#Bitcoin price forecast update:

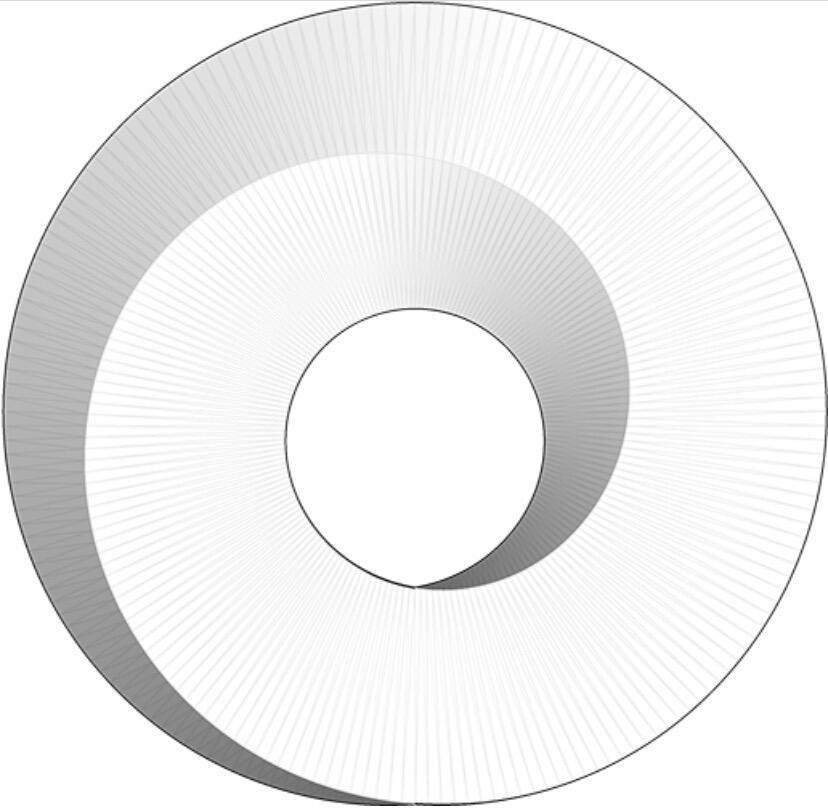

The rejection of #BTC below $118,000 and the failure to hold key levels on the downside, shifts the momentum back to the bear count (path 1).

The probability weighting for path 1 (bear scenario) is now 45% (up from 30%). Path 2 (bull scenario) now weights at 30% (down from 45%) probability of playing out.

#Trading #Tradestr

View quoted note →

LogicallyMinded

npub1s0fs...rqf5

Crypto trader. Independent thinker diligently working to move the Overton window closer to the truth. Advocate for decentralized governance models and freedom tech. Banned from Twitter for denouncing the vax pass. Don’t follow if you can’t handle the truth!

XMR: 88RzWHVvdifJHwf1nsfVBrLYm8D5hFUcWHMtPK8F3TkzLLe2rqHkfNAUBQ2dSU1tTQenfSoXtqnxSMNiCaMekZ6wUMWtgnB

Can #crypto hobbyists still make money with #mining? Whether it’s mining with ASICs, GPUs or even CPUs, professional participants have captured the market and priced out hobbyists.

When it comes to earning staking rewards, even running a mining node at home has become less accessible for most blockchains. As a result, most hobbyists just stick with stake delegation but delegators don’t provide much added-value to the network so there isn’t much value to extract through stake delegation. However, the risk of not delegating is for your savings to get eroded by the #blockchain’s token issuance. So stake delegation is more akin to a punishing rather than rewarding mechanism.

So can profitable mining be made accessible to the plebs again?

If we look at what’s is being done on #ProofOfPersonhood blockchains, I would say that it’s possible. Proof-of-Personhood (PoP) blockchains allow to prove that a node is run by a unique human and that this human isn’t running multiple nodes. Rather than consuming energy or staking capital, PoP blockchains are fighting sybils by proving that a given participant is a unique individual. It’s easy to see how this feature cannot be easily captured by commercial entities to outcompete the plebs. Although in some cases, it is possible for businesses to hire and use humans as a proxy to run multiple nodes, the value added by the commercial entities would be negative.

PoP blockchains use various systems to prove the uniqueness of a human such as biometrics, ID checks, #WebOfTrust, or proof-of-human-work. Although biometrics and ID check systems are often critized for their dystopian nature blockchains like the #Idena network uses proof-of-human-work which has the advantage to not require any personal data. All you need is to complete some tasks that can only be solved by humans.

PoP blockchains are an interesting area of growth for a plebs-friendly distribution of the block subsidy. Plus, the PoP capabilities aren’t restricted to fair mining as they can be extended to fair launch, fair faucet distribution, fair voting and more.

When enhanced with proof-of-stake, PoP blockchains can also prevent the concentration of the token issuance among whales by assigning a higher staking yield to smaller stakers.

So why haven’t PoP blockchains gained more traction yet?

One reason is that the space is often associated with dystopian narrative due to the use of biometrics or IDs. However, as said earlier, not all PoP blockchains rely on those mechanisms and even those that do, can obfuscate personal data through the use of ZK proofs.

That said, even if PoP blockchains are still under the radar (the Idena network has a market cap below $500k), the concept is being mentioned more and more especially in the context of being used as a tool to combat #AI generated frauds or bot spam, a use case that could certainly be applicable to #nostr.

a16z crypto

On AI & personhood credentials: a new paper - a16z crypto

#meme #memes #memestr #trump #bitcoin #crypto #stablecoin

Safe self-custody doesn’t exist without privacy.

#Monero

Self-custody and #privacy are still being under attack by the U.S. government. When a government tells you they are pro-#crypto understand that they are just buying time.

#Bitcoin

View quoted note →

#Bitcoin price forecast update:

I don’t have much changes to make to the two paths described below other than increasing the weighting for path 2 to 45% (from 35%) and decreasing the weighting for path 1 to 30% (from 45%). So far the bulls have successfully defended the $105,580 level and based on lower time frame price action the odds for this level to remain untouched has increased. The invalidation for the path 1 remains $125,759 although breaching $118,680 would significantly decrease the odds of seeing path 1 playing out. Path 2 will likely see a longer consolidation phase between $107,000 and $125,000 that shown on the latest chart screenshot.

#BTC #Trading #Tradestr

View quoted note →

Interesting take on the potential motives behind the #CharlieKirk assassination. Charlie was being a bit too vocal about #Epstein and #Israel apparently.

If I had to bet on the primary motive for the #CharlieKirk assassination, I would say that it was to eliminate a man who had the ambition, charisma and operational capabilities (grassroots support and media network) to run for and win the Presidency without the support of the system. This combination of attributes is rarely seen and Charlie had them all.

It’s sobering to see #CharlieKirk being assassinated...

Open debates are essential to a functioning society and no one should be persecuted or worse for sharing ideas and confronting opposite viewpoints.

I have no idea if this is the act of a lunatic or if something else more nefarious is at play here. I hope this tragic event won’t be used to promote authoritarian predictive policing type of policies but the shock is going to be so profound in the society that I wouldn’t be surprised if this it will be.

RIP Charlie

With the #quantum threat on the horizon, the ability to reach consensus on new upgrades and proactively execute on them is going to be a key factor to successfully migrate a blockchain to a post-quantum world. It’s not the time for #Bitcoin to talk about ossification. Innovation has to be back on the table.

One way to compare Proof-of-Work to Proof-of-Stake is to look at the production of work through time that is required to earn future rewards.

In the case of Proof-of-Work, future rewards can only be earned by work provided in the future while for Proof-of-Stake, future rewards are earned through capital that has been earned and allocated at an anterior date to future earned rewards.

Proof-of-Stake attracts passive actors which can simply buy, stake and forget (especially in the case of delegated stake) while Proof-of-Work requires a continuous involvement of the miners to keep earning rewards.

The importance of not distributing rewards only based on past work is that doing so can give an enormous advantage to the “early adopters” (that may just have been at the right place at the right time) while discouraging future competition.

Of course, in Proof-of-Work capital expenditures are required and those are technically work that has been provided in the past but operational expenditures (which is work that has to be provided in the future) is still required. However, the more capital expenditure is required, the more a Proof-of-Work system is close in nature to a Proof-of-Stake system as the importance of past work is higher than for Proof-of-Work systems with low capital expenditure requirements.

Intuitively, we could say that #Ethereum (pure PoS) rewards past work more than #Bitcoin (high CapEx) which rewards past work more than #Monero (low CapEx). There are also other approaches that fits in between such as #Idena which relies on Proof-of-Human-Work (Lowest/No CapEx) coupled to sublinear staking (lowest staker earns the highest yield, highest staker earns the lowest yield).

Another advantage of distributing the rewards for future work is that it protects the network against seizures. Stake seizure by state actors are a threat to the future decentralization of a network while seizure of mining hardware isn’t in itself sufficient to pose a risk to future decentralization as some operational expenditures are still required.

Those thoughts on PoW vs PoS aren’t totally fleshed out and it would also be interesting to consider the impact of the ASICS performance race (constantly requiring new CapEx) as well as the choosen rewards issuance curve (early adopters receiving more rewards could produce a “right place at the right time” effect seen in PoS).

Every #Bitcoin that is held on a custodian with a lending offer is expanding the #BTC supply. Those bitcoins aren’t kept in cold storage, they lended to traders as ammunition to play the short side.

Think that treasury companies, Strategy and IBIT are bullish for Bitcoin?

Figure out where those bitcoins are custodied then think again.

#Trading #Tradestr

The more time the price of #Bitcoin stays below this curved wedge, the more likely the chances that #BTC has already topped become.

#Trading #Tradestr

View quoted note →

View quoted note →

View quoted note →

View quoted note →#Bitcoin #Knots now has 18% market share and still increasing it. At which point does Bitcoin #Core sees this progression as an existential threat and changes its position?

Also it seems as Core manage to keep its current market by seeing net new nodes added to Core. That seems a bit like an anomaly. Are they spinning up Sybil nodes in an attempt to cap Knots market share?

#NodesWar