The next breakout company will solve the problem of subscription overload. A one-time fee.

I just want to own things again

Mags

mags@nostrverified.com

npub1tjyl...0e9k

Bitcoin mining, custody, & memes 🫡. Advisor PRTI ⛏️. Energy, carbon & economic dev policy. Volunteer firefighter 🚒

The alternate timeline where North Korea becomes a quantum powerhouse so it can hack Satoshi's coins or vulnerable Bitcoin addresses

𝗕𝗹𝗼𝗰𝗸𝘀𝗽𝗮𝗰𝗲 𝘄𝗮𝗿𝘀

Bitcoin blockspace and hashrate will emerge as strategic resources on par with airspace and maritime lanes: essential infrastructure for exercising financial sovereignty and a nations ability to access global commerce and trade

Without access to blockspace, users cannot send or receive Bitcoin. Hashrate secures access to blockspace.

Thus, nations that pair domestic Bitcoin mining with sovereign mining pools (or allied pools) will ensure:

1. Censorship-resistant payment rails for their citizens

2. Insurance against economic warfare or sanctions

3. A new export industry: blockspace

Nations that ignore this new domain risk discovering that future sovereignty... will be settled one block at a time

Who would win?

@Steven Lubka

@Steven Lubka

@Steven Lubka

@Steven LubkaCanadians elected a Globalist central banker. A prominent advocate of CBDCs. The antithesis of a bitcoin advocate.

The silver lining? For Carney's term, Canadians have been given the opportunity to understand exactly why they need Bitcoin more than ever

Bitcoin mining offers 4 strategic advantages to nations:

1. Energy security: infra development & grid stability

2. Financial independence & national security via hashrate & blockspace control (can't censor a country or its citizen's from transacting)

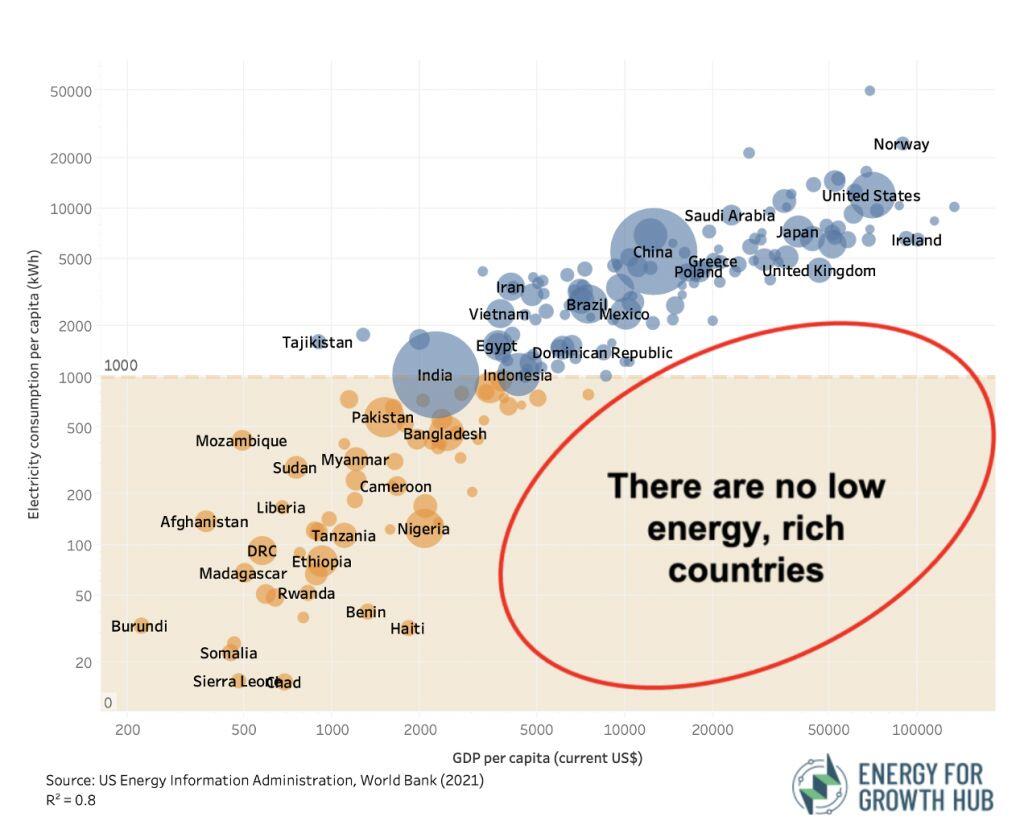

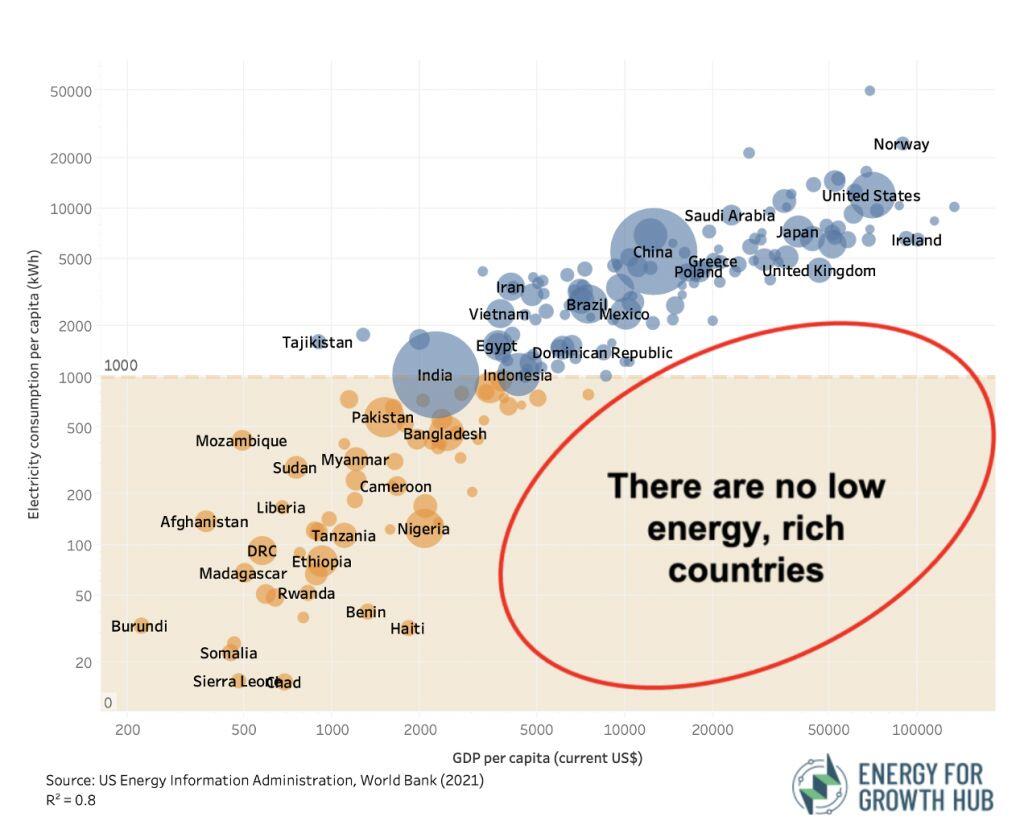

3. Economic sovereignty for traditionally resource poor nations (no minerals, oil or gold) by allowing them to stack a digitally scarce resource

4. Socioeconomic/env benefits: economic development & jobs & methane reductions

"𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗳𝗶𝘅𝗲𝘀 𝘁𝗵𝗶𝘀": 𝘁𝗵𝗲 𝗔𝗜 𝗲𝗱𝗶𝘁𝗶𝗼𝗻

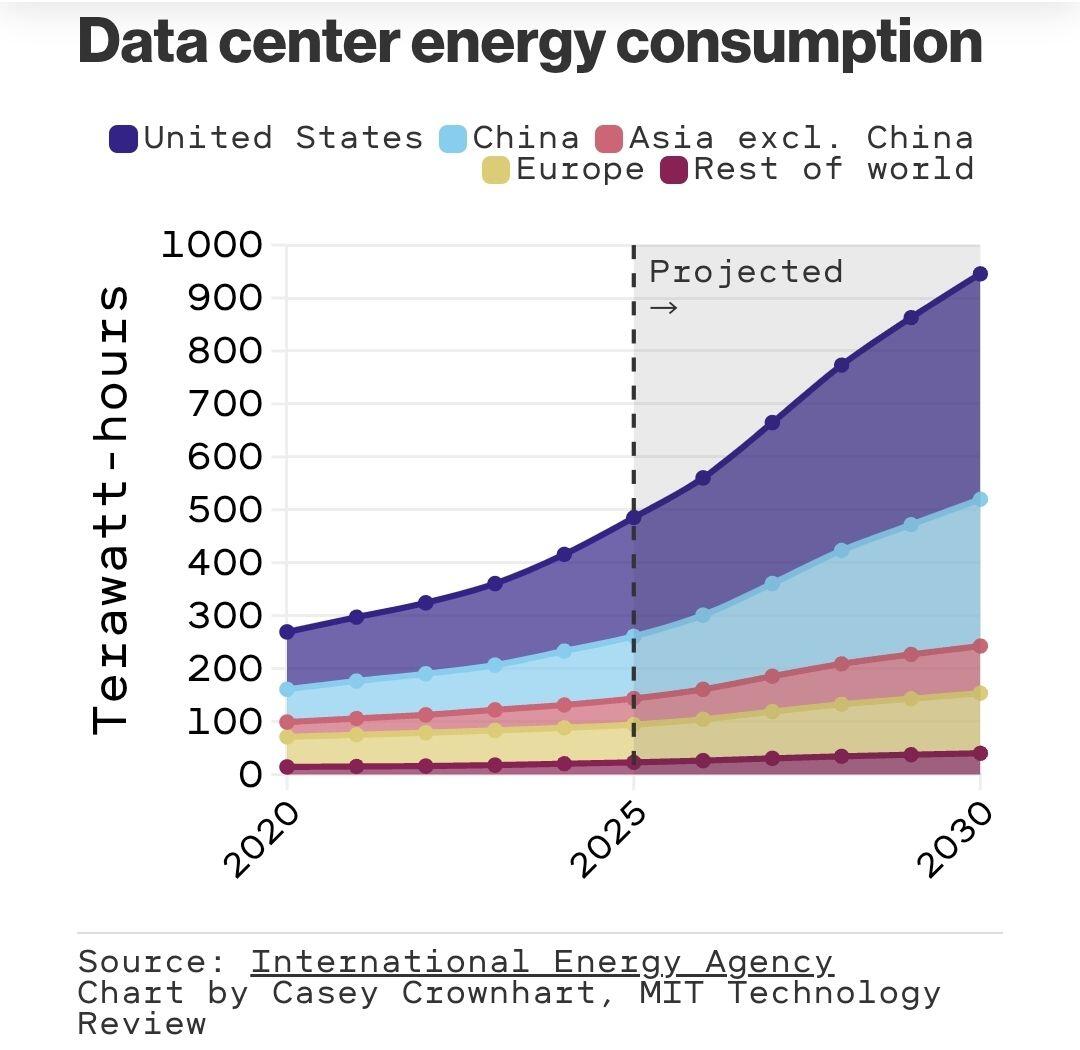

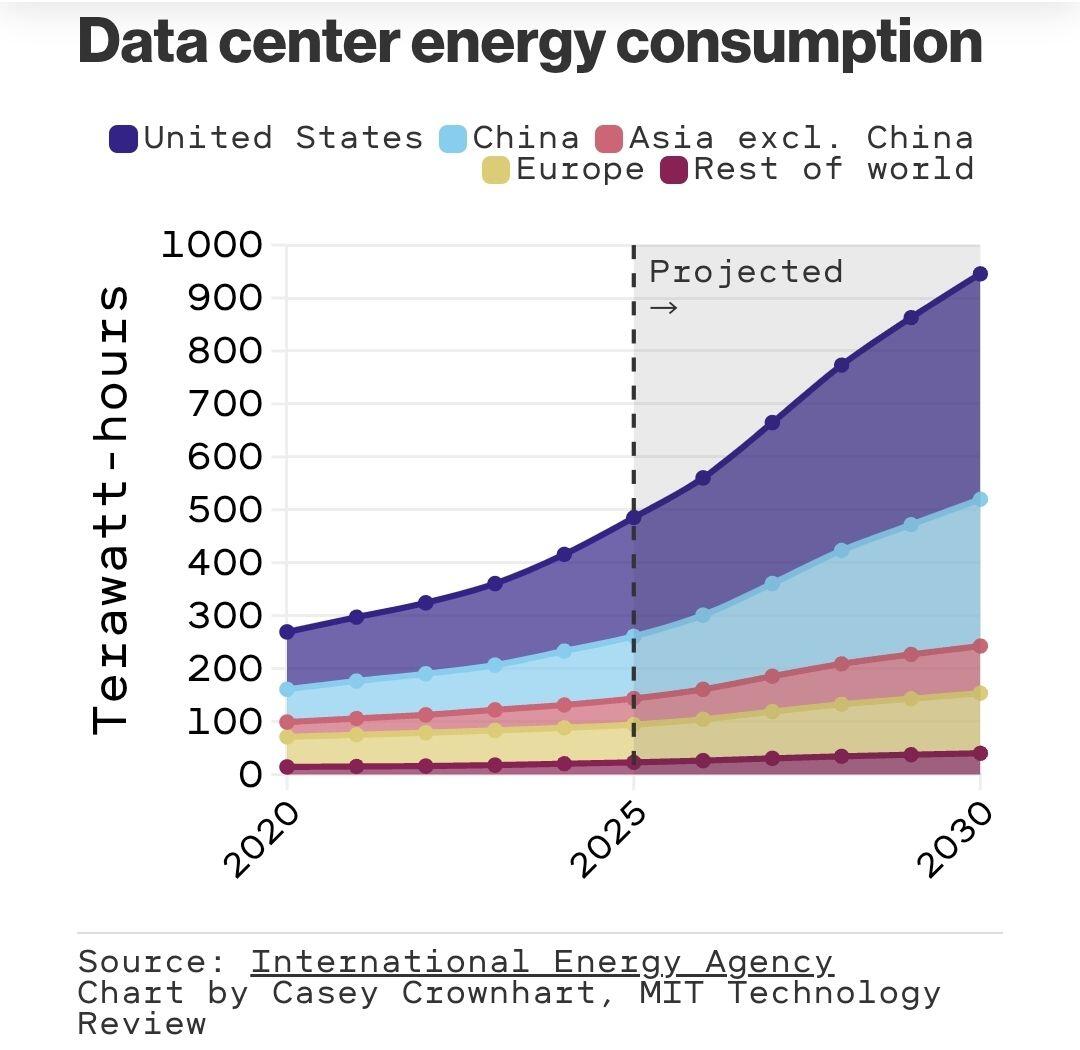

Bitcoin mining is a bridge to an energy & technology abundant future. The International Energy Agency estimates AI electricity consumption is set to more than double by 2030, & the US is projected to represent about half of this growth. How will we feed the new tech beast?

₿/accelerate 🤝🏻 e/acc

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

₿/accelerate 🤝🏻 e/acc

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

₿/accelerate 🤝🏻 e/acc

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

₿/accelerate 🤝🏻 e/acc

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

Blessed are the humble, for they will inherit the earth

Stay humble, stack sats

Home for Easter. Got to check in on my dad's mining fleet! 🫶🏼⛏️

Braiins BMM & Bitaxe

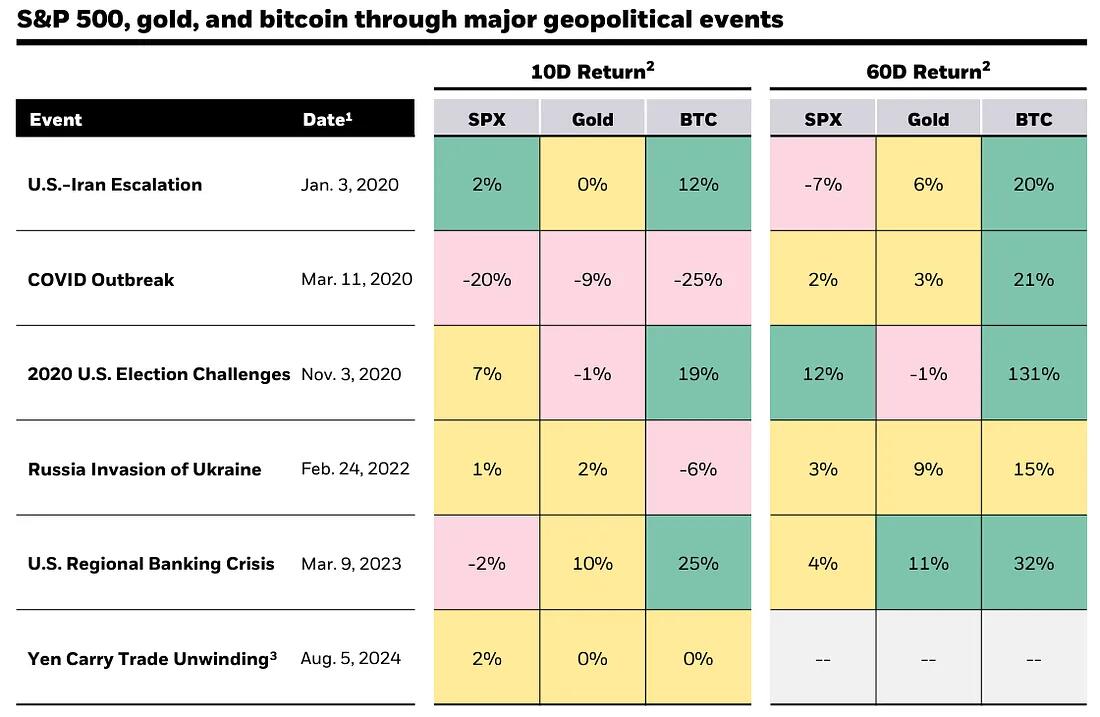

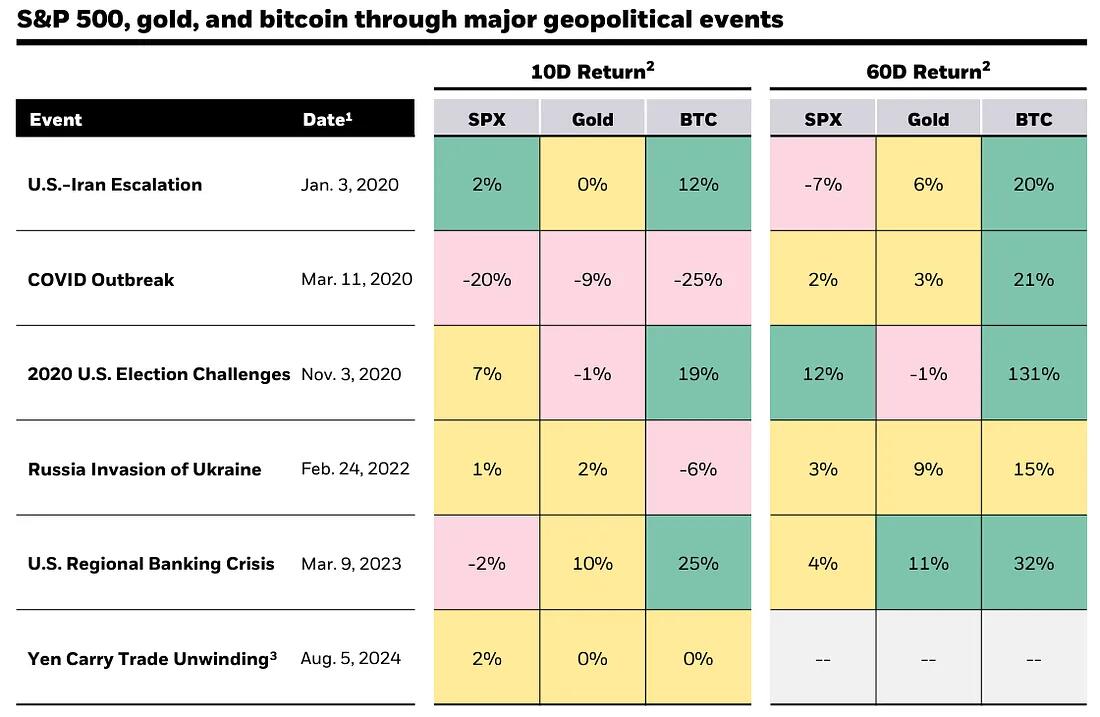

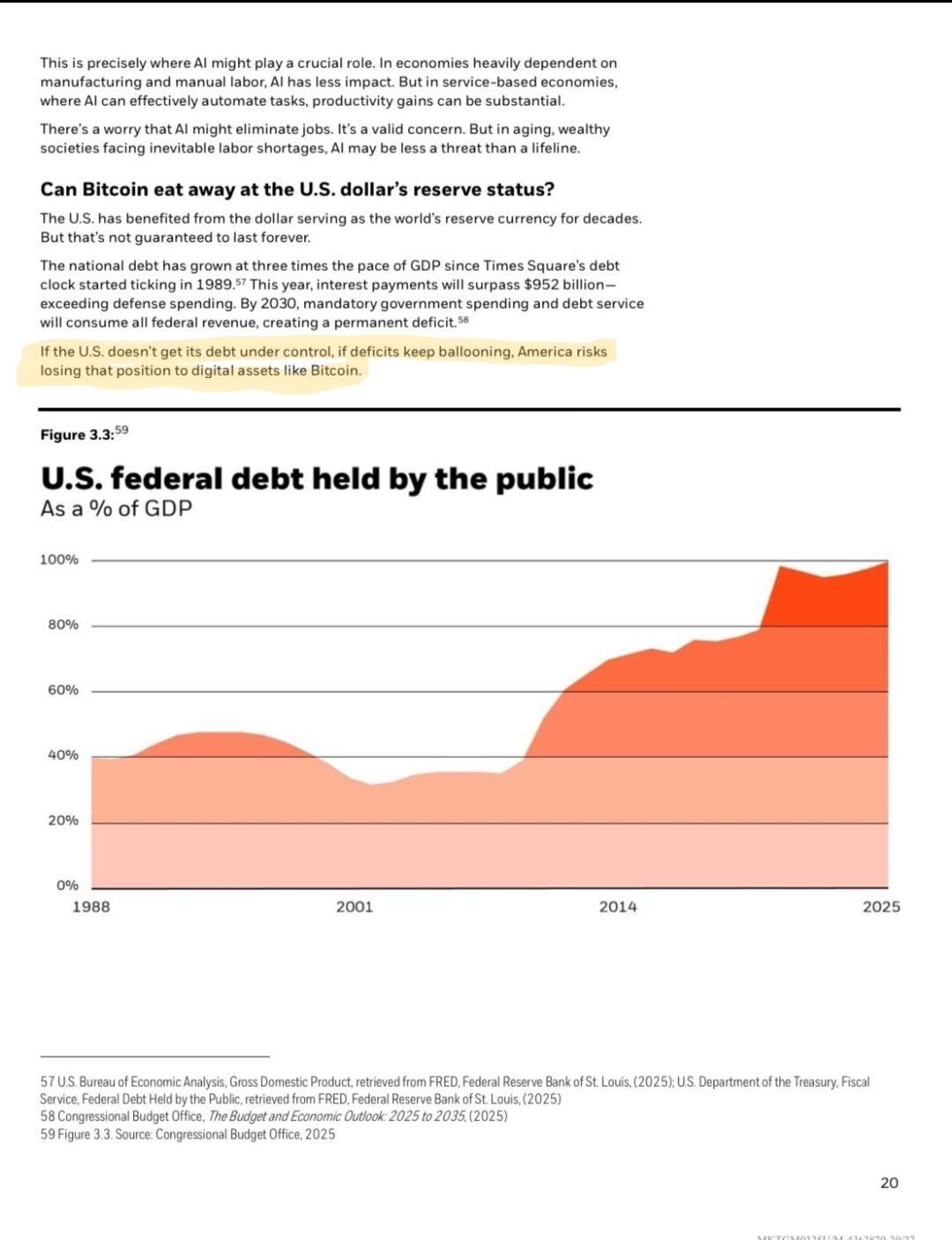

Bitcoin: iykyk  Source: Blackrock

Source: Blackrock

Source: Blackrock

Source: BlackrockListening to my spouse singing a made up song under his breath

🎵

HODL, HODL, HODL, we're going full throttle

The Bitcoin reserve, because Republicans have nerve

You should buy, or else you'll die... (poor)

🎵

🤣🤣🤣

What type of bitcoin-based vibecoding integrations exist (beyond chatbots) for Nostr, lightning payments, wallets, etc?

Who is building these tools?

Cc:

@Vitor Pamplona @jb55 @preston

Trump to launch a monopoly-like crypto game...

Bitcoin had better be the Boardwalk, railroads are digital payment rails like the base layer, lightning & liquid, & ofc it needs a "go to jail" for crypto scams!

Then:

Now:

Now:

Now:

Now:

> grabs a bottle of No More Tears Shampoo

> checks portfolio

On weathering Bitcoin price

𝗨𝗦 𝗧𝗿𝗲𝗮𝘀𝘂𝗿𝗶𝗲𝘀, 𝗧𝗿𝗮𝗱𝗲 𝗖𝗵𝗮𝗼𝘀 & 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗕𝗼𝗻𝗱𝘀

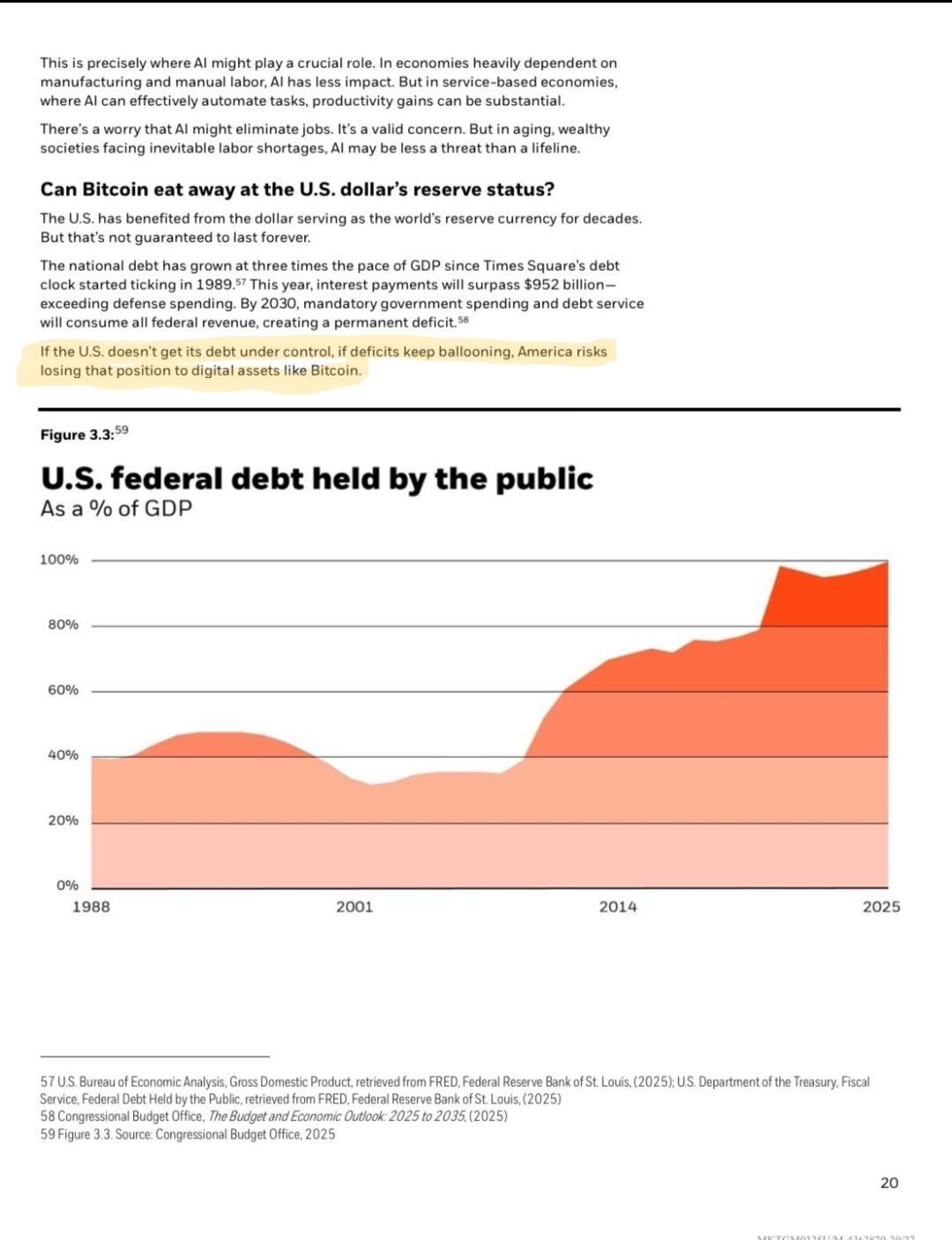

In his 2025 letter to shareholders this week, Blackrock's CEO warns, “The U.S. has benefited from the dollar serving as the world’s reserve currency for decades... If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

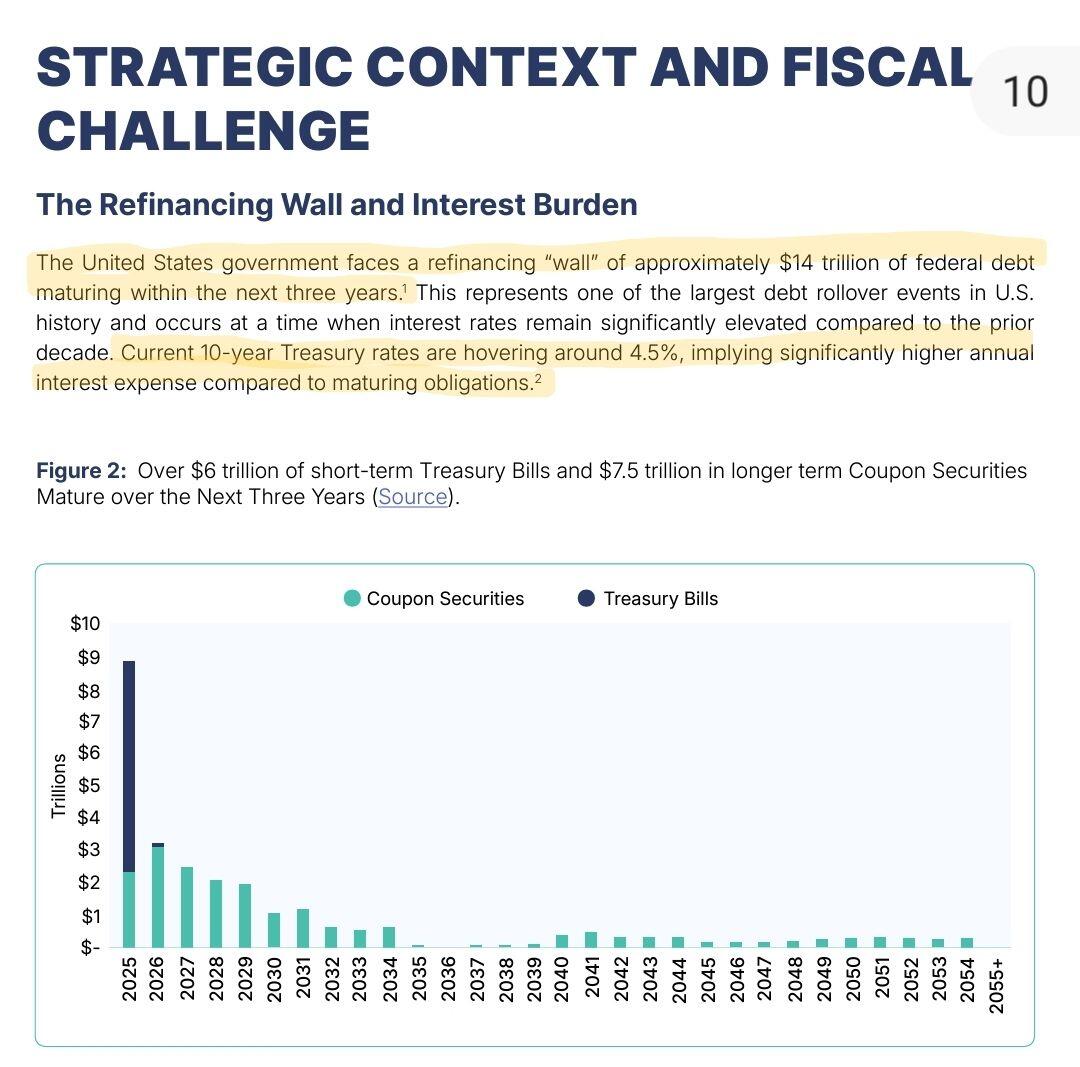

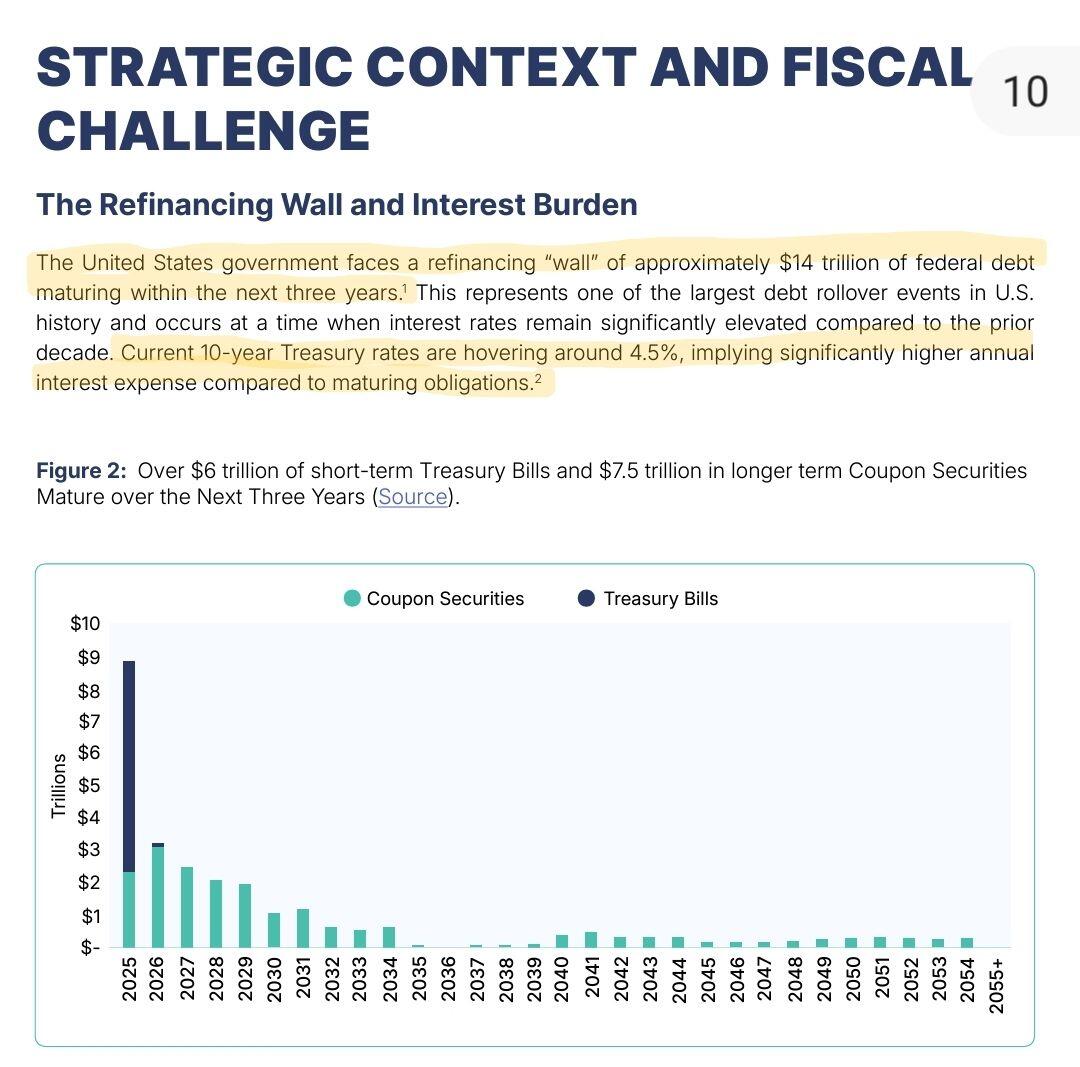

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.Me, when the omega candle is delayed another month

The Golden Age of Crypto:

Buying shitcoins & meme coins is like panning for fools gold, hoping to strike it rich