Some of these mstr tards are getting so annoying. We get it, you like fiat bucks.

Btcfeen

npub1x6h3...0hte

BTC, MACRO, COOKING, FITNESS.

I am generally interested in a lot of things and very open minded. I talk about things I find interesting.

16 oz ribeye for the ladies bday

What’s your fav pump up song? #asknostr

Usa and global liquidity… usa liquidity sideways. Globa down a bit recently. Btc normally trades on a 3m lag to global liquidty. So perhaps we see an iterim top in dec until this starts picking back up  DXY… the weekly resistance rejected it for now. Highest weekly rsi since oct of 22’.

DXY… the weekly resistance rejected it for now. Highest weekly rsi since oct of 22’.  Us10y… 8 consective green candles… final had a close over the resistance… I feel like this is starting to have a bit of an effect on gold finally

Us10y… 8 consective green candles… final had a close over the resistance… I feel like this is starting to have a bit of an effect on gold finally  Tlt… closed below one of the weekly supports

Tlt… closed below one of the weekly supports  Spx… red week last week but structure still fine

Spx… red week last week but structure still fine  Gold.. bit of a sell off recently. Probably healthy tbh. Daily rsi lowest since oct of last year. Prob good for a bounce at min

Gold.. bit of a sell off recently. Probably healthy tbh. Daily rsi lowest since oct of last year. Prob good for a bounce at min  BTC… the 2w week closed and pushed up on the bands. This is coming off of a top 3 squeeze ever. The past times this has occurred we have had very nice expansions in the subsequent months

BTC… the 2w week closed and pushed up on the bands. This is coming off of a top 3 squeeze ever. The past times this has occurred we have had very nice expansions in the subsequent months  Good weekly close. Almost full body even though most of the gain was early last week. We avoided any weird deviation on the bband breakout which is great. There is a trendline that could provide some resistance around 105k.

Good weekly close. Almost full body even though most of the gain was early last week. We avoided any weird deviation on the bband breakout which is great. There is a trendline that could provide some resistance around 105k.  Linear fibs from the range says this should go to 113k next

Linear fibs from the range says this should go to 113k next  Log scale says 140k next if 94 breaks

Log scale says 140k next if 94 breaks  When looking at the updated price/50dma ratio it is in a similar spot to both previous ath range breakouts. We can see on the chart that price/50dma was right around 1.25 where it is now. All 3 times had very nice gains after. So I am expecting price to run a bit more before we get a pullback/consolidation.

When looking at the updated price/50dma ratio it is in a similar spot to both previous ath range breakouts. We can see on the chart that price/50dma was right around 1.25 where it is now. All 3 times had very nice gains after. So I am expecting price to run a bit more before we get a pullback/consolidation.  the tops happened within 20 days

the tops happened within 20 days  the cycle low multiple says we should have an interim top within 30 days too. Expecting basically up only into this. Minimal pullbacks in price. Maybe some consolidation. This also matches with the first wave of hype of new retail and any investors that need to get reallocated. https://charts.bitbo.io/cycle-low-multiple/

I think in regards to game theory saylor is likely trying to push up price/ get as much hype as he can for btc before thanksgiving. He wants the btc price up so he can sell shares too to buy more btc. He always wants to get in the qqq and spx as soon as possible for the passive flows. Right now his average is around 50k. leverage still seems ok to me atm. I hope he doesn’t push it too far too fast though. Although it is all term debt.

We have more btc held by long term holders than ever before. It is natural that as price increases that old holders will want to increase the quality of their lives. I do think that this new set of entrants is more likely to hold for the long term. The boomers have done that pretty well and have been conditioned to do so. We still haven’t really seen IRA’s starting to allocate. I have seen anecdotes of people scoffing at the idea of investing in mstr or etfs. Im sure some are but its still pretty early in that front imo. In 2017, we saw 3m btc sold on the way up from 730 to 20k. in 2021 we saw 2.2 mil sold from 11k to 65k. in the run up phases in 2016 and 2020 we saw 600-700k of selling from long term holders. This time we saw 1.6 mil sold on the run up from 30k to 73k. so imo we have already seen a decent distribution and reaccumulation. The reason price didn’t dip that much was from the spot etf buying. Imo bc of the selling we have already seen price will likely need to go quite a bit higher to unlock major supply. What that is idk, maybe double? Imo the time to get worried is when we have seen 2 to 3 mil of long term holders sell. https://charts.checkonchain.com/btconchain/supply/breakdown_lthsth_0/breakdown_lthsth_0_light.html

looking at mid tfs we have a 4 hr bband squeeze and ascending tri. The 4 hr macd has been a good signal recently. If this plays out similarly when it crosses price to should above 100k.

the cycle low multiple says we should have an interim top within 30 days too. Expecting basically up only into this. Minimal pullbacks in price. Maybe some consolidation. This also matches with the first wave of hype of new retail and any investors that need to get reallocated. https://charts.bitbo.io/cycle-low-multiple/

I think in regards to game theory saylor is likely trying to push up price/ get as much hype as he can for btc before thanksgiving. He wants the btc price up so he can sell shares too to buy more btc. He always wants to get in the qqq and spx as soon as possible for the passive flows. Right now his average is around 50k. leverage still seems ok to me atm. I hope he doesn’t push it too far too fast though. Although it is all term debt.

We have more btc held by long term holders than ever before. It is natural that as price increases that old holders will want to increase the quality of their lives. I do think that this new set of entrants is more likely to hold for the long term. The boomers have done that pretty well and have been conditioned to do so. We still haven’t really seen IRA’s starting to allocate. I have seen anecdotes of people scoffing at the idea of investing in mstr or etfs. Im sure some are but its still pretty early in that front imo. In 2017, we saw 3m btc sold on the way up from 730 to 20k. in 2021 we saw 2.2 mil sold from 11k to 65k. in the run up phases in 2016 and 2020 we saw 600-700k of selling from long term holders. This time we saw 1.6 mil sold on the run up from 30k to 73k. so imo we have already seen a decent distribution and reaccumulation. The reason price didn’t dip that much was from the spot etf buying. Imo bc of the selling we have already seen price will likely need to go quite a bit higher to unlock major supply. What that is idk, maybe double? Imo the time to get worried is when we have seen 2 to 3 mil of long term holders sell. https://charts.checkonchain.com/btconchain/supply/breakdown_lthsth_0/breakdown_lthsth_0_light.html

looking at mid tfs we have a 4 hr bband squeeze and ascending tri. The 4 hr macd has been a good signal recently. If this plays out similarly when it crosses price to should above 100k.

Ethusd… sideways weekly. Not much to comment on here besides watching this big ass tri. Very bullish when the yellow breaks imo

Ethusd… sideways weekly. Not much to comment on here besides watching this big ass tri. Very bullish when the yellow breaks imo  sentiment on eth is still so down in the dumps. I get that sol has taken over and is the base chain for speculation and memecoins, but imo that is just speculation and it can easily flip around if price rebounds. Imo eth is still a bit underowned for this cycle. I think sentiment now for eth is where sentiment from sol was in early 2023.

Ethbtc red engluflign after the nice candle last week. Bull div atm now on the weekly rsi. Weekly rsi also at a point from where weve seen nice bounces. Pa is in a bit of no mands land. Unless .04 can be reclaimed or .03 hits not sure there is anything super actionable. I do think eth calls are attractive here. eth etf flows are finally getting started and I think it is very possible eth might get a staking yield on top. I think people and wall st might find that attractive over btc and that could allow eth to outperform a bit.

sentiment on eth is still so down in the dumps. I get that sol has taken over and is the base chain for speculation and memecoins, but imo that is just speculation and it can easily flip around if price rebounds. Imo eth is still a bit underowned for this cycle. I think sentiment now for eth is where sentiment from sol was in early 2023.

Ethbtc red engluflign after the nice candle last week. Bull div atm now on the weekly rsi. Weekly rsi also at a point from where weve seen nice bounces. Pa is in a bit of no mands land. Unless .04 can be reclaimed or .03 hits not sure there is anything super actionable. I do think eth calls are attractive here. eth etf flows are finally getting started and I think it is very possible eth might get a staking yield on top. I think people and wall st might find that attractive over btc and that could allow eth to outperform a bit.  Total2 very nice breakout of the wedge. At resistance currently

Total2 very nice breakout of the wedge. At resistance currently  Total3 same deal here. at resistance

Total3 same deal here. at resistance  Btc.d still in the channel

Btc.d still in the channel  Overall thoughts. Another good week. Saylor is a mad man and is going to keep pushing the gas imo. We also have mara that is trying to buy 700 mil worth soon. I am still very bullish for the next month. I think thanksgiving dinners will be hyped and it could lead to a new wave of buying post thanksgiving for a few weeks while people figure it out. This also lines up with my bullish timeline for the next 2-4 weeks. Eth is starting to get more attractive to me. Just a feeling. I think the play there is calls for march or wait until .03 is tagged.

Overall thoughts. Another good week. Saylor is a mad man and is going to keep pushing the gas imo. We also have mara that is trying to buy 700 mil worth soon. I am still very bullish for the next month. I think thanksgiving dinners will be hyped and it could lead to a new wave of buying post thanksgiving for a few weeks while people figure it out. This also lines up with my bullish timeline for the next 2-4 weeks. Eth is starting to get more attractive to me. Just a feeling. I think the play there is calls for march or wait until .03 is tagged.

TradingView

FRED:WALCL-FRED:WTREGEN-FRED:RRPONTSYD Chart Image by cwsyx5

TradingView

TVC:DXY Chart Image by cwsyx5

TradingView

TVC:US10Y Chart Image by cwsyx5

TradingView

BATS:TLT Chart Image by cwsyx5

TradingView

FX:SPX500 Chart Image by cwsyx5

TradingView

FX:XAUUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITFINEX:ETHUSD Chart Image by cwsyx5

TradingView

BINANCE:ETHBTC Chart Image by cwsyx5

TradingView

CRYPTOCAP:TOTAL2 Chart Image by cwsyx5

TradingView

CRYPTOCAP:TOTAL3 Chart Image by cwsyx5

TradingView

CRYPTOCAP:BTC.D Chart Image by cwsyx5

4hr squeezing again. Feeling confident about 100k this week. If not this week then before thanksgiving. 2w broke out

Random fact. I’m a huge sports fan. That’s right. SPORTBALL

Looks like Netflix wasn’t ready for prime time

fri note... nice little consolidation here. imo this is continuing to track past cycles and i think we see 100k+ by thanksgiving. we should be at either of these two spots imo  we should see a 22% pump within 10 days. that would put it at 106k. from there i could see a washout for one last bear trap.

what is insane is that from the cycle low we are matching the last 2 cycles at a multiple of 5.58 208 days from halving. if this continues to track price should be a min of 120k within 30 days (2017 cycle) and a max of 205k (2020 cycle). i still think we track closer to the 2016 cycle bc we have done that almost perfectly so far. https://charts.bitbo.io/cycle-low-multiple/ these also show a low with 50 days too which would help to print the yearly low in early jan.

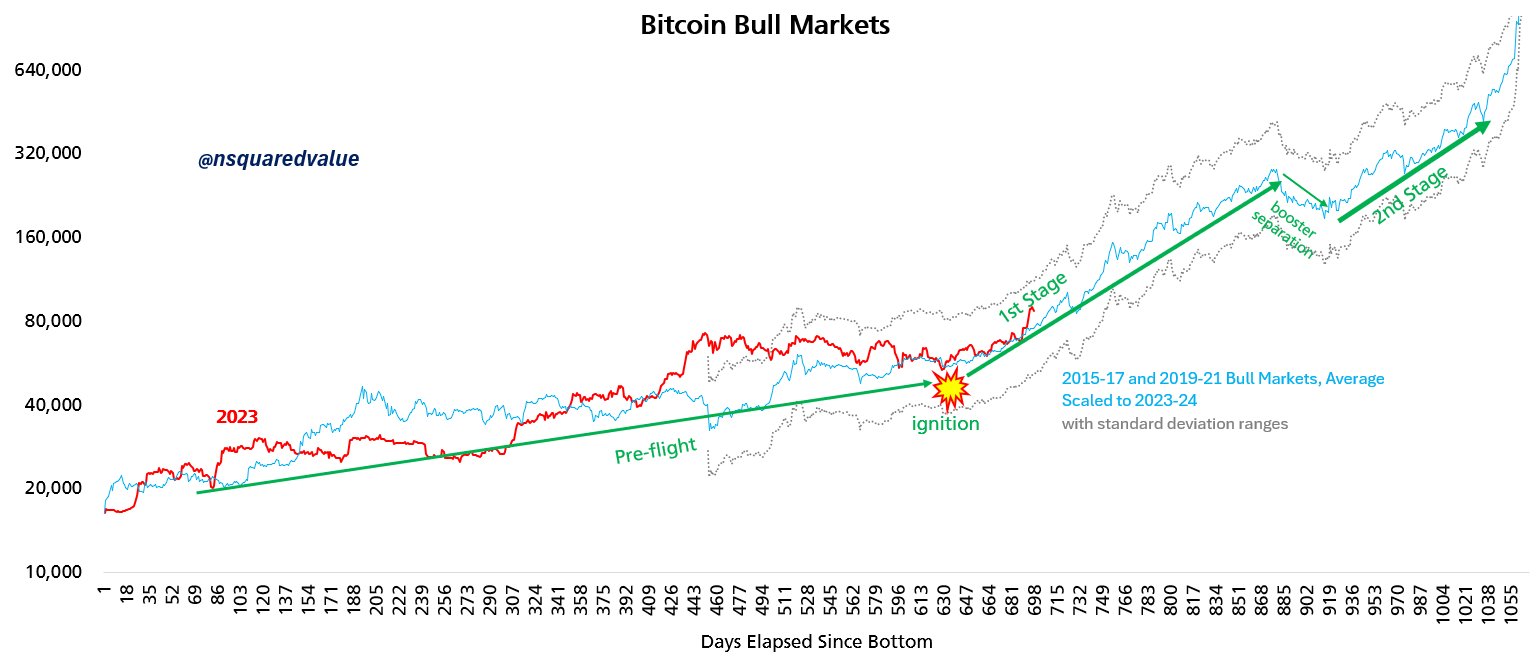

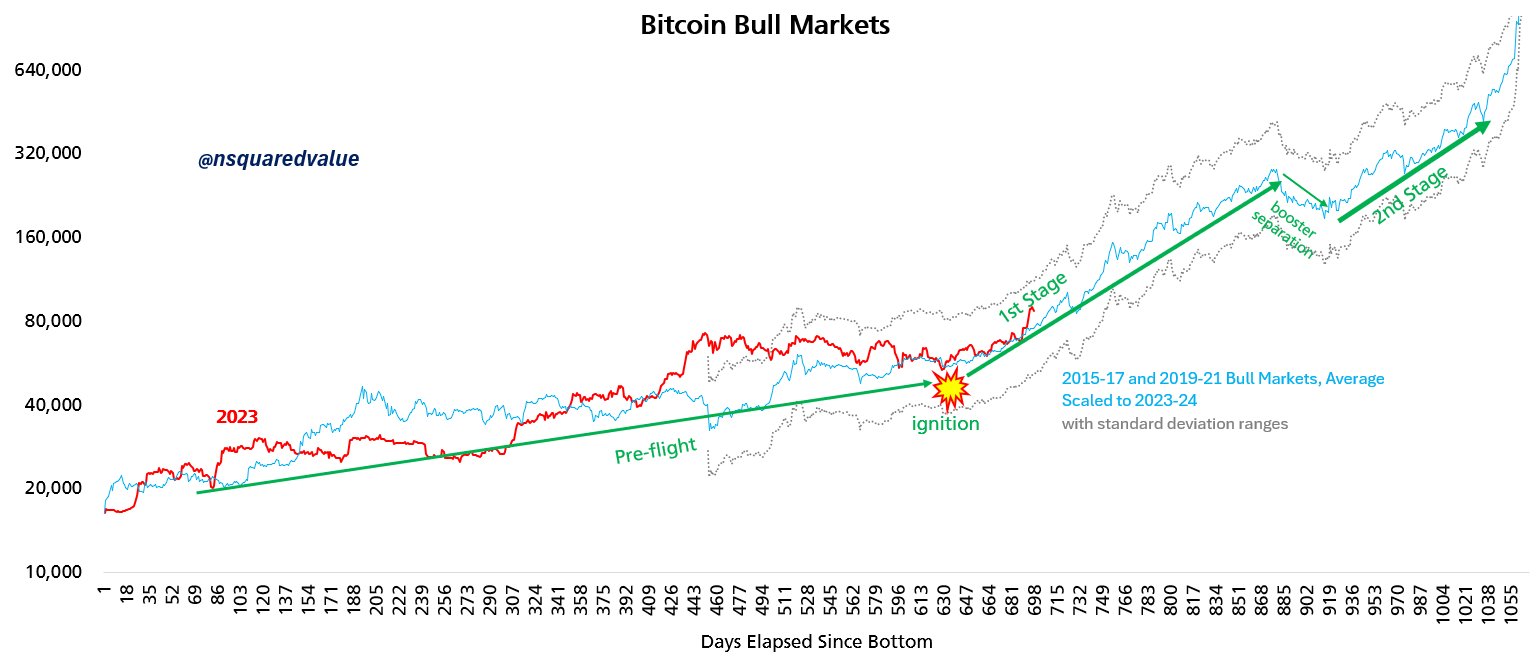

tim thinks we go sideways from here based on past cycles averages but i think we see lower 100s at a min before any consolidation

we should see a 22% pump within 10 days. that would put it at 106k. from there i could see a washout for one last bear trap.

what is insane is that from the cycle low we are matching the last 2 cycles at a multiple of 5.58 208 days from halving. if this continues to track price should be a min of 120k within 30 days (2017 cycle) and a max of 205k (2020 cycle). i still think we track closer to the 2016 cycle bc we have done that almost perfectly so far. https://charts.bitbo.io/cycle-low-multiple/ these also show a low with 50 days too which would help to print the yearly low in early jan.

tim thinks we go sideways from here based on past cycles averages but i think we see lower 100s at a min before any consolidation  regarding 2017 comparisons, we consolidated above the 78 fib. https://x.com/omagarjua/status/1857436562503479652

here is the fractal unaltered

regarding 2017 comparisons, we consolidated above the 78 fib. https://x.com/omagarjua/status/1857436562503479652

here is the fractal unaltered  funding pretty muted here overall. barely a perp premium . spot cvd is basicallyl sideways while perp is down. this looks good here from a derivatives standpoint imo

mentioned yesterday but dxy at resistance here. any drop will be a tailwind for btc imo

funding pretty muted here overall. barely a perp premium . spot cvd is basicallyl sideways while perp is down. this looks good here from a derivatives standpoint imo

mentioned yesterday but dxy at resistance here. any drop will be a tailwind for btc imo  there is a massive divergance between the inverse dxy and btc here. my guess is btc is sniffing this out properly but time will tell. as you can see from the chart the big rises are accomponied by dxy weakness (inverse dxy strength)

there is a massive divergance between the inverse dxy and btc here. my guess is btc is sniffing this out properly but time will tell. as you can see from the chart the big rises are accomponied by dxy weakness (inverse dxy strength)  eth is in a massive tri here. break above the yellow and it enters full send mode imo

eth is in a massive tri here. break above the yellow and it enters full send mode imo

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

X (formerly Twitter)

Timothy Peterson (@nsquaredvalue) on X

#Bitcoin prognosis: sideways for 1-2 months.

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

TVC:DXY Chart Image by cwsyx5

TradingView

0-TVC:DXY Chart Image by cwsyx5

TradingView

BITFINEX:ETHUSD Chart Image by cwsyx5

My guess is next Thursday the 21st View quoted note →

Closest guess for the day btc hits 100k gets a fat zap

For your listening pleasure

Usa and global liquidity… still choppy. Not much to add here  DXY… At the top diagonal resistance now. Bear div still in tact. Im sure there are some fundamental drivers pushing this higher. It seemed to rally on the trump win. Again, btc showing at of strength with this rallying. If it heads down it will be an additional tailwind

DXY… At the top diagonal resistance now. Bear div still in tact. Im sure there are some fundamental drivers pushing this higher. It seemed to rally on the trump win. Again, btc showing at of strength with this rallying. If it heads down it will be an additional tailwind  Us10y… fakeout above the large resistance.

Us10y… fakeout above the large resistance.  Tlt… still at support here

Tlt… still at support here  Spx… at the top of the diagonal resistance. If it does pop over the line and accelerate it could hit the 261 ext fairly quickly.

Spx… at the top of the diagonal resistance. If it does pop over the line and accelerate it could hit the 261 ext fairly quickly.  Gold.. looks to be getting rejected at the fib. I actually think this would be good for btc. In the past gold has rallied first. Perhaps we even get some profit taking on gold that flows into btc.

Gold.. looks to be getting rejected at the fib. I actually think this would be good for btc. In the past gold has rallied first. Perhaps we even get some profit taking on gold that flows into btc.  BTC… very good weekly close. Last week was the retest of the diagonal breakout that held 68k. I said that a lot of times those long upward dojis are actually bull and it turns out it was. Bband expansion which is very good to see. In the words of mr Bollinger its time to “pay attention”.

BTC… very good weekly close. Last week was the retest of the diagonal breakout that held 68k. I said that a lot of times those long upward dojis are actually bull and it turns out it was. Bband expansion which is very good to see. In the words of mr Bollinger its time to “pay attention”.  It is all about the fib ext. there are no more history and it’s a blue sky breakout. These are the most fun.

The cup and handle linear target is 130k.

It is all about the fib ext. there are no more history and it’s a blue sky breakout. These are the most fun.

The cup and handle linear target is 130k.  94k is the regular fib ext target

94k is the regular fib ext target  99k is the trend based fib ext target from aug 23 low

99k is the trend based fib ext target from aug 23 low  If you take it from the jan low its 85k.

If you take it from the jan low its 85k.  All I know is im not trying to fade a 7 month range breakout and in reality it’s a 3 year range breakout too. If btc follows gold its going to 173

All I know is im not trying to fade a 7 month range breakout and in reality it’s a 3 year range breakout too. If btc follows gold its going to 173  I like to track price/dma to see how extended price is. It seems on the 50 dma it’s the 125 level we have to watch for. That’s about 85k. but since it’s a range breakout it could extend past that a bit. Overall I think we could see a pullback a bit before 100k but who knows.

I like to track price/dma to see how extended price is. It seems on the 50 dma it’s the 125 level we have to watch for. That’s about 85k. but since it’s a range breakout it could extend past that a bit. Overall I think we could see a pullback a bit before 100k but who knows.  In 2020 when the breakout first started it ran to 1.4. in 2017 it ran to 1.53.

In 2020 when the breakout first started it ran to 1.4. in 2017 it ran to 1.53.  I will keep checking this every few days to see when we need to use caution

Ethusd… still think this is heading to 4k fairly quickly.

I will keep checking this every few days to see when we need to use caution

Ethusd… still think this is heading to 4k fairly quickly.  last time btc broke ath eth was 59% and went to its ath within 1.5 months later. That would put eth at an ath by year end

last time btc broke ath eth was 59% and went to its ath within 1.5 months later. That would put eth at an ath by year end  Ehtbtc nice bounce but still rejected resistance. I think this runs when btc consolidates. Similar to how btc is with gold

Ehtbtc nice bounce but still rejected resistance. I think this runs when btc consolidates. Similar to how btc is with gold  Btc.d nice rejected at the diagonal

Btc.d nice rejected at the diagonal  Overall thoughts. A trump win and red sweep is very good for btc and crypto. Imo there is a very good shot at lummis passing the btc bill which the usa would try to acquire 1 mil btc within 5 years. This will set of a sovereign game theory race like we have never seen. Price will likely have to go much higher to accommodate that level of buying. Yes older holders will sell but I doubt theres more than a few mil coins people want to let go of. Exciting stuff. Overall, we just had a 7 month and 3 year range breakout. This is def not where I would want to be fading btc. In the past we got a double pretty quickly after this level broke.

Overall thoughts. A trump win and red sweep is very good for btc and crypto. Imo there is a very good shot at lummis passing the btc bill which the usa would try to acquire 1 mil btc within 5 years. This will set of a sovereign game theory race like we have never seen. Price will likely have to go much higher to accommodate that level of buying. Yes older holders will sell but I doubt theres more than a few mil coins people want to let go of. Exciting stuff. Overall, we just had a 7 month and 3 year range breakout. This is def not where I would want to be fading btc. In the past we got a double pretty quickly after this level broke.  alts should start to get a bid now that btc has broke its inflation adjusted ath.

alts should start to get a bid now that btc has broke its inflation adjusted ath.

TradingView

FRED:WALCL-FRED:WTREGEN-FRED:RRPONTSYD Chart Image by cwsyx5

TradingView

TVC:DXY Chart Image by cwsyx5

TradingView

TVC:US10Y Chart Image by cwsyx5

TradingView

BATS:TLT Chart Image by cwsyx5

TradingView

FX:SPX500 Chart Image by cwsyx5

TradingView

FX:XAUUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

TradingView

BITFINEX:ETHUSD Chart Image by cwsyx5

TradingView

BITFINEX:ETHUSD Chart Image by cwsyx5

TradingView

BINANCE:ETHBTC Chart Image by cwsyx5

TradingView

CRYPTOCAP:BTC.D Chart Image by cwsyx5

TradingView

BITSTAMP:BTCUSD Chart Image by cwsyx5

I’ll prob start posting my analysis I do for my hedge fund here. Feel free to drop some sats if you enjoy it

This is my general pitch.

1. Btc is 1.4

Tril of 900 tril store of value assets

2. There’s over 50 million millionaires in the world. Not everyone can get to 1 btc.

3. Every gov will be buying soon View quoted note →

Just orange pilled a friend last sat whil drunk lol. He’s buying 100k today

We’re going to win

Time to accelerate