Don't Count on a Fed Rate Cut Before 2025

The Ship Has Sailed three years ago

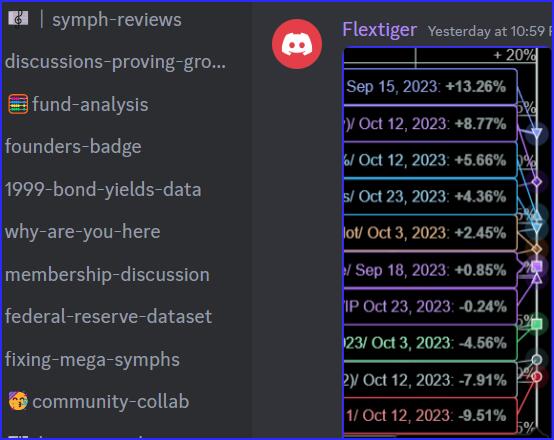

FLEXTIGER

SEP 20, 2023

The Federal Reserve has been aggressively raising interest rates in 2022 to fight high inflation. But with signs of economic slowdown emerging, many investors expect the Fed to reverse course and start cutting rates sometime in 2023. However, a closer look at recent economic data and the Fed's own communications suggests rate cuts may not actually materialize until 2025 or later. Here's why:

- The Fed Already Front-Loaded Rate Cuts in 2019-2020

Most analysis of the Fed's rate changes focuses narrowly on 2020, when the central bank slashed rates to near zero to fight the COVID-induced recession. But the timeline actually started earlier. The first rate cut came in July 2019, as global growth slowed amid trade tensions. The Fed then proceeded to cut rates 3 more times in 2019, putting them back near post-crisis lows even before the pandemic hit US shores.

This means that the Fed front-loaded stimulus ahead of the recession, getting out in front of the downturn far faster than in the past. Rate cuts usually happen slowly over the course of a recession. But in this case, the Fed compacted the equivalent of several years' worth of cuts into just 7 months.

They then reinforced those cuts with trillions of dollars in quantitative easing once the pandemic took hold. This ultra-accommodative monetary response was only possible because the Fed had gotten a head start.

- We May Already Be Near the End of a Short Recession

Most economists peg the pandemic recession as lasting just 2 months - the shortest in US history, thanks to unprecedented stimulus. After a quick V-shaped recovery, growth plateaued in 2022 before slowing again amidst inflation and geopolitical turmoil.

However, we could view the last 2 years as containing two distinct, brief recessions triggered by external shocks - the pandemic and the Ukraine war. Some indicators like jobless claims and consumer confidence suggest the US may now be emerging from the second mini-recession.

Recent comments from business leaders also hint at turning sentiment. Salesforce CEO Marc Benioff announced plans on September 15, 2023 to start rehiring employees laid off just months ago, suggesting he sees a recovery on the horizon.

Recent GDP and unemployment forecasts support this idea. The Atlanta Fed's GDPNow tracker shows the economy growing at a 2.9% pace in Q3 after two quarters of contraction. And the Congressional Budget Office has revised down its unemployment projections, with the jobless rate now expected to hold near 50-year lows through 2025.

This paints a picture of an economy approaching a "Goldilocks" state - not too hot, not too cold. With inflation still well above target, the Fed does not need to goose growth further with rate cuts.

- Core Inflation is Projected to Remain Above 2%

The Fed has made clear that fighting inflation is its top priority now. But private forecasts see core PCE inflation - the Fed's preferred gauge - remaining above the 2% target through at least 2025.

In their latest Summary of Economic Projections (SEP), Fed officials forecast core inflation to still be 2.3% in 2023 and 2.1% in 2024 before settling at 2% in 2025. Expectations remain unanchored.

With inflation so sticky and resilient, the Fed is highly unlikely to cut rates anytime soon and run the risk of igniting inflation further. Rate hikes are still firmly on the table.

- Major Crises Follow Rate Cuts, Not Precede Them

Historically, recessions and financial crises have tended to occur years after Fed rate cuts, not before. This pattern played out in both 2001 and 2008.

One hypothesis is that post-rate cut periods, characterized by easy money and booming markets, lead to excessive risk appetite that eventually results in a crash. Cutting rates from already low levels now could lay the seeds for the next crisis later this decade.

If this historical pattern holds, the next recession may not emerge until the late 2020s. This would likely postpone it until after the 2024 election, avoiding economic turmoil during President Biden's potential second term.

While the case for no rate cuts until 2025 looks reasonably strong, there are some counterpoints to address:

+Recession models from Wall Street banks show elevated risks of a downturn in 2023 as rate hikes compound.

+Rising geopolitical turmoil and energy shock risks from the Ukraine war could trigger a recession.

+Stubbornly high inflation may force the Fed to overtighten until something breaks, even though a mild US recession alone may not bring inflation down.

The Fed has historically eased policy preemptively when risks build to provide insurance and ensure a soft landing.

Ultimately the Fed remains data dependent. A material reassessment of the economic outlook could always change their calculus. But as things stand today, the path of least resistance appears to be toward restraint rather than accommodation over the next 2-3 years. The era of easy money is likely behind us for now.

I made my first GPT chatbot - SDR Dynamo, your go-to AI for all things sales development - the latest strategies, trends, and learning resources to help #SDR excel. Stay ahead in sales with tailored advice, industry updates, and pro tips.

I made my first GPT chatbot - SDR Dynamo, your go-to AI for all things sales development - the latest strategies, trends, and learning resources to help #SDR excel. Stay ahead in sales with tailored advice, industry updates, and pro tips.

Recession never took over the economic steering gear. We have been in inflationary expansion since May 2003 till today Oct 20, 2023. Will situation change? At least the monthly chart is slow to tell.

Recession never took over the economic steering gear. We have been in inflationary expansion since May 2003 till today Oct 20, 2023. Will situation change? At least the monthly chart is slow to tell.

Most analysis of the Fed's rate changes focuses narrowly on 2020, when the central bank slashed rates to near zero to fight the COVID-induced recession. But the timeline actually started earlier. The first rate cut came in July 2019, as global growth slowed amid trade tensions. The Fed then proceeded to cut rates 3 more times in 2019, putting them back near post-crisis lows even before the pandemic hit US shores.

This means that the Fed front-loaded stimulus ahead of the recession, getting out in front of the downturn far faster than in the past. Rate cuts usually happen slowly over the course of a recession. But in this case, the Fed compacted the equivalent of several years' worth of cuts into just 7 months.

They then reinforced those cuts with trillions of dollars in quantitative easing once the pandemic took hold. This ultra-accommodative monetary response was only possible because the Fed had gotten a head start.

- We May Already Be Near the End of a Short Recession

Most analysis of the Fed's rate changes focuses narrowly on 2020, when the central bank slashed rates to near zero to fight the COVID-induced recession. But the timeline actually started earlier. The first rate cut came in July 2019, as global growth slowed amid trade tensions. The Fed then proceeded to cut rates 3 more times in 2019, putting them back near post-crisis lows even before the pandemic hit US shores.

This means that the Fed front-loaded stimulus ahead of the recession, getting out in front of the downturn far faster than in the past. Rate cuts usually happen slowly over the course of a recession. But in this case, the Fed compacted the equivalent of several years' worth of cuts into just 7 months.

They then reinforced those cuts with trillions of dollars in quantitative easing once the pandemic took hold. This ultra-accommodative monetary response was only possible because the Fed had gotten a head start.

- We May Already Be Near the End of a Short Recession

Most economists peg the pandemic recession as lasting just 2 months - the shortest in US history, thanks to unprecedented stimulus. After a quick V-shaped recovery, growth plateaued in 2022 before slowing again amidst inflation and geopolitical turmoil.

However, we could view the last 2 years as containing two distinct, brief recessions triggered by external shocks - the pandemic and the Ukraine war. Some indicators like jobless claims and consumer confidence suggest the US may now be emerging from the second mini-recession.

Recent comments from business leaders also hint at turning sentiment. Salesforce CEO Marc Benioff announced plans on September 15, 2023 to start rehiring employees laid off just months ago, suggesting he sees a recovery on the horizon.

Recent GDP and unemployment forecasts support this idea. The Atlanta Fed's GDPNow tracker shows the economy growing at a 2.9% pace in Q3 after two quarters of contraction. And the Congressional Budget Office has revised down its unemployment projections, with the jobless rate now expected to hold near 50-year lows through 2025.

This paints a picture of an economy approaching a "Goldilocks" state - not too hot, not too cold. With inflation still well above target, the Fed does not need to goose growth further with rate cuts.

- Core Inflation is Projected to Remain Above 2%

Most economists peg the pandemic recession as lasting just 2 months - the shortest in US history, thanks to unprecedented stimulus. After a quick V-shaped recovery, growth plateaued in 2022 before slowing again amidst inflation and geopolitical turmoil.

However, we could view the last 2 years as containing two distinct, brief recessions triggered by external shocks - the pandemic and the Ukraine war. Some indicators like jobless claims and consumer confidence suggest the US may now be emerging from the second mini-recession.

Recent comments from business leaders also hint at turning sentiment. Salesforce CEO Marc Benioff announced plans on September 15, 2023 to start rehiring employees laid off just months ago, suggesting he sees a recovery on the horizon.

Recent GDP and unemployment forecasts support this idea. The Atlanta Fed's GDPNow tracker shows the economy growing at a 2.9% pace in Q3 after two quarters of contraction. And the Congressional Budget Office has revised down its unemployment projections, with the jobless rate now expected to hold near 50-year lows through 2025.

This paints a picture of an economy approaching a "Goldilocks" state - not too hot, not too cold. With inflation still well above target, the Fed does not need to goose growth further with rate cuts.

- Core Inflation is Projected to Remain Above 2%

The Fed has made clear that fighting inflation is its top priority now. But private forecasts see core PCE inflation - the Fed's preferred gauge - remaining above the 2% target through at least 2025.

In their latest Summary of Economic Projections (SEP), Fed officials forecast core inflation to still be 2.3% in 2023 and 2.1% in 2024 before settling at 2% in 2025. Expectations remain unanchored.

With inflation so sticky and resilient, the Fed is highly unlikely to cut rates anytime soon and run the risk of igniting inflation further. Rate hikes are still firmly on the table.

- Major Crises Follow Rate Cuts, Not Precede Them

Historically, recessions and financial crises have tended to occur years after Fed rate cuts, not before. This pattern played out in both 2001 and 2008.

One hypothesis is that post-rate cut periods, characterized by easy money and booming markets, lead to excessive risk appetite that eventually results in a crash. Cutting rates from already low levels now could lay the seeds for the next crisis later this decade.

If this historical pattern holds, the next recession may not emerge until the late 2020s. This would likely postpone it until after the 2024 election, avoiding economic turmoil during President Biden's potential second term.

While the case for no rate cuts until 2025 looks reasonably strong, there are some counterpoints to address:

+Recession models from Wall Street banks show elevated risks of a downturn in 2023 as rate hikes compound.

+Rising geopolitical turmoil and energy shock risks from the Ukraine war could trigger a recession.

+Stubbornly high inflation may force the Fed to overtighten until something breaks, even though a mild US recession alone may not bring inflation down.

The Fed has historically eased policy preemptively when risks build to provide insurance and ensure a soft landing.

Ultimately the Fed remains data dependent. A material reassessment of the economic outlook could always change their calculus. But as things stand today, the path of least resistance appears to be toward restraint rather than accommodation over the next 2-3 years. The era of easy money is likely behind us for now.

The Fed has made clear that fighting inflation is its top priority now. But private forecasts see core PCE inflation - the Fed's preferred gauge - remaining above the 2% target through at least 2025.

In their latest Summary of Economic Projections (SEP), Fed officials forecast core inflation to still be 2.3% in 2023 and 2.1% in 2024 before settling at 2% in 2025. Expectations remain unanchored.

With inflation so sticky and resilient, the Fed is highly unlikely to cut rates anytime soon and run the risk of igniting inflation further. Rate hikes are still firmly on the table.

- Major Crises Follow Rate Cuts, Not Precede Them

Historically, recessions and financial crises have tended to occur years after Fed rate cuts, not before. This pattern played out in both 2001 and 2008.

One hypothesis is that post-rate cut periods, characterized by easy money and booming markets, lead to excessive risk appetite that eventually results in a crash. Cutting rates from already low levels now could lay the seeds for the next crisis later this decade.

If this historical pattern holds, the next recession may not emerge until the late 2020s. This would likely postpone it until after the 2024 election, avoiding economic turmoil during President Biden's potential second term.

While the case for no rate cuts until 2025 looks reasonably strong, there are some counterpoints to address:

+Recession models from Wall Street banks show elevated risks of a downturn in 2023 as rate hikes compound.

+Rising geopolitical turmoil and energy shock risks from the Ukraine war could trigger a recession.

+Stubbornly high inflation may force the Fed to overtighten until something breaks, even though a mild US recession alone may not bring inflation down.

The Fed has historically eased policy preemptively when risks build to provide insurance and ensure a soft landing.

Ultimately the Fed remains data dependent. A material reassessment of the economic outlook could always change their calculus. But as things stand today, the path of least resistance appears to be toward restraint rather than accommodation over the next 2-3 years. The era of easy money is likely behind us for now.

On September 15, 2023, the last day of Salesforce 2023 Dreamforce event, Marc Benioff start rehiring employees that were just laid off? "It's okay. Come back!" So he must already know something about the economy and is scooping up talent before other companies realize things have changed.

On September 15, 2023, the last day of Salesforce 2023 Dreamforce event, Marc Benioff start rehiring employees that were just laid off? "It's okay. Come back!" So he must already know something about the economy and is scooping up talent before other companies realize things have changed.