Simon is on point again, like clockwork every week. I always look forward to catching up on Bitcoin Hardtalk on a Saturday morning.

Thank you @SimonDixon

Nick

nick@nickjstevens.com

npub1ljq0...cpnl

I’m an engineer, trail runner, father, learner, teacher and dreamer.

My happy place, with a coffee.

Even on a cloudy day there is something peaceful being down by the water.

Happy Saturday folks.

📍 Kingswear, Devon, UK

🎯 Decentralised innovation over centralised control

🎯 Economic calculation over political calculation

🎯 Market-driven over centrally planned

🎯 Individual initiative over systemic apathy

🎯 Competition over ‘too-big-to-fail’

🎯 Local solutions over distant committees

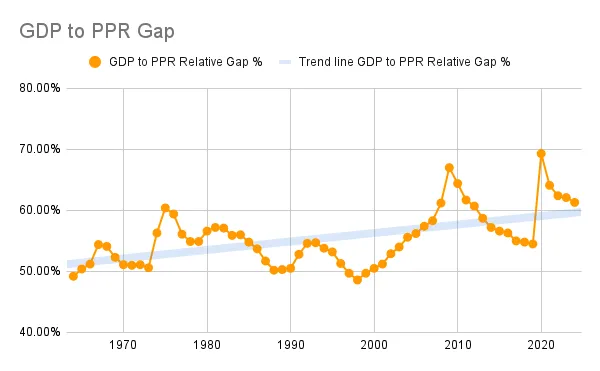

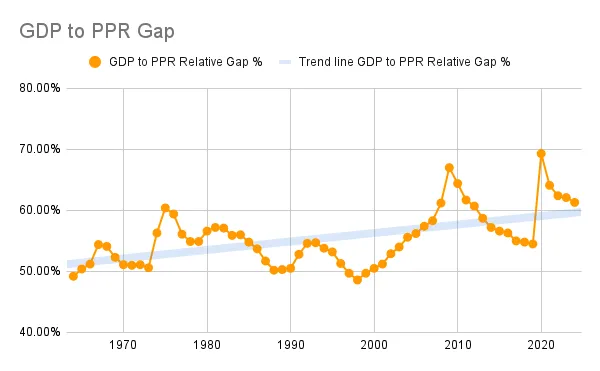

Mind the Gap ⚠️ - a look at the gap between GDP and Private Product Remaining (PPR) for the UK. PPR is an alternative metric to GDP where government spending is removed. In general, the lower the gap between GDP and PPR the better as this means the role of the government in the economic output is less. Unfortunately for the UK the trend is the other way - with government spending becoming more significant in recent decades.

Full paper here: https://www.nickjstevens.com/blog/a-tale-of-two-economies/

Fantastic report by Unchained on Repricing the Economy in Bitcoin. %20copy%202.png)

%20copy%202.png)

Download - Repricing the Economy in Bitcoin

Why it's time to see your portfolio through a bitcoin lens using a bitcoin-denominated discounted cash flow (DCF) model.

Currently reading:

Just finished reading The Big Print. Fantastic work @Lawrence Lepard . I’m in the UK but the parallels are very similar, and the solution — Bitcoin — the same.

I analysed historic bitcoin price data to see what the best days of the month to buy and sell are, as I aim to live on a bitcoin standard. 📈

The best strategy (for me) is to buy on the 3rd of the month and sell on the 25th or 26th.

With my pay check I will buy Bitcoin at the start of the month and then sell at the end of the month to pay off the credit card. Doing this means that, on average, I will gain in Bitcoin terms over a 4 year cycle.

Future abundance from monetary scarcity. Bitcoin is the way.

What are some great resources for being a sovereign individual?

I’ve now reached the age where my son gets birthday presents that I want to read…

Orange is my favourite colour…

A week since adopting my own version of a bitcoin standard and the price is struggling to get above the 21 day EMA. No change in my strategy though, I believe the tailwind is huge and I can be patient. #freedom

A blustery and grey day here in Devon, UK. Time for a coffee and a @Simon Dixon BitcoinHardTalk, episode 84.

It’s unclear how the UK plans to fund the defence spending increases expected in the Strategic Defence Review. Is this going to lead to money printing…

The Independent

From a ‘more lethal’ army to extra AI – what’s in Starmer’s strategic defence review?

The Independent looks at the outcome of the strategic defence review

Taken my first steps towards a bitcoin standard. I now transfer my monthly fiat pay to bitcoin and then sell on a monthly basis to pay off my credit card.

Still deciding on whether to use Koinly or Recap for UK tax.

A must-read… fascinating and terrifying:

AI 2027

A research-backed AI scenario forecast.

“what we now have is rugged capitalism for individuals, but socialism for the rich and powerful” — The Big Print, Lawrence Lepard. 🎯

📙Sunday reading - The Big Print. Enjoying it so far.