I looked into the companies that were getting regulatory approval as digital asset custody providers across the larger financial jurisdictions. I do think that it is possibly a case of being a "rush to the next big thing" and somewhat of a bubble/fintech trend but for a number of these groups I can see some of these companies have MAJOR connections to established banking and "old money" organisations. I'm seeing the names in this list pop up now regularly in news about collaborations with governments and structures as countries announce their new "crypto" regulations. Of note is the custodians and who the institutions are that are behind them.

I'll just paste my previous note below as my note link/id skills never seem to work......

In an attempt to understand and get an idea about where Governments and regulators are trying to push us, I’ve taken some time to investigate the “Custody” sector that has been built up in recent years. So many of these companies I’ve never heard of despite them having substantial AUM. Start looking deeper and there are a lot of connections/affiliations that surprised me, for example Lord Philip Hammond (ex Chancellor of the Exchequer, ex Secretary of State for Foreign and Commonwealth Affairs, ex Secretary of State for Defence, ex Secretary of State for Transport and Life Peer) who is Chairman of Copper Technologies (UK).

Now, I’m, along with many of you, a strong advocate of self custody and I believe in maintaining that self-sovereignty. The state doesn’t share that view so, it is what it is. By being aware of want they want to see happen, I think we can be better informed and prepared.

The following is a list of “Custody” providers who, as far as I can see, are providing Institutional level custody for various sectors involved in Digital assets from ETFs, funds to exchanges and wallet providers(?). Some of them also provide custody for individuals and are likely one step away from custodial wallet providers. Most are involved with Shitcoins and some don’t even touch Bitcoin. As new countries are pulled into establishing regulatory frameworks around these assets, the first place they consult, in my opinion, is FATF. The FATF and wider Banking guidelines then form the basis for how the regulators in the country draft legislation and subsequently who and how they grant approval to.

I’ll say it again, I am not an advocate for this and seeing the suited smiling bankers, tech bros and even ex-civil service sitting on the board of these companies makes me cringe.

Looking forward are we going to see a bifurcation in Bitcoin? The coin that is sucked into “Custody” via ETFs and institutions…..will it ever escape from that space? Will those of us who hold our own keys be the custodians of un-enslaved coin?

If you are serious about your belief in Bitcoin I reckon taking a look at some of these companies platforms is informative. Understand in order to be prepared.

"Know your enemy, know his sword." Miyamoto Musashi

It took a fair amount of digging to compile this list and I likely didn’t find them all. I added a very brief amount of basic info about the companies. Repost if you find value in it. 🫡

https://zodia.io/. -Standard Chartered, Northern Trust and SBI

-Nomura, Ledger and Coinshares founded 2018 Japan,UK and Europe

-Nomura, Ledger and Coinshares founded 2018 Japan,UK and Europe

- Copper Technologies - State Street Digital UK/Europe

- Societe Generale (founded 2018) Europe

(founded 2018) USA based

https://www.coinbase.com/institutional. USA based

- Copper Technologies - State Street Digital UK/Europe

- Societe Generale (founded 2018) Europe

(founded 2018) USA based

https://www.coinbase.com/institutional. USA based

- Andreessen Horowitz, GIC—Singapore’s sovereign wealth fund, Goldman Sachs, KKR, and Visa. (founded 2017) USA based

- Andreessen Horowitz, GIC—Singapore’s sovereign wealth fund, Goldman Sachs, KKR, and Visa. (founded 2017) USA based

(founded 2018) USA based

(founded 2018) USA based

(founded 2013) USA based Coverage: Global (Licensed in South Dakota, New York, Switzerland and Germany)

(founded 2013) USA based Coverage: Global (Licensed in South Dakota, New York, Switzerland and Germany)

also

also  (founded 2009? Qualified Bitcoin custodian since 2017) USA based

(founded 2009? Qualified Bitcoin custodian since 2017) USA based

(founded 2019) USA based

https://www.metaco.com. (founded 2015) working with HSBC, Zodia, Ripple, BBVA, Union Bank of Philippines. Coverage: Global

also

(founded 2019) USA based

https://www.metaco.com. (founded 2015) working with HSBC, Zodia, Ripple, BBVA, Union Bank of Philippines. Coverage: Global

also  - USA based

also - 2019 Hong Kong based. Coverage: Global

- USA based

also - 2019 Hong Kong based. Coverage: Global

(founded 2017) Hong Kong based Coverage: Singapore

(founded 2017) Hong Kong based Coverage: Singapore

(founded 2019) USA based Coverage: Global

https://www.floating.group (founded 2018) USA based Coverage: Global

(founded 2019) USA based Coverage: Global

https://www.floating.group (founded 2018) USA based Coverage: Global

Hong Kong based Coverage: Global, licensed in Hong Kong , France, UAE and Italy. Offices in Singapore, Hong Kong, Dubai, Italy, and Vietnam.

(founded 2021) Founders from Indian Exchange Zebpay. Singapore based Coverage: APAC and MENA

https://propine.com (founded 2018) USA based Coverage: Global and first independent digital asset custodian licensed by the Monetary Authority of Singapore (MAS)

Hong Kong based Coverage: Global, licensed in Hong Kong , France, UAE and Italy. Offices in Singapore, Hong Kong, Dubai, Italy, and Vietnam.

(founded 2021) Founders from Indian Exchange Zebpay. Singapore based Coverage: APAC and MENA

https://propine.com (founded 2018) USA based Coverage: Global and first independent digital asset custodian licensed by the Monetary Authority of Singapore (MAS)

(founded 2018) UK based Coverage: Global

(founded 2018) UK based Coverage: Global

(founded 2018) Switzerland based Coverage: Global, Europe focused

(founded 2018) Switzerland based Coverage: Global, Europe focused

(founded 2018) Israel based Coverage: Global. Acquired by Galaxy Digital in February 2023.

Another to add to the list of institution aligned players receiving regulatory go ahead. Of note is their custody provider being Metaco.

(founded 2018) Israel based Coverage: Global. Acquired by Galaxy Digital in February 2023.

Another to add to the list of institution aligned players receiving regulatory go ahead. Of note is their custody provider being Metaco.

Adding to the list

Japan Digital Asset Trust Preparatory Company, inc.

Japan Digital Asset Trust Preparatory Company, inc. (JADAT) will be a preparatory company for the purpose of establishing a trust company specializing in digit

jadat.com

(founded 2022?) connected with Bitbank and Sumitomo Mitsui Trust. Coverage: Japan

KDAC

한국 디지털자산수탁(KDAC)은 디지털자산에 대한 커스터디 서비스를 제공합니다. KDAC은 기존 거래소 중심의 수탁 서비스의 단점을 보완하고 보다 안전한 자산 보관을 통해 시장 건전성을 향상 시키고자 합니다. 한국 최초의 가상자산 거래소 코빗을 비롯해 블로코, 페어스퀘

www.kdac.io

founded by crypto exchange Korbit 2020. Shinhan Bank an investor. Coverage: South Korea

Korea Digital Asset Co. (KODA) 2020 a partnership with blockchain-oriented venture fund Hashed and blockchain firm Haechi Labs. Established by S. Korea’s largest bank KB Kookmin Bank. Coverage: South Korea

Hana Bank announced partnership for Digital asset Custody with BitGo 2023/2024. Coverage: South Korea

Coverage: Singapore, Thailand and Hong Kong

ON1ON Custody – A Hong Kong TCSP licensed digital custodian

A trustworthy and regulatory compliant digital asset custody with a state-of-the-art security framework suitable to institutions and individual clients.

www.on1on-custody.com

Coverage: Hong Kong, Shanghai and Shenzen

(founded 2018) Offices in the USA, Hong Kong, Singapore and Taiwan.

Welcome • First Digital

Experts in trust, custody, and asset servicing.

1stdigital.com

(founded in 2019) Based in Hong Kong Coverage:APAC, Europe, and North America. Also established FDUSD a US$ stablecoin.

Custody Plus | Your Trusted Partner For Digital Assets Custody

Custody Plus, a subsidiary of SGX-listed company (VCPlus Limited), offers digital asset custody services to safekeep investors’ assets.

custodyplus.sg

Singapore based. Coverage: Singapore

https://www.custodize.com Website looks dodgy as fuck!

Adding to the list

Japan Digital Asset Trust Preparatory Company, inc.

Japan Digital Asset Trust Preparatory Company, inc. (JADAT) will be a preparatory company for the purpose of establishing a trust company specializing in digit

jadat.com

(founded 2022?) connected with Bitbank and Sumitomo Mitsui Trust. Coverage: Japan

KDAC

한국 디지털자산수탁(KDAC)은 디지털자산에 대한 커스터디 서비스를 제공합니다. KDAC은 기존 거래소 중심의 수탁 서비스의 단점을 보완하고 보다 안전한 자산 보관을 통해 시장 건전성을 향상 시키고자 합니다. 한국 최초의 가상자산 거래소 코빗을 비롯해 블로코, 페어스퀘

www.kdac.io

founded by crypto exchange Korbit 2020. Shinhan Bank an investor. Coverage: South Korea

Korea Digital Asset Co. (KODA) 2020 a partnership with blockchain-oriented venture fund Hashed and blockchain firm Haechi Labs. Established by S. Korea’s largest bank KB Kookmin Bank. Coverage: South Korea

Hana Bank announced partnership for Digital asset Custody with BitGo 2023/2024. Coverage: South Korea

Coverage: Singapore, Thailand and Hong Kong

ON1ON Custody – A Hong Kong TCSP licensed digital custodian

A trustworthy and regulatory compliant digital asset custody with a state-of-the-art security framework suitable to institutions and individual clients.

www.on1on-custody.com

Coverage: Hong Kong, Shanghai and Shenzen

(founded 2018) Offices in the USA, Hong Kong, Singapore and Taiwan.

Welcome • First Digital

Experts in trust, custody, and asset servicing.

1stdigital.com

(founded in 2019) Based in Hong Kong Coverage:APAC, Europe, and North America. Also established FDUSD a US$ stablecoin.

Custody Plus | Your Trusted Partner For Digital Assets Custody

Custody Plus, a subsidiary of SGX-listed company (VCPlus Limited), offers digital asset custody services to safekeep investors’ assets.

custodyplus.sg

Singapore based. Coverage: Singapore

https://www.custodize.com Website looks dodgy as fuck!

Komainu

Institutional Gateway to the Digital Asset Market | Komainu

Access the digital asset ecosystem with Komainu, connecting institutions to digital asset services through secure custody and bank grade protection

Copper

Copper | Building the institutional standard for digital assets

We provide digital asset custody and trading solutions that reduces counterparty risk, boosts capital efficiency and gives institutions control of ...

SG Forge

SG Forge | Bridging the gap between Capital Markets and Digital Assets

Societe Generale – FORGE provides issuers and investors with innovative services to issue and manage digital-native financial products registered...

Home Page | Fidelity Digital Assets

Fidelity Digital Assets is dedicated to building enterprise-grade custody and trading services for institutional investors. Learn more about our di...

Crypto Bank for Institutions | Anchorage Digital

Anchorage Digital is a regulated crypto platform that provides institutions with integrated financial services and infrastructure solutions. With t...

Bakkt

Bakkt

Building next generation institutional digital-asset infrastructure, reshaping what money is, how it moves & how markets operate.

The Digital Asset Infrastructure Company

BitGo

How institutions and platforms securely access crypto

Choice

Kingdom Trust

Resources for Kingdom Trust clients & more information about Choice.

Choice

Choice | The #1 Rated Retirement App

Choice enables you to invest in bitcoin, crypto, stocks, and more in a single IRA. You can also play Blinko & stack free sats daily.

Secure Crypto Storage - Gemini Custody

Gemini Custody® offers institutional-grade security with multisignature technology, governance protocols, & biometric controls to safeguard your c...

Key technology in expanding digital assets

Discover how technology is key to expanding digital asset services in institutions. Explore innovations to facilitate the adoption of digital assets.

PolySign

Ripple

Financial Infrastructure & Blockchain Technology Solutions

Ripple is the leading provider of stablecoin-powered cross-border payments and digital asset custody solutions. Discover how we’re driving impact...

Cactus Custody

Matrixport: All-in-one Crypto Financial Services Platform

Cobo

Cobo | Your trusted partner for custody and wallet infrastructure solutions

Get access to 4 wallet technologies in one platform - Custodial, MPC, Smart Contract, and Exchange Wallets. Our advanced risk controls and develope...

Fireblocks

Home | Fireblocks

Infrastructure that powers financial possibility Your strategy. Your choice. Get to know Fireblocks. Built for scale. Trusted for security. Payment...

Hex Trust | The Leader in Digital Asset Solutions

Regulated institutional digital asset custody, staking and markets services for builders, investors and service providers.

Liminal Custody

Best Institutional Digital Asset Custody Platform

Liminal Custody is a bank-grade, institutional digital asset custody platform that provides a secure, segregated, and scalable wallet infrastructur...

Qredo - The leading distributed MPC wallet for institutions

With Qredo, take secure custody of your digital assets more easily than ever - the network is the vault

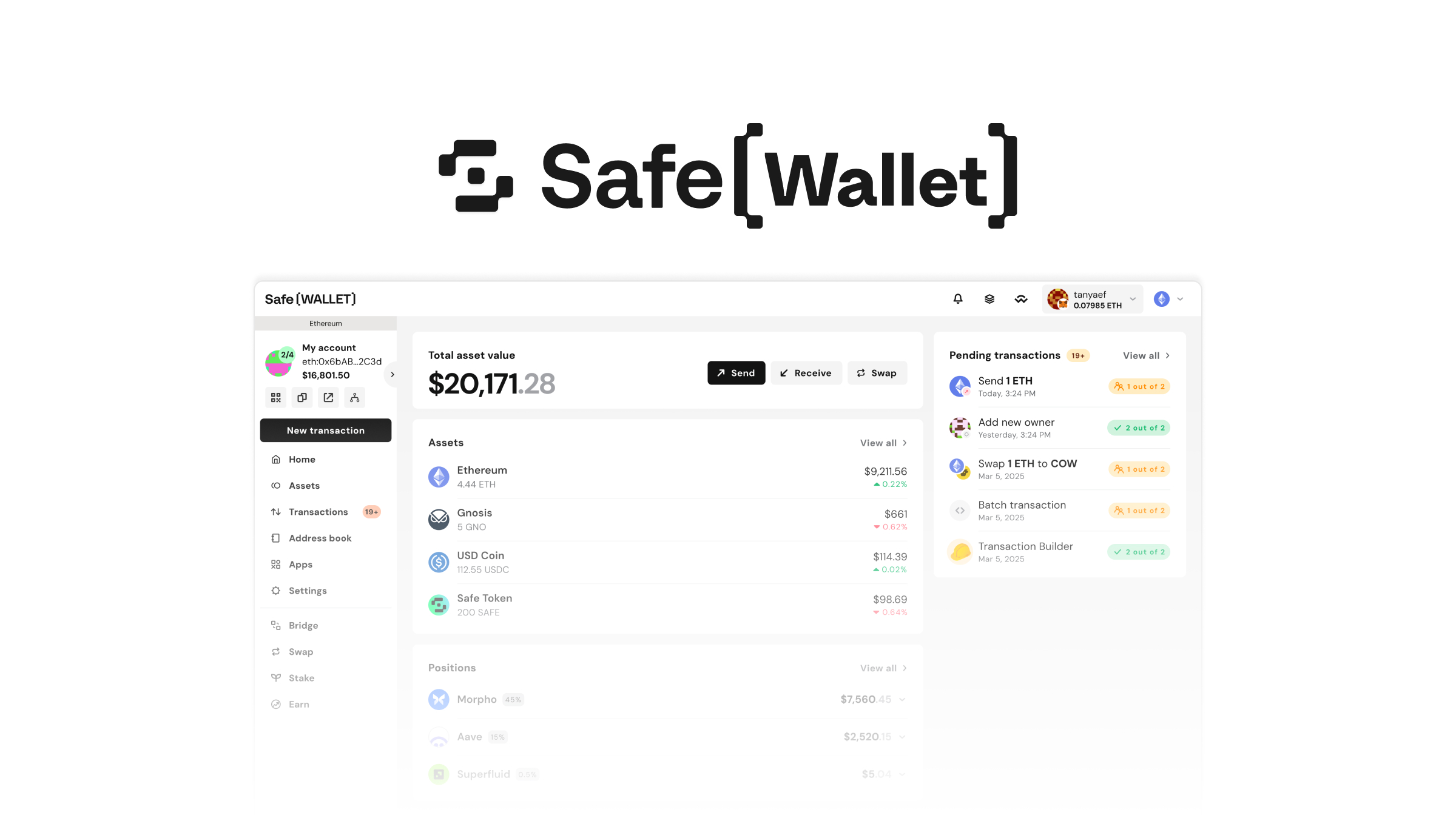

Safe{Wallet}

Safe{Wallet}

Multisig Security for your onchain assets

GK8 by Galaxy

GK8 by Galaxy

Protect your bank’s reputation and pave the way for the mass adoption of digital assets with Impenetrable Custody — the only technology that en...

RULEMATCH

Home - RULEMATCH

RULEMATCH is a spot crypto trading venue based in Switzerland, built with Nasdaq technology - for financial institutions only.

Asia's Leading Digital Asset Custody Provider for Institutions | Rakkar

Safeguard your digital assets with Rakkar, Asia's leading digital asset custody provider for institutional crypto custody based in Singapore.

Aegis Custody

We are a fully-licensed and insured digital asset custodian that provides secure, institutional-grade, proprietary, integrated custodial blockchain...