Si estás pensando dejar algunos SATS para tus herederos y no sabes cómo hacerlo sin perder la custodia o sin compartir tus semillas, @lianabitcoin es una muy buena opción.

CriptoPanas

CriptoPanas@BitcoinNostr.com

npub1c99a...wnw3

Making video tutorials about Bitcoin in Spanish for my youtube channel

Seguramente tienes algún cuñado o amigo que solo invierte en ladrillo, porque no entiende qué es Bitcoin...Envíale este video.

Bitcoin in Real Life II

My wife studied artisanal jewellery design and worked for several years crafting unique pieces. Yesterday, someone from her hometown messaged her asking if they could call her for a quick consultation.

The situation? Her mother-in-law had recently passed away, leaving behind a large collection of jewels.

Over the years, she had purchased these pieces during trips to places like India, Africa, Brazil, and Mexico. Some featured precious stones, others were made of gold or silver. It was a diverse and valuable collection.

She didn’t buy them just for beauty, she saw them as a form of savings, a way to preserve value over time and even move wealth across borders if needed.

And honestly, that made perfect sense.

For generations, saving in gold and jewels was one of the most practical ways to store value, especially for those who didn’t fully trust banks or wanted something physical they could take with them in uncertain times.

But since 2009, we have a tool that allows us to do this in a much simpler, safer, and more efficient way: Bitcoin.

Now, the family wants to divide the jewels into eight lots of similar value to distribute among the heirs.

My wife’s answer was straightforward:

Most jewelry is valued by the weight of the metal, gold or silver and the quality of the stones. The craftsmanship rarely adds much to the resale price unless it comes from a known designer or brand.

Her advice: visit multiple jewelry shops, get a few appraisals, and use those estimates to create balanced lots.

But just imagine…

If instead of jewels, this woman had left Bitcoin.

There’d be no need for appraisers.

No arguments over who gets what.

No guessing, no expert needed to evaluate the worth or certify the authenticity.

Just a universally recognized, mathematically verifiable asset that can be divided down to the smallest unit and distributed with perfect fairness.

BTC fixes this.

Bitcoin in Real Life

Last week I went on a very special trip: a family reunion. As many of you know, I’m originally from Venezuela, and we all planned to meet up in Spain. Family came in from the U.S., Costa Rica, Australia… and of course, from Venezuela.

For someone still living in Venezuela, getting access to foreign currency is incredibly difficult. Some have managed to open bank accounts abroad to keep part of their savings in a currency that doesn’t lose value as fast as the bolívar. One of my relatives, a long-time CitiBank customer, had never had issues with his bank—until now.

While vacationing in Spain, his account was suddenly frozen. Just like that, he couldn’t use his debit or credit cards. When he contacted the bank, they told him he’d have to physically go to a Citi branch in the U.S. to unlock his account.

I gave him a simple but powerful suggestion: next time he travels, he should carry a Bitcoin wallet with some funds. I explained that with just that, he could access local currency anywhere in the world—no banks involved. He didn’t know there are Bitcoin ATMs in Spain. I showed him how the lnp2pBot on Telegram works, and he was surprised by how many people were ready to buy Bitcoin instantly.

I also showed him the map on btcmap.org, where he could see all the businesses that accept BTC as payment. That really opened his eyes.

I’m sure that now he sees Bitcoin differently—not just as an investment asset, but as real money.

BTC fixes this.

That simple.

El BIP-85 nos permite generar semillas hijas a partir de una semilla madre, ideal para custodiar fondos de familiares o en una empresa. En el video te cuento cómo se usa en la #JADEWALLET de

@Blockstream

First tariff war, then trade wars and then real wars...

Do you think it will happen this time?

Jade wallet, es uno de los dispositivos que te permite configurarla SIN necesidad de usar el software del fabricante.

En este video, cuento paso a paso cómo puedes configurar tu hardware wallet JADE utilizando el software de Sparrow:

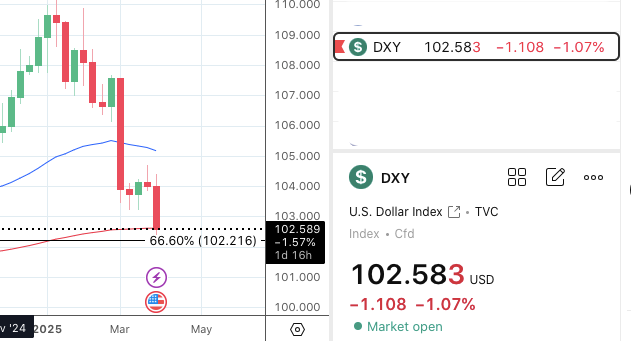

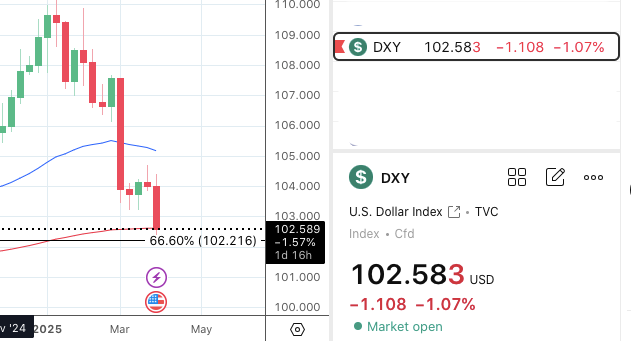

If the USD continues this trend, it will depeg from USDT ;)

Si ya tienes algunos SATS en una wallet custodial y quieres subir al nivel de auto-custodia, @PhoenixWallet es una de las más sencillas para empezar.

Blue Wallet y SeedSigner son la combinación perfecta para custodiar tus BTC.

Si quieres empezar a guardar tus SATS en Cold Storage, SeedSigner es la preferida de muchos Bitcoiners, te dejo por aquí mi video:

Comparto por aquí un tutorial sobre Passport Wallet, billetera only BTC super completa y muy fácil de utilizar.

Si estás cerca de Pontevedra y quieres aprender sobre las grandes ventajas del OPEN SOURCE para tus dispositivos, estamos preparando un gran evento el sábado 8 de Marzo.

Más info en este link:

Eventbrite

OPEN SOURCE Meetup !

El compañero GabiAnon nos enseñará ventajas y virtudes de usar en nuestro día a día programas de código abierto y accesibles para todos.

Muchas Gracias a todas las personas que apoyan mi contenido, son la gasolina que me permite seguir subiendo videos.

Muchas Gracias a todas las personas que apoyan mi contenido, son la gasolina que me permite seguir subiendo videos.Have you seen this project???

looking forward to test it.

Made by:

WeSatoshis | Sovereign Bitcoin Hardware

Experience a better way to move your Sats. A decentralized transfer mechanism that allows you to move sats without needing a mobile app or computer...

What would be the best way for a newlywed couple to receive Bitcoin as a wedding gift?

If you get into Bitcoin, no matter what you do, I'll tell you upfront: you're going to regret it.

There will be moments when you'll regret having invested too much money.

There will also be days when you wish you had bought more. That feeling of "what if...?" will always accompany you.

I assure you: you'll regret listening to that person who told you to buy Bitcoin to protect the value of your assets. But at the same time, you'll regret even more not having listened to them sooner.

Every purchase you make will be an emotional roller coaster. Because right after your purchase is confirmed, it's likely that Bitcoin's price will drop by 5% or even more. And there you'll be, regretting watching your big investment lose value.

But wait, because it doesn't end there. After every sale you make, you'll feel a pang seeing the price continue to rise, breaking all your expectations.

And months or even years later, you'll still be regretting it.

You'll regret not having bought more SATs when you had the chance. And you'll also remember all those times you sold Bitcoin to "secure" your gains in dollars... and you'll wish you hadn't.

However, it's not all regret. Because, instead of lamenting, you'll likely feel proud of having used Bitcoin as real money. Maybe you'll remember that time when you paid with Bitcoin at a store that accepted it, avoiding intermediaries and showing that Bitcoin is much more than just an investment: it's money.

To avoid this emotional roller coaster, the most important thing is to have a plan.

The best way to deal with emotions is not to make impulsive decisions.

Having a clear plan and sticking to it is fundamental. A simple and effective strategy is DCA (Dollar Cost Averaging): you buy regularly, regardless of what's happening with the price, and you don't worry about the fluctuations.

You follow your plan and let time do the rest.

Over time, you'll realize something fundamental: it's not that Bitcoin's price goes up, it's that the dollar keeps losing value. That will be the moment when many pieces fall into place, and you'll probably regret not understanding this simple principle much sooner.

In Bitcoin, regret is inevitable. But it's also inevitable to feel proud of being part of something so revolutionary. But if you have a plan and the right education, your path to freedom will be much smoother.

Cripto Panas