_Good Morning_ ☕ 📖 🌞

`Debt Loop Fallacy`

- **Debt Loop Fallacy**: Theory suggesting modern state currency isn't actual money but a money substitute, a claim for borrowed money, leading to a conceptual loop.

- **Fiat as Money Substitute**: Claims are for a definite amount, but this leads to circular reasoning as the value is defined by what the state will accept in trade.

- **Nature of Money**: Money represents what it can be traded for, not an intrinsic value. Fiat differs from commodity money only by presumed lack of use value, which is subjective.

- **Invalid Theory**: A claim cannot be for itself; holding the claim satisfies the claim, making it money, not a debt. Thus, the theory is invalid.

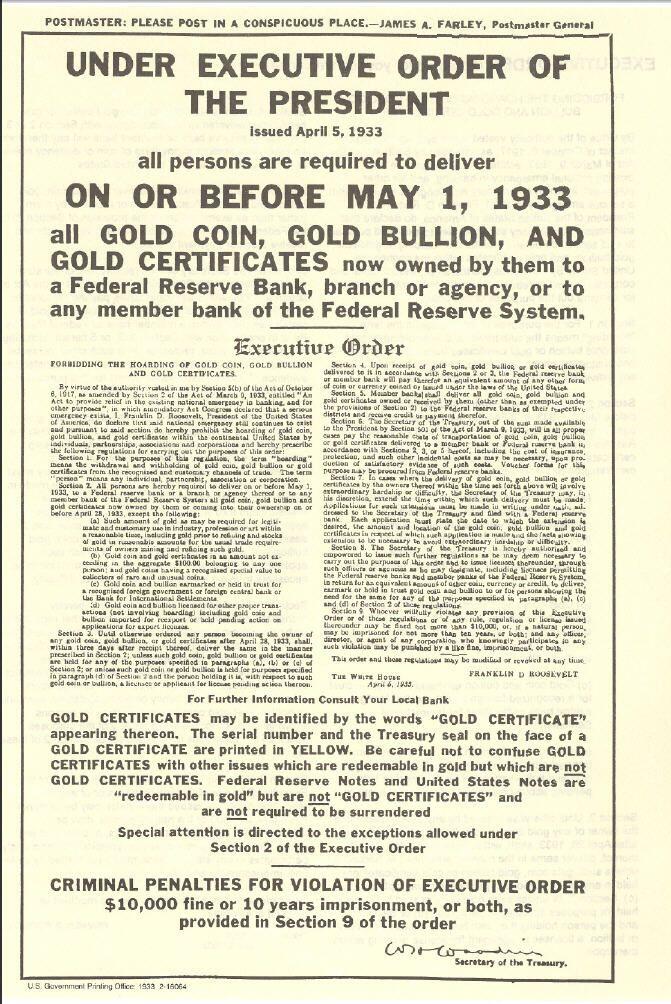

- **Transition to Fiat**: Occurs when representative money loses redeemability, as with the U.S. Dollar in 1934.

- **Money Substitutes and Debt Regression**:

- **No Regression**: Direct money (e.g., Gold, Bitcoin, modern U.S. Dollar).

- **Single Regression**: Representative money (e.g., redeemable U.S. Dollar).

- **Finite Regression**: Indirect claims with a finite chain of settlements.

- **Infinite Regression**: Theoretically impossible; a claim must end.

- **Conclusion**: The "debt loop" is essentially a description of money itself, not a fallacy, as money substitutes eventually become money when claims settle or are circular.

**Cryptoeconomics by [Erik Voskuil](https://github.com/evoskuil).**

*The book can be found on [GitHub]( The rest of the summarized chapters are at

The rest of the summarized chapters are at

GitHub

Home

Bitcoin Cross-Platform C++ Development Toolkit. Contribute to libbitcoin/libbitcoin-system development by creating an account on GitHub.

A Blog by Expatriotic

A Blog by Expatriotic

...

These are the casualties of that agreement...

For additional context. My wife works out almost daily but complains that she's not where she wants to be. And we both suspect it's due to a diet that isn't very optimized and includes lots of sweets...

I'm more of a long distance runner and cycler and have frequently been injured trying to lift. I'll focus on full range of motion and calisthenics to start...

Time to talk to Grok and get a workout plan

These are the casualties of that agreement...

For additional context. My wife works out almost daily but complains that she's not where she wants to be. And we both suspect it's due to a diet that isn't very optimized and includes lots of sweets...

I'm more of a long distance runner and cycler and have frequently been injured trying to lift. I'll focus on full range of motion and calisthenics to start...

Time to talk to Grok and get a workout plan  90+ years ago on this day the government seized everyone's gold at $22 an ounce... Then once they finished taking everyone's gold, they repriced gold to $35 an ounce. Effectively halving the purchasing power of the dollar overnight...

FDR was not a good man.

Beware a politician who's backed into a corner.

Very similar to Nixon in 1970 with the gold shock when he ended the controvertibility of dollars into gold for other nations... It was still $35 an ounce. 10 years ago it was $1200 an ounce. And today it's pushing $3000 an ounce for gold... SMH... All starting in 1933 when it became illegal to hold or own gold or use it as currency... Nothing could be allowed to compete with dollars... How else could they inflate them without competition or accountability?

90+ years ago on this day the government seized everyone's gold at $22 an ounce... Then once they finished taking everyone's gold, they repriced gold to $35 an ounce. Effectively halving the purchasing power of the dollar overnight...

FDR was not a good man.

Beware a politician who's backed into a corner.

Very similar to Nixon in 1970 with the gold shock when he ended the controvertibility of dollars into gold for other nations... It was still $35 an ounce. 10 years ago it was $1200 an ounce. And today it's pushing $3000 an ounce for gold... SMH... All starting in 1933 when it became illegal to hold or own gold or use it as currency... Nothing could be allowed to compete with dollars... How else could they inflate them without competition or accountability?