7.5km

18.7k steps

One incredible view

Bonus pic :)

Bonus pic :)

Bonus pic :)

Bonus pic :)

Bonus pic :)

Bonus pic :)

@Steven Lubka

@Steven Lubka ₿/accelerate 🤝🏻 e/acc

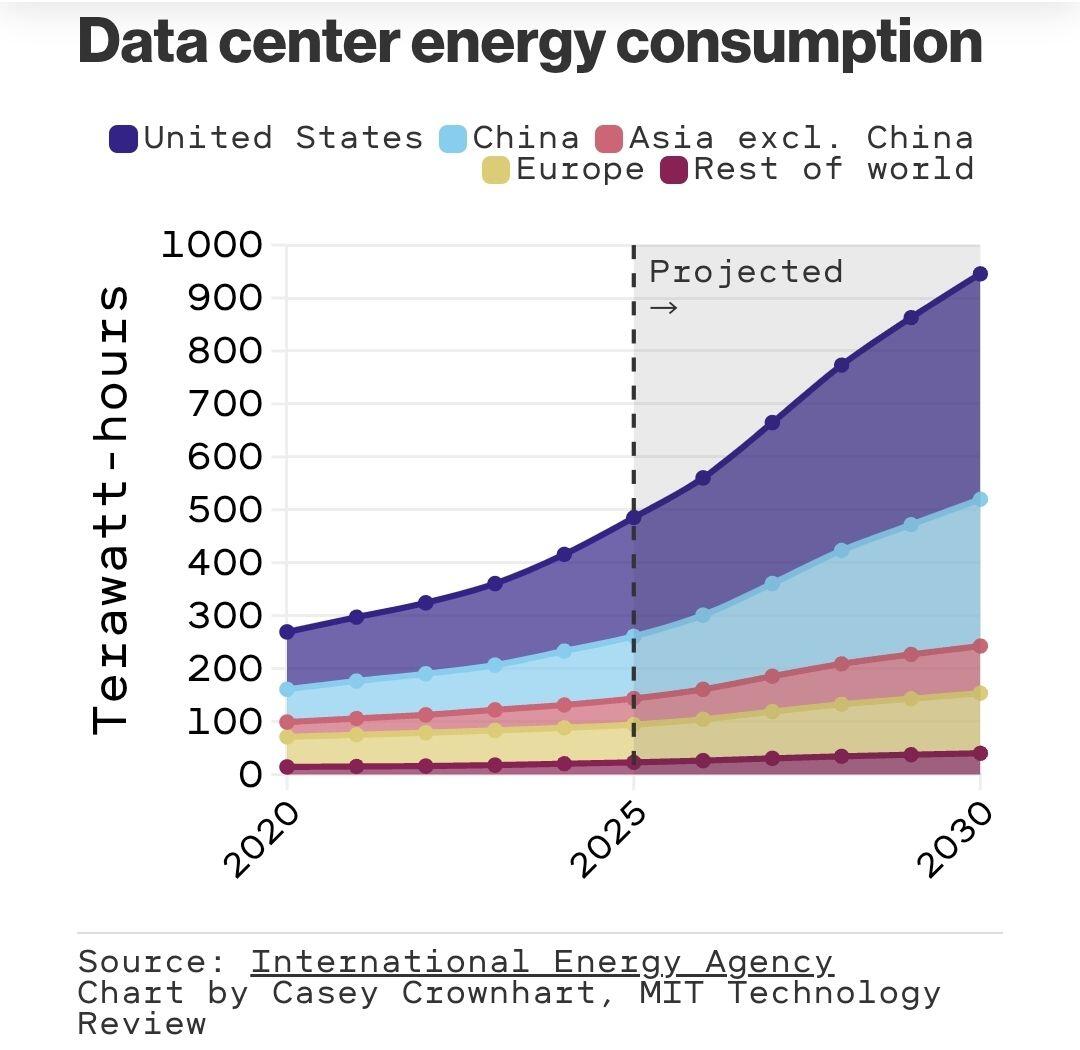

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

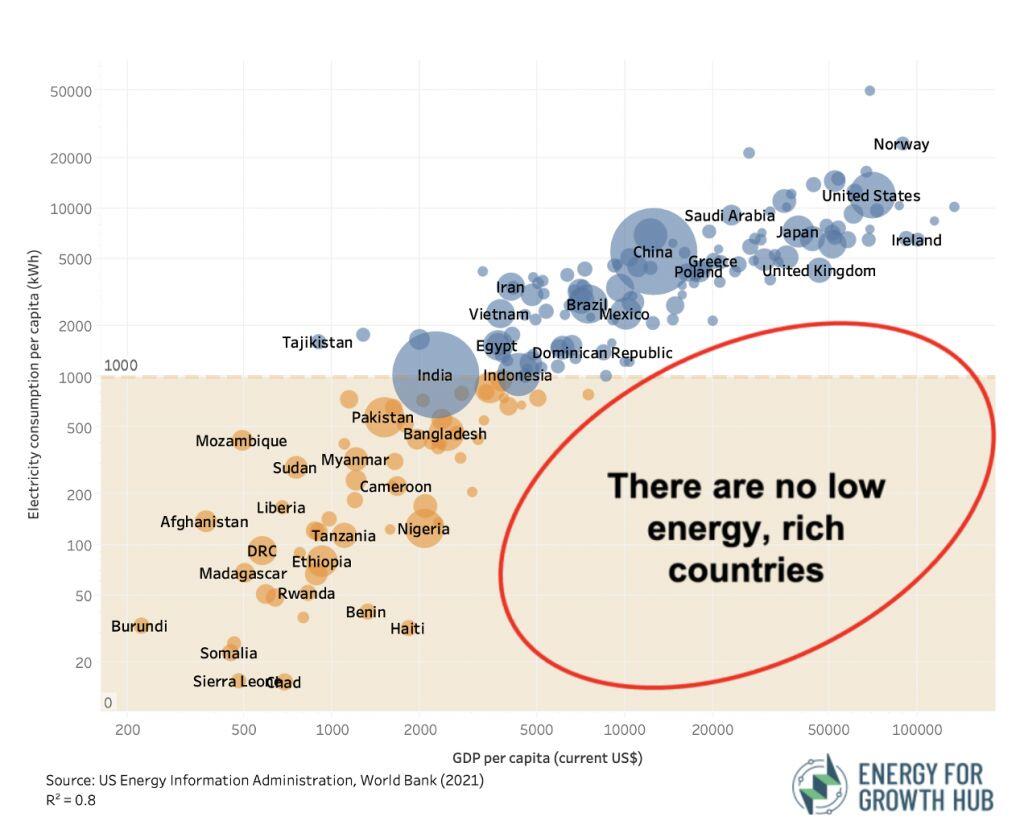

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

₿/accelerate 🤝🏻 e/acc

Bitcoin mining presents a novel way to subsidize our energy systems. Mining is built on Proof of Work & an elegant system of economic incentives. Economic incentives are built in to lower cost, maximize revenue, & optimize resources. Mining is very resource-intensive: it requires substantial computing power to meet the cryptographic rules which secure the system & electricity represents ~80% of operating costs.

Bitcoin miners seek out cheap energy sources globally & they are location & energy source agnostic. As a result, miners are anchor tenants for new energy generation that wouldn’t otherwise exist in rural sites where traditional industrial or commercial customers are unavailable. They also subsidize generators that are transmission constrained (eg, renewables in Texas).

This is where the magic happens: aligned incentives. Miners provide a predictable revenue stream, helping get public infrastructure projects over their hurdle rates & recieve cheaper power (vs the grid). In this way, Bitcoin mining rewards fund the build-out of electrical infrastructure through a third pocket, where traditionally it was paid for by the ratepayer pocket or taxpayer pocket.

As consumer demand for power grows in a community (including for AI datacenters), Bitcoin mining can be decreased or removed entirely, but fundamentally, it enabled critical energy infrastructure to be built out.

In this way, miners support existing renewables with excess generation & the construction of new sites (and not just renewables) around the world. It's already happening with large miners in the US, Gridless in Africa, & Volcano Energy in El Salvador. And this is not stopping.

Furthermore, some Bitcoin miners are shifting towards AI. Miners are uniquely positioned as they already operate large-scale, power-intensive infrastructure & have the right experience. Retrofitting mining facilities for AI workloads (esp hosting GPUs) is often faster & cheaper than building new ones. Thus, infrastructure that was built out for mining is being reallocated to AI (eg Core Scientific) & likewise wrt new energy sites being developed with mining originally in mind (eg Crusoe).

Lastly, Bitcoin miners are the perfect demand response participant. The best DR participants are large loads with a consistent draw & that can turn off (curtail) for any amounts of time. AI is a much less curtailable load. In this way, miners help balance the grid & provide grid stability, particularly during extreme events (see Texas storms & Riot).

This is why Bitcoin mining is a ENERGY & NATIONAL SECURTY issue. It's about ensuring we can build an abundant & reliable energy system for a prosperous future.

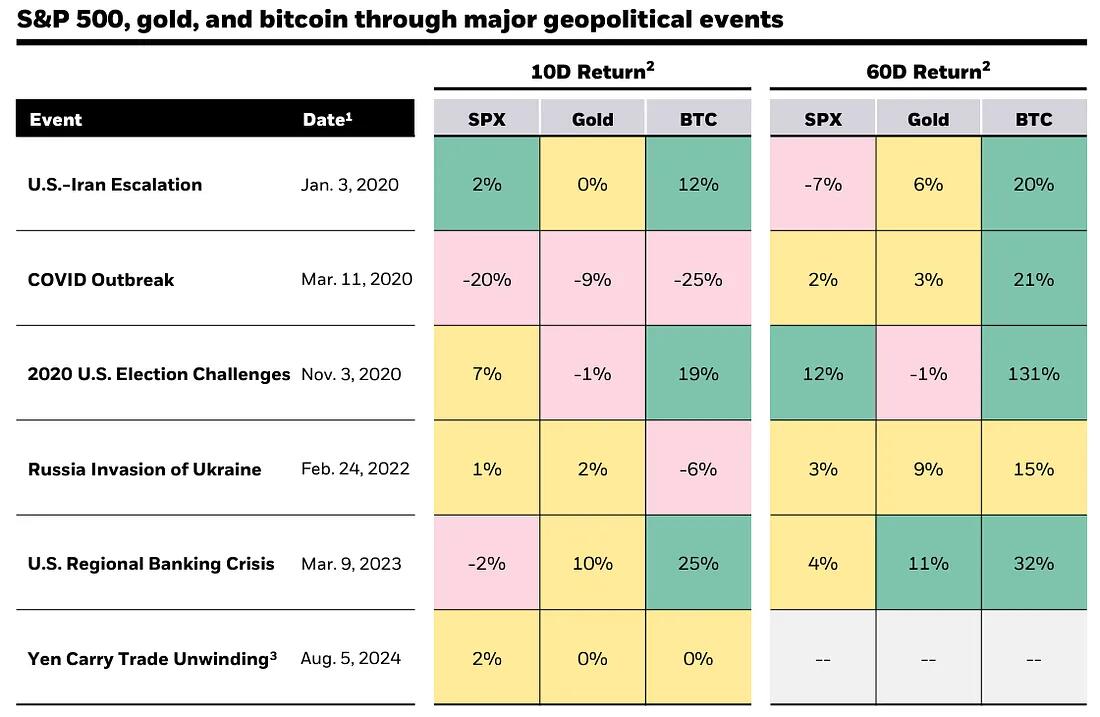

Source: Blackrock

Source: Blackrock

Now:

Now:

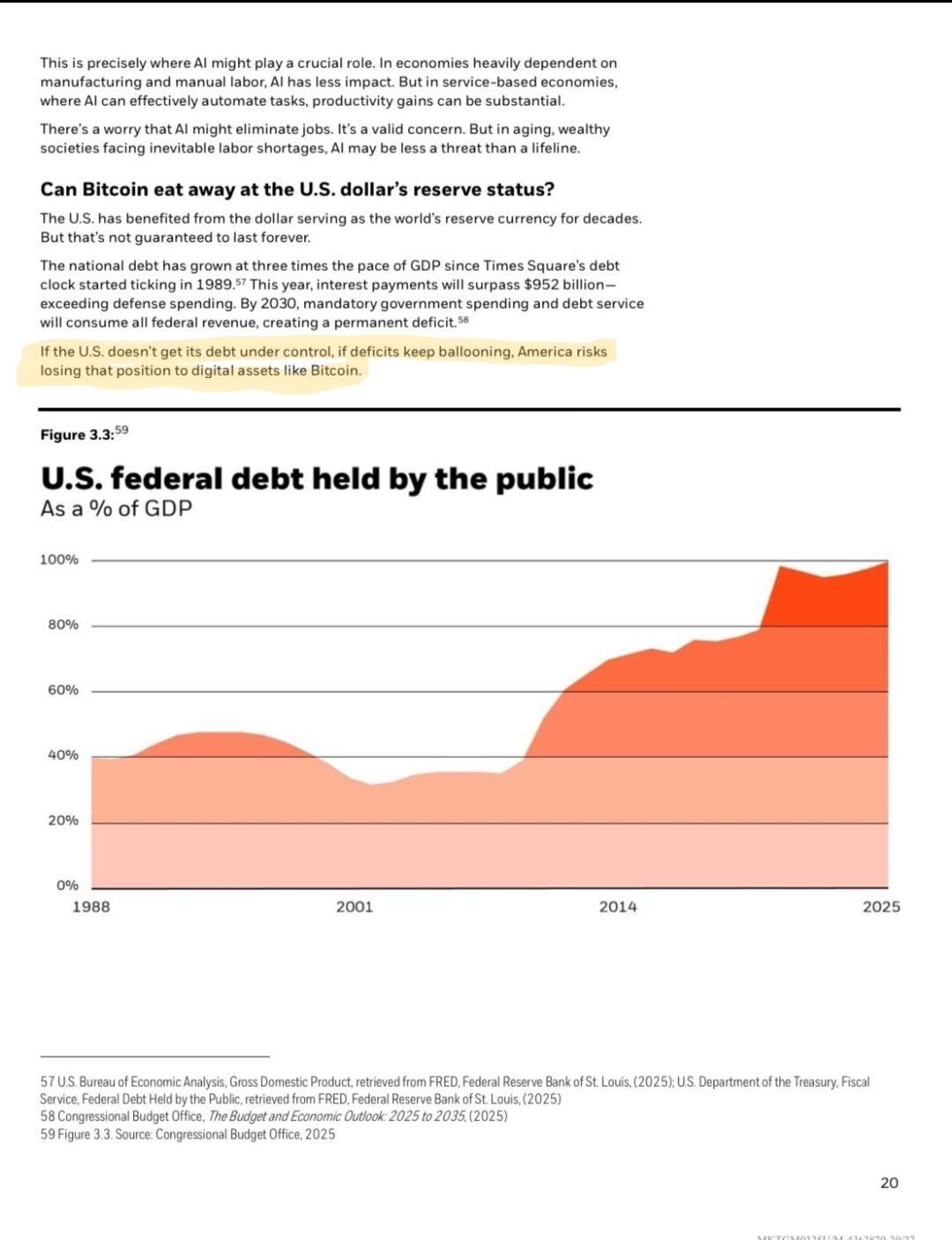

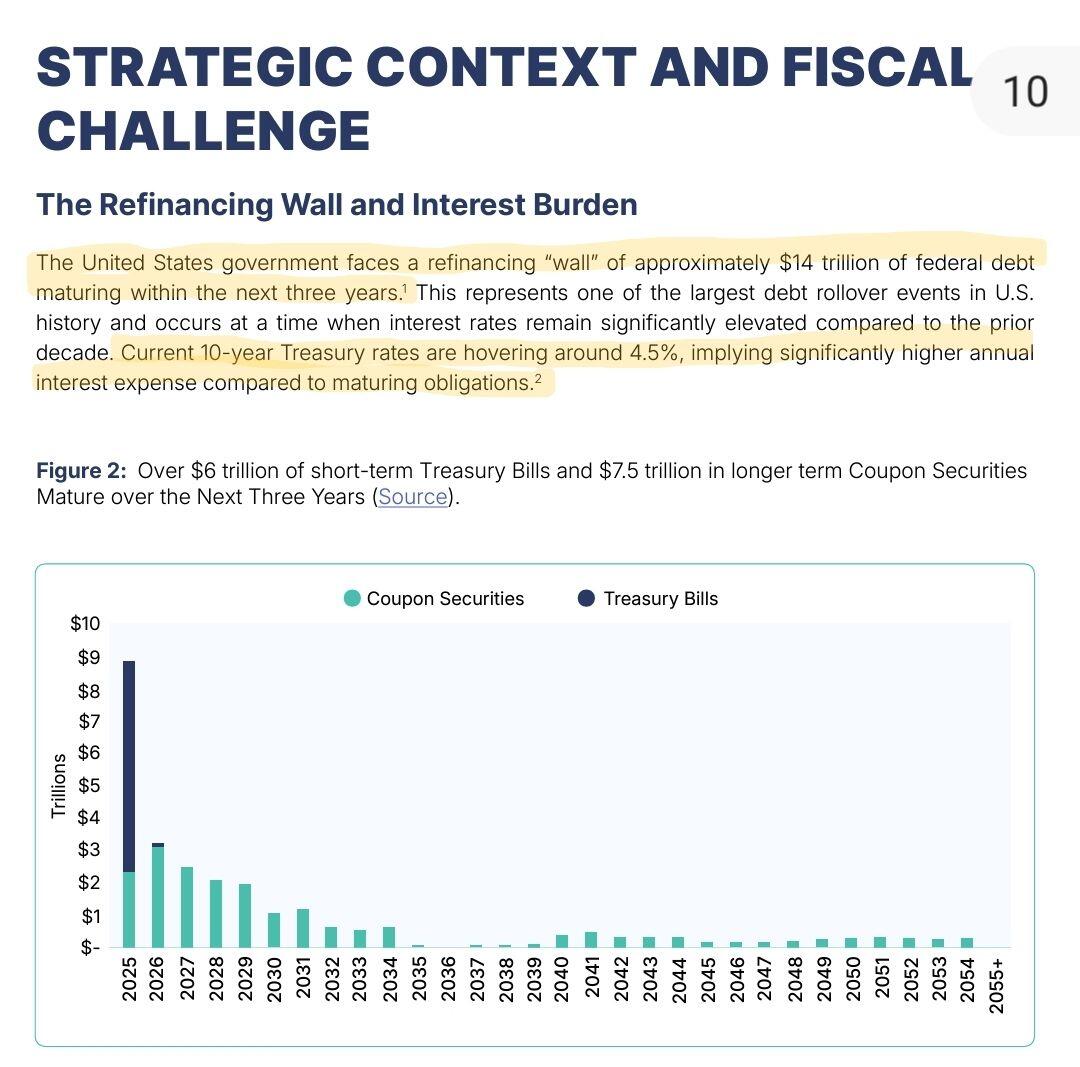

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @npub128tl...fadp propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.