𝗨𝗦 𝗧𝗿𝗲𝗮𝘀𝘂𝗿𝗶𝗲𝘀, 𝗧𝗿𝗮𝗱𝗲 𝗖𝗵𝗮𝗼𝘀 & 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗕𝗼𝗻𝗱𝘀

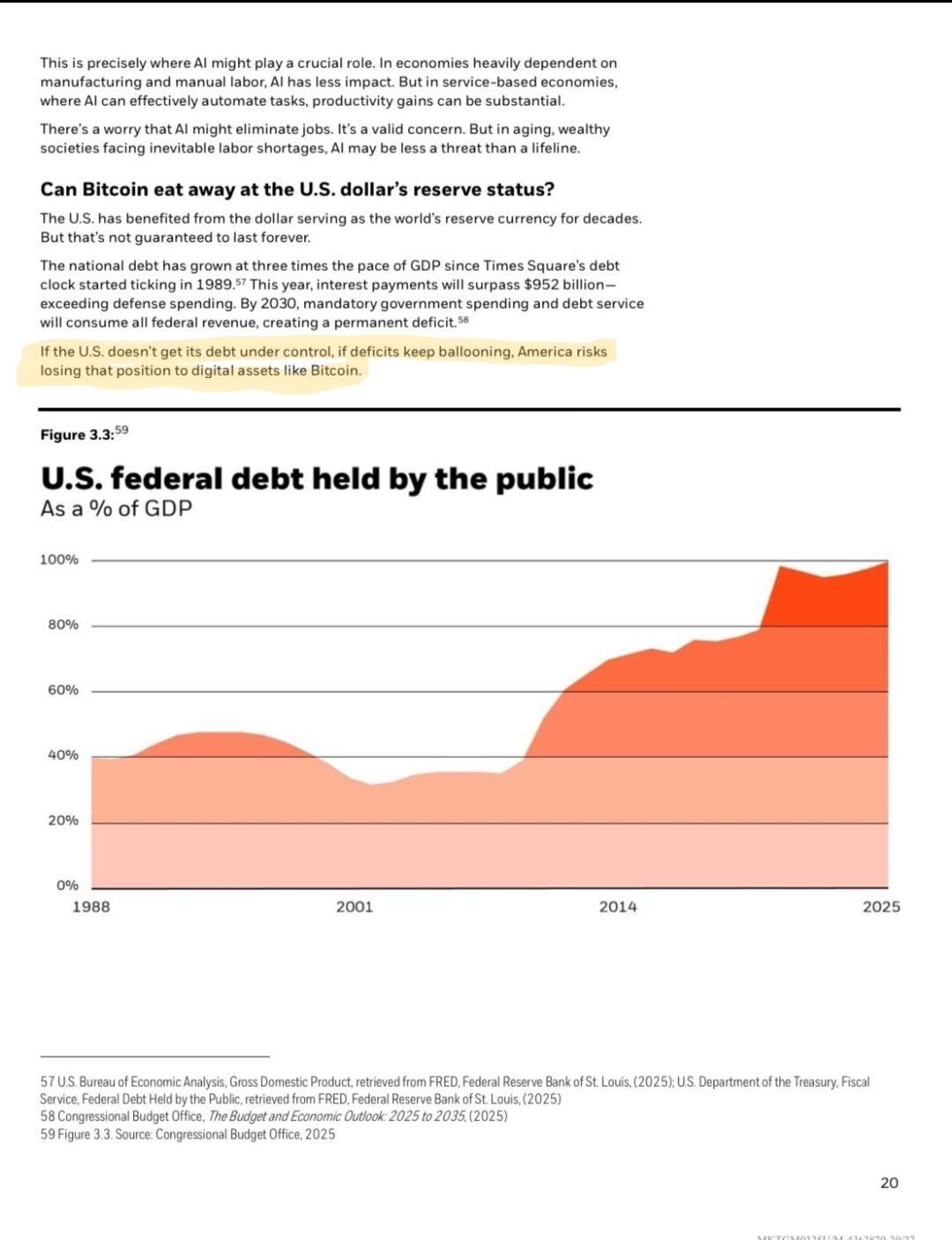

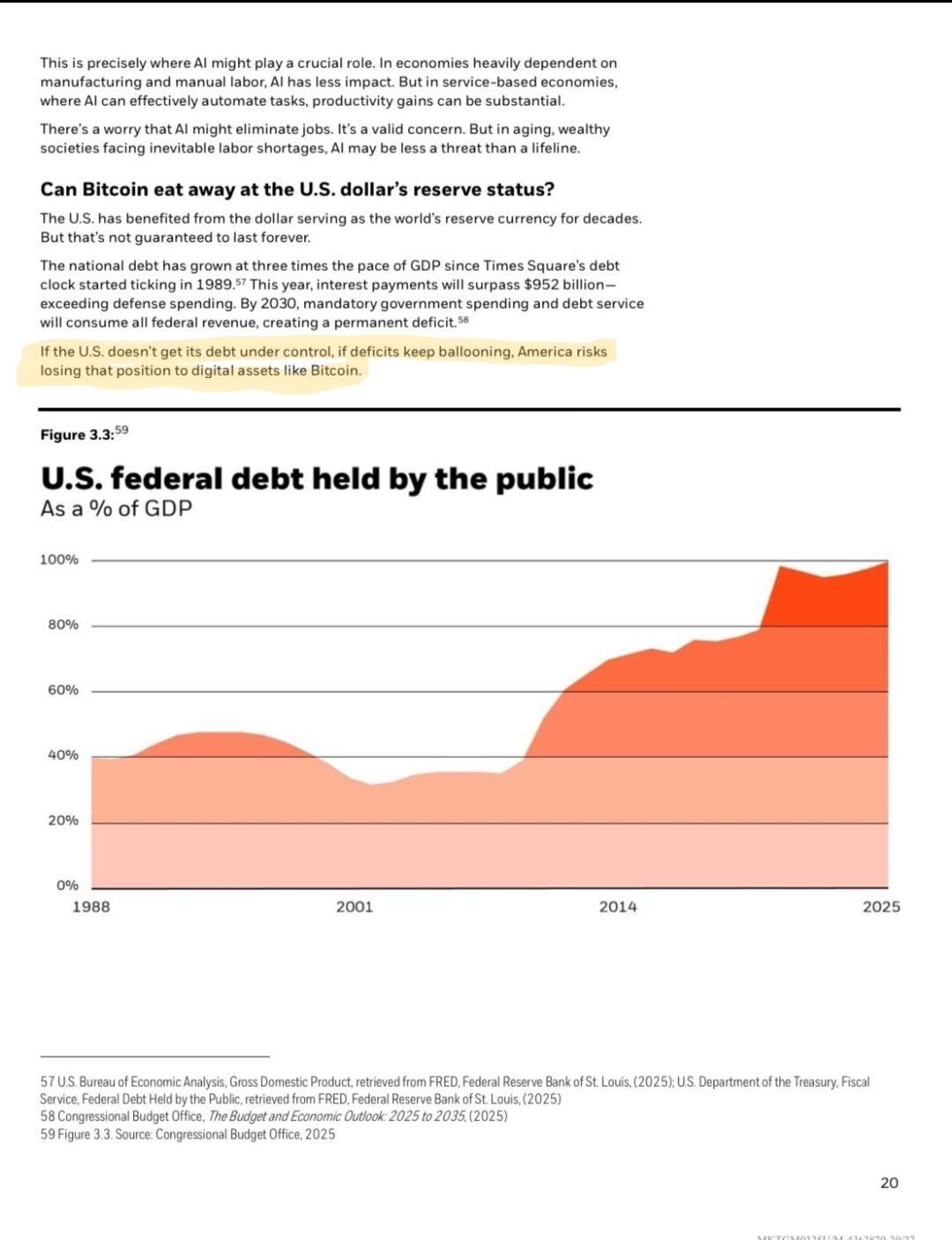

In his 2025 letter to shareholders this week, Blackrock's CEO warns, “The U.S. has benefited from the dollar serving as the world’s reserve currency for decades... If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

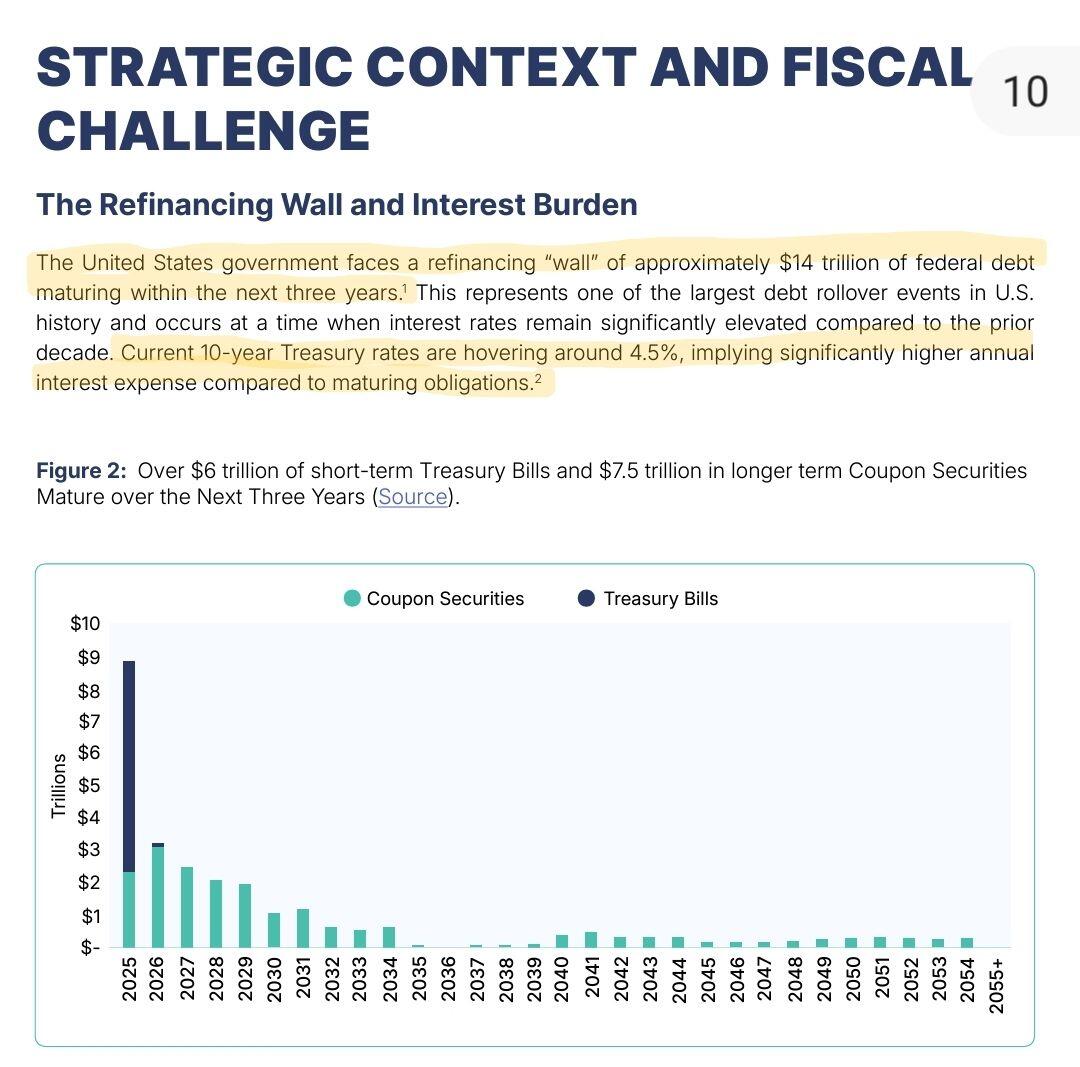

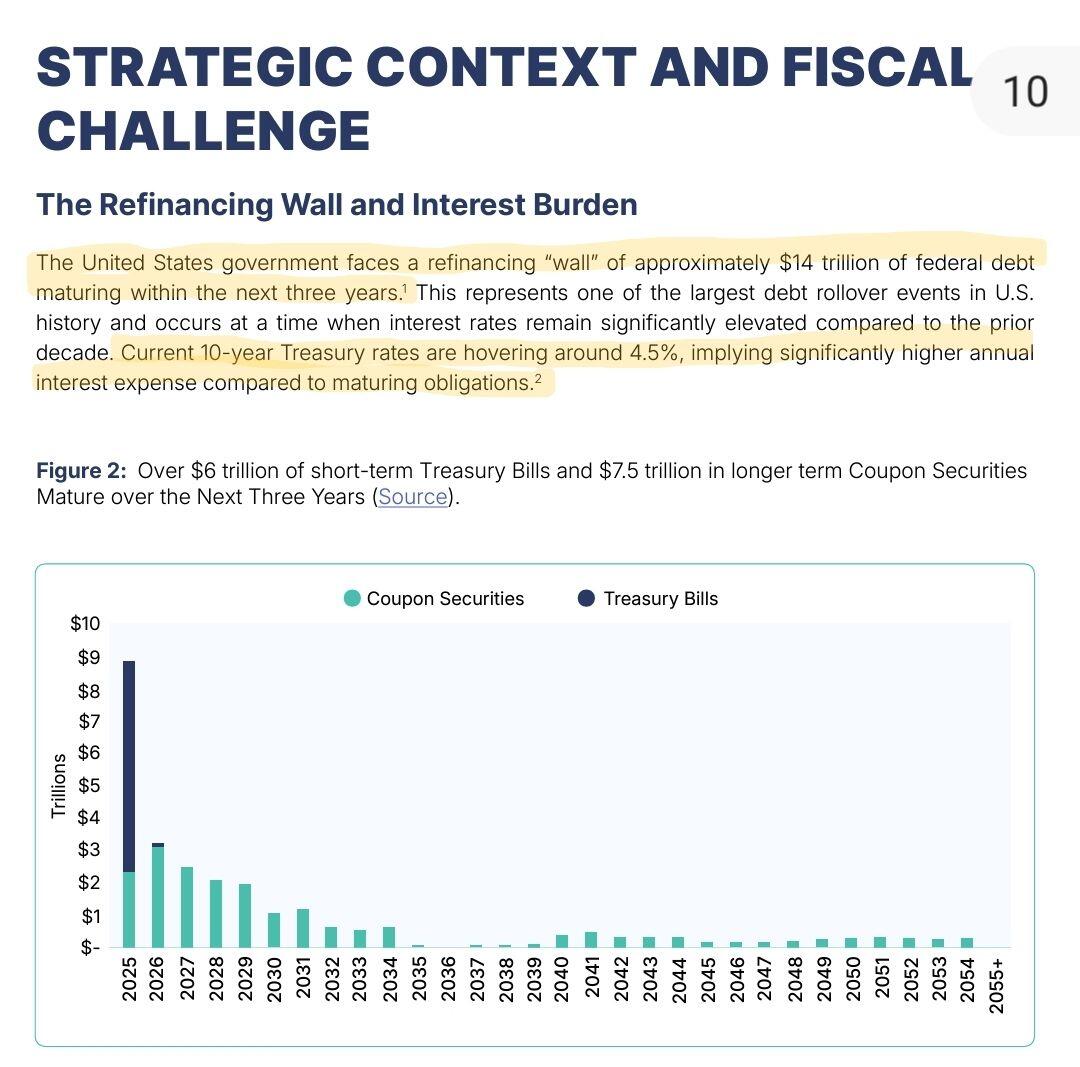

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

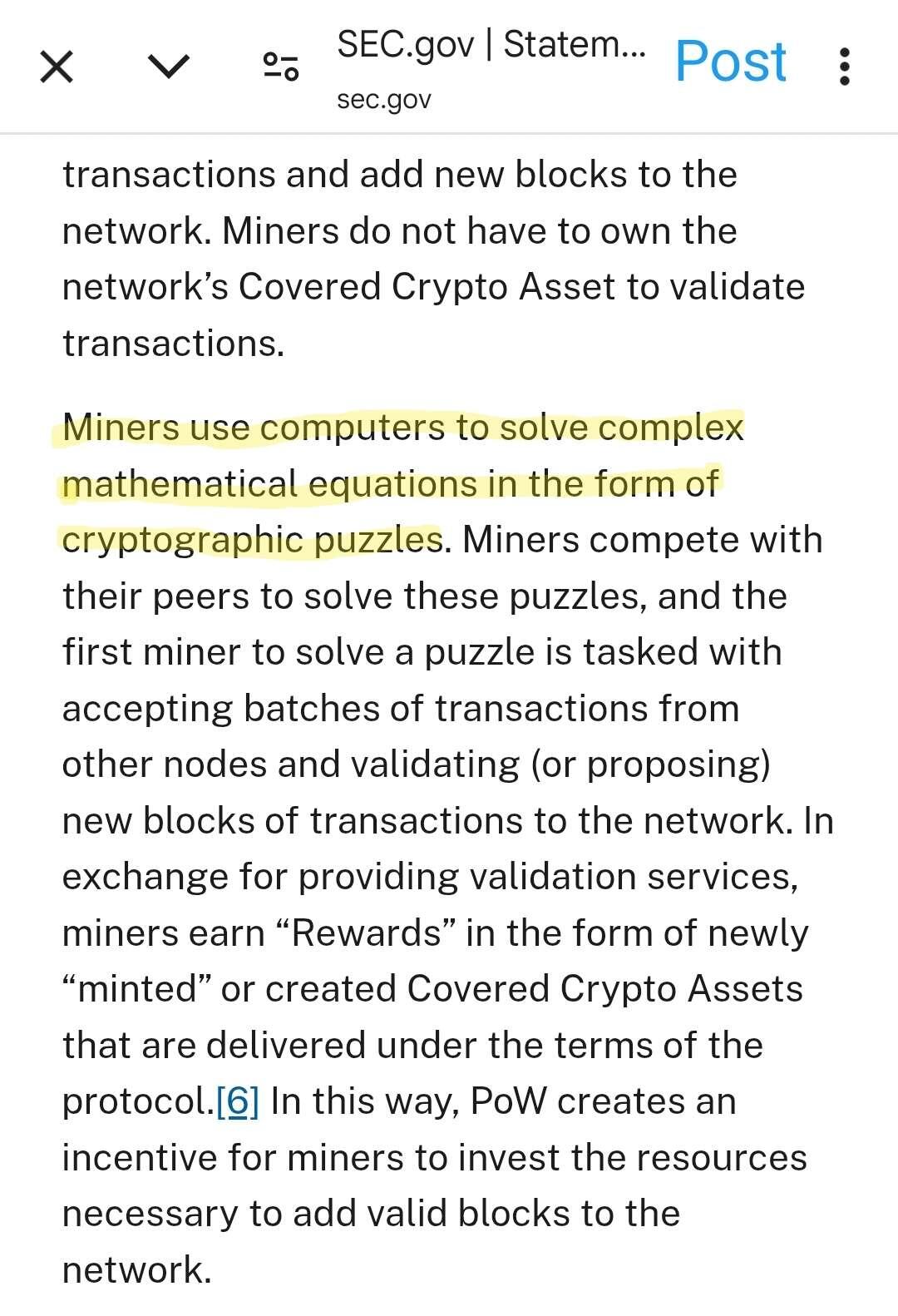

1. Miners don’t solve complex equations: they're repeatedly hashing a block header using the SHA-256 algorithm until a valid hash is found

2. Not cryptographic puzzles: it's closer to a brute-force search for a hash that meets a specific difficulty target

3. The process is trial & error: a game of luck & computational power

We're getting there, but more education is needed

1. Miners don’t solve complex equations: they're repeatedly hashing a block header using the SHA-256 algorithm until a valid hash is found

2. Not cryptographic puzzles: it's closer to a brute-force search for a hash that meets a specific difficulty target

3. The process is trial & error: a game of luck & computational power

We're getting there, but more education is needed