"Os homens viraram mulheres e as mulheres viraram crianças mentais bicho pqp, é isso ou não é?" - Renato Trezoitão

ADM

administrator@BitcoinNostr.com

npub1agfx...end5

I am your messenger.

(I will often give my opinion)

#carnivore

#BTC

#bitcoin

"Todos os que apoiaram Lula estão, ou bem empregados, ou ricos, ou enriquecendo. Todos os que apoiaram Bolsonaro estão, ou mortos, ou presos, ou fugidos, ou caindo em si da besteira que fizeram".

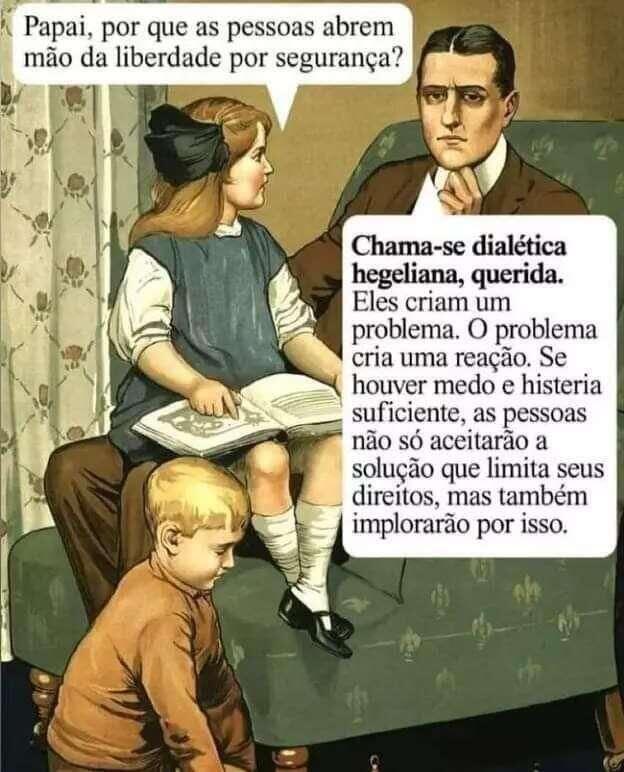

He who sacrifices freedom for security will end up with none.

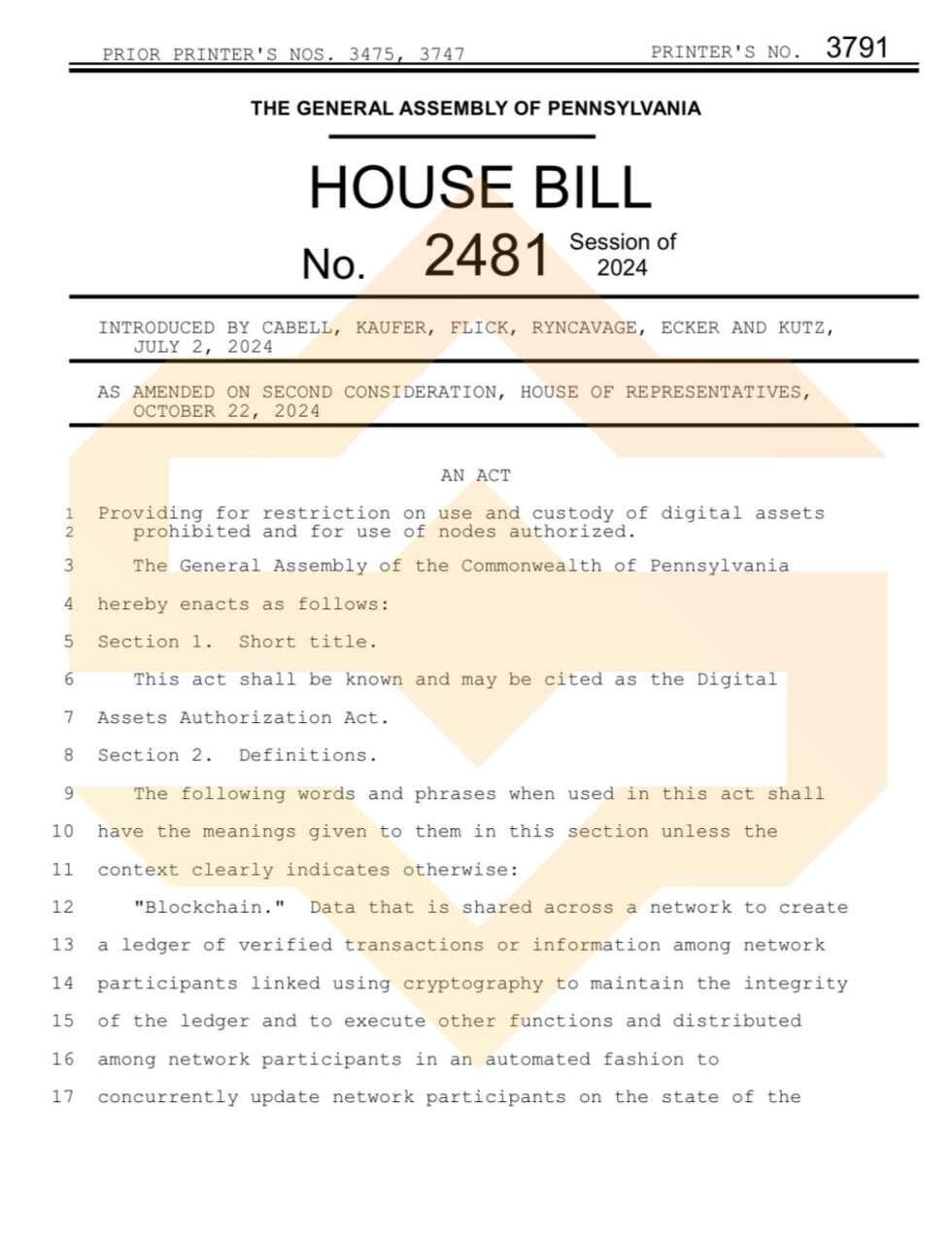

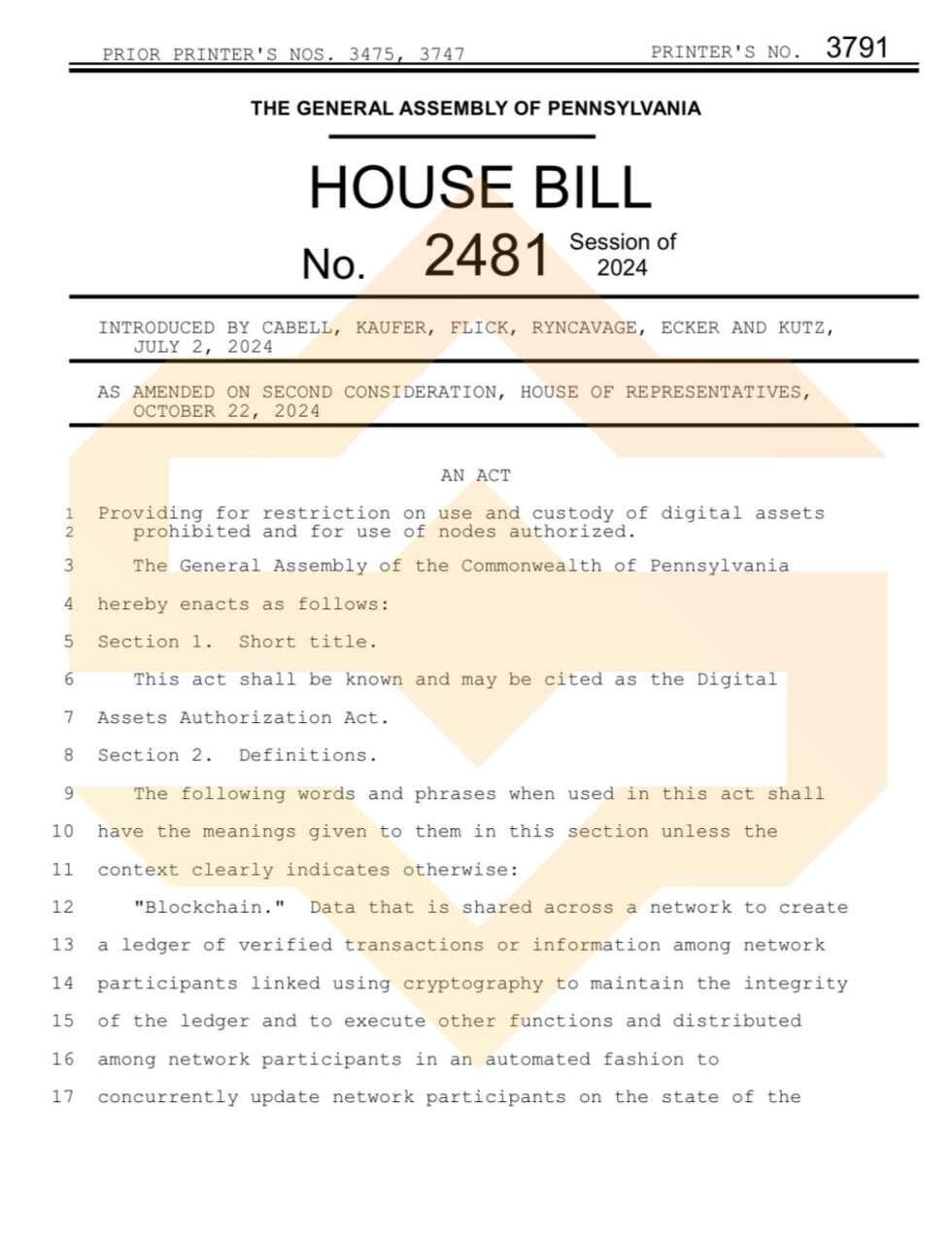

BREAKING: 🇺🇸 The state of Pennsylvania has passed ‘Bitcoin Rights’ in the House by a sweeping majority 🙌

Both Republicans and Democrats united together to pass the bill.

The Decline of Morality with the End of the Gold Standard

The abandonment of the gold standard in 1971 marked a turning point in the global financial system, with profound economic and moral implications. Previously, national currencies were backed by gold, a finite resource that limited the issuance of money. This forced governments to maintain fiscal responsibility, as printing more currency required equivalent gold reserves.

When the gold backing was abolished, fiat currencies became detached from any tangible asset, relying solely on trust in the issuing government. This shift allowed for inflationary policies, excessive debt, and monetary manipulation, as governments could now print money at will, often without considering the long-term consequences.

This change in the monetary system led to a kind of "moral decline" in economic practices. Inflation became a common tool to cover deficits, devaluing the common citizen’s money while benefiting those closest to the centers of economic power. At the same time, public debt skyrocketed, compromising the future of upcoming generations.

Additionally, the end of the gold standard weakened the notion of intrinsic value in money. While gold represented something real and limited, fiat money became seen as malleable, subject to manipulation based on political interests. This, in turn, fueled a culture of consumption and debt, where the value of money seemed to fluctuate based on government convenience.

In summary, the end of the gold standard not only destabilized global economies but also contributed to a moral degradation in the use of money, encouraging practices that sacrifice financial stability and fairness for short-term solutions.

Bitcoin as a Store of Value

#Bitcoin has increasingly been seen as a store of value, similar to gold, due to its scarcity and unique characteristics. With a fixed supply of 21 million coins, it is protected against inflation, something that government-controlled fiat currencies cannot guarantee. While these currencies can be printed in unlimited amounts, leading to devaluation over time, Bitcoin’s supply remains limited.

Moreover, #Bitcoin's decentralization makes it resistant to censorship and government control, providing a secure way to store wealth. Rather than spending it, many view BTC as an asset to hold, expecting its value to increase over time as more people seek alternatives to traditional financial systems. This makes it a hedge against the devaluation of national currencies and unstable economic policies.

For those looking for long-term financial security, holding #Bitcoin as a store of value is a strategy to preserve wealth.

use #Monero, in case of privacy, and #Bitcoin as a store of value.

Governments see Bitcoin as a threat to their control over the financial system. While fiat currencies, such as the dollar and the real, are controlled and tracked, Bitcoin is decentralized, allowing financial freedom without intermediaries. This is a political concern, which may soon limit or even prevent the purchase of Bitcoin with state currency. In the future, obtaining Bitcoin may become extremely difficult, requiring effort, sacrifices and extreme alternatives such as mining or direct negotiations. The fight for financial freedom through Bitcoin will be increasingly challenging.

Flag Theory and Tax Planning for Bitcoin and Cryptocurrency Users: Legal and Strategic Tax Avoidance In the world of cryptocurrencies, protecting assets and optimizing the tax burden are priorities. Flag Theory offers a legal and efficient strategy, distributing residence, citizenship and business between different jurisdictions to make the best of each. This allows tax avoidance — the legitimate use of the law to reduce taxes — as opposed to evasion or evasion, which are illegal. Bitcoin self-custody, for example, is a key tool in this planning, providing greater security and tax optimization in some jurisdictions. To exploit these advantages ethically and legally, proper planning is essential. I remember making a video about it.

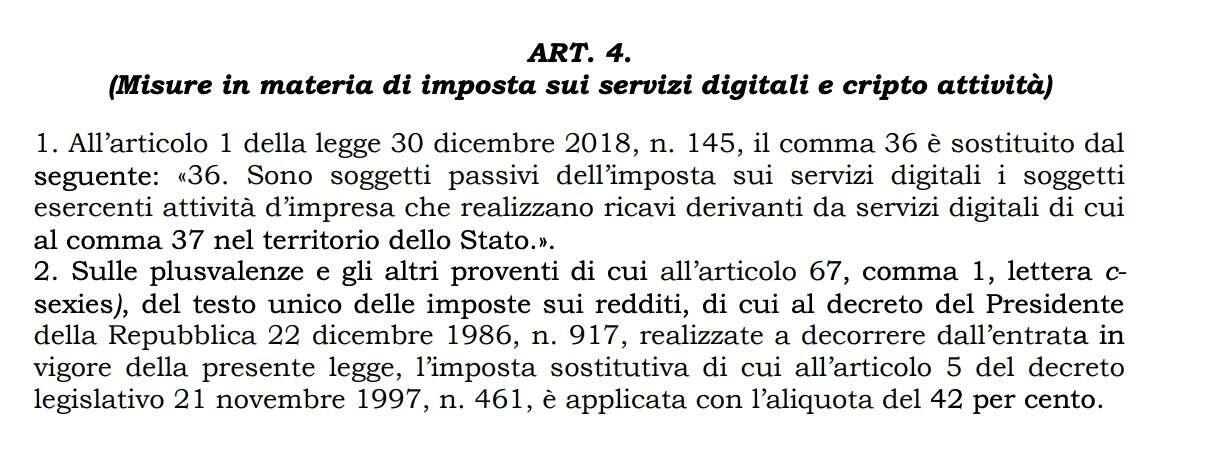

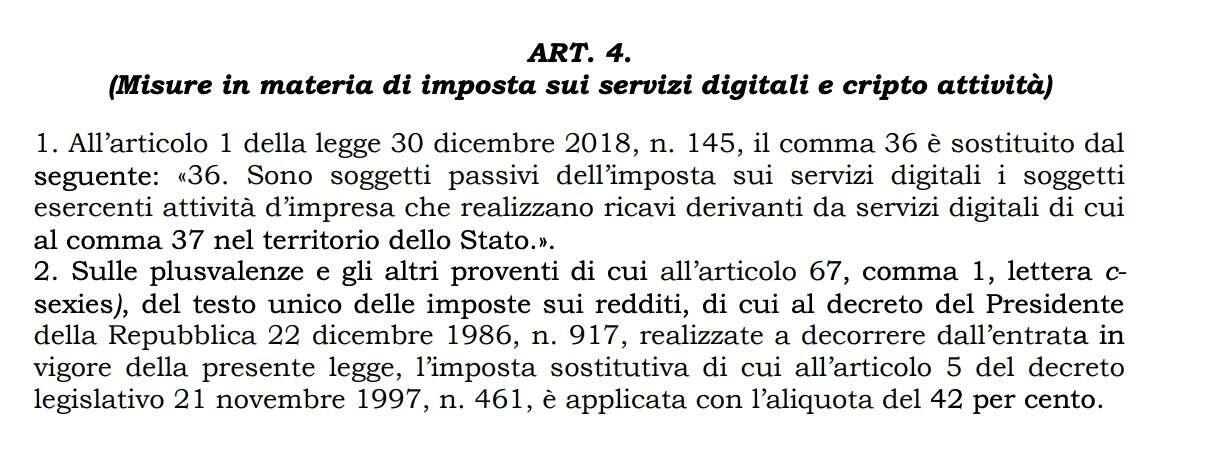

NEW: 🇮🇹 The official text of the 2025 Budget Law, signed by the President of Italy, has been presented❗️

The text includes the increase in the rate on #Bitcoin capital gains to 42%.

The law will now be debated.

The Cash and Carry strategy is an arbitration technique used in the financial market to obtain profit through the simultaneous purchase and sale of an asset1 . Here's a summary of how it works: Spot Purchase: The investor buys an asset on the spot market. Future Sale: At the same time, the investor sells a futures contract for the same asset1 . Profit by Difference: Profit is obtained by the difference between the purchase price in the spot market and the sale price in the futures market1 . This strategy exploits the price difference between spot and futures markets, guaranteeing profitability if the asset's price in the future is higher than the current purchase price1 .

That's what I understood, the principle is very simple.

ㅤ ㅤ ㅤ ㅤㅤ ㅤ ㅤ

To define the next supreme leader of the party, a test is scheduled to see who can drink the most cachaça without falling.

BRICS Summit Proposes Bitcoin as Solution to Sanctions Against Russia

At the BRICS summit, Russian President Vladimir Putin directly addressed the use of the dollar as a political weapon, stating: “The dollar was used as a weapon. It’s true… If they won’t let us work with it, what else should we do? We should look for other alternatives.”

#brics

#bitcoin

#freedom

A dificuldade #Bitcoin atinge um recorde histórico de 95,67T, o que coincide com uma taxa de hash recorde que ultrapassou 700 EH/s pela primeira vez.

#stackfy

#hashrate

#bitoinc

24/10/2024 12:49:38

Se os brasileiros não gostarem podem recorrer ao Bitcoin, diz coordenador do Drex

BlockTrends - Blockchain Notícias | Investimentos | Economia

Se os brasileiros não gostarem podem recorrer ao Bitcoin, diz coordenador do Drex

Para Fabio Araújo, o Bitcoin serve como um "balizador" para o desenvolvimento de inovações financeiras reguladas, como o Drex.

The prospect of U.S. debt reaching $153 trillion highlights the unsustainable nature of fiat currencies and the potential for Bitcoin to surge in value. As confidence in the dollar wanes, Bitcoin's finite supply makes it an attractive hedge against inflation and economic instability. If Bitcoin gains mainstream acceptance as a store of value or medium of exchange, its price could skyrocket, with predictions of reaching $10 million becoming more plausible. In a world where traditional currencies face increasing challenges, optimism about Bitcoin's future is warranted.

The Bank of Canada has recently cut its benchmark interest rate by 50 basis points to 3.75%, marking its largest rate change in over four years. This decision aims to stimulate economic activity in a sluggish environment by lowering borrowing costs for consumers and businesses.