The world has never seen an asset with a finite supply being applied to ETFs.

#Bitcoin

Louis

louis@vlt.ge

npub1kznj...7zc4

Founder & CEO @mimesiscapital 研山資本 | #Bitcoin Hodler | Views are my own. No financial advice.

The biggest winner in this cycle is not the issuers of the Bitcoin ETF but the #Bitcoin hodlers who have front run the Wall Street for 15 years.

Gold 4x after the GLD ETF was launched.

What about Bitcoin after the iBTC is launched?

I think a 10x increase is possible.

100 hours till Bitcoin ETF is approved.

The world will change forever.

In hindsight, it was inevitable that Bitcoin would overtake Gold as the king of commodities. The reason is very simple: digital finite scarcity.

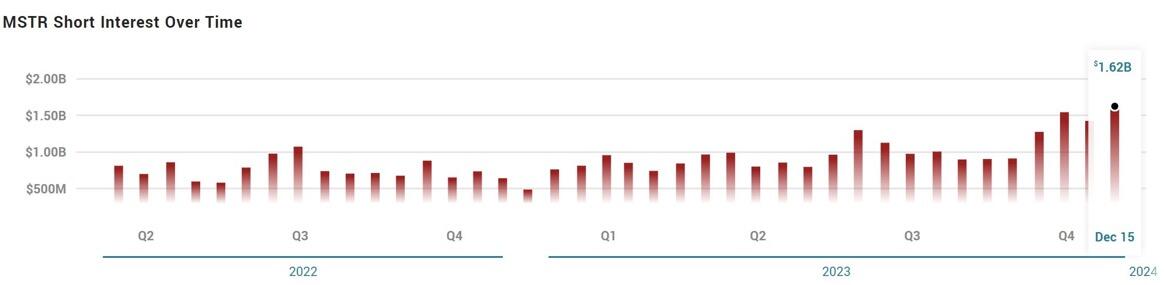

As of Dec. 15, $MSTR had $1.6B worth of short interest which represented 19.56% of shares.

Most shorts are now rekted. If they keep on adding, we will see a massive short squeeze when #Bitcoin gets another big leg up.

Res tantum valet quantum vendi potest.

2024 is the Return of The Bull Run.

Happy Mew Year!

As 2023 ends, I'm noting down my thoughts for the next 20 years about #Bitcoin 's evolution 📝👇

What is money?

Money functions as a store of value, a medium of exchange, and a unit of account. Bitcoin, serving as money, will eventually fulfill all these roles.

Currently, Bitcoin is in its store of value phase, protecting value from dilution. This phase might end in the next 8 years or after two halving cycles, with the Bitcoin ETF as a key indicator of this shift. At the end of this phase, Bitcoin could be trading at or above 1 million dollars.

Following this, we'll likely witness significant adoption and innovation in Bitcoin's layers and applications, focusing on its use as a medium of exchange. This phase will see a surge in companies developing on Bitcoin layers. Post this phase, Bitcoin might trade around 10 million dollars, with nearly everyone on the planet owning a wallet or using Bitcoin apps.

As for its role as a unit of account, I don’t see it happening in the next 20 years. I believe this will occur automatically after the store of value and medium of exchange functionalities have reached their maximum. My timeline for this to occur is before 2140, at which point Bitcoin will become the default money for everyone.

Bitcoin ETFs are a boomer thing. Yes, they will pump the price to the moon, and we must welcome that. But we, Gen Z, need to own the actual Bitcoin and take self-custody. This is how we can front-run them and win.

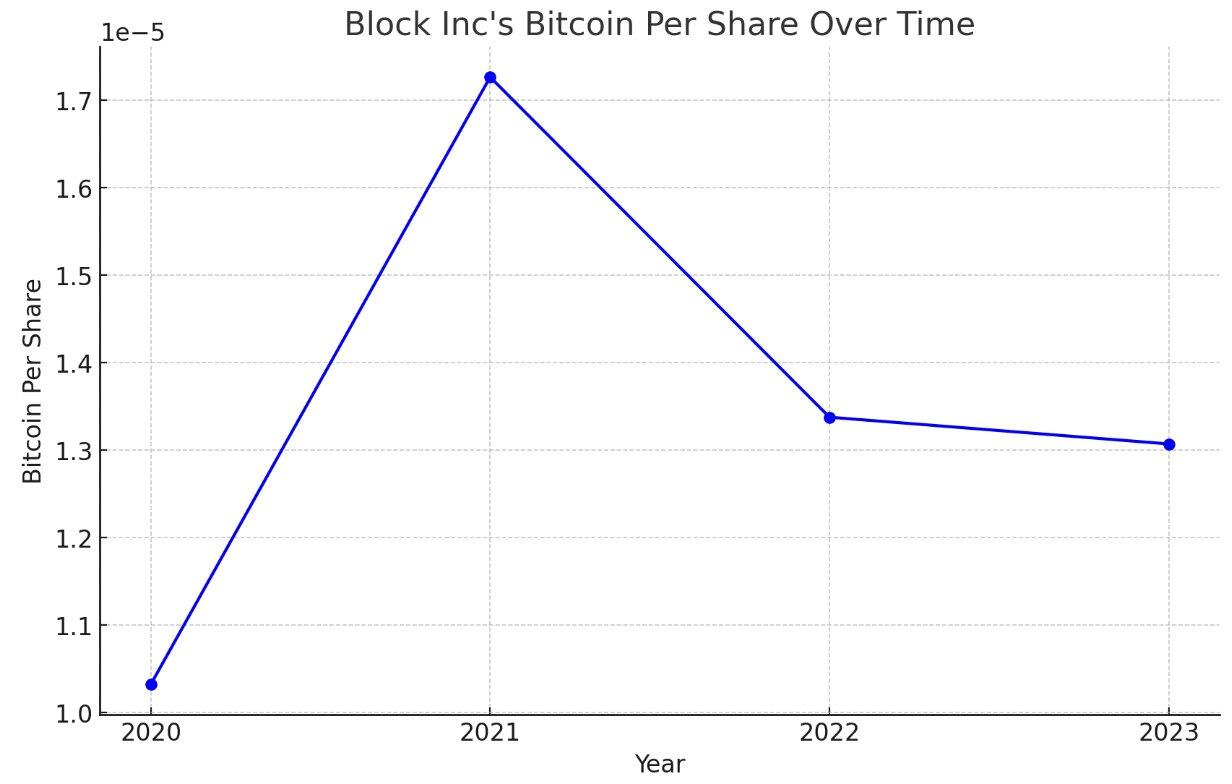

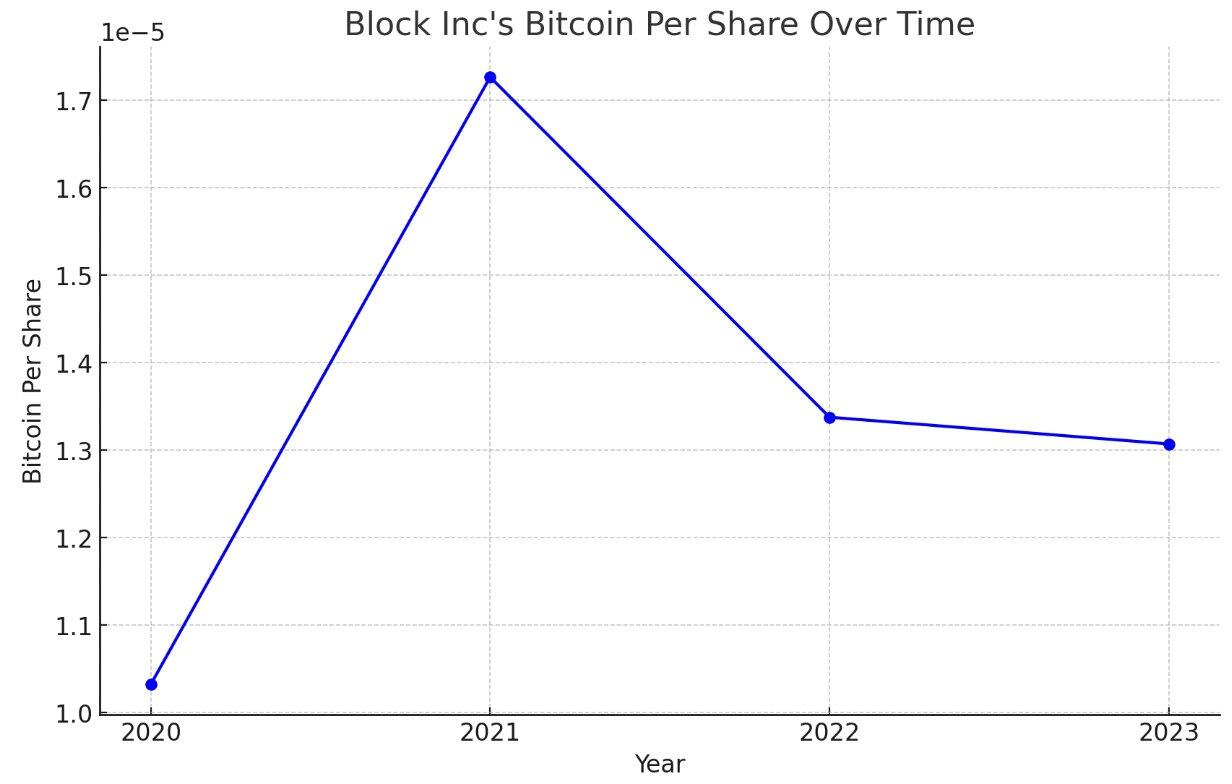

Here is my analysis on Block Inc's (known as $SQ) based on #Bitcoin per Share (BPS):

The BPS ratio, surprisingly low for a company that positions itself as a key player in Bitcoin infrastructure, offers an intriguing perspective on Block's valuation. Let's delve deeper.

Background: Renowned for its financial technology services, Block serves nearly 4 million merchants and 51 million users as of 2023. The company has significantly advanced Bitcoin initiatives through CashApp, Spiral, and TBD. CashApp, in particular, has facilitated billions in transaction revenue by providing easy access to Bitcoin. Jack Dorsey, Block's CEO, is a notable Bitcoin advocate and evangelist.

When analyzing BPS, a look at the table reveals a substantial increase in shares outstanding over time. Interestingly, the capital raised from share offerings was primarily used for acquisitions like Afterpay, rather than for Bitcoin purchases. Block's significant Bitcoin acquisitions include 4,709 bitcoins in 2020 and 3,318 in 2021, amounting to a total of 8,027 bitcoins. Since 2021, no additional Bitcoin purchases have been made.

The BPS trend, as depicted in the chart, shows no upward trajectory but a marked decline from 2021 to 2022, following an initial spike from 2020 to 2021. This sharp drop is largely attributed to share dilution. The discrepancy between Bitcoin per Share in dollars and the year-end stock price somewhat diminishes the relevance of BPS analysis. Nevertheless, for a Bitcoin-centric public company, this indicates a significant business premium relative to its Bitcoin holdings.

Examining the price action, Block's stock price has seen a 63.47% decrease from 2020 to 2023. Despite Bitcoin's 140% rally from its low this year, many Bitcoin mining stocks and MicroStrategy have outperformed Bitcoin, yet Block has only achieved a 23% return YTD.

This analysis, while not a comprehensive valuation of Block, underscores that despite its active involvement in Bitcoin, the company's actual Bitcoin holdings are relatively modest compared to its shares. Its stock price reflects a substantial business premium over its Bitcoin holdings and hasn't significantly benefitted from the current Bitcoin rally.

Based on my analysis of #Bitcoin per Share (BPS) on MicroStrategy ($MSTR), I am sharing some potential alpha:

The only instance when MicroStrategy's stock price traded below its Bitcoin per Share (BPS) in dollar terms occurred in 2022. This was when Bitcoin reached a new cycle low of $16,531, and $MSTR was trading at $141.57 per share, while its BPS in dollars stood at $189.54. This discrepancy indicated a significant buying opportunity.

This table represents MicroStrategy's #Bitcoin holdings per share, or BPS, from 2020 to 2023.

Overall, the BPS is in an uptrend. However, there is a slight decrease of -1.31% from 0.01147 BPS in 2022 to 0.01132 BPS in 2023.

$MSTR

Instead of arguing and focusing on things you can’t control, go figure out how to stack more Bitcoin

Many say that once a #Bitcoin ETF is available, there will be no demand for proxies like $MSTR. I disagree.

A relevant comparison is between index funds and Berkshire Hathaway. Index funds track the S&P 500, while Berkshire is akin to a stock picker aiming to outperform the indexes.

Similarly, $MSTR could outperform a Bitcoin ETF as it offers strategic advantages like intelligent leverage and business opportunities in emerging technologies, mirroring how Berkshire outperforms index funds through strategic stock selections and business operations.

My aunt who I have bought her one bitcoin for think I am still poor 😅

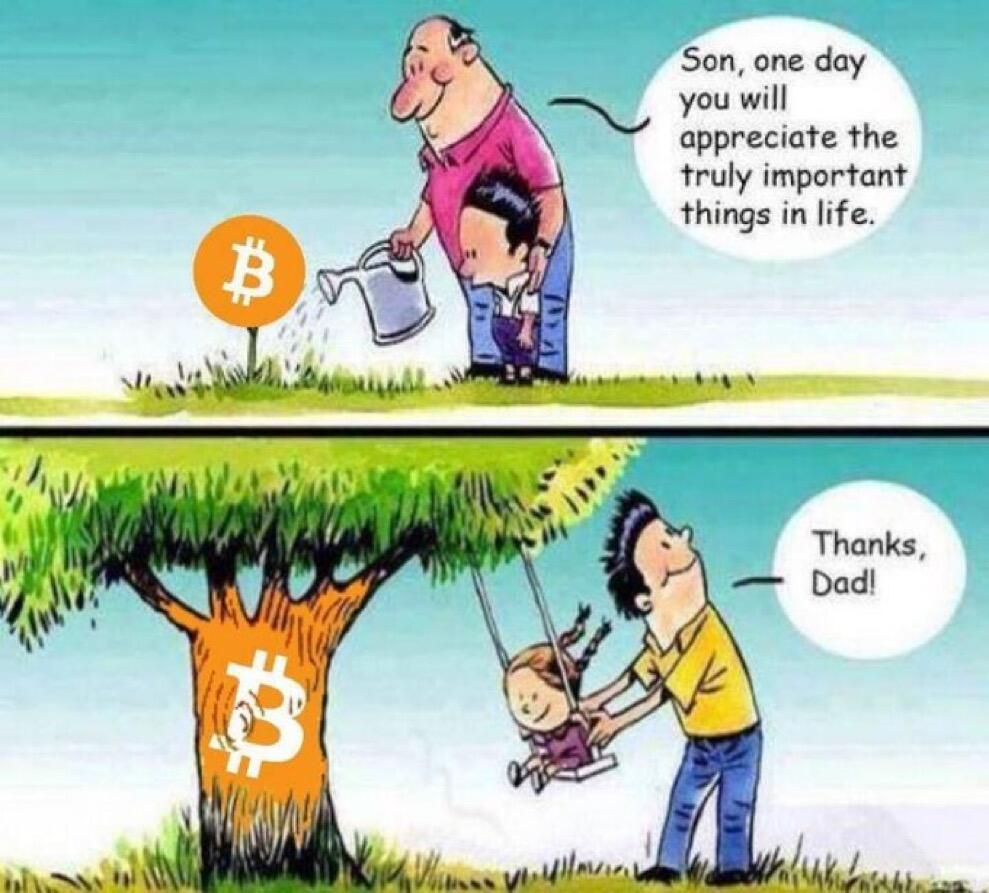

Bitcoin is for every family.

🎄