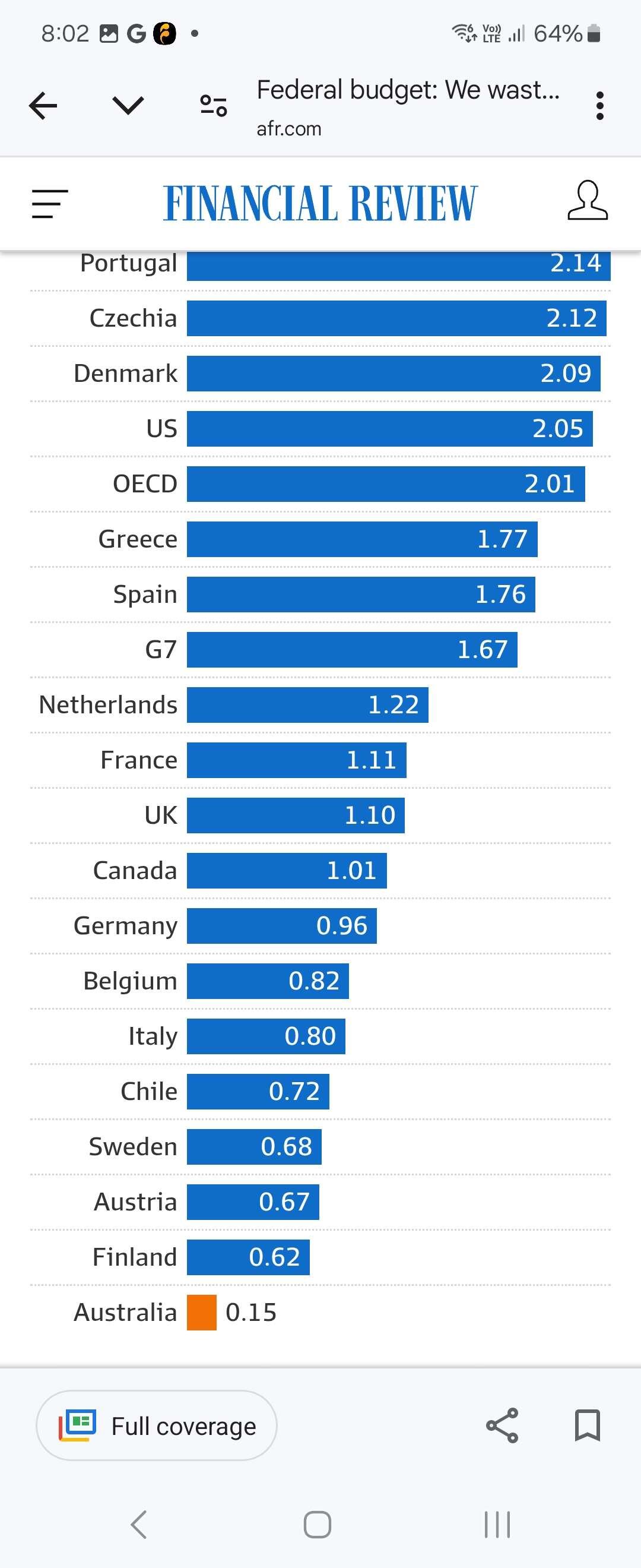

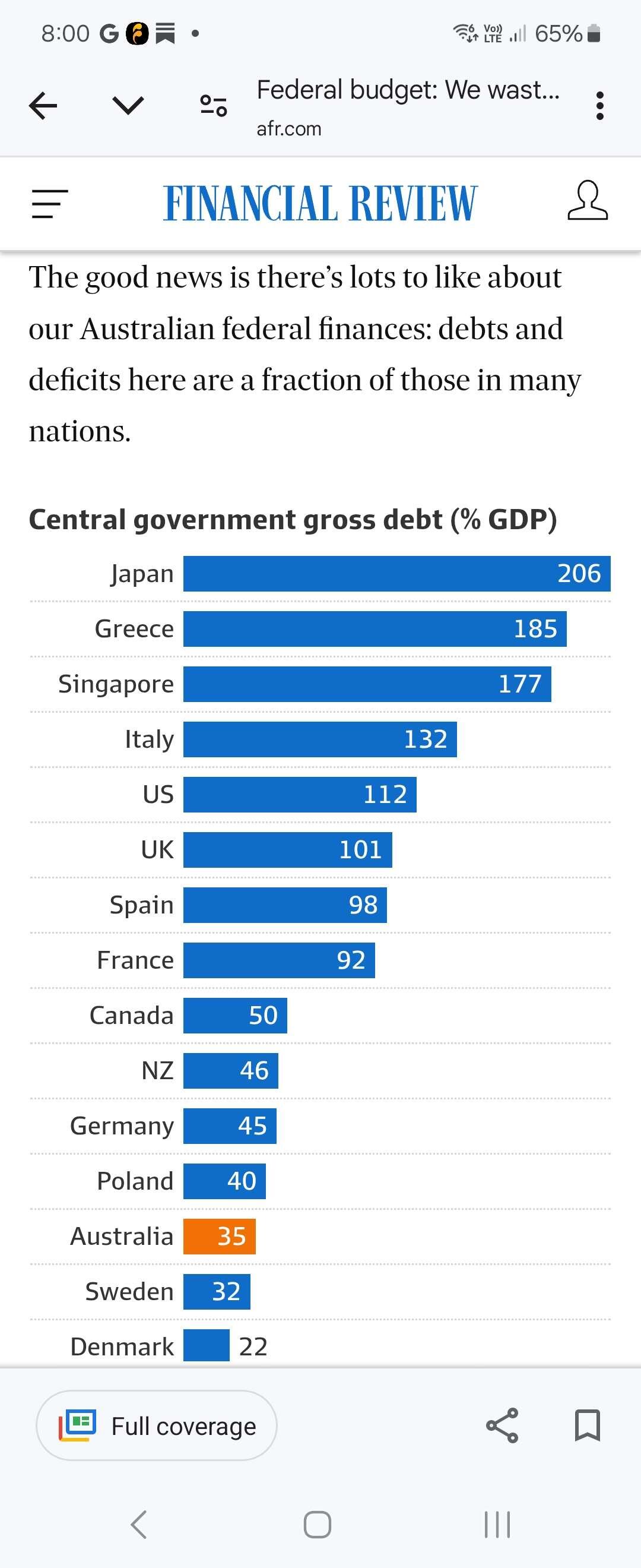

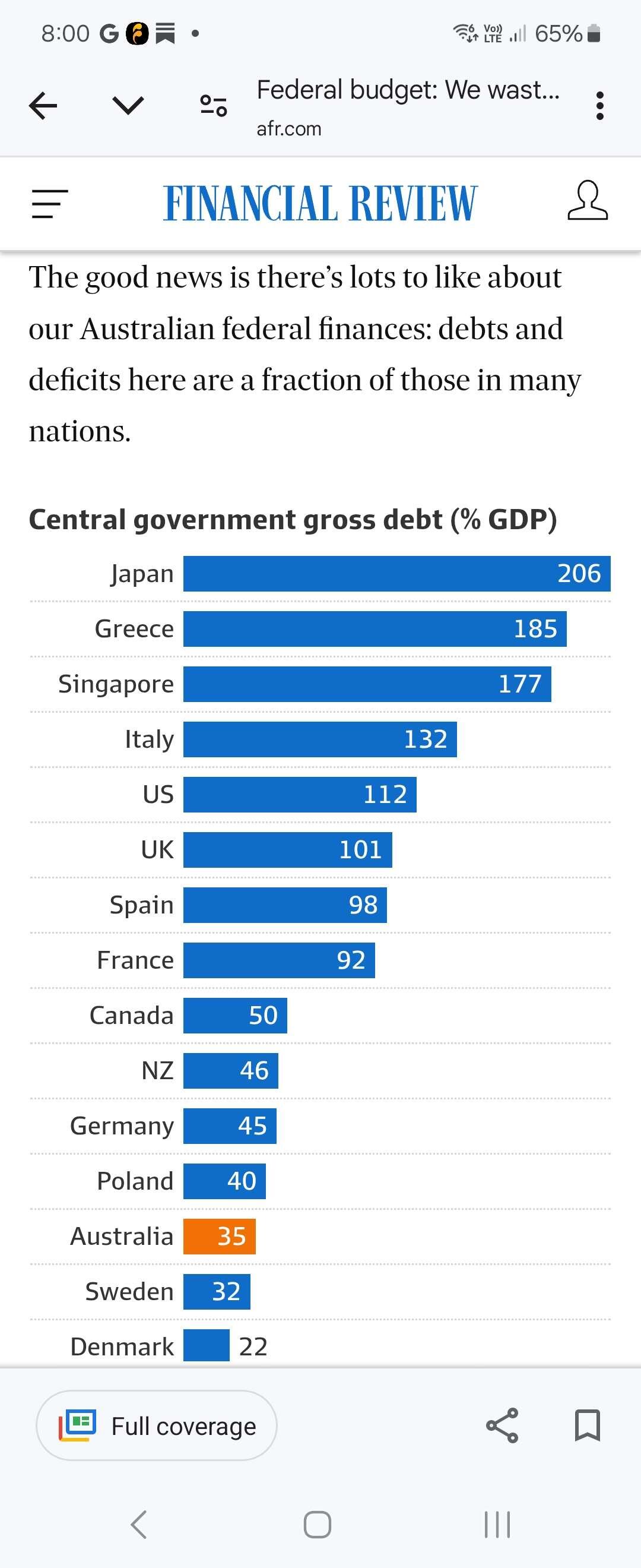

Regarding the the debt chart above...I've been reading

@Lawrence Lepard Big Print and he lays out that crossing 130% is historically the beginning of a currency meltdown. So I was confused about Singapore's position in this chart.

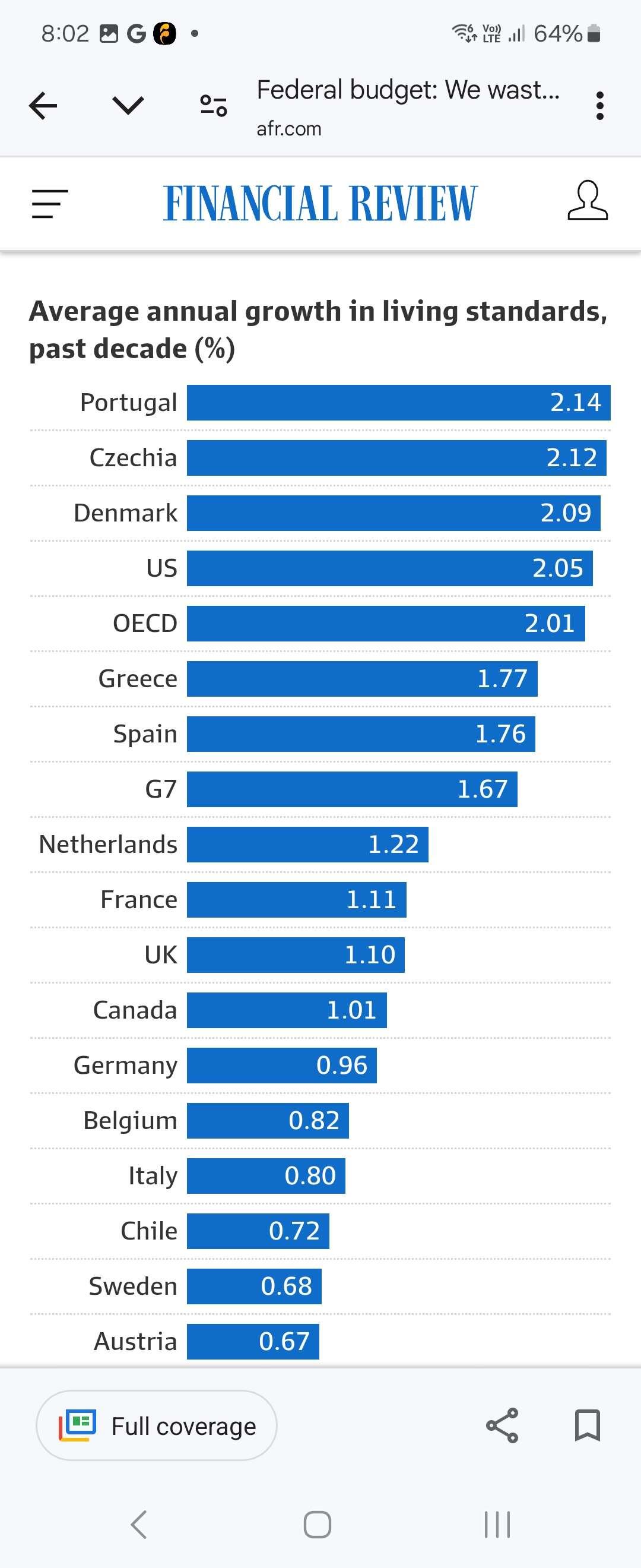

Turns out that the debt is just for strategic investment (they have a law against spending on shortfalls), the government also holds a very large stock of financial assets. So Singapore has no net debt — it’s actually a large net creditor. Norway, HK and Switzerland are similar but with much lower debt ~50%.