I want to present a case for #Bitcoin 's performance in the next few years. Instead of the typical four-year cycle with a blow-off top followed by an extended bear market, I believe there's a good chance we'll see an eight-year bull run, followed by a long, uneventful bear market lasting several years without any catalysts.

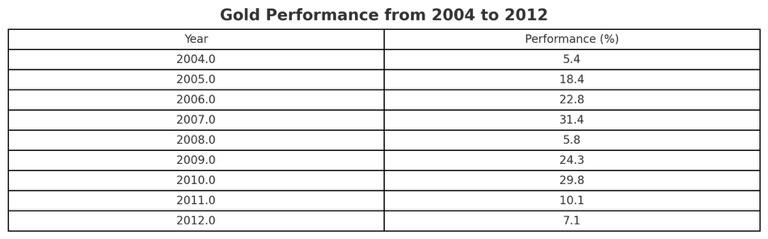

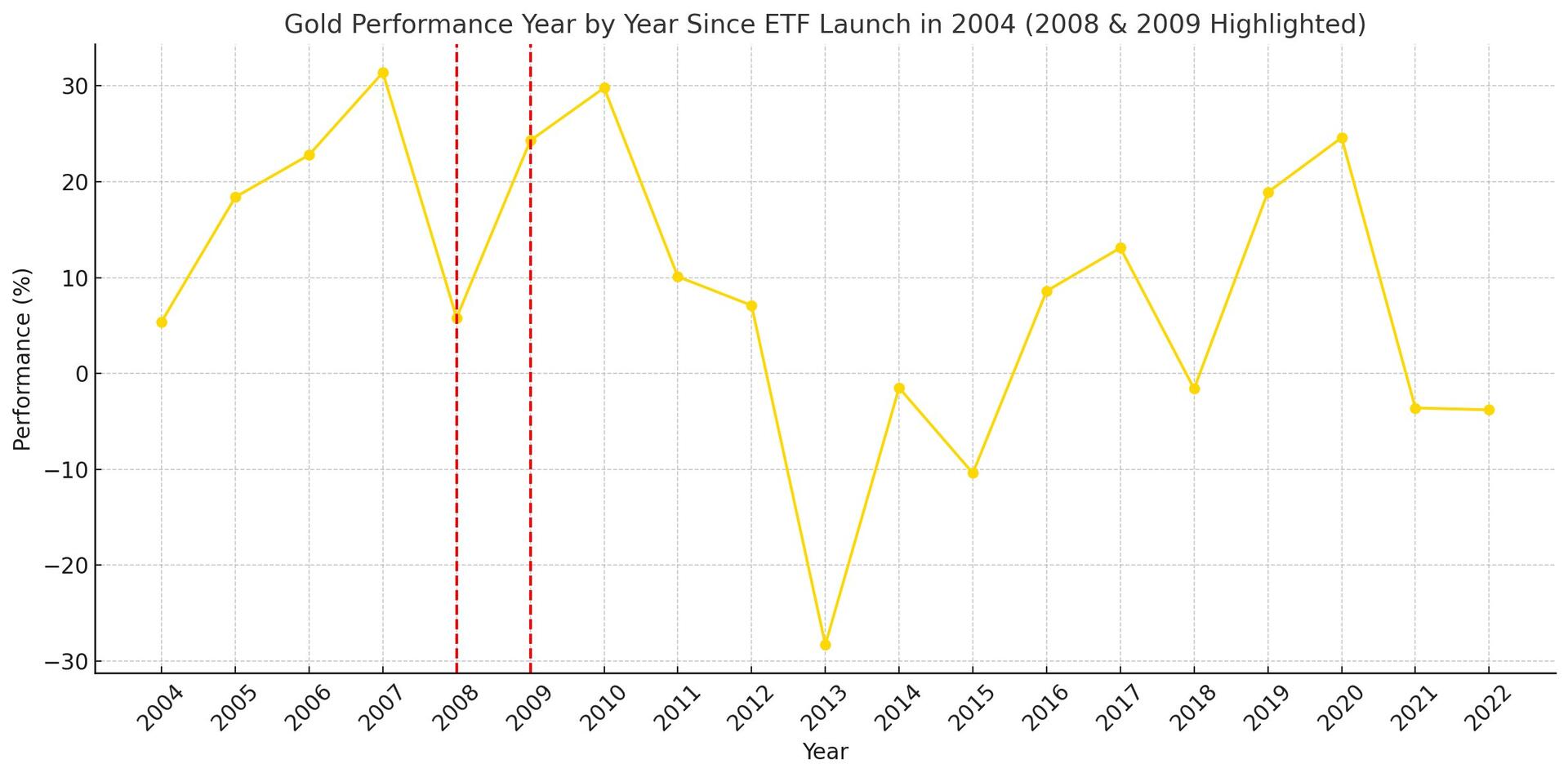

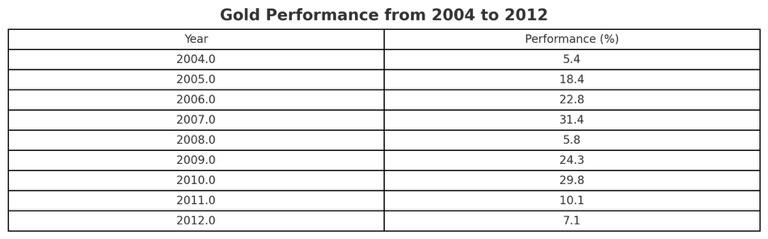

My reasoning is partly based on the Gold ETF launch in 2004. Gold experienced a remarkable nine-year bull run, followed by a three-year bear market, during which its value quadrupled. (See table below)

A similar scenario might unfold for Bitcoin following the launch of Bitcoin ETFs. We can anticipate continued year-over-year capital inflow from investors drawn to the world’s first asset with a finite supply. Consequently, Bitcoin's price has the potential to outperform Gold in its first nine years post-ETF.

My rough estimate is that Bitcoin could achieve a 10x increase, compared to Gold's 4x, following its ETF moment. This prediction considers the escalating geopolitical issues, overwhelming debt, and central banks' pivot to lower rates to monetize debt.

This is a quick analysis and my first long-form post. I'm working on a more detailed thesis for my fund.