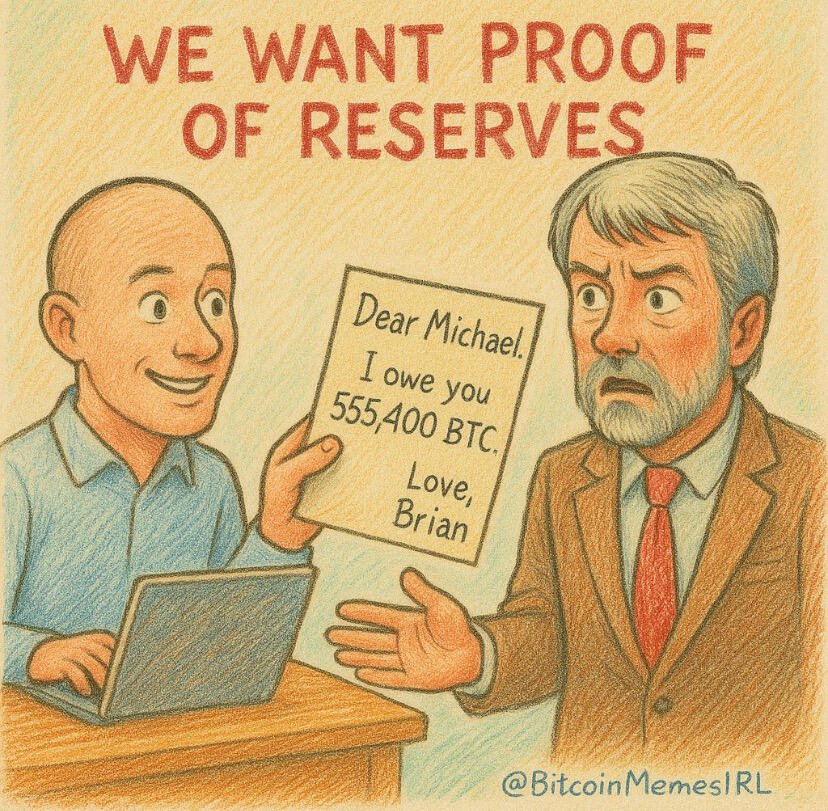

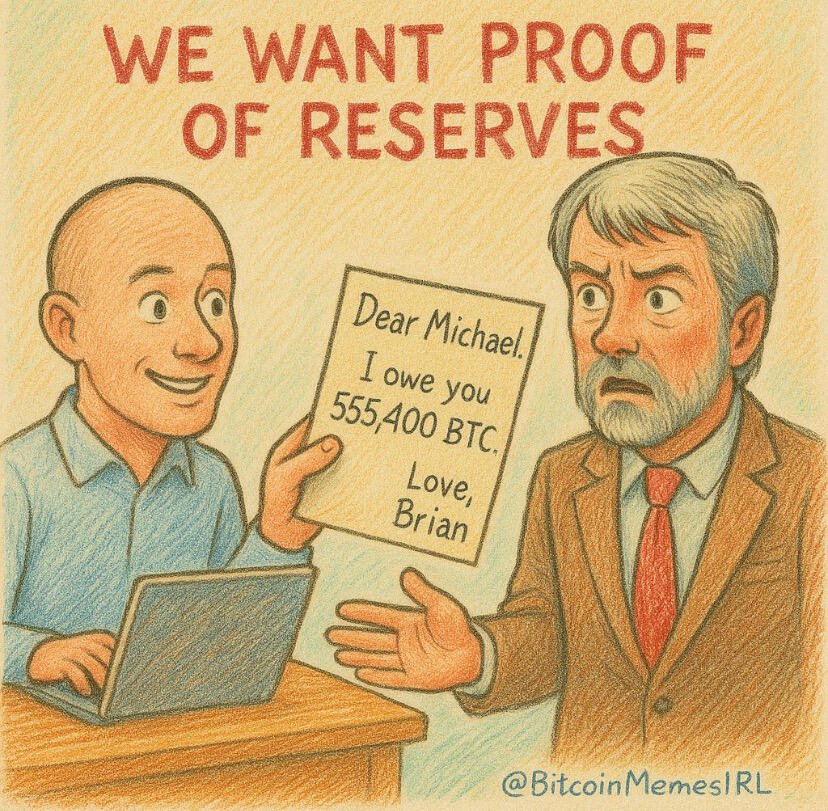

#meme #memes #memestr #Saylor #MSTR

As far as I understand #Coinbase reserves are audited quarterly. This leaves a lot of room for the commingling of #MSTR and #IBIT #bitcoin holdings with Coinbase users’ funds which could allow some degree of market manipulation. I would be happy to be shown that this type of manipulation isn’t possible but until proven otherwise, we have to consider this as a real possibility.

All speculations could be cleared by demonstrating proof of reserve and the rational provided by #Saylor to justify not doing so are weak at best.

View quoted note →

View quoted note →

#Saylor was asked if #MSTR will ever show proof-of-reserve and Saylor replied that the reason #Strategy doesn’t show proof-of-reserve is for security reasons.

This answer raises more than an eyebrow. It’s unlikely that Saylor isn’t aware that he could prove MSTR’s #Bitcoin reserves in a private manner through zero-knowledge proofs. Maybe that’s not a service that #Coinbase is willing to provide but why not just say so in that case?

It seems to me that this response hides something bigger. I really only see two reasons as to why Startegy wouldn’t show proof for its #BTC holdings:

1) There are some accounting trickeries going on between Coinbase and their big institutional clients (#BlackRock, Strategy…). Maybe some form of paper Bitcoin or other tricks allowing them to manipulate the market.

2) Saylor knows, he will have to sell some BTC at some point and he doesn’t want the move to be broadcasted publically until officially announced.

What other reasons do you think of?

If Saylor is so concerned about the #privacy of its holdings maybe he just needs a #Monero.

https://xcancel.com/BitcoinMemesIRL/status/1927180295138103434Here is an update on the #Bitcoin price forecast:

As it stands, I think we are more likely than not to see an atypical extended cycle in time that could top around early 2027 (which is the path 3 in the previous note).

Updated paths:

Path 1: 45% probability. #BTC breaks out without any substantial pull back from the current levels. The top could be reach at around 240K early in 2027.

Path 2: 25% probability. Pretty much the same as path 1 but with a retracement of the current move up (we shouldn’t revisit the last low though) before the break out.

Path 3: 20% probability. There is still a possibility that this market cycle has completed and that we take out the recent low with more downward chop to follow.

#Trading #Tradestr

View quoted note →

View quoted note →I don’t know much about #Bukele’s rise and actions beyond the general parroted praises on his support for #Bitcoin or his crackdown on gangs violence. I certainly took those with a good amount of skepticism but without listening to dissident voices, it’s hard to not be somewhat sympathetic to his success.

So if like me you have a generally positive image of Bukele you may want to watch the segment below. It certainly puts things in perspective. Not that, I’m surprised about what’s reported but rather that I haven’t heard it sooner. This tells me that Bukele’s propaganda arm has some reach.

#ElSalvador

I foresee that the #GENIUSAct will mark the start of a new wave of crackdown on #crypto similar to the crackdown we’ve seen on #privacy coins/layers but instead the pressure will be applied to parties involved with non-compliant #stablecoins. Like for privacy, the best answer will be extreme decentralization where no single dev can be single out and targeted for publishing “non-compliant” code.

#DeFi #Stablecoin

I’m not seeing much uproar about the #GENIUSAct. Instead people are having fun memifying Warren. You would think that a regulation attempting to force on-chain #KYC (as I understand it) would get more attention.

This could backfire for regulators though. Instead of KYCing their users, #DeFi protocols may choose to ditch USD-backed #stablecoins and adopt alternatives instead. That said, USD-backed stablecoins are largely adopted so this would require some significant changes from DeFi protocols. Implementing KYC may be the path of least resistance.

Also, it’s unclear to me to what extent wrapped versions of #USDC or #USDT could be frozen by the issuer. There will probably be some workaround but using those non-KYCed wrapped versions in their protocols would certainly exposed the protocols to some form of retaliation.

#Crypto #Stablecoin

Paradoxically, the #GENIUSAct and #STABLEAct may be counterproductive in asserting the dominance of the U.S. dollar within the #crypto ecosystem.

The adoption of the U.S. dollar in crypto is already pervasive. Many decentralized #stablecoin protocols rely to some extend on dollar-backed assets.

By wanting to increase the control U.S. authorities have over the usage of US-backed #stablecoins, the legislators take the risk of undermining this dominant position. #DeFi protocols can’t be stopped and they will seek alternatives to US-backed assets.

This is a perfect example of how a bad regulation can accelerate innovation that goes against the intent of the regulation.

May 15: #Coinbase announced that customers’ data collected via #KYC procedures leaked, highlighting the danger of KYC to consumers.

5 days later: the U.S. Senate passes the #GENIUSAct that will mandate systematic KYC checks to transact in #stablecoins.

Poor timing to pass the bill, but still it passed.

#Stablecoin #crypto #USpol

The #GENIUSAct, an anti-innovation, #CBDC-like enabler bill has passed the US Senate today. I don’t know all the details of the bill it looks to me that, it puts US devs and companies working on #DeFi protocols at risk of being sued by US authorities for using decentralized #stablecoins or integrating fiat-back stablecoins without #KYC procedures.

Below is #AaronDay summary of the bill:

These are the current KYC/AML implications of the GENIUS Act and STABLE Act. Note, it will likely get worse as the bills move towards reconciliation and final passage (they never become more freedom oriented). If you read this and the bills, and still think this is pro-freedom and pro-crypto, I am sorry, I can’t help you.

STABLE Act KYC/AML Implications:

- Stablecoin issuers classified as financial institutions under the Bank Secrecy Act, subject to AML obligations.

- Issuers must implement KYC processes, including customer identification, due diligence, and transaction monitoring.

- Federal regulators can supervise issuers, investigate violations, and impose penalties up to $100,000 per day.

- Asset segregation mandated to protect customer funds, supporting AML transparency.

- Two-year moratorium on algorithmic stablecoins to limit unregulated entities bypassing KYC/AML.

GENIUS Act KYC/AML Implications:

- Stablecoin issuers classified as financial institutions under BSA, requiring AML programs and customer due diligence.

- Annual AML compliance certifications required, with criminal liability for false certifications.

- U.S. jurisdiction extended to foreign issuers serving U.S. customers, enforcing AML/KYC compliance.

- Regular audits and public disclosure of reserve holdings to ensure AML traceability.

- KYC/AML rules may limit anonymous DeFi transactions, raising privacy concerns.

Key Differences:

- GENIUS Act applies AML/KYC to foreign issuers and DeFi, STABLE Act focuses on U.S. issuers.

- STABLE Act bans algorithmic stablecoins for two years, GENIUS Act requires Treasury study.

- GENIUS Act allows state regulation for smaller issuers, STABLE Act emphasizes federal oversight.

- GENIUS Act prohibits marketing stablecoins as FDIC-insured, reducing AML misrepresentation risks.

Broader Implications:

- Increased compliance costs for issuers like Tether and Circle, potentially excluding smaller players.

- Stricter rules may enhance consumer confidence but limit DeFi innovation and privacy.

- GENIUS Act aligns with global frameworks like EU’s MiCA, STABLE Act focuses on domestic control.

- Democrats raise concerns about GENIUS Act’s AML protections, suggesting stronger enforcement.

#stablecoin #crypto #USpol

The #Coinbase data breach is the perfect example as to why #KYC applied to #crypto is a major security risk for crypto users. Wealthy crypto users are prime targets for criminals conducting wrench attacks due to the irreversibility of crypto transactions. Although the use of crypto #privacy tech can minimize the risk by making you a less attractive target, they still don’t fully remove the risk because once you’ve been KYCed, your data is forever at risk of being leaked. Regulators claim that KYC is necessary to fight criminals laundering money but they always omit to mention that it is at the cost of the safety of all cryptos users and to the profit of violent criminals.

#Coinbasehack

View quoted note →

View quoted note → View quoted note →

View quoted note →