Debt to GDP as core metric is already looking bad in most countries but seems very misleading. For a household you would take all debt (liabilities) vs income. For a mortgage here is an example guideline for DTI (debt to income):

100% or higher DTI - these prospective borrowers represent a huge risk and do not show an ability to make regular mortgage payments. Almost all lenders will reject an application in this instance.

75% to 99% DTI - borrowers who are very high risk. A select few specialist lenders will be willing to look at the application and make a positive decision where other factors are given more weight, such as credit score and a clean credit history or substantial deposit.

50% to 74% DTI - high risk borrowers. Some specialist lenders are willing to accept applications at this level, but terms are less favourable and larger deposits are required.

40% to 49% DTI - moderate risk borrowers. Specialist lenders will want to see good credit history and may ask for larger deposits.

30% to 39% DTI - acceptable risk. Most specialist lenders will offer a mortgage at this level at standard terms.

20% to 29% DTI - good borrower. Almost all lenders are happy to approve mortgage applications at this level.

0% to 19% DTI - very low risk borrower. All lenders will consider an application

Now let’s look at US as a virtual household:

Gov income is not (yet) 100% of GDP! More like 17%. So 25.4 * 0.17 = 4.3T

Total liabilities are more like 100T, this is current and future outgoings the gov has committed to even though not all of it is funded - which doesn’t mean the liability magically goes away. Current low estimate for this is 100T.

So the debt to income ratio is about 23.2 or 2300%.

Buying gov bonds is like financing a mortgage for that household.

You know how this ends 🟠.

Nicorama

nico@nostr.com

npub1w4yf...quku

☕️ Design, Art & Engineering

🧡 Class of 2012 - always learning

🇬🇧 London

Argh… UK is soooo not getting this and keep braking on all 4 for the past 10 years, missing the biggest opportunity of all time to become the new center of modern finance.

- avail to HNW / accredited investors only

- not SPOT !!! Paper bitcoin 💩

- also approved ETH etn, not protecting investors from exposure to a scammy unregistered security

https://www.forbes.com/sites/digital-assets/2024/03/28/london-stock-exchange-bitcoin-etns-edge-towards-market-demand-response/

Proper link this time - t-30

X (formerly Twitter)

SpaceX (@SpaceX) on X

Watch Starship's third flight test https://t.co/1u46r769Vp

@primal why does your lightning wallet activation require PII like email, country and DOB ?

As soon as the 4y price cycle model is being accepted more broadly it will be broken since everyone will start to front run it. That would explain why we are already making ATHs. What happens when we start to front run ♾️/ 21M ?

Bitcoin return last 10y+ are face melting but also totally comparable to returns from a successful startup investment from seed to IPO (for bitcoin, basically from pizza day to the ETF).

From now the baseline is now the “IPO” price (45k) and TAM is a one quadrillion SOV market, of which BTC currently has about 0.1% market share. Public companies have done 10, 100, 1000x from their IPO prices (eg market share going from 0,1 to 1 to 10 to 50%+ saturation) so not breaking new ground in that sense but doing so with the largest market of all.

Only by accepting the enormity and binary aspect of the endgame (the number zero or a number with 6+ zeroes) is someone able to overcome the ‘being too late’ mental block, overcome their ego and jump in.

Fiat is the volatile asset.

Fiat rug pull in Egypt today

Fiat is IOUs backed by the promise of future IOUs paid in those same IOU units. After 10+ year trying to ‘understand’ it that is the best way I can describe it and it still doesn’t make sense 🤣

When you press ❤️ to see who liked a note and you end up liking your own note and can’t undo 😳 @primal

Awesome client overall !

This is right outside the LSE (London school of economics) building 😉

From Satoshi / Malmi email archive

(…) My choice for the number of coins and distribution schedule was an

educated guess. It was a difficult choice, because once the network is

going it's locked in and we're stuck with it. I wanted to pick

something that would make prices similar to existing currencies, but

without knowing the future, that's very hard. I ended up picking

something in the middle. If Bitcoin remains a small niche, it'll be

worth less per unit than existing currencies. If you imagine it being

used for some fraction of world commerce, then there's only going to be

21 million coins for the whole world, so it would be worth much more per

unit. Values are 64-bit integers with 8 decimal places, so 1 coin is

represented internally as 100000000. There's plenty of granularity if

typical prices become small. For example, if 0.001 is worth 1 Euro,

then it might be easier to change where the decimal point is displayed,

so if you had 1 Bitcoin it's now displayed as 1000, and 0.001 is

displayed as 1.

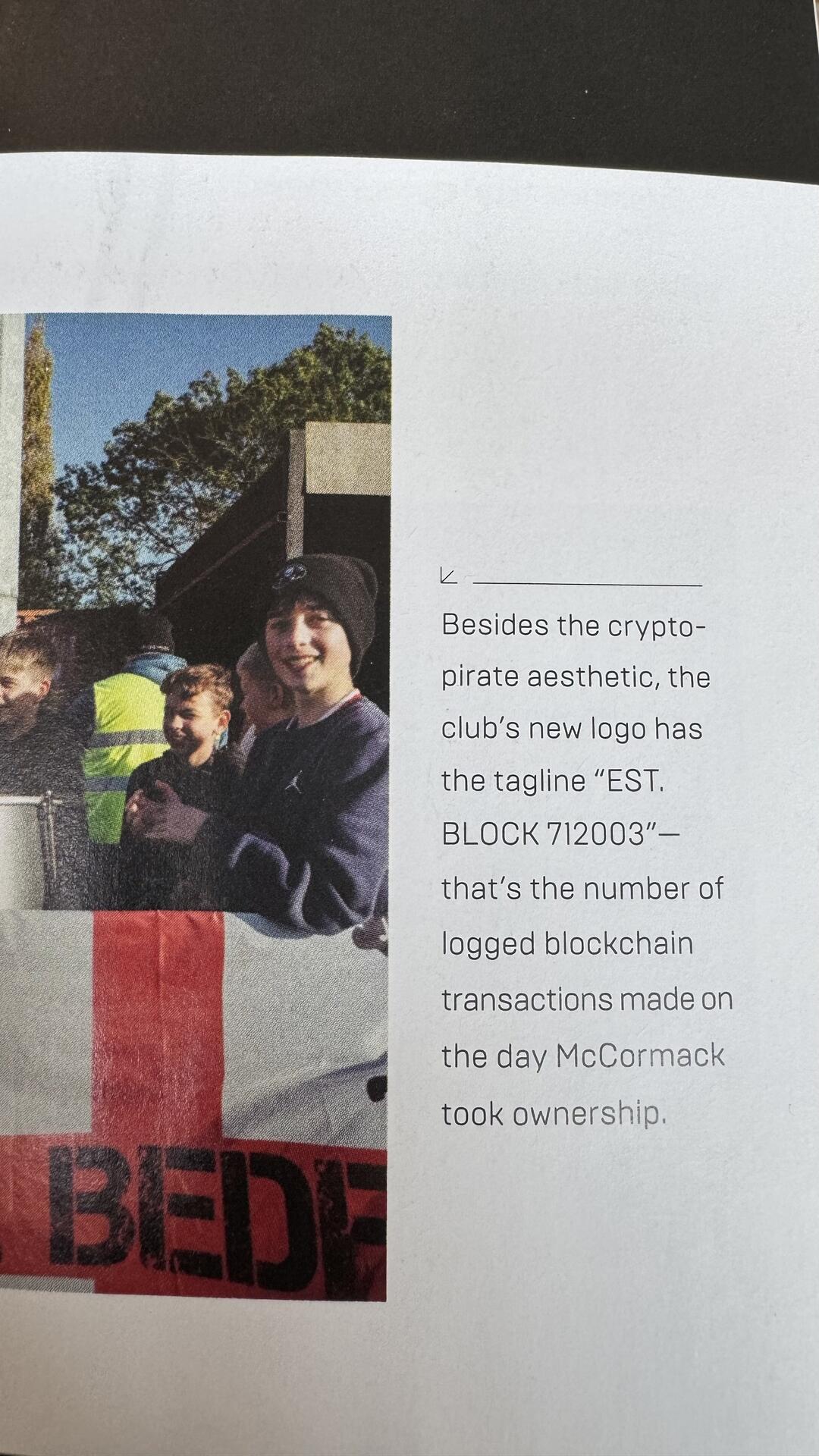

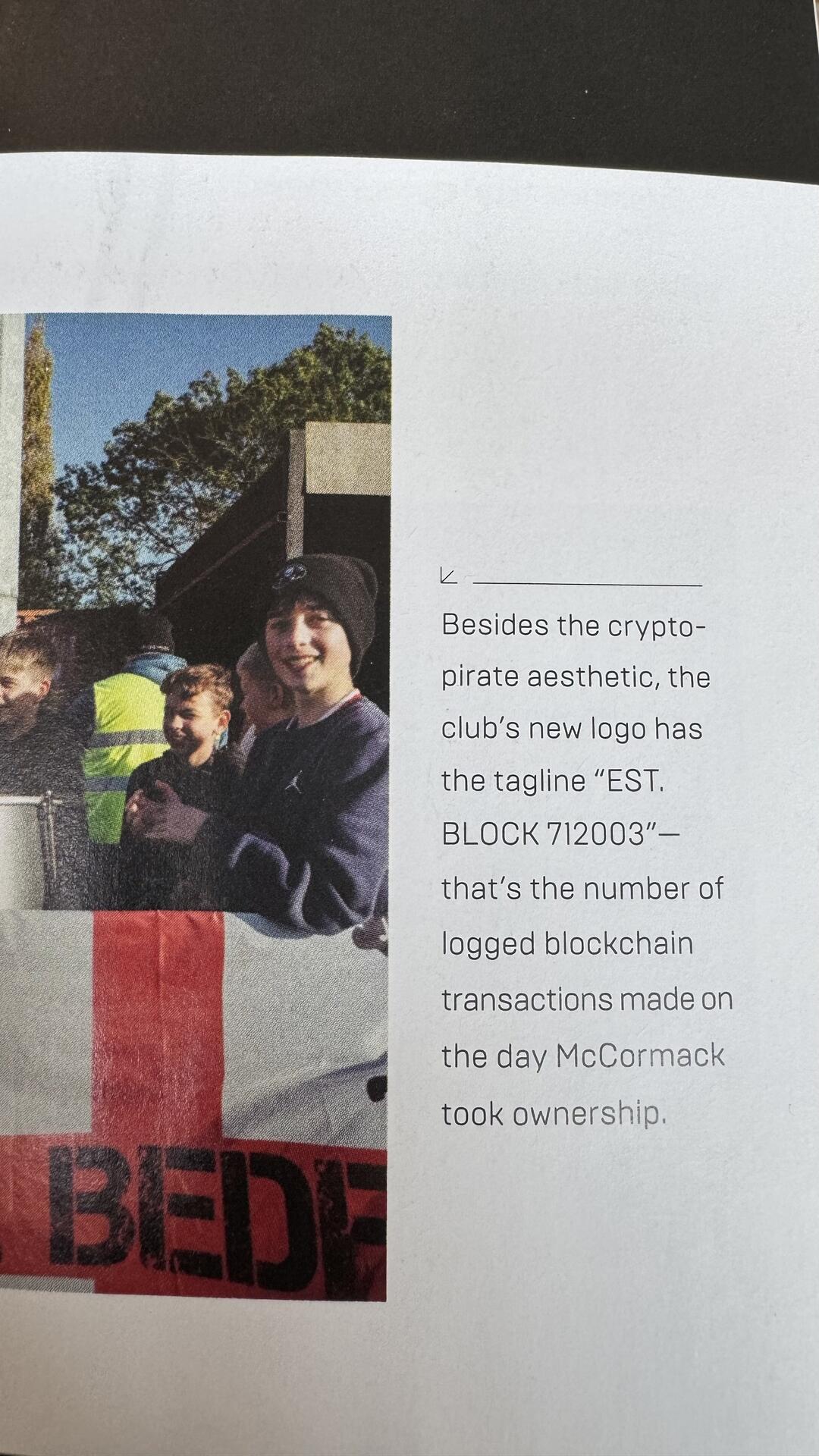

Wired magazine in 2024 still without basic understanding of the bitcoin time chain 🤦♂️ congrats @Peter McCormack for great coverage though!

US corps will indirectly begin ‘buying’ massive amounts of BTC via combination of 401k matching & ETFs - contributing to the speculative attack on fiat 😂

Bitcoin is more than twice the age of the Euro on genesis day.

Reverse god candle > dog candle ? 😂