Since US law enforcement agencies have been able to identify a money laundering offence involving this particular wallet, then they are well equipped to detect such crimes, and there is no need to criminalise mixers or #bitcoin wallets as a technology and its developers in general.

This is exactly what we talk about in our meetings with regulators: we understand that US law enforcement has all the tools to track #Bitcoin transactions on the blockchain. That is why real criminals, and even more so oligarchs, use completely different schemes to launder dirty money.

Besides, Western intelligence services are diligently training dictatorial regimes how to recognise both traditional banking and crypto-assets transactions, so the oligarchs have this knowledge from the intelligence services under their control in non-democratic countries. They don't want and don’t need to use such tools.

And to be precise, I definitely think it's very harmful to promote or ask oligarchs, criminals to use your privacy payment tools. It gives more opportunities to weaponise this kind of rhetoric by any kind of government.

Our 15 years of human rights practice shows that real oligarchs prefer other tools for laundering dirty money. For example, the daughter of dictator Nursultan #Nazarbayev, Dariga #Nazarbayeva - #UK law enforcement authorities failed in their attempts to hold her accountable for money laundering.

the Guardian

UK crime agency loses case against ex-Kazakh president

Judge overturns unexplained wealth orders that led to freezing of London properties

Kazakhstani regime used political lobbyists, expensive Western law firms, and the Kazakhstani state apparatus to succeed in laundering her dirty money.

This scheme works for the oligarchs, people who have stolen billions from the budget of a country where their family members have been in power for decades, politically persecuting any dissent, torturing and killing.

They do not need mixers, they have perfectly mastered money laundering schemes through investments in expensive real estate and consultations with former higher officials, top Western law firms.

Mixers and self-hosted wallets, on the other hand, are used by activists who are financially excluded by authoritarian regimes and do not have the privilege to use banking services in general due to political repression.

Moreover, the knowledge of US intelligence agencies is used to financially exclude regime critics and their family members both domestically and transnationally. This is exactly what #Turkey, #Kazakhstan and other regimes do all the time, sharing knowledge gained from Western partners with #Russia, #Iran, #China to repress dissenters abroad.

In less than 5 minutes Kazakhstan blocks fundraising via bank account or @stripe for families of political prisoners, so bitcoin p2p transactions and mixers are currently the only instrument to protect human rights in such authoritarian countries. Regimes can trace such transactions, but they can't stop them and so far it has helped save lives.

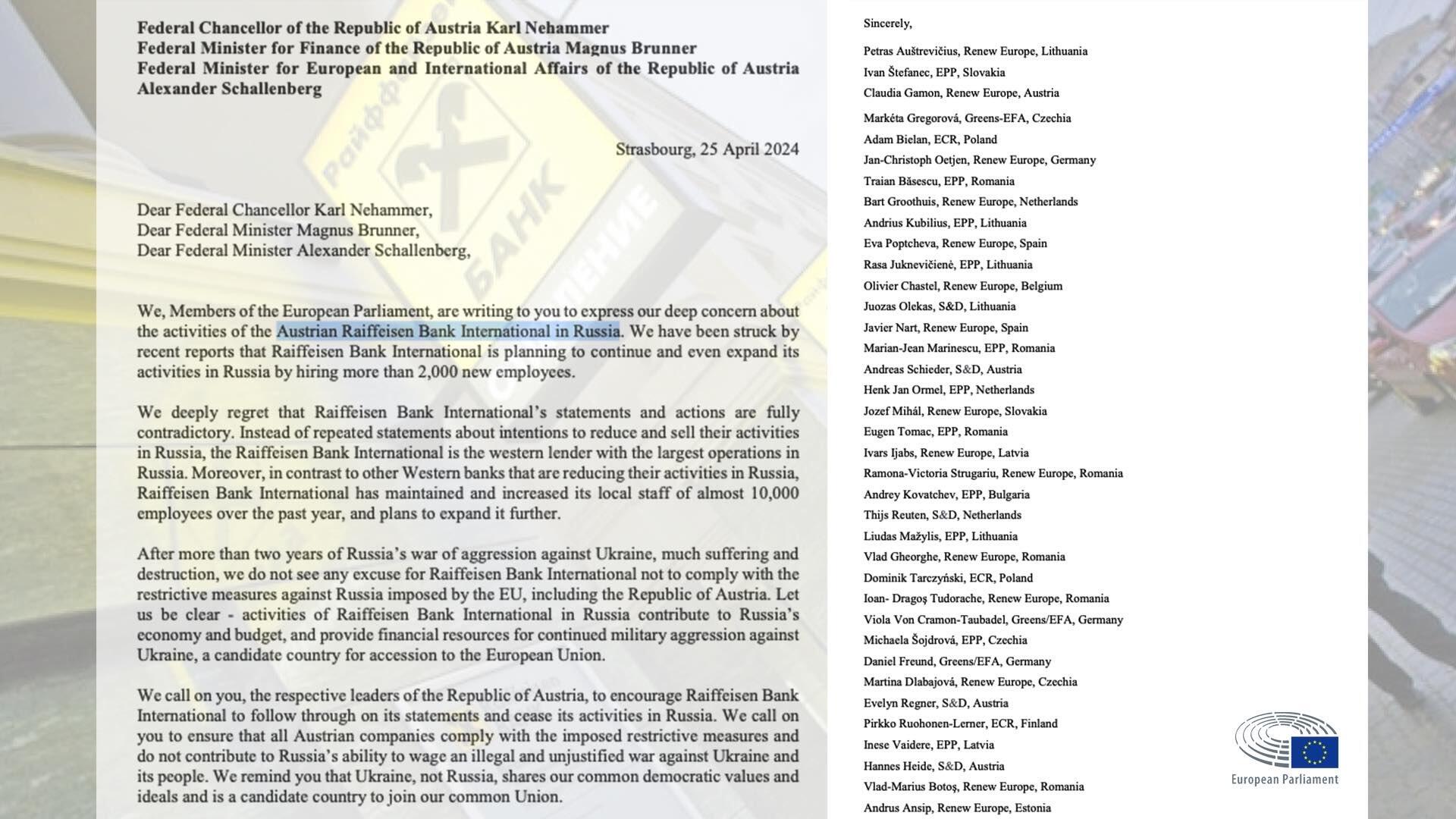

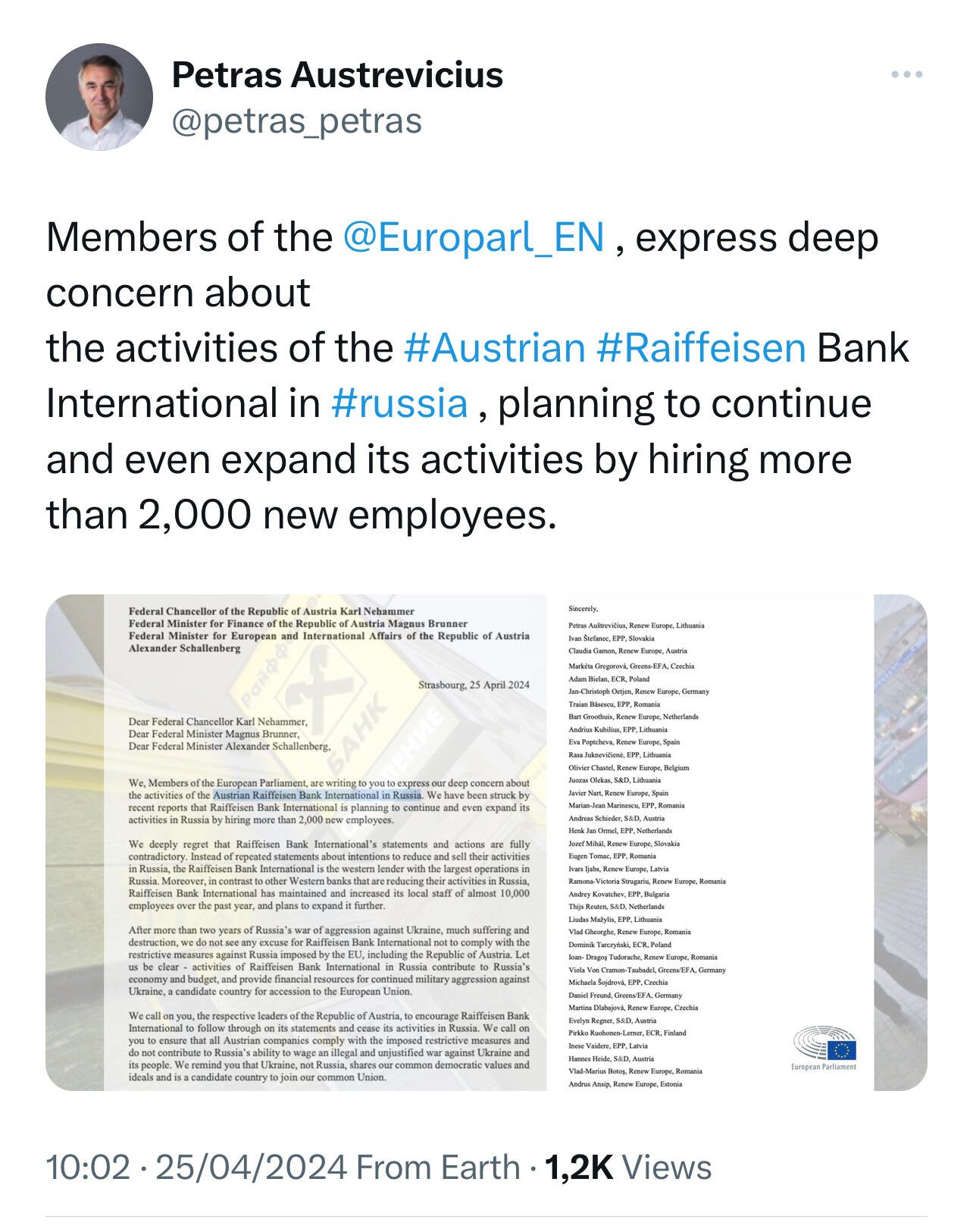

Therefore, an effective fight against money laundering would begin not with the criminalisation of privacy payment tools and their developers, but with ending the impunity of authoritarian regimes and their oligarchs in using legal schemes to circumvent sanctions through the banking systems of third countries.