The USA by the numbers:

Instead of being evidence of healthy growth in productivity driven by new investments (from accumulated savings), the US map looks like an inflationary boom driven by debt.

Total M2 money supply in he US has grown 158% this century.

Total federal government debt has grown by 560% since the start of the new millennium, from $5.6 trillion to $37 trillion.

Total debt–public, private, and corporate–has grown 281%, from $26.8 trillion to $102.2 trillion.

Household net worth data from the Fed says US households are 290% richer this century, from $41 trillion to $160 trillion.

This isn’t a history-making boom. It’s an inflationary asset bubble pumped up by record debt accumulated at historically low interest rates (which are now moving up).

Source: Bonner Research

mattaroo

mattaroo@nostrplebs.com

npub1wwus...7lcn

Family First For Life. Save Some Sats. ₿ank ₿etter. MONEY GIVES YOU WINGS. ₿ITCOIN IS THE GOLDEN EAGLE. ₿uy more ₿itcoin.

Currently sitting on the 3rd stone from the sun and looking out.

Marinate on this good Dr. A Daily Dose for @Sergio

Spotify

SpottieOttieDopaliscious

Outkast · Aquemini · Song · 1998

The chart highlights a historic shift in the U.S. housing market toward buyers in April 2025, with nearly 500,000 more sellers than buyers—the largest gap in decades. This suggests - NOBODY BUYING, EVERYONE SELLING which will drive a cooling RE market. In order to sell sellers may need to lower prices. Youth have no cash to buy nor can afford high mortgage rates. I also have a theory that people are selling real estate to buy hard assets like BTC and TSLA - and renting instead or even downsizing their homes.

Source: Invest Answers

The chart highlights a historic shift in the U.S. housing market toward buyers in April 2025, with nearly 500,000 more sellers than buyers—the largest gap in decades. This suggests - NOBODY BUYING, EVERYONE SELLING which will drive a cooling RE market. In order to sell sellers may need to lower prices. Youth have no cash to buy nor can afford high mortgage rates. I also have a theory that people are selling real estate to buy hard assets like BTC and TSLA - and renting instead or even downsizing their homes.

Source: Invest Answers Saylor and Strategy's financial chess game has been doing very well since 2020:

Capital Markets: tapped out.

NAV PREM Tanks, he sells preferred and buys the stock back cheap.

NAV PREM Rises, he sells stock, buys Bitcoin, which raises BTC price.... which raises MSTR price, which gets the Preferred excited.

Checkmate.

Saylor and Strategy's financial chess game has been doing very well since 2020:

Capital Markets: tapped out.

NAV PREM Tanks, he sells preferred and buys the stock back cheap.

NAV PREM Rises, he sells stock, buys Bitcoin, which raises BTC price.... which raises MSTR price, which gets the Preferred excited.

Checkmate.Another spike above 5%. This s not working out very well for the Trump administration or new wanna be mortgage holders.

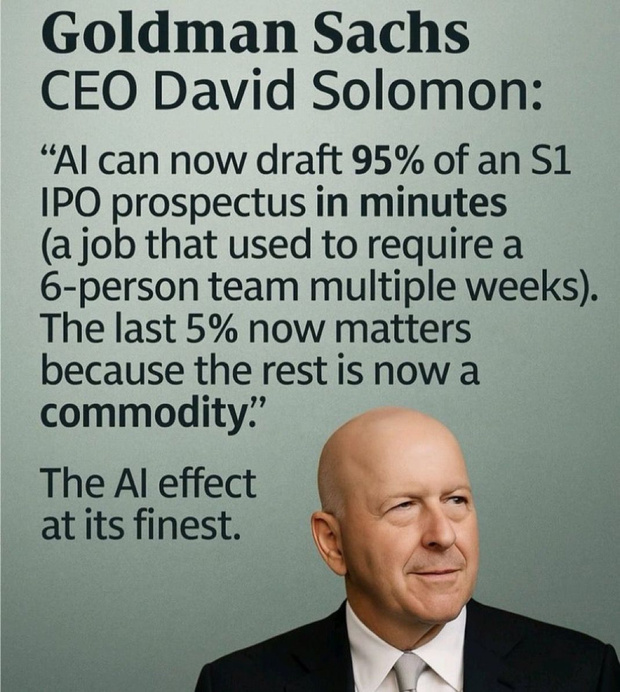

AI is already good at doing things like writing code, analyzing data, and making documents, which are big parts of office work. A 2023 study by McKinsey said 30% of office tasks might be done by AI by 2030, but Amodei thinks it’ll be faster—50% of starting jobs gone by 2030. If businesses start using AI at a steady rate of 15% each year, and 60% of them use AI for office work by 2030, there’s about a 70% chance that 40-50% of these jobs could disappear.

For bigger office jobs, like mid-level lawyers or accountants, the changes might take longer—around 8 to 10 years, so by 2033-2035. These jobs need more complex thinking and personal connections, which AI can’t fully do yet. If AI improves at these harder tasks by 10% each year, there’s a 40-50% chance mid-level jobs will be affected by 2035. There’s a 90% chance entry-level tech jobs are already being changed. If only 30% of leaders and companies listen to these warnings, there’s a 70-80% chance of big problems, with unemployment possibly hitting 15-20% by 2030, starting with tech and office jobs in 2025 and growing over the next 10 years. I see the signs all over already starting with big tech and consulting. Source: IA

HOW TO SURVIVE:

1. Learn AI skills

2. Build a portfolio of Assets that will ride this wave.

AI is already good at doing things like writing code, analyzing data, and making documents, which are big parts of office work. A 2023 study by McKinsey said 30% of office tasks might be done by AI by 2030, but Amodei thinks it’ll be faster—50% of starting jobs gone by 2030. If businesses start using AI at a steady rate of 15% each year, and 60% of them use AI for office work by 2030, there’s about a 70% chance that 40-50% of these jobs could disappear.

For bigger office jobs, like mid-level lawyers or accountants, the changes might take longer—around 8 to 10 years, so by 2033-2035. These jobs need more complex thinking and personal connections, which AI can’t fully do yet. If AI improves at these harder tasks by 10% each year, there’s a 40-50% chance mid-level jobs will be affected by 2035. There’s a 90% chance entry-level tech jobs are already being changed. If only 30% of leaders and companies listen to these warnings, there’s a 70-80% chance of big problems, with unemployment possibly hitting 15-20% by 2030, starting with tech and office jobs in 2025 and growing over the next 10 years. I see the signs all over already starting with big tech and consulting. Source: IA

HOW TO SURVIVE:

1. Learn AI skills

2. Build a portfolio of Assets that will ride this wave.FTX is set to distribute over $5 billion in stablecoins to creditors this week on May 30.

GM good Dr. It takes a lot to laugh and a train to cry. Daily Dose for @Sergio

One of the best things about human nature is that it always has the potential to change into something even better than it already is. Daily Dose for @Sergio

Spotify

Human Nature

Michael Jackson · Thriller 25 Super Deluxe Edition · Song · 2008

SpaceX Starship made it to orbit.

Just think of all those sats you can buy instead of spending all that cash in Vegas. Another day, another Daily Dose for @Sergio

Spotify

Tumblin'

The California Honeydrops · Soft Spot · Song · 2022

"This collapse of duration-based thinking demands a new benchmark—one that reflects the liquidity, speed, and belief-driven nature of today’s markets. Bitcoin, now the fifth-largest asset in the world, may be that benchmark. Unlike long-duration assets, Bitcoin is global, open 24/7, liquid, and doesn’t require debt or labor to grow. Its value isn’t rooted in future cash flows or corporate projections but in network adoption and digital scarcity. Many traditional investors dismiss it for lacking “intrinsic value.” But that may be its greatest strength. Intrinsic value takes time to build—it assumes a world where patience is rewarded and slow compounding is safe. Bitcoin, by contrast, fits a cultural and economic shift where time is no longer a luxury but a liability. Among its mostly young and digitally native user base, Bitcoin is more than an asset—it’s a symbol of taking back control over time. It represents a rejection of the old system: the corporate ladder has broken, upward mobility feels out of reach, and belief in long-term reward has eroded. For many, Bitcoin is hope—for the time they’ve lost and the autonomy they want to regain." Jordi Vissor

Why is Peter Schiff a guest speaker at Bitcoin2025 this week? Sounds like a glutton for punishment.

One of the biggest issues I see out in the world right now is the dilemma that people are grappling with between security vs self custody. Maybe this is where diversification is the best route.

In order for what DOGE is/was trying to do, the 10 year would have to come down. It did the exact opposite. DOGE has had close to zero impact. Even pointing out the ridiculous spending with NGO's and people getting things like Social Security payments while in the grave will be forgotten as the deficit grows at record pace. The rich are getting richer from tax benefits (see my earlier post today with chart) and all I can hear in my head is Lyn saying, "Nothing stops this train" I get it now more clearly than ever before.

Watch buying and selling in real time. To see these volumes in real time is eye popping.

https://coinact.gg

Been digging into the centralized vs decentralized topic and discovered that in 2010 and again in 2013 Bitcoin had an infinite money glitch that got exploited and the blockchain was rolled back. The same thing happened to Ethereum in 2016 and they rolled back the blockchain and also forked it. Just last week, Sui blockchain had a math coding error exploited and the validators voted to filter and did not need to roll back the chain.

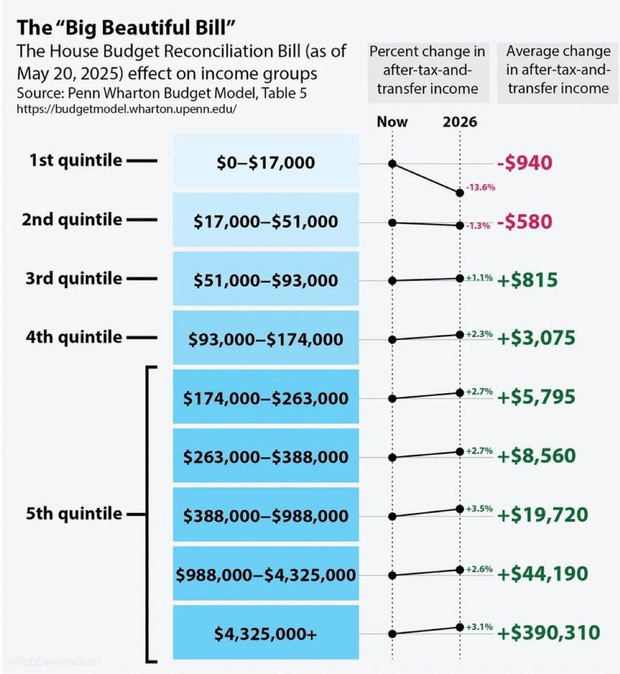

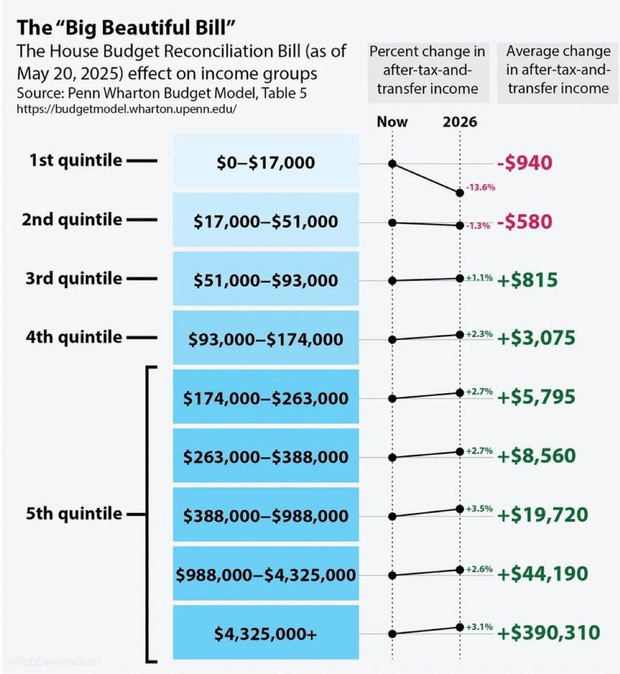

New tax bill implications:

What It Means: The richer you are, the more you gain—especially the ultra-wealthy, who could get hundreds of thousands more. This points to big tax cuts for high earners, like on investments or capital gains. The bill favors the rich. The top 1% (especially the top 0.1%) get huge boosts, while the bottom 40%—especially the poorest—lose money. This widens the gap between rich and poor.

What It Means: The richer you are, the more you gain—especially the ultra-wealthy, who could get hundreds of thousands more. This points to big tax cuts for high earners, like on investments or capital gains. The bill favors the rich. The top 1% (especially the top 0.1%) get huge boosts, while the bottom 40%—especially the poorest—lose money. This widens the gap between rich and poor.

What It Means: The richer you are, the more you gain—especially the ultra-wealthy, who could get hundreds of thousands more. This points to big tax cuts for high earners, like on investments or capital gains. The bill favors the rich. The top 1% (especially the top 0.1%) get huge boosts, while the bottom 40%—especially the poorest—lose money. This widens the gap between rich and poor.

What It Means: The richer you are, the more you gain—especially the ultra-wealthy, who could get hundreds of thousands more. This points to big tax cuts for high earners, like on investments or capital gains. The bill favors the rich. The top 1% (especially the top 0.1%) get huge boosts, while the bottom 40%—especially the poorest—lose money. This widens the gap between rich and poor.