencies, there are two types – those that might actually do something (smart contracts to buy and sell real estate, that may have value). Tokenising things that you do something with." - last I checked there've been 23,000+ crytpocurrencies or tokens. There are also smart contracts on Bitcoin.

"Then there’s one that does nothing, I call it the pet rock, the Bitcoin or something like that" - feigning ignorance of its name! One of Bitcoin's most important features IS that it is pure money and its supply and demand will not be affected by the ebb-and-flow and unpredictability of industrial, commercial or decorative uses.

"On the Bitcoin there are use-cases – AML, fraud, anti-money laundering, tax avoidance, sex trafficking – and you see it being used $50-100b a year for that" - On the Bitcoin?! First, he mentions anti-money laundering twice and lumps it together with fraud and sex trafficking as if it's an evil thing - not the first time, as he also said this to congress. Perhaps he's so fed up of those AML people bugging him all the time that he's forgotten they're supposed to be the good guys! As for the amounts he quotes, each year about $500b is lost in tax avoidance, $150b spent of sex trafficking and up to $2 trillion in fraud. This amounts to over $2.5T. If the global money supply is about $50T, that means 5% is spent on these illicit activities. Bitcoin pails in comparison, with less than 0.3% of Bitcoin used for illicit activities

"Everything else is people trading among themselves (speculating?)" - er... why would people trade Bitcoin among themselves, 1BTC = 1BTC. There's arbitrage, yes, but any speculation involves fiat and other cryptos as well. There are plenty of people trading their Bitcoin for goods and servces.

“I don’t care what Larry Fink finks so please stop talking about this shit" - ooh getting lairy, but JPM's happy to support Larry's ETF nonetheless.

"I don’t know what [Larry] would say about blockchain vs currencies that do something and Bitcoin that does nothing" - why does he think that a currency has to DO something other than be a currency?!?1

Eye-opening talk with Hal Finney’s wife Fran and Peter McCormack. It’s admirable how well Hal seemed to adapt to his condition with ALS but also shocking what the family had to go through on top of all that

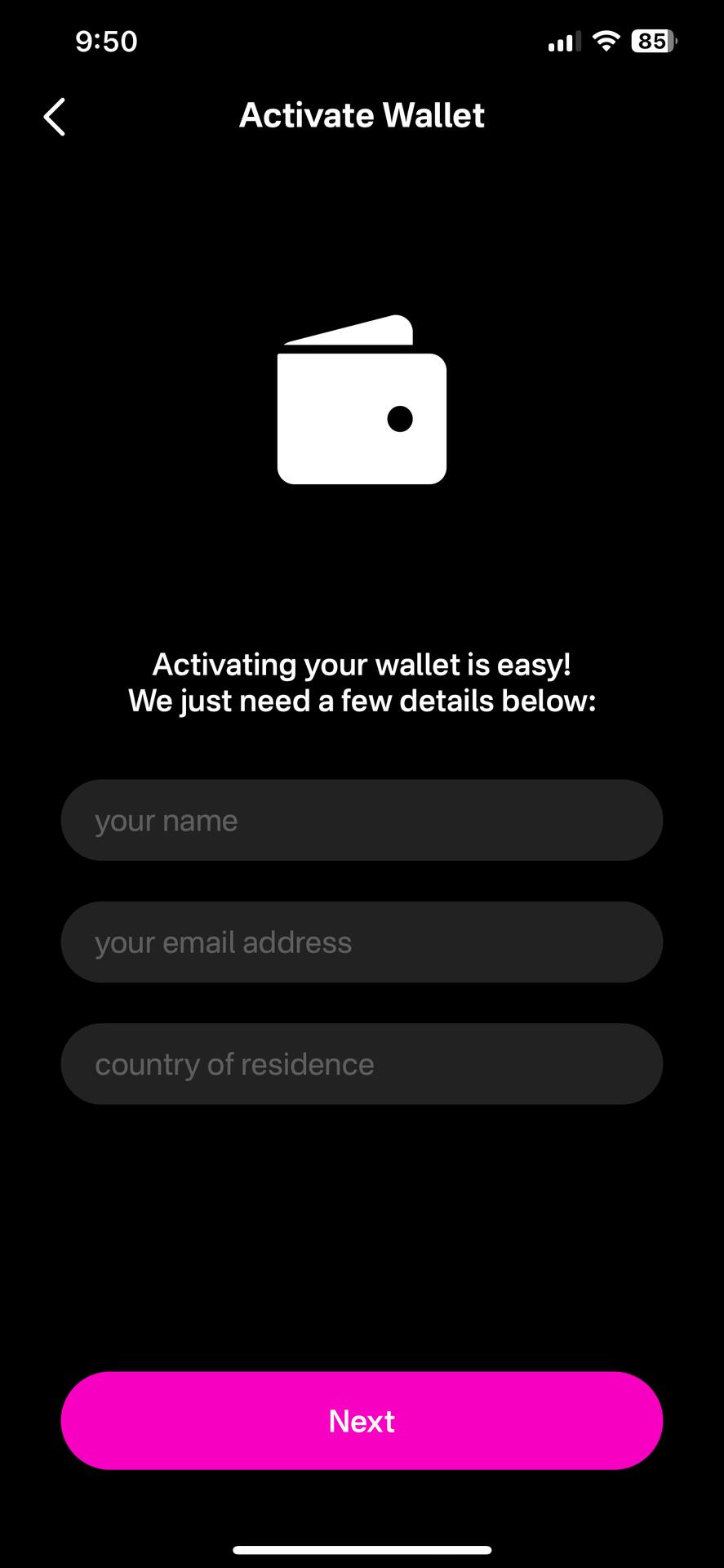

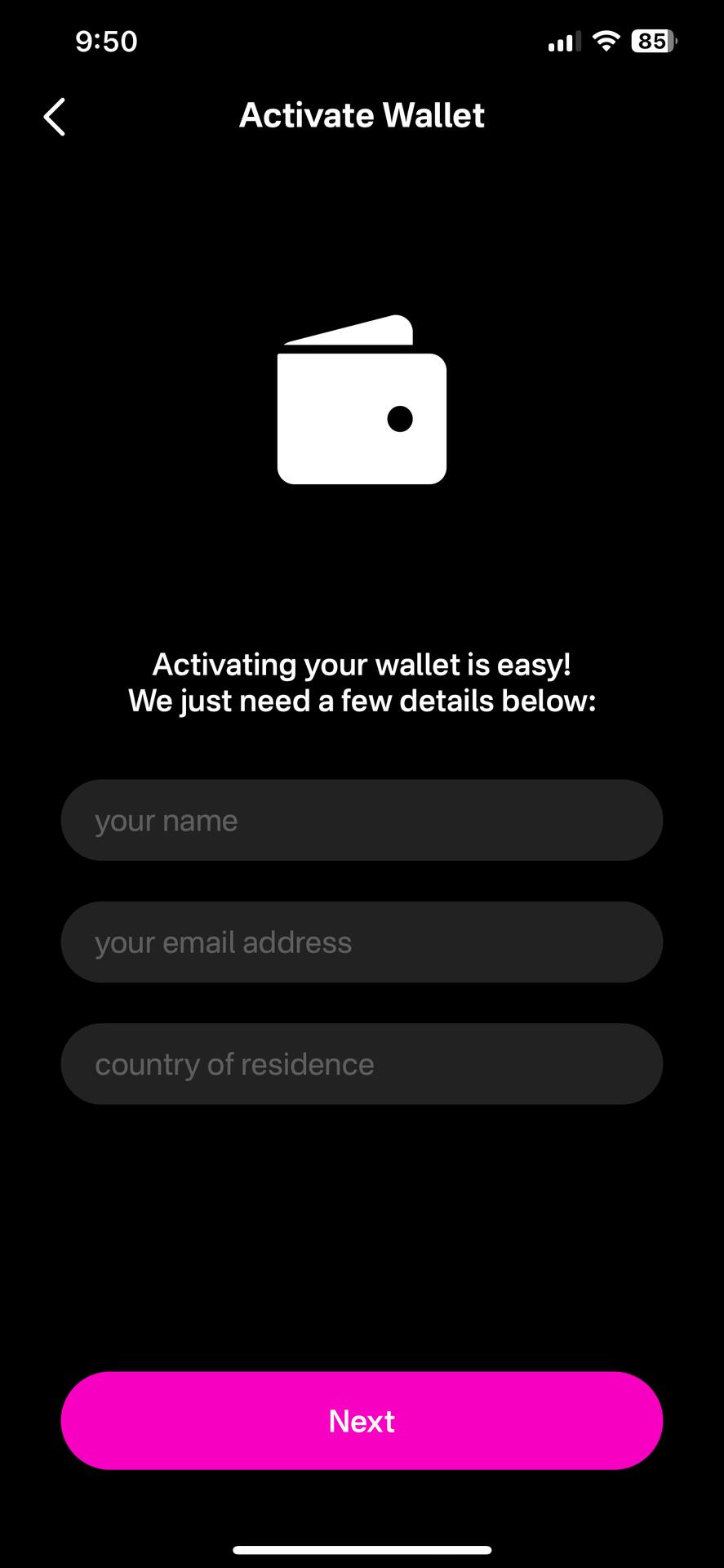

@miljan Why does #primal ask for personal info when setting up the wallet? Isn’t this against the ethos of #nostr ?

Talk by Maxim Orlovsky on Prime, alternative Layer 1 for Bitcoin. Seems promising for privacy and scalability but I’m having difficulty conceptualizing how individuals would maintain only the histories related to their own transactions for client-side validation of the Prime chain, without many of those getting irretrievably lost or corrupted and it ending up in a mess. Validation is one thing but if you don’t have the transaction data to validate it wouldn’t be much good. Appreciate if someone can explain how this part works?