Someone actually did the science:

Turns out that four years after The End Of The World (according to the mainstream media's 'Science' section), bitcoin uses 0.065% of global electricity, and produces 0.024% of emissions.

Turns out that four years after The End Of The World (according to the mainstream media's 'Science' section), bitcoin uses 0.065% of global electricity, and produces 0.024% of emissions.

BITCOIN POWER CONSUMPTION.INFO

Bitcoin power consumption

Bitcoin energy consumption & emissions, a climate alarmists take. TLDR- Bitcoin essential !

Alternatives do exist and I would suggest using them.

An example that just launched is

Alternatives do exist and I would suggest using them.

An example that just launched is

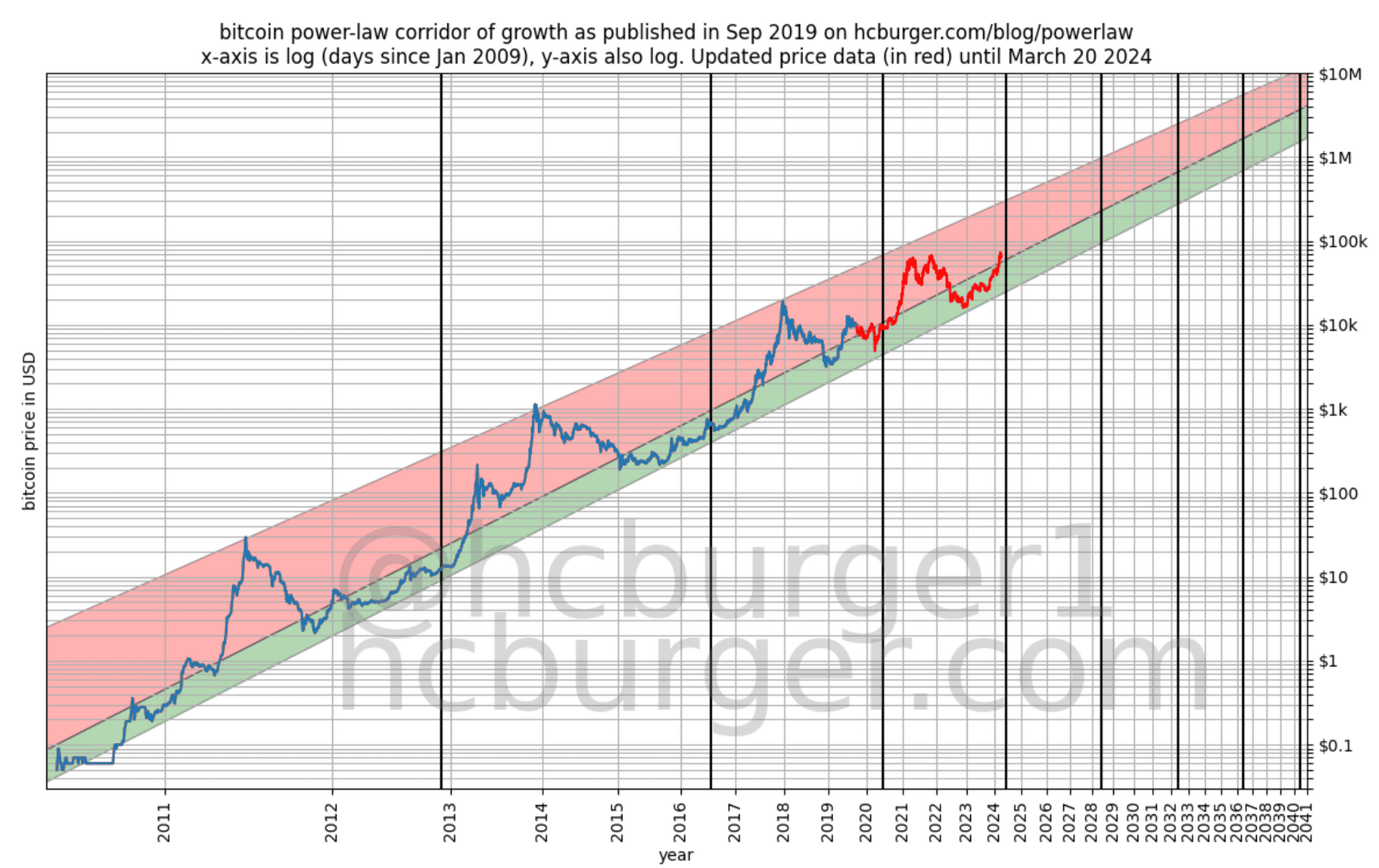

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at

A model is just a model, and they can break. The log range used in these types of models is huge, so of course they are anyway useless as trading or timing tools. And as many people have pointed out, these chart models cannot take into account the real world fundamentals, such as the recent launch of the ETFs.

But there is still signal in these charts:

- we can expect ever increasing returns

- returns are a multiple of adoption increase (e.g. 10X adoption = 100X price)

- those returns are DIMINISHING rather than exponential.

You don't necessarily need a Power Law chart to work those things out, but the chart verifies the logic, and is currently the best model when correlating price against time. I don't suggest anyone (seriously) predicts price against time, because it will make you look like a fool.

But it is fun. And it is good marketing for bitcoin, which brings new adoption - and that is good.

A live chart is available at