Eye opening interview of Richard Werner, who got warning visits from the CIA when he laid bare the truth on how the world's banks and credit system work.

Highly recommended.

https://tuckercarlson.com/tucker-show-richard-werner

OneBigLife

nostr@onebig.life

npub1dvnf...ypmm

Nostr brings freedom. Bitcoin gives hope.

Government 'protecting us' has direct and immediate 2nd order effects.

In this case, being blocked from using AI.

The descent continues.

The Bank of England asked the people to submit designs for the next generation of bank notes.

Looks like someone would prefer an Aqua Wallet .

@Samson Mow

Watching the bitcoin price too much, it's easy to feel disappointed. The rush of dopamine you get when All Time Highs are hit always has its balancing emotional comedown soon after.

Remember, by definition, price spends most of the time not at the ATH.

If you Dollar Cost Average into an asset that goes up over the longer timeframe, your returns are *increased* the more volatile the price action is. The volatility puts more bitcoin into your strong hands at lower prices as the speculators are shaken out.

Crazy price action is the Universe smiling on HODLers. Be happy!

Family member is on holiday with some of his uni friends.

Turns out an Economics degree curriculum at a UK Russell Group university doesn't even mention the world's second largest asset class that underlies the whole financial system. ๐คฃ

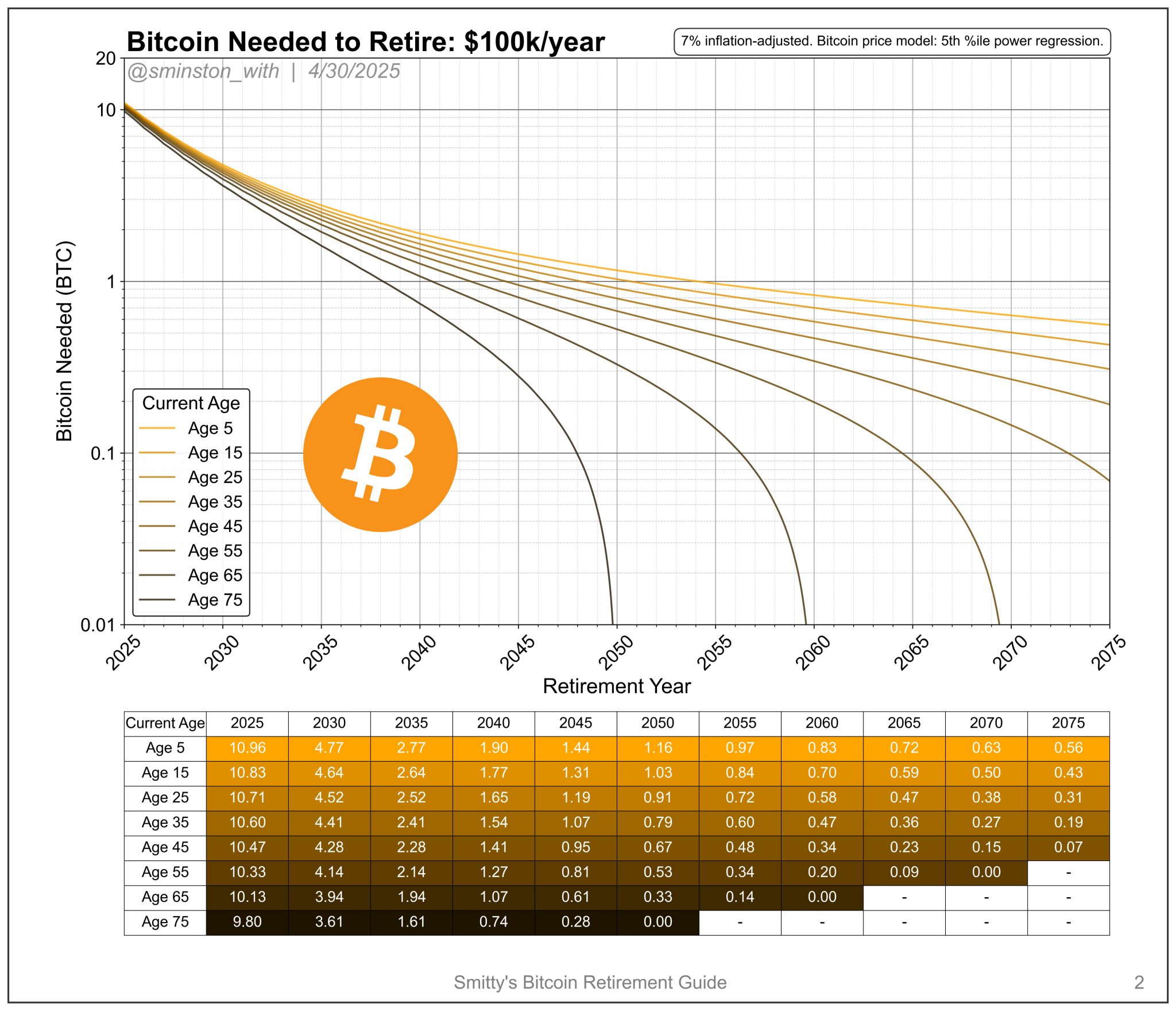

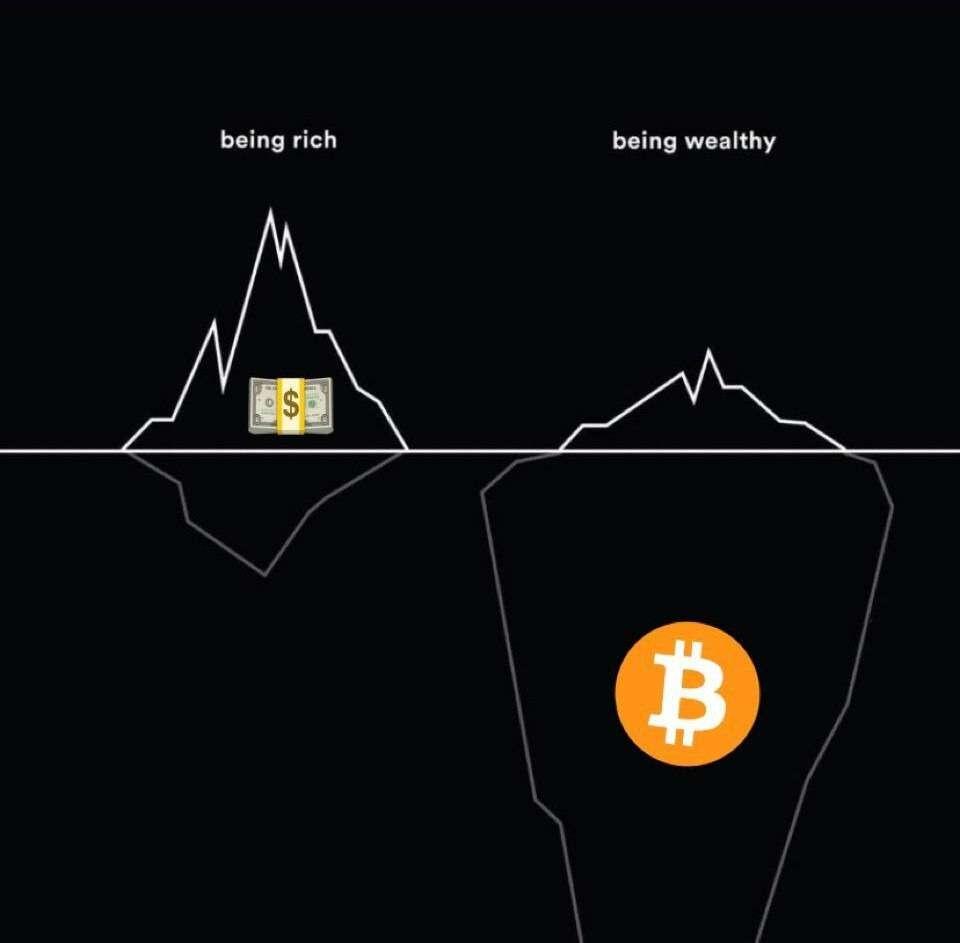

Love this chart that attempts to answer "how much is enough?"

Author posted explanation and charts for different retirement incomes at

Author posted explanation and charts for different retirement incomes at

Author posted explanation and charts for different retirement incomes at

Author posted explanation and charts for different retirement incomes at

X (formerly Twitter)

Sminston With ๐ (@sminston_with) on X

Smitty's Bitcoin Retirement Guide: e-Book Edition ๐

*Only here on X*

The wait is finally over - you're going to want to bookmark this.

- - -

๐...

Bitcoin is going up in value against major assets and has overtaken Google and Amazon. But most people ignore something even better:

When a company goes up in value, a shareholder has some of that value diluted away via share issuances and employee stock options.

Bitcoin is the opposite. If you own bitcoin, your share of the value pie slowly increases over time as coins get lost, and some people burn coins.

The first job of government is protection and security.

The UK government is utterly failing, and our journalists are too scared (or politically correct) to report on this and force discussion. Something needs to change.

Not many greater pleasures than buying incredible venison direct from the game keeper with bitcoin (apart from eating it, obviously)

People are currently infatuated with Micro Strategy / MSTR "because it is a 1.5 leverage play on bitcoin", and are in (deserved) admiration of @Michael Saylor for beating the S&P 500 so convincingly.

I know people close to me who have worked hard and saved bitcoin, but are now being tempted to exchange BTC for MSTR, spurred on by influencers like American @HODL (I'm a fan) and his latest strong endorsement.

But, MSTR is nothing like BTC. You sell 1 BTC and buy the equivalent value MSTR. You now own a security that is holding ~0.35 BTC on your behalf. The 'BTC yield' isn't yield on your 1 BTC. It is growing the 0.35 BTC up a little higher each year, but nowhere near the original 1 BTC you had.

Yes, I understand Micro Strategy is offering a service that is of value "like an oil company" (see latest Micro Strategy Earnings Call) and therefore trades at a premium. But this is pure speculation just like buying any other company share. The calculation is whether MSTR will generate more value with his company on the 0.65 BTC (the non-BTC treasury part of your 1 BTC investment) than holding the 0.65 BTC would. And in Saylor's own words about other companies, that means MSTR needs to compound more than 29% a year going forwards in terms of company value. That's quite a hurdle - one that very few companies in history have achieved over the long term.

There are good arguments on both sides regarding MSTR, the value the company provides and therefore its premium.

BUT BEFORE SELLING THE SCARCEST FINANCIAL ASSET on earth, one with no counterparty or company director risk, for a speculative asset, one should just THINK VERY HARD.

You may never be able to get the BTC you sold back again.

(disclaimer: I hold both BTC and MSTR - but MSTR only where I can't hold BTC)

It is becoming increasingly obvious which of the sound monies is going to win.

h/t x.com/bitcoin__apex

h/t x.com/bitcoin__apexChancellor of UK has come up with a genius plan for reducing the gigantic UK government debt.

Power Law

Power Law

This is an extraordinary clip from the Chair of the Council of Economic Advisors.

There is zero competence at the helm of the fiat financial system.

Choose #bitcoin, and choose sooner rather than later.

There is zero competence at the helm of the fiat financial system.

Choose #bitcoin, and choose sooner rather than later.

X (formerly Twitter)

Arnaud Bertrand (@RnaudBertrand) on X

This is absolutely priceless. And probably the most frightening clip you'll ever watch on the people in charge of the US economy.

Jared Bernstein ...