Bought some lottos in SFG1T at 1.25 (new position). Based on latest blogpost.

Main point - by end of Q3, they should have more cash on balance than their market cap. 2025 H1 TTM FCF yield is above 18%.

Nemesis? Corporate governance, hence the lottos.

Generalist

Generalist@generalistlab.com

npub15l8f...0ar3

Embodying Generalism. Geopolitics, Investing, Bitcoin, Human Rights, Arts, Personal Growth, Global Trends, Tech, Inner Harmony, Unexpected Ideas...

People around the world forced Disney's hand on #Kimmel

Subscriptions drop outweight the merger/WH admin lawsuits.

Sadly CEO Bob Iger, did not care about authoritarian slide from beginning though.

#DIS

I'm sure there were CRISPR editing breakthroughs I'm not aware of, but diabetes its a disease for nearly 10M people.

Using CRISPR, scientists modified diabetes I patients cells, to enable them to produce insulin without immune system response.

Live Science

Diabetic man produces his own insulin after gene-edited cell transplant

The new proof-of-concept study points a way to curing diabetes without the need for immune-suppressing drugs.

In LBT I trust. Three large capital infusions, one major partnership and a slow turnaround in progress. +35% since end of July.

Had a limit sell a while back at ~$30 (gap fill scenario), but cancelled, good call.

$INTC

Last week:

-Sold $IAC at $35.55. incl $VMEO, $ANGI spinoffs -66% loss, (-20.6% CAGR)

-Sold ~14% of held AKO1L at €1.57 at +153% profit (+21.43% CAGR) (FIFO)

-Bought a new position on Friday - $AMZN at $230

Current portfolio:

https://pbs.twimg.com/media/G051RKHXEAAogW4?format=png&name=900x900

Busy weekend w/ stocks, market data.

Wrote my learnings to a blogpost. Comments on:

-Nasdaq Baltic equities: MRK1T, MDARA, SFG1T, VLP1L, K2LT

-US equities: $COO, $AMZN

-My take on valuation on US and local market

-Shortfalls of CAPE, Buffett Indicator

Generalist Lab

Stocks Ideas and Valuations - 2025 September – Generalist Lab

Recent ideas in Baltic Stock Exchange (MRK, VLP, MDARA..), Amazon.com, Cooper Companies Inc, and valuations on both sides of the Atlantic

Lithuania decreasing electricity imports:

In 2025H1 LT achieved record local electricity production. Power plants generated as much as 84.5% of the total electricity consumed and 80% of the total electricity demand in Lithuania.

Production (+73% YoY):

Wind: 41%

Solar: 19%

Other: Hydro, thermal, and other power plants

Why iris on web doesn't have the same default relay picks as Amethyst on android?

My nostr experience on web with a single connected relay is unusable and lately I could not even send posts.

Ignore the implied laziness on the matter.

MIRAN: TARIFFS AREN'T INFLATIONARY

= MIRAN IS A LOYALIST

When a human ages, beauty goes either internally through wisdom or externally through shiny material things around, rarely both.

Telecom and digital giant Reliance Jio Platforms is aiming to file for an initial public offering (IPO) by the first half of 2026, setting the stage for one of India's highly anticipated stock market debuts Mukesh Ambani told shareholders on Friday

BESSENT: DON'T THINK NVIDIA NEEDS FINANCIAL SUPPORT

Increased AKO1L (Akola Group) position by 40% ahead of FY 2024-2025 earnings. Too bad I was busy to absorb stellar Q2-Q3 reports in time, price ran away quite a bit.

Few comments why:

-Q2, Q3 profit drivers were poultry and raw milk. Chicken pox in Poland, supply constraints after market downturn forced some players out, and prices, that kept rising throughout Q4 (end June 30)

-wholesale electricity prices were more muted in Q4, with highly windy June In Baltics

-Alytus factory in Q3 was still undergoing machinery calibration with revenue ramping under pressure and added cost, both of which should be gone by Q4 (according to CFO)

-although raw milk prices are on decline, they are still +30% YoY for July in Lithuania

-revised EBITDA guidance for FY from 70-90 -> 80-100M EUR

Too much hastle nowadays to attach pics on nostr, besides I don't even know if note is saved on any relay anyway.

ref:

X (formerly Twitter)

Generalist Lab (@Generalist_Lab) on X

1/3

Increased AKO1L (Akola Group) position by 40% ahead of FY 2024-2025 earnings. Too bad I was busy to absorb stellar Q2-Q3 reports in time, price...

https://pbs.twimg.com/media/GwsuJHPW8AADhE2?format=png&name=900x900

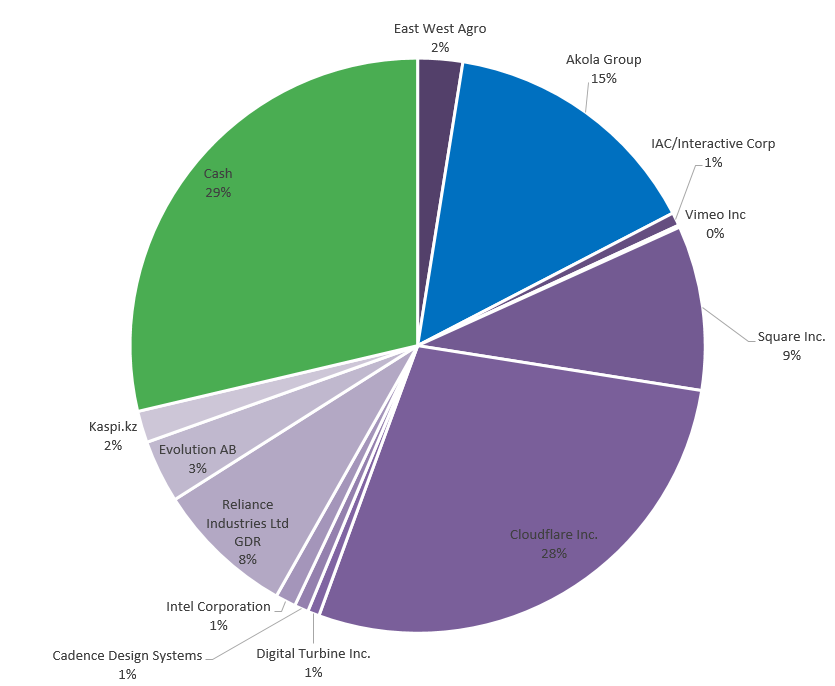

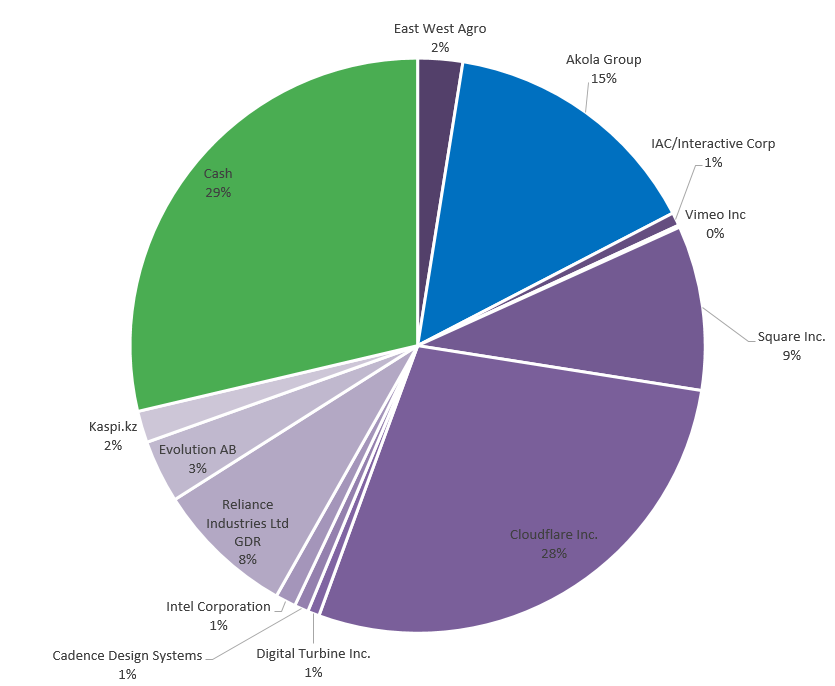

Finally updated excel portfolio. Current composition.

As you can see I've been working on that cash position by means of .. work.

Note: not included: $ANGI, that was split from $IAC sometime this year and I'll be after I go through recent recent calls there.

Opened a small position of $INTC. Will update portfolio composition tomorrow. Wiped from work today.

Basically trusting Lip-Bu Tan on Intel turnaround and loved technical setup posted few days ago.

Listened Q1 EC & BAC conf. Main points that stuck out:

-Strong balance sheet

-cutting layers of management. Lip's been attending shit ton of meetings w/ clients, engineering, polling talent

-likes to underpromise and overdeliver. Analyst asked CFO why guide so weak Q2. A: tariff orders pull, BUT ALSO, so Intel can beat, basically

-Contrary to my previous view, ARM in server is mostly for HPC own workloads, software support is just not there yet

-ofc, pulling their sleeves in catching up with product.

Might trade, might hold, will see how story unfolds

Relays I had setup on web dropped off. Not even fetching my username. Amethyst works fine, but no idea if this reaches anyone.

What are your relay recommendations?

Very few U2/Bono tracks have pushed through my taste wall. My understanding this version of Sunday Bloody Sunday is a special rework for Bono's movie Stories Of Surrender. Just beautiful.

https://pbs.twimg.com/media/GwkGSKoWMAAu-zn?format=jpg&name=large

#GLMusicDiscovery

WTF Pat Gelsinger?

New Intel CEO on his observations:

"I’ve been surprised to learn that, in recent years, the most important KPI for many managers at Intel has been the size of their teams. Going forward, this will not be the case."