US should front load the minerals deal, like a mortgage.

The dictator after Zelenskyy will probably be chosen and installed by the CIA anyway, but grab as much repayment as soon as possible.

furio

furio@pailakapo.com

npub1jxjm...0mdf

Make the states great again.

Move all unconstitutional federal powers back to state control.

Enforce the 10th Amendment.

Build cashu tools.

After passing the audit of the gold, put a 24 hr livestream on treasury.gov so no shenanigans take place.

It’s not like we buy gold all the time, we’ve had the same number of ounces for years.

The world needs more bank runs.

The US founding fathers didn’t trust government. This was from experience, and we should not forget this.

Audit all the spending: check

Audit the physical gold: maybe?

And that’s just the government checking “themselves.”

Everyone take custody of everything, trust no one: (ideal)

London and Fort Knox need simultaneous audits.

This strengthens the dollar if Fort Knox has the gold but London doesn’t.

I think the dollar is on life support if there’s no gold in Fort Knox.

So the only way we see an audit is if it’s there.

Canada is finding out.

Poilievre is a step in the right direction, but I think to put your money where your mouth is re: hating the US, is to survive without the US economy and specifically the US taxpayer.

Can’t do that? Then you should bend the knee.

US beat USSR at hockey then they were dissolved within 10 years.

Tick tock Canada.

Trump is re-defining the executive.

In the best way possible.

This is what MAGA voted for in 2016 and 2024.

He is un-apologetically stomping on the woke mind virus and establishing dominance.

Now it’s up to congress to ensure these executive orders become the law of the land, or we’ll regress back to the swampy bureaucracy we had before.

All federal outgoing money should flow through the treasury (I assume it already does) and within the treasury there should be an auditor that *requires* documentation on which law passed by congress this money derives from, and exactly who the recipient is and for what purpose the money is being sent.

This documentation should be on treasury.gov website for *anyone* to see.

Sunlight is the best disinfectant

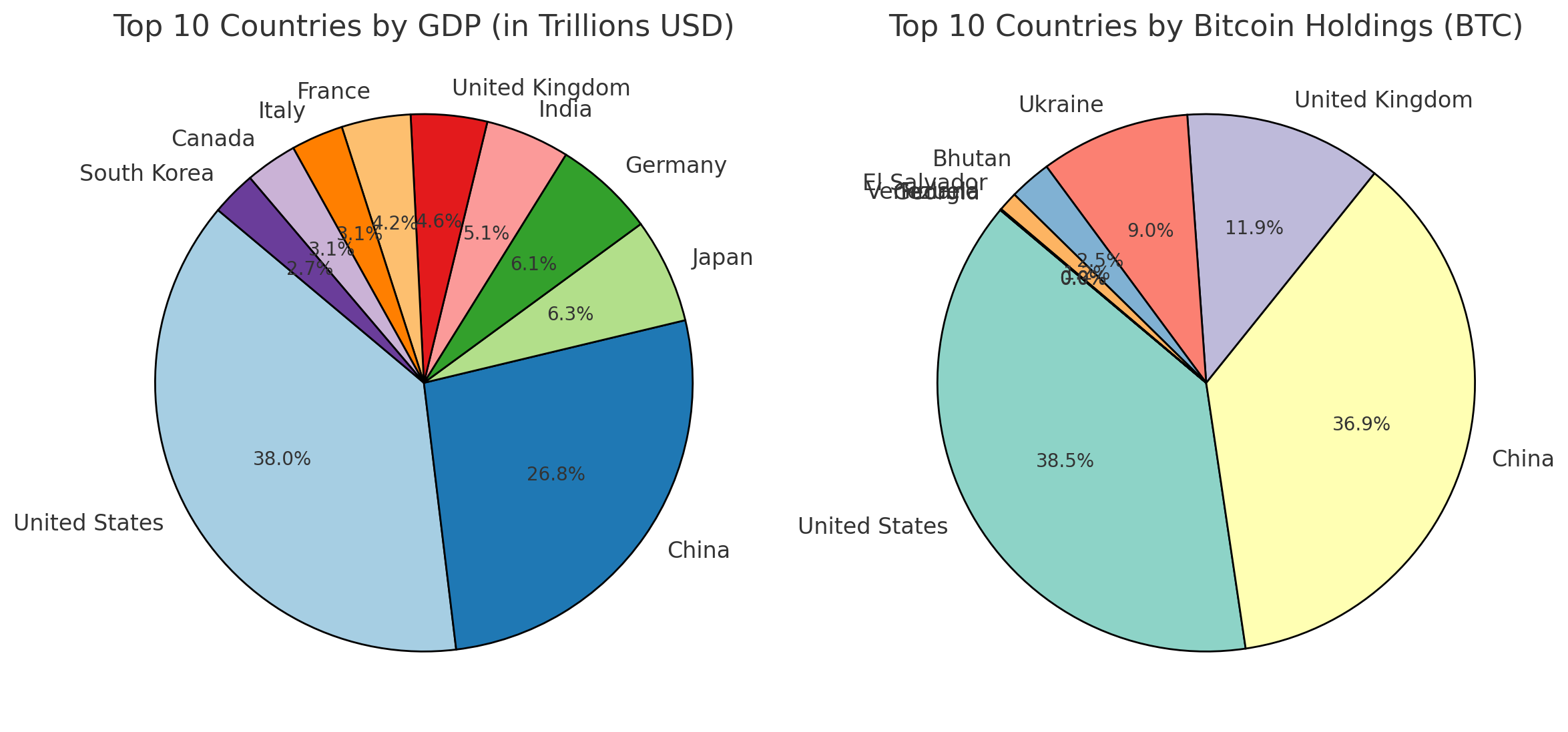

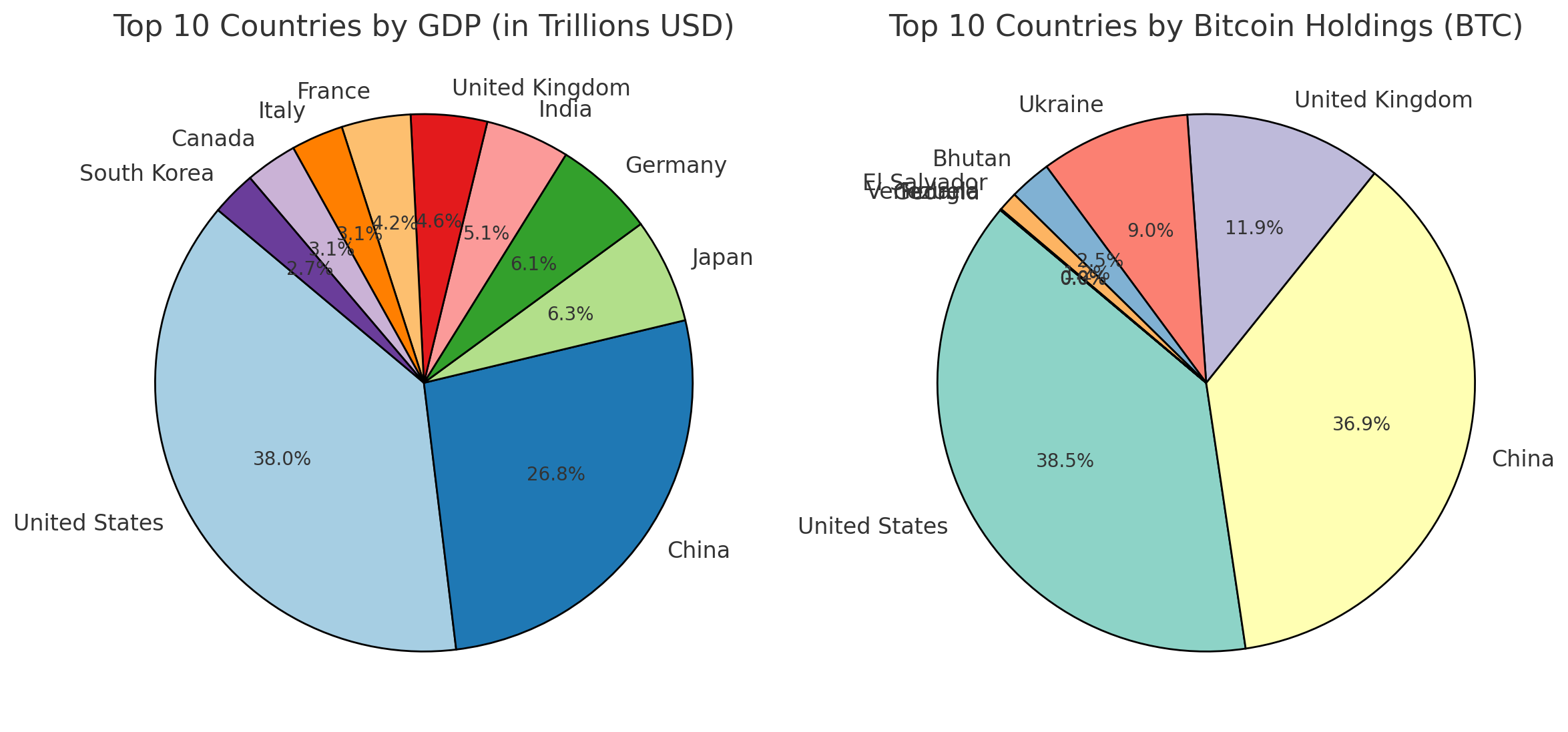

Bhutan and El Salvador making outsized projections onto the future of global wealth.

EU looks cooked.

US holding steady, but I don’t believe the China numbers in BTC holdings or gold holdings.

Maybe the real reason to release $TRUMP and $$MELANIA was to accelerate the demise of altcoins.

Coinbase is complaining about compliance *because* of what these coins exposed (the ease of grift.)

The separation of Bitcoin and *all other “projects “* should be obvious to anyone paying attention.

Now we see who is truly dense. Exposing $XRP is an easy lift.

Arguing with a mob…

Bitcoin Nostr is mad because the US government is using bitcoin and putting “state stink” on it.

Bitcoin nostr is super mad because Trump is keeping their bitcoin and other seized crypto and not calling it an SBR.

Everything is good for bitcoin. In the end, the US Government will print north of $2T in 2025, which is literally all that matters. The dollar will be devalued.

Nothing stops this train!

How many scammers are creating Ross Ulbrict nostr profiles to get the first mover zaps?

Question about an LND node:

I have a bunch of small transactions (+1c, -3c, etc) on Zeus under transactions. I didn’t initiate these.

The show_forwards only lists 4 forwards in the same timeframe as 10+ transactions.

I don’t remember forwards showing in transactions on Zeus before.

I had my phone stolen and reset and spun up a new LND node so I wanna make sure these transactions aren’t some attacker testing liquidity.

@ZEUS

On the iOS Zeus app, when setting up a remote LND the certificate instructions say that tapping the .crt file on iOS will prompt an “install” or to manually install on settings->general-…

Neither of these work for me.

Are these instructions still correct?

iOS 18.1.1,

LND on remote node

After listening to Luke Gromen on Coin Stories podcast, I have a proposal:

Allow US regulated banks to issue FDIC backed stablecoins under the following conditions:

1. Each bank is responsible for their own coin (no collusion of rules, funds,etc, and no government intervention so no CBDC risk)

2. 100% funded by treasuries and the treasuries allocated to the coin must never go below 100% (so the FDIC will never be used to pay coin redemptions). If the bank fails outside of the coin, FDIC would backstop the tradfi element.

Under this proposal the customer gets :

- competition for their dollar IOU so accountability.

- protection from rug risk with FDIC insurance

The federal government gets guaranteed buyer of treasuries.

The bank gets interest income on 0% loans gladly given to them by customers.

Non-FDIC stables would be drained and the US would get citizens of countries from all over the world with ability to purchase USTs with little to no friction.

Bond yields up.

Gold down.

Bitcoin ATH.

This smells like Saylor was right. And the smart money is starting to figure it out.

There is no second best.