Common commentary down under:

“I was at (insert cafe/shopping centre/restaurant) and it was packed. People aren’t suffering yet…” blah, blah, yadda, yadda

My hunch is that there is actually two sides to this coin:

- Low debt Gen X and Boomers are in the sweetest spot in history. All assets, including cash (yes, that dirty fiat y’all despite), is producing a return. They’ve had a massive run up in asset prices, if they aren’t levered to the tits, then disposable income is fine

- low asset Millennials and younger who don’t see hope in ever owning a home live for the moment. Yeah the probably DCA low amounts into something, maybe YOLO into bitcoin or have a crack at some sort of 💩coin….but there week to week pay checks are for having fun now. Fuck it, you know?

So we still have some busy consumer spending. Even though we are in the midst of long per capita recession, severe decline in “living standards” and an inflationary shit fight.

Not sure what else to say here - just thinking out loud.

Thoughts #austriches ?

Leigh

npub1ardh...wt67

I invest, I write, I own a biz

Peace is….

Discussions about compounding with a pour over (for me) and a matcha (for her), Japanese cafe in Aus and a walk.

#investing

#bitcoin

#coffee

@Nadia

But wen 100k?

New weekend read

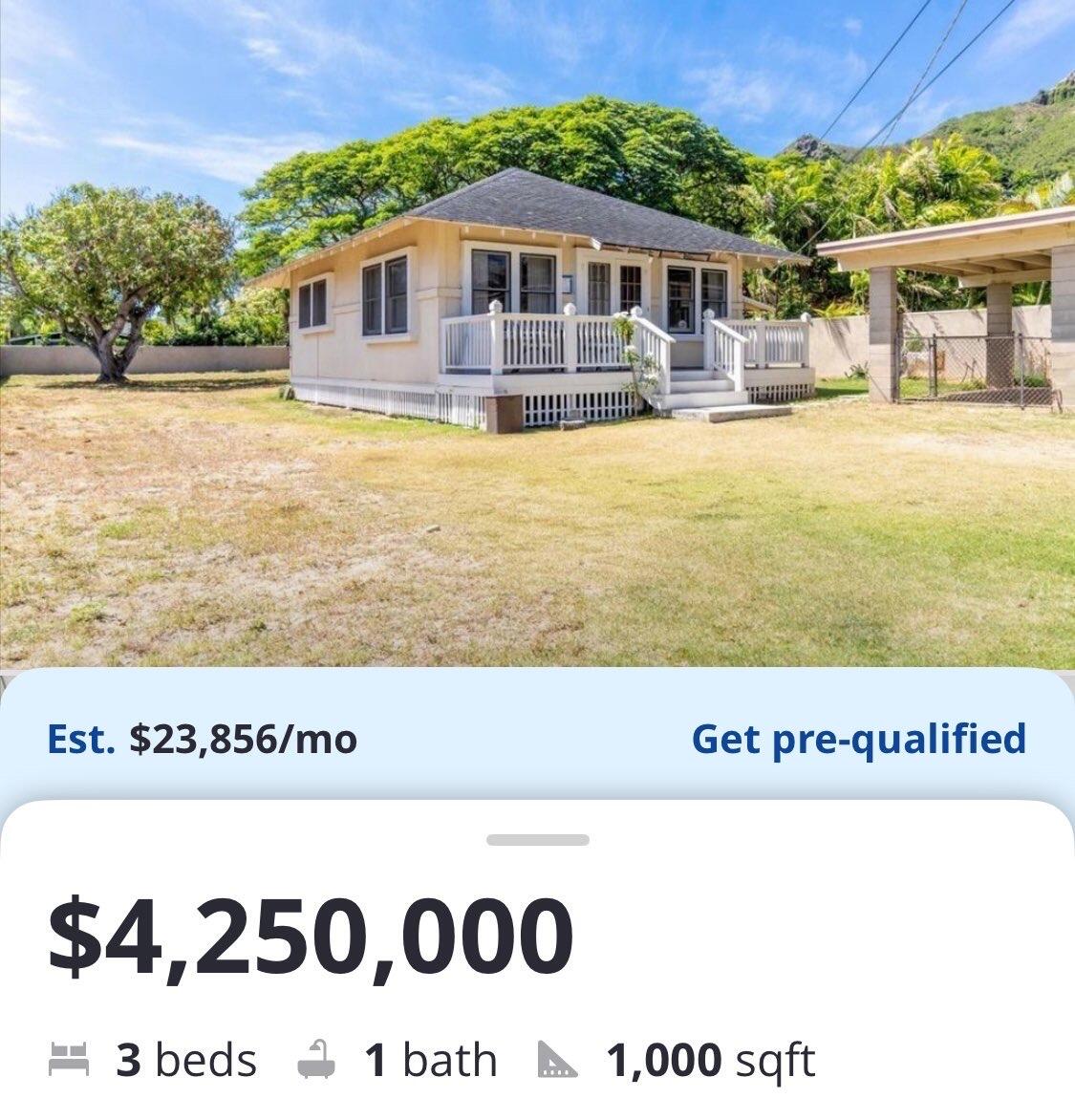

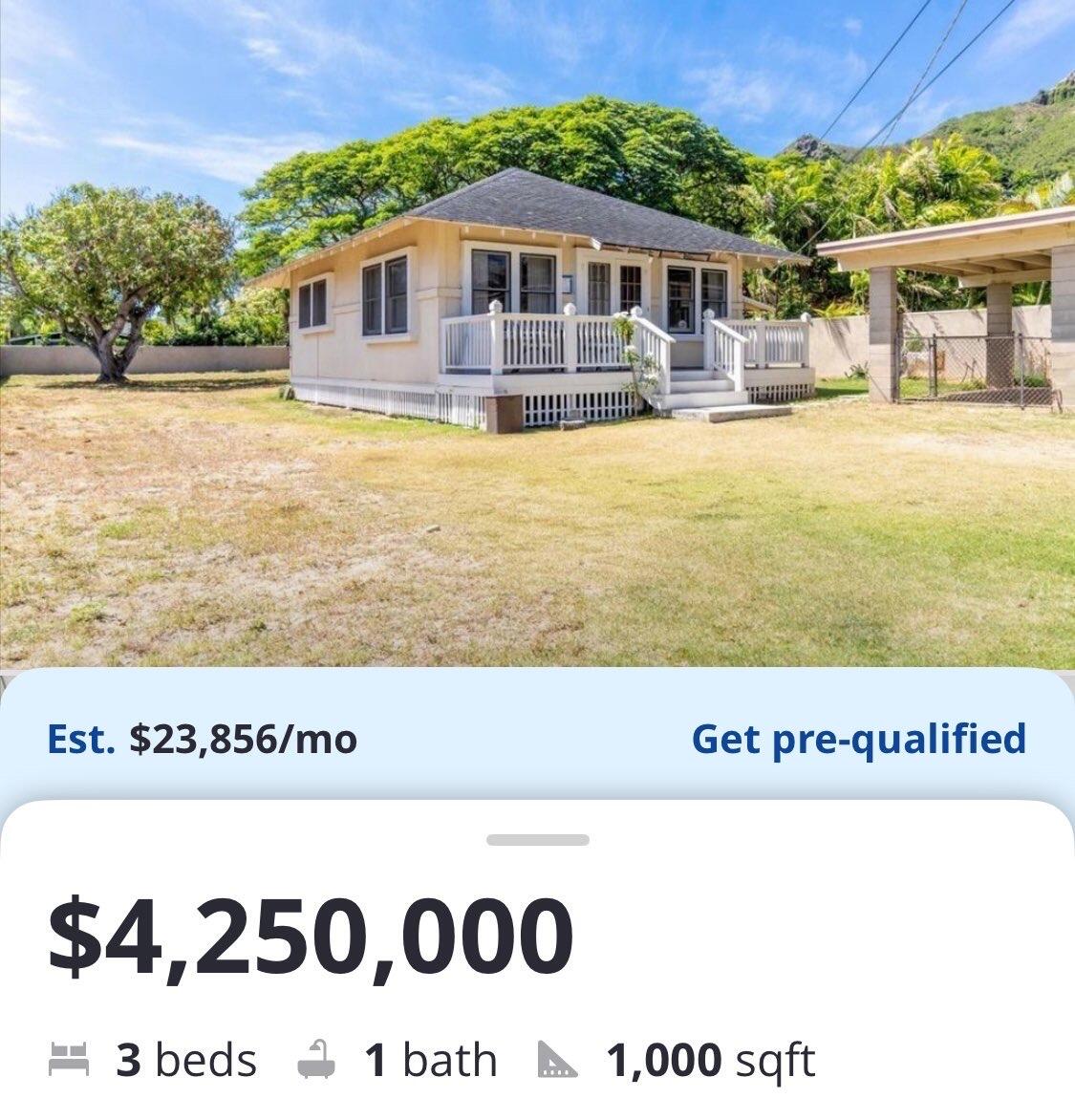

What would you rather have?

This Aussie palace or about 28 #bitcoin ?

UK pension scheme labelled “deeply irresponsible” for investing in #bitcoin

Read more:

Sky News

UK pension scheme called

The unnamed defined-benefit scheme became the first in the UK to take the plunge, using 3% of its assets to buy into the cryptocurrency last month.

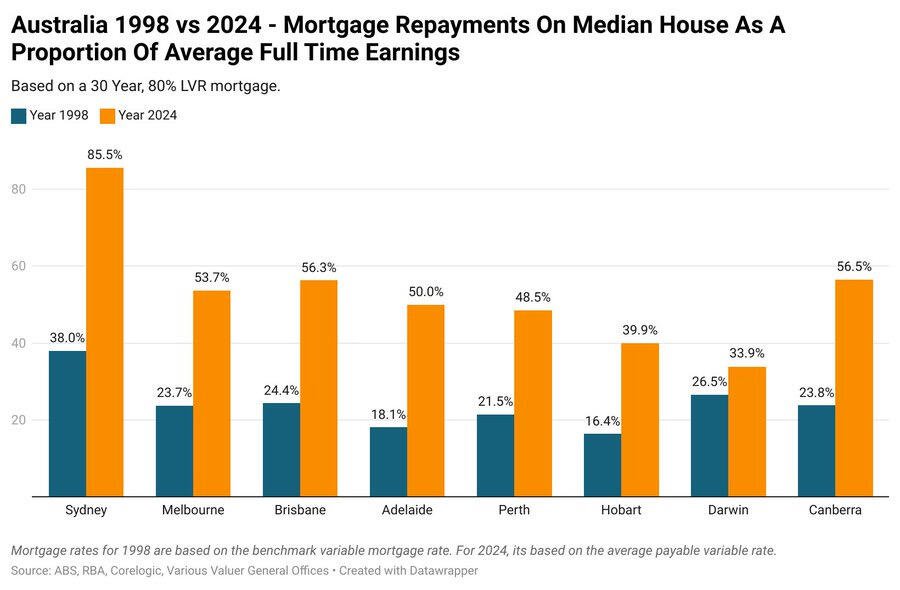

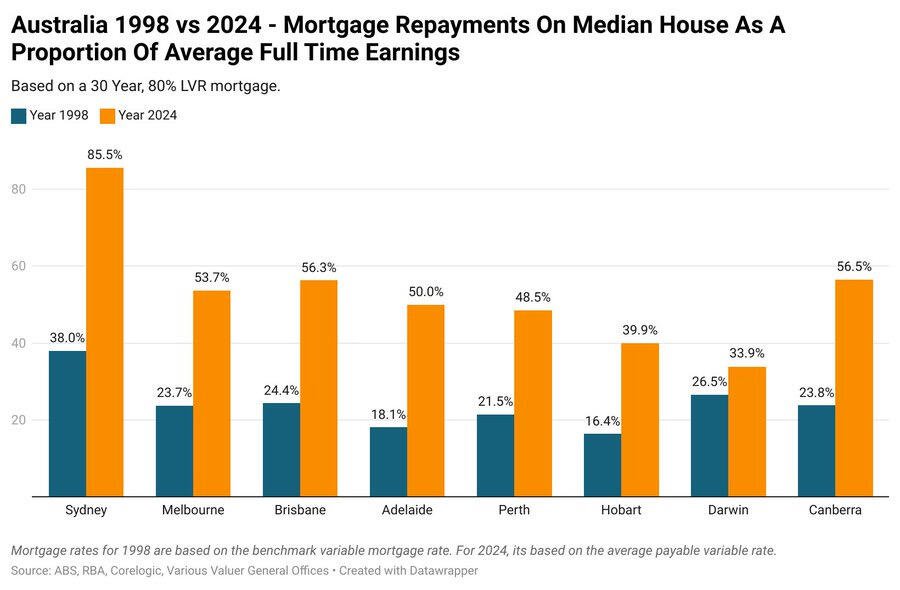

Aussies at auctions going in hot with a 2% deposit for a 400sq m dog box

#property

#justbuybitcoin

Ooooh hot damn Damus is smooooth

It’s probably nothing, ammaright #austriches ?

Alright, Primal was not working well so now I’m trying Damus

#testing

Still can’t post pics @primal

Hey what’s with my Primal/Nostr not letting me upload pics?

I’ve got memes to share, MEMES I TELL YA

#nostriches and #austriches

Just caught up with a mate who assisted his old business at a large trade show in Austin, Texas.

His comparison to Australia was that the US vibe was optimistic. Retailers spending at trade shows, good outlook and general consensus that economy was NOT falling apart.

What will be the straw the breaks the camel’s back here?

- growing homelessness

- relentlessly immigration

- per capita recession coming up 7 quarters in a row

- worst decline of living standards among peers (and non peers!)

- small businesses going bust

- increasing taxes to fuel handouts and 💩 policies

All of those make me 😡

But what’s most alarming is the second level consequences of this:

South China Morning Post

‘War is messed up’: why young Australians don’t want to join the military

Observers blame a ‘culture of self-loathing’ for destroying the self-esteem of Australia’s youth and undermining faith in its institutions.

Yeah bitcoin is cool, but have you ever gambled on pharma 😂

Well, well, welllllll

First edition of the MAD bill dumped.

Hopefully this is the beginning of a united stand against government overreach in Australia.

I’m sure they’ll repackage it and try again, but for now it’s cactus.

Since 2016, the government’s share of GDP has surged by nearly a third—funded by our high taxes.

But instead of creating real wealth through our abundant natural resources, they inflate a false economy by growing public sector jobs.

Where’s the real leadership? Where’s the vision?

We are abundant in resources the world craves, yet we lag.

What’s really going on?

#nostriches #austriches

Shoutout to this one on X

Propadeeeeee

#nostriches and #austriches

Here’s an Aussie joke for you:

Australia's Future Fund was established in 2006 with the purpose of strengthening the country’s long-term financial position.

Its primary goal? To ensure the government can meet unfunded superannuation obligations for public sector employees without placing a financial strain on future budgets.

The Future Fund is structured to be a patient, long-term investor—designed to maximize returns over time while managing risk, ensuring there’s enough in the pot when liabilities come due.

An independent sovereign wealth fund, created to accumulate savings and offset the government's future liabilities, particularly public sector superannuation payments.

But today, the Treasurer reckons it’s a good idea to start investing in houses and renewables.

So much for independence.

Here’s the punchline:

1 in 5 working Australians is employed by the public sector.

66% of all GDP growth since Q2 2018 has been fueled by government spending.

Meanwhile, we’re in a per capita recession with peak biz insolvencies hitting just recently.

The government created a Future Fund to secure the future, but their actions seem designed to mortgage it.

#TheJokeIsOnUs