Good article. Encapsulates the recent disillusionment that my logical analysis of the past couple years of narratives and attempts at regulation have forced me to undergo. Not abandonment, just greater treatment of BTC as a hedge.

nostr:note1eqdnpznkvcr94t7p9ejh2cmg8lf68v4g76j6w9kl2gpedlyhhapswymhud

1776

npub1e7dj...fw7d

Notes (6)

I’ve been thinking a lot about the amount of dollar debasement and inflationary theft that will need to happen in order for Bitcoin to attain a $10M price level by 2035. A 100x from $100k has a lot bigger economic implications than a 10x from $12k. The more I think about this, the more in understand stablecoins. Same eventual fiat outcome, but the can gets kicked down the road till 2050. Buckle up and keep that powder dry. Keep stacking.

#asknostr #bitcoin

I had to write this for my young twenty something. It’s not perfect but it’s a start. Amounts stated in CAD cuckbucks.

Stay Free

Good Morning my Girl,

I had some time before my first appointment today, so I wanted to write you something that I really wish my parents had taught me when I was just starting out on my own. It wasn’t their fault, it’s just that they never received a financial education themselves or faced enough economic pain to force them to seek out the information for themselves. I have.

Times were different when my parents were your age. A family could thrive on a father’s single income, and he didn’t even need to have a professional, high paying job. This lesson is about personal finances and your only shot at true freedom in this life. I hope you take it seriously.

This material is intentionally not taught in public schools. Here’s the thing: The government, big

companies, and the banks that control how much of your stored work energy (money) that you get to keep each payday, do not want free and educated people. They want obedient workers

that show up when the bell rings, stay at their desks, pay their taxes, and get into housing, student loan and consumer (credit card) debt so they are forced to stay on the treadmill and feed the financial elite. The problem is that by the time most people feel enough economic pain, take the time to do the research, and realize that they are essentially slaves, it is too late to do anything about it. My hope in writing this is that you will know that there is a way to avoid this slavery. Or at least spend as little of your adult life in it as possible. Everybody has to work, but there is a way to make sure that you are constantly moving away from the slave system and keeping your options open to spend your days doing what you WANT to do, not just what you must do. With the government continuing to tighten the noose and about to introduce programmable money that they can turn on and off if they don’t like the way you are living, it is going to be extremely important for people your age to build an escape route.

All the introductory information above is meant to give you some background for what is really a single thing that I want you to know:

The only way to achieve freedom in this life is not by working in a job and saving in dollars, but to acquire things that grow in value over time, and hold them.

The way the system is currently set up for people that have jobs is for their food, shelter, taxes,

inflation and debt payments (credit cards/loans/car payments) to use up all of their paycheque every two weeks so that they are trapped in their work. Add to these things the responsibility of supporting a family, and you quickly find yourself with no choice but to stay in the same place. Working hard but not actually moving toward freedom.

The first step in avoiding this trap is to avoid as many of these things as possible, so that you end up with a little money left over to acquire assets that grow in value while you sleep, so that your wealth grows even when you are not clocked in at your job.

Here is, item by item, how to avoid the things above that can trap you:

Employment

Obviously a job is necessary if you don’t have the money or an idea that allows you to start your own business. If you do have an idea for a business or a side hustle, then go for it. Especially when you are young. The best starter ways to be your own boss is to provide services for people that don’t require you to buy a lot of expensive things to start, or that to get you into debt to start. They can be really simple things, like odd jobs, yard care, cutting hair, caring for animals, personal fitness training, etc.

Taxes

Provide services that allow you to get paid in a way (cash, Bitcoin, or tradeable items that you need to live) that you do not have to tell the government about. Educate yourself on ways to do this, but to still "look good on paper” at tax time each year, so you don’t attract the attention of the tax man and get locked up. Don’t accept cheques or direct deposits to your bank ie things that leave a record for money you want to hide.

Inflation

Most people think that inflation is the natural increase in the price of things over time. It is not natural. It is theft by a hidden tax that you did not vote on. The reason that things are getting more expensive every year is NOT that companies are being greedy and charging more to make more profit. It is because the government is continually increasing the money supply (printing

dollars) and watering down what the remaining dollars in circulation are worth. Including the ones under your mattress or in a safe. The way to avoid this trap is to get paid and save in a

money that can’t be printed. Things like gold, silver, and Bitcoin. Here is an example of how

sneaky theft by inflation is. If, when I was born, someone gave my parents $1000 cash as a gift

for when I was older, that $1000 today would only buy about what $100 would today. Back then it would buy enough groceries to feed a big family for 3 months. Now it would buy a single bag of food or a dinner out. It is crazy! Money supply inflation is just complicated enough and just gradual enough that people ignore it.

Debt

One of the biggest traps to avoid that will stand in the way of having enough left over each month to acquire appreciating assets (things that rise in value) is debt. Examples are student loans, car loans, credit cards, personal loans, and buying things that have monthly payments. As much as possible, try to avoid credit cards or taking out loans to buy things that you can do without. One of the best things that I have seen you do (and that has made me so proud) was seeing you work so hard to buy your first car and NOT go into debt to do it. That was very smart. When you take out a loan to buy something, the company or the bank that gives you the money will expect you to pay back the amount that you borrowed, PLUS extra money called

interest. So the thing you are buying can end up costing you double what the original price tag

was, depending on the interest % and the length of time. Take our hot tub for example. That hot tub was $13,500. We took a loan to get it. With interest, by the time it was paid off, that hot tub cost us nearly $20,000! The same thing goes for furniture, electronics, quads, sleds, etc. If you can’t afford something, save up for it. Don’t take out a loan for it.

Appreciating Assets

(Things to put your savings in, that grow in value over time and give you a place to store your hard work in a way that cannot be stolen):

Gold

Physical gold that you have in your hand has continually risen in value for over 3000 years. The only down side is that a single one ounce gold coin is now worth over $5500. It takes a while to save up that much to buy one. Then you have to keep it safe from theft or loss in a fire. If you put it in a safe deposit box at the bank and the bank has problems, you may lose access to it.

Silver

Much the same as gold in terms of it’s money properties, but way more affordable. It has tripled in value since 2010. Silver 1oz coins can be acquired pretty easily at a dealer, but you still have to keep them safe and lug them around without having them lost or stolen.

Bitcoin

The great thing about Bitcoin is that you can acquire it in really small pieces. Even if you only have $20 left over on payday, you can buy some Sats (small parts of a Bitcoin) and squirrel them away, protected by a hardware wallet. They are weightless, can be sent across the world in seconds, and as long as you protect your 12 or 24 word seed phrase, they can never be stolen. It is worth learning how to buy and self custody Bitcoin. You can learn how to use a service like Bitcoin Well or Bull Bitcoin (online places to buy Bitcoin) easily on their websites. You can also learn how to buy privately from other Bitcoiners using various services. You can learn how to use a signing device and metal plates to protect your seed words on BTC Sessions’ YouTube channel. I can teach you

everything you need to get started.

Land (Not houses that fall apart)

If you make enough money from the assets above, you can eventually get some land. Land, even though you never truly own it in Canada because of annual property taxes, gives you a place to go if the whole world goes sideways. Or if the government really gets even more out of hand. If it is good land, it will rise in value and you can sell it off as a whole or in pieces. It is worth doing some research on how to pick a piece of land that has everything you need on it to survive. Water, good soil, animal pasture, harvestable trees, etc. It is also worth doing some research on what kinds of land and locations are most likely to rise in value.

These are about the best things available now that have proven to be appreciating assets.

A Note on Cash

Even though the value of cash decreases about 12% each year, it is still worth having a couple thousand dollars always available in small bills so you can still buy things if the banks get closed like they did after WW1, or if there is temporary social unrest.

A Note on Where You Choose to Live

In the 54 years that I have been alive, the Canadian government has taken away many of our rights and stolen the average family’s chance to achieve financial freedom. And it is only getting worse. Taxes and prices continue to rise. Young people no longer have a chance to buy a house, and with the digital ID and digital dollar that they are planning to launch soon, the control will be complete. Once cash money goes away and a digital programmable money is introduced, the government with have 100% visibility and control over every purchase we make. They will be able to turn our money on and off with the flick of a switch. They will be able to set limits on how much of certain items you purchase each month. If you complain on social media about them, they will be able to turn off your wallet and your ability to buy food and fuel. Many

Canadians that have wealth are getting passports and citizenship in countries like Panama and Uruguay that are not farming their people like cattle. Taxes are low. There are fewer rules. The people are happy and friendly. With the direction that Canada is heading, I would highly recommend that you start researching places to go where you will not be trapped and have

everything stolen. I would leave Canada right now if I hadn’t learned so much of what I have written here too late.

Anyway, I hope you get something out of this writing. I would feel guilty, knowing what I know now, if I didn’t share with you some secrets to being free and not living your life as a tax slave. I love you.

#bitcoin #grownostr

What’s the best current Graphene compatible Google Pixel? #asknostr

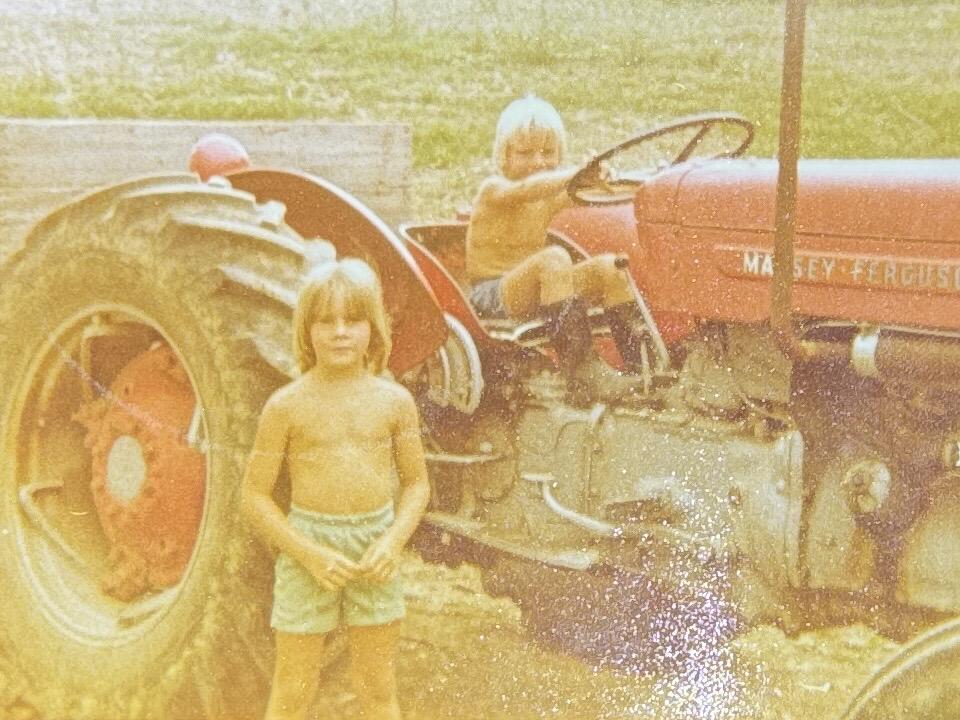

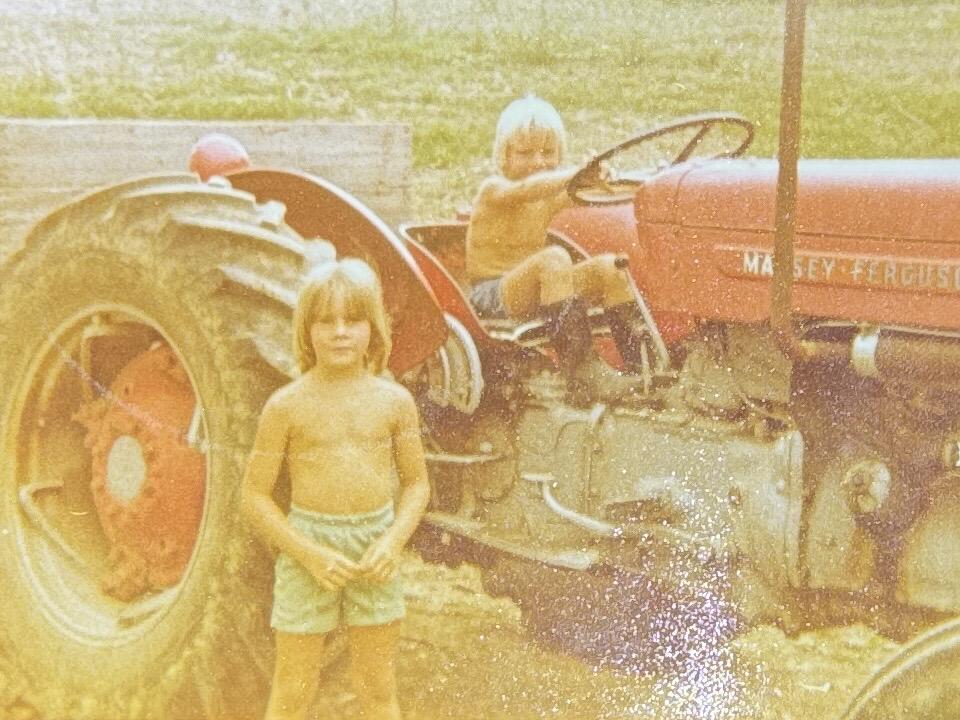

I was looking through old albums tonight. Great childhood memories. Do your kids a favour. Raise them in the country if you can. #grownostr #lastfreegeneration

My wife and I regularly send this to one another.