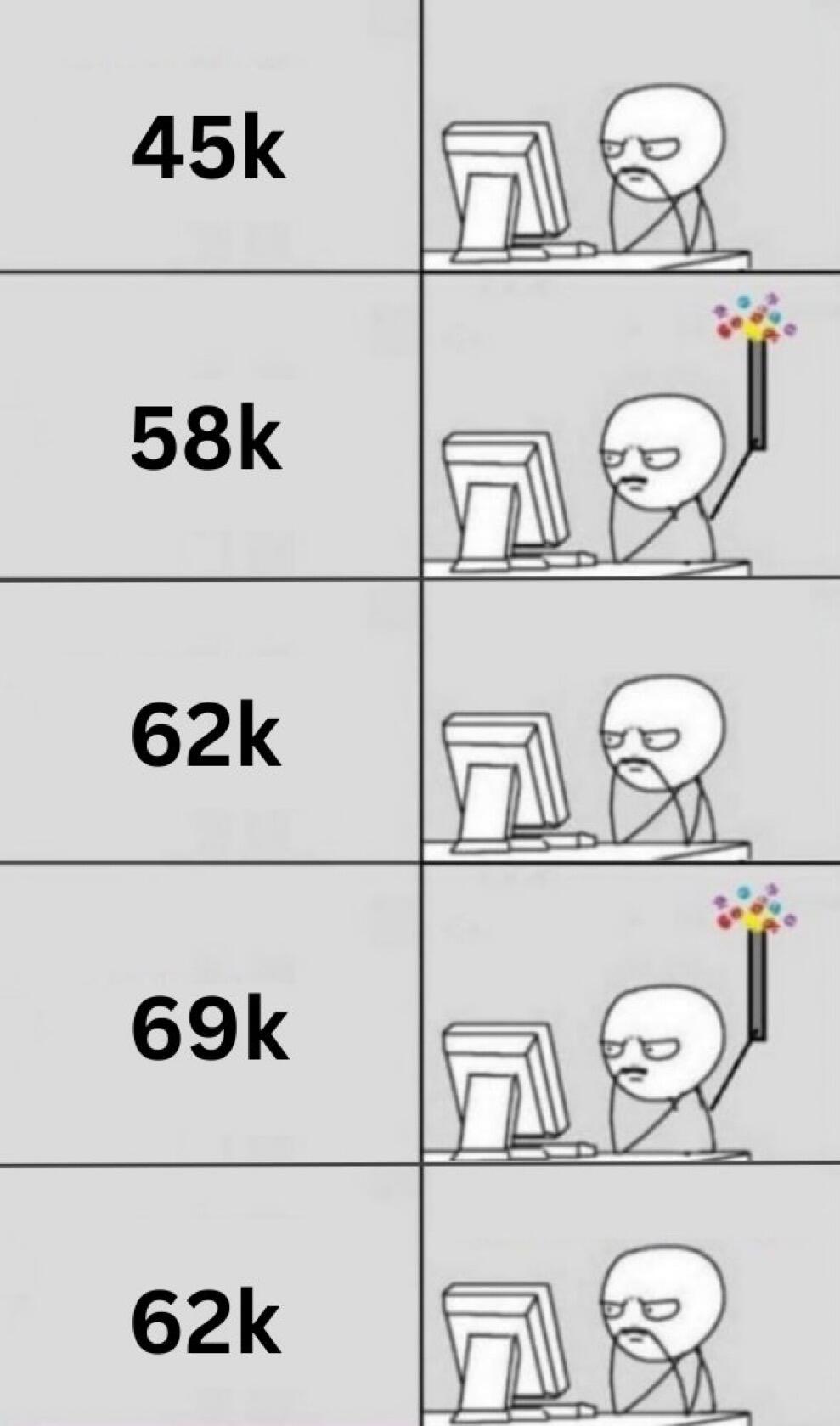

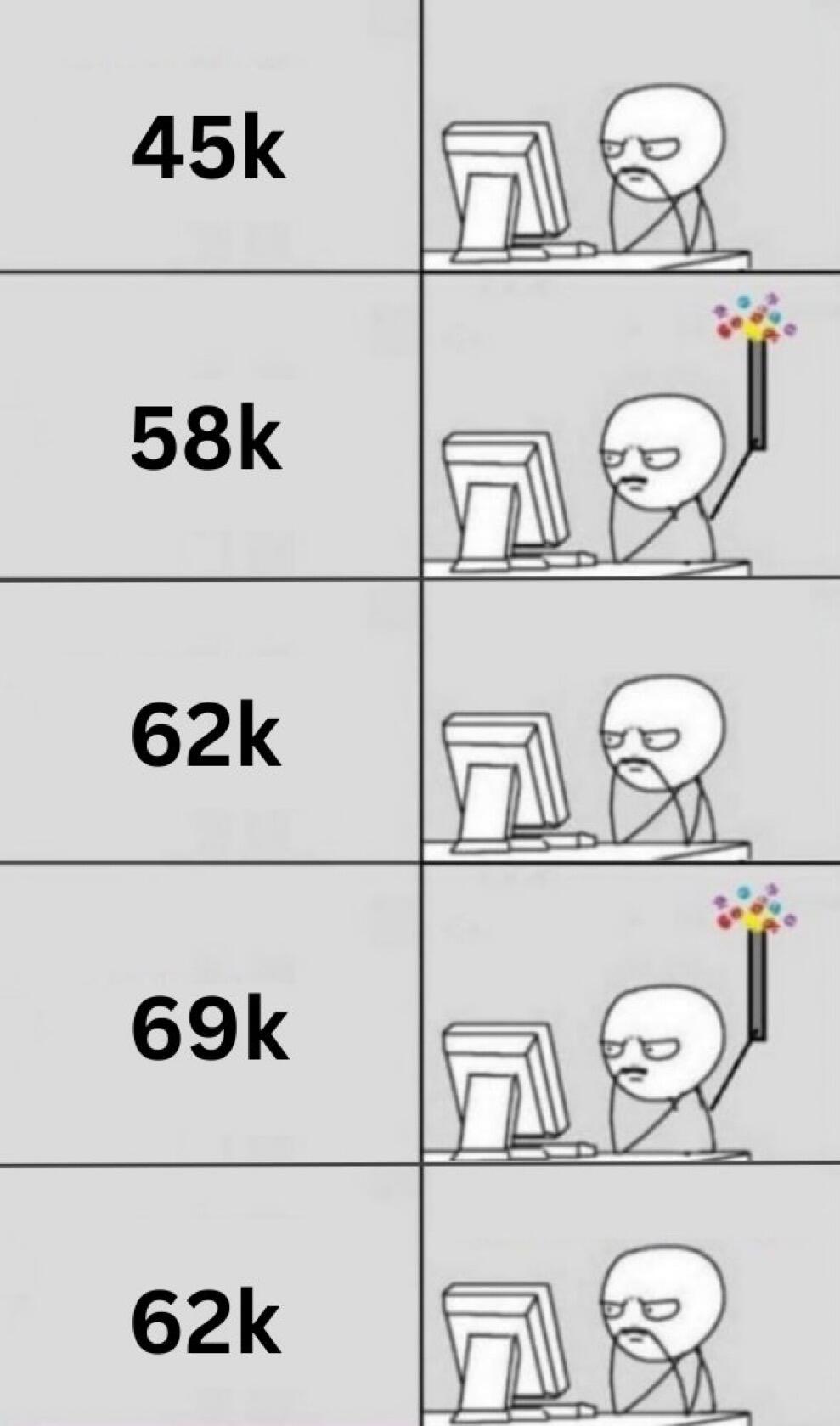

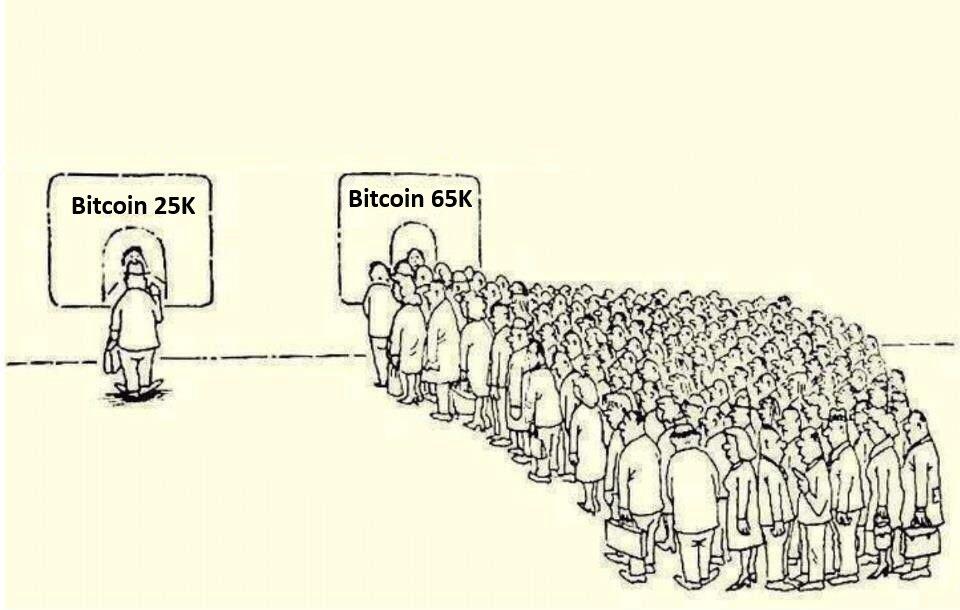

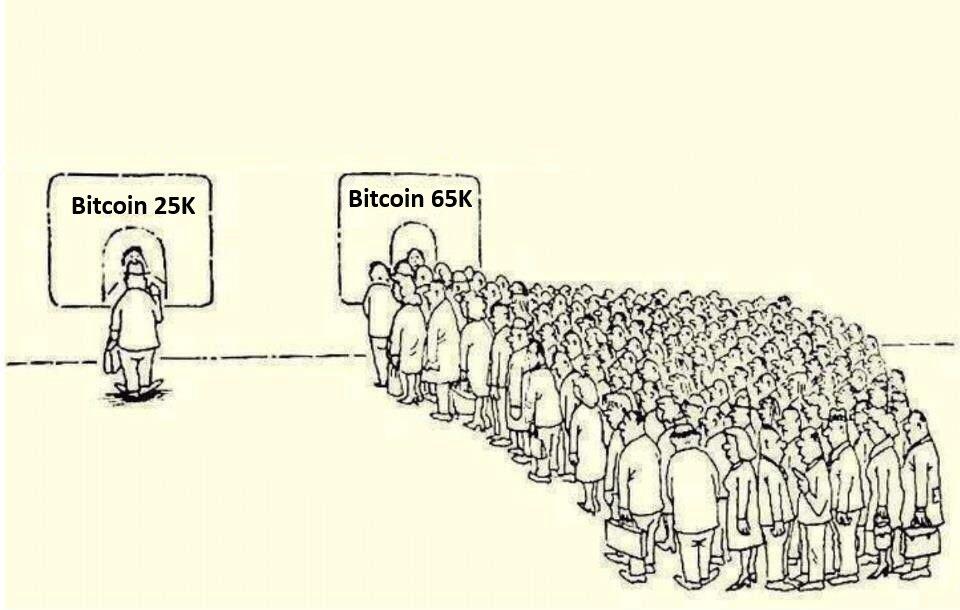

When the fear is running the market, only the brave one will have the courage to buy.

Louis

louis@vlt.ge

npub1kznj...7zc4

Founder & CEO @mimesiscapital 研山資本 | #Bitcoin Hodler | Views are my own. No financial advice.

1st rule of Bitcoin: Buy it.

2nd rule of Bitcoin: Hodl it.

3rd rule of Bitcoin: Don’t over leverage it.

Risk assets react poorly to the risk of weaken job market.

Fed has been consistent and transparent on their rate policy. 25 bbp cut is most likely.

There is overwhelming support and consensus on soft landing. The Fed wants it so do the market. However, the unemployment data is telling a different story.

Bitcoin price action is signaling risk-off. Stock market should take a notice.

Bloomberg.com

Bitcoin Taking Cue From Stocks Heading Into Pivotal US Jobs Data

Bitcoin and other cryptocurrencies turned sharply lower, erasing earlier gains, as digital assets got swept up in a volatile trading session across...

Allen Litchtman, the man who successfully predicted the U.S. presidential election in the past 40 years, is predicting Kamala Harris will win.

If he placed his bet on his prediction each time, he would turn 1 dollars into 1024 dollars. That’s 102400% of compounding return.

BlackRock Bitcoin ETF has ZERO outflow yesterday.

Buffett’s cash pile is now $300 billion.

To put that in comparison, that’s 1/3 of Bitcoin’s market capitalization.

"We will make America the world capital of crypto and Bitcoin." – Donald Trump

The potential black swan for Bitcoin and risk assets is the market has over underestimated the trend in unemployment rate.

The equity market has top for now and it’s just starting to go through a correction sparked by the unemployment rate and the weaker economy. The AI sector is cooling off for now until Nvidia’s BlackWell release in Q4. Whether or not we have entered a recession is unknown, but any bad economy data will continue to drive the market lower. The market can still have a strong rally but it will depends on strong overriding on the current trend in the unemployment data.

The good news is the Fed will cut rate and release liquidity to the market but the effect will not immediately affect the market price action. It tends to kick a month or two before the market bottoms.

I could be wrong and I am wrong often.

Labor market is showing signs of weakness. It will shake investors’ confidence in the market.

View quoted note →

Why hasn’t anyone suggest presidential candidates to do a fund raising on Nostr?

Happy Halving!

Haven’t post for a while. Anything that excites you on the #nostr land?

Zen

GM

The way you own the Internet is through investing in equities like Google, Amazon, or Meta.

The way you own AI is through investing in equities like TSMC, Nvidia, or AMD.

These investments have risks associated with a corporation. The Internet won’t go away because Google ends up bankrupt. The same applies to AI.

The way you own Money is different from owning equity in a company. You directly own Bitcoin, which is native to the Bitcoin protocol.

The risk profile of owning Bitcoin is completely different from owning equity. What you are buying is a piece of the internet that can’t go bankrupt, with no management risk, no politics, and no human intervention, but its liveness depends on human adoption like any technology.

The suffering comes from not knowing money is broken