Three Key Constraints That Could Derail The Data Center Buildout Story

Three Key Constraints That Could Derail The Data Center Buildout Story

The data center investment macro story centers on hyperscalers such as Microsoft, Alphabet, Meta, and Amazon Web Services, whose massive cloud computing services are becoming the backbone for AI workloads, including ChatGPT and others. However, as we've previously noted, the data center buildout has run into

, including memory chip shortages, power-grid constraints, and even a shortage of turbine blades for natural-gas generators.

The data center boom powering the AI revolution is certaintly impressive to watch unfold, but it won't be a straight line from here as the US attempts to hold the number one spot in the global AI race. Challenges are mounting, and the latest coverage on this comes from a conversation Goldman analyst Brian Singer had with Mark Monroe, a former principal engineer in Microsoft's Datacenter Advanced Development Group, who warned that data center buildouts face three major headwinds.

Here's a recap of the conversation between Singer and Monroe, which focused on three key constraints: power, water, and labor.

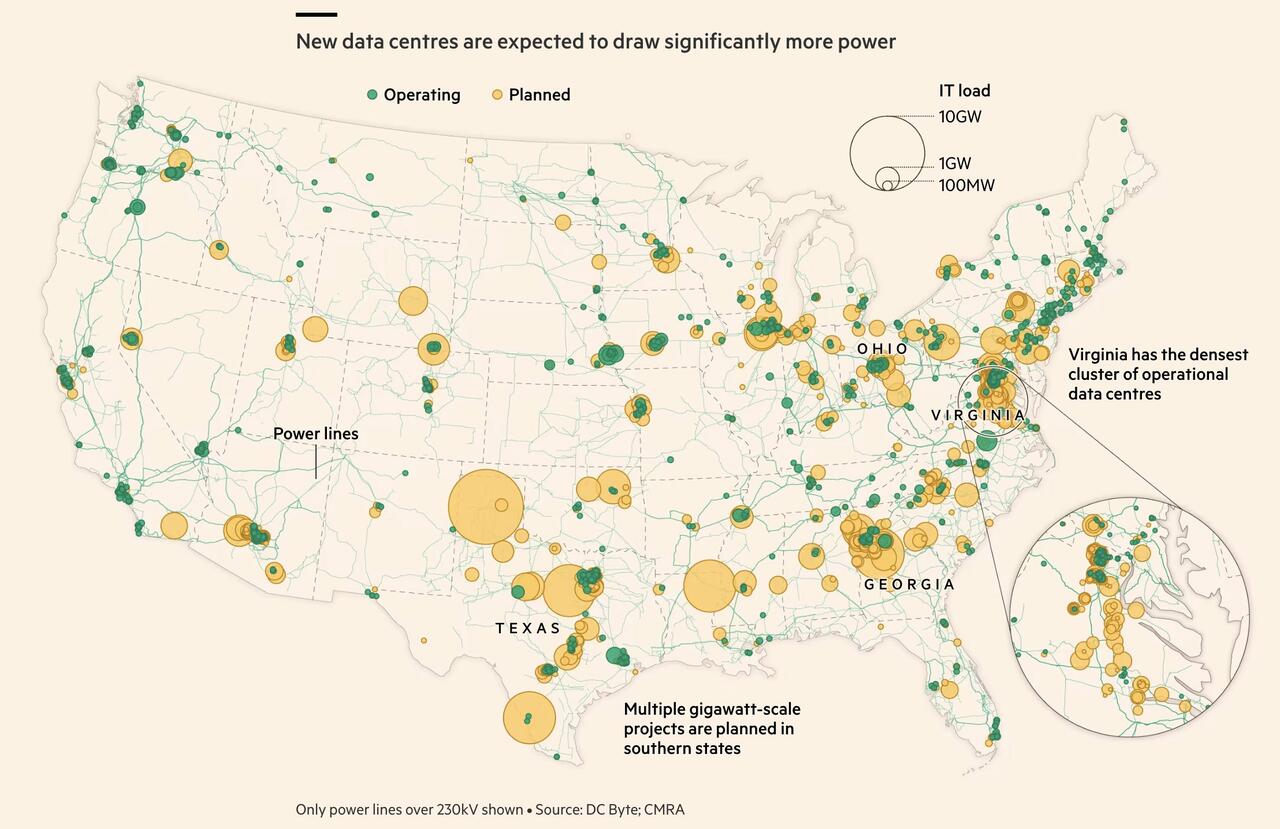

1. Energy: Power remains the most critical near-term constraint for data center deployment, while flexible load management and Behind-the-Meter solutions could help close the power gap. While cloud and AI inference workloads generally require proximity to end-users -- creating power shortages in these congested markets -- AI training workloads are location-agnostic and migrating to remote areas with available power. Grid conditioning or flexible load management for data centers during peak electricity consumption could unlock significant capacity. A Duke University study suggested that 76 GW of new load (10% of US aggregate peak demand) could be integrated if data centers accepted average annual load curtailment of 0.25% (99.75% up time) and 98 GW added for curtailment of 0.5% (99.5% up time). While this could potentially unlock ~100 GW of capacity, Mr. Monroe notes that adoption: (a) is hindered by the industry's inherent risk aversion of cycling IT equipment off and on; and (b) may require stronger financial or regulatory incentives.

Behind-the-Meter power is a costly and likely temporary bridge to initial grid gaps. While a single digit percentage of data centers in the pipeline have BTM requests, Mr. Monroe highlighted this can still be significant for power demand given these are typically larger data centers. Primarily deploying natural gas simple cycle generators, onsite power solutions cost 5x-20x more than grid power. However, Mr. Monroe highlighted that deploying BTM solutions to push forward data center startups can be an economically viable choice given the immense profitability of large scale AI data centers. According to Mr. Monroe, data centers deploying BTM power ultimately aim to connect to the grid eventually over three years, while either relocating to other data centers, integrating and selling power back into the grid, or retiring BTM assets.

2. Water: Community, regulatory and chip advancement pressures likely to shift the industry towards more water-efficient cooling technologies coming at significant energy costs. The industry is seeing a shift from the traditional water-intensive evaporative approaches towards more waterless designs, especially among hyperscalers, as community, regulatory and technological pressure mounts. According to Mr. Monroe, the shift towards closed-loop and waterless cooling systems is likely to raise Power Usage Effectiveness (PUE) from best-in-class levels of 1.08 to 1.35-1.40, representing a 35%-40% energy overhead versus 8% in evaporative systems. Although innovations such as direct-to-chip liquid cooling and higher-temperature water cooling could enable more efficient heat transfer in more geographic locations, co-location data centers are likely to remain committed to chiller-based designs given their diverse customer base and need to commit to cooling architecture early in construction. Regardless of any diminishing share of overall data center cooling solutions, according to Mr. Monroe the demand for chillers is expected to continue to see a material increase over the next decade, driven by overall growth in data center capacity.

3. Labor: Skilled labor shortage could become the next gating factor for data center deployment. Data centers are differentiated from generic industrial buildings by the specialized electrical and mechanical systems required, making electricians and pipefitters critical to the continued data center build out. According to Mr. Monroe, the skilled labor shortage represents the next major constraint after power. Industry organizations, in collaboration with technical universities and colleges, are actively developing training programs to address this gap, while attempting to reach students as early as middle school to make skilled trades more attractive career paths. We estimate the US will require >500,000 net new workers across manufacturing, construction, ops & maintenance, and transmission and distribution to deploy all the power to meet demand by 2030.

Related coverage:

Looking ahead, the key question is whether the U.S. can sustain a largely uninterrupted surge in data center capex, given how much these buildouts are now embedded in both the macro narrative and tech valuations. The investment thesis assumes that continued buildout translates into measurable productivity gains and, in turn, a multi-year uplift in growth. Overall, the execution risk boils down to critical inputs and infrastructure, including core components, grid access, and related supply chain bottlenecks, which could slow buildouts and stymie overly optimistic expectations.

To bypass these ground-based constraints, that's why the narrative of

.

portal.

Wed, 02/18/2026 - 15:25

Behind-the-Meter power is a costly and likely temporary bridge to initial grid gaps. While a single digit percentage of data centers in the pipeline have BTM requests, Mr. Monroe highlighted this can still be significant for power demand given these are typically larger data centers. Primarily deploying natural gas simple cycle generators, onsite power solutions cost 5x-20x more than grid power. However, Mr. Monroe highlighted that deploying BTM solutions to push forward data center startups can be an economically viable choice given the immense profitability of large scale AI data centers. According to Mr. Monroe, data centers deploying BTM power ultimately aim to connect to the grid eventually over three years, while either relocating to other data centers, integrating and selling power back into the grid, or retiring BTM assets.

2. Water: Community, regulatory and chip advancement pressures likely to shift the industry towards more water-efficient cooling technologies coming at significant energy costs. The industry is seeing a shift from the traditional water-intensive evaporative approaches towards more waterless designs, especially among hyperscalers, as community, regulatory and technological pressure mounts. According to Mr. Monroe, the shift towards closed-loop and waterless cooling systems is likely to raise Power Usage Effectiveness (PUE) from best-in-class levels of 1.08 to 1.35-1.40, representing a 35%-40% energy overhead versus 8% in evaporative systems. Although innovations such as direct-to-chip liquid cooling and higher-temperature water cooling could enable more efficient heat transfer in more geographic locations, co-location data centers are likely to remain committed to chiller-based designs given their diverse customer base and need to commit to cooling architecture early in construction. Regardless of any diminishing share of overall data center cooling solutions, according to Mr. Monroe the demand for chillers is expected to continue to see a material increase over the next decade, driven by overall growth in data center capacity.

3. Labor: Skilled labor shortage could become the next gating factor for data center deployment. Data centers are differentiated from generic industrial buildings by the specialized electrical and mechanical systems required, making electricians and pipefitters critical to the continued data center build out. According to Mr. Monroe, the skilled labor shortage represents the next major constraint after power. Industry organizations, in collaboration with technical universities and colleges, are actively developing training programs to address this gap, while attempting to reach students as early as middle school to make skilled trades more attractive career paths. We estimate the US will require >500,000 net new workers across manufacturing, construction, ops & maintenance, and transmission and distribution to deploy all the power to meet demand by 2030.

Related coverage:

Looking ahead, the key question is whether the U.S. can sustain a largely uninterrupted surge in data center capex, given how much these buildouts are now embedded in both the macro narrative and tech valuations. The investment thesis assumes that continued buildout translates into measurable productivity gains and, in turn, a multi-year uplift in growth. Overall, the execution risk boils down to critical inputs and infrastructure, including core components, grid access, and related supply chain bottlenecks, which could slow buildouts and stymie overly optimistic expectations.

To bypass these ground-based constraints, that's why the narrative of

.

portal.

Wed, 02/18/2026 - 15:25

Goldman Warns DRAM Shortage Not The Only Bottleneck In AI Data Center Buildouts | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Behind-the-Meter power is a costly and likely temporary bridge to initial grid gaps. While a single digit percentage of data centers in the pipeline have BTM requests, Mr. Monroe highlighted this can still be significant for power demand given these are typically larger data centers. Primarily deploying natural gas simple cycle generators, onsite power solutions cost 5x-20x more than grid power. However, Mr. Monroe highlighted that deploying BTM solutions to push forward data center startups can be an economically viable choice given the immense profitability of large scale AI data centers. According to Mr. Monroe, data centers deploying BTM power ultimately aim to connect to the grid eventually over three years, while either relocating to other data centers, integrating and selling power back into the grid, or retiring BTM assets.

2. Water: Community, regulatory and chip advancement pressures likely to shift the industry towards more water-efficient cooling technologies coming at significant energy costs. The industry is seeing a shift from the traditional water-intensive evaporative approaches towards more waterless designs, especially among hyperscalers, as community, regulatory and technological pressure mounts. According to Mr. Monroe, the shift towards closed-loop and waterless cooling systems is likely to raise Power Usage Effectiveness (PUE) from best-in-class levels of 1.08 to 1.35-1.40, representing a 35%-40% energy overhead versus 8% in evaporative systems. Although innovations such as direct-to-chip liquid cooling and higher-temperature water cooling could enable more efficient heat transfer in more geographic locations, co-location data centers are likely to remain committed to chiller-based designs given their diverse customer base and need to commit to cooling architecture early in construction. Regardless of any diminishing share of overall data center cooling solutions, according to Mr. Monroe the demand for chillers is expected to continue to see a material increase over the next decade, driven by overall growth in data center capacity.

3. Labor: Skilled labor shortage could become the next gating factor for data center deployment. Data centers are differentiated from generic industrial buildings by the specialized electrical and mechanical systems required, making electricians and pipefitters critical to the continued data center build out. According to Mr. Monroe, the skilled labor shortage represents the next major constraint after power. Industry organizations, in collaboration with technical universities and colleges, are actively developing training programs to address this gap, while attempting to reach students as early as middle school to make skilled trades more attractive career paths. We estimate the US will require >500,000 net new workers across manufacturing, construction, ops & maintenance, and transmission and distribution to deploy all the power to meet demand by 2030.

Related coverage:

Behind-the-Meter power is a costly and likely temporary bridge to initial grid gaps. While a single digit percentage of data centers in the pipeline have BTM requests, Mr. Monroe highlighted this can still be significant for power demand given these are typically larger data centers. Primarily deploying natural gas simple cycle generators, onsite power solutions cost 5x-20x more than grid power. However, Mr. Monroe highlighted that deploying BTM solutions to push forward data center startups can be an economically viable choice given the immense profitability of large scale AI data centers. According to Mr. Monroe, data centers deploying BTM power ultimately aim to connect to the grid eventually over three years, while either relocating to other data centers, integrating and selling power back into the grid, or retiring BTM assets.

2. Water: Community, regulatory and chip advancement pressures likely to shift the industry towards more water-efficient cooling technologies coming at significant energy costs. The industry is seeing a shift from the traditional water-intensive evaporative approaches towards more waterless designs, especially among hyperscalers, as community, regulatory and technological pressure mounts. According to Mr. Monroe, the shift towards closed-loop and waterless cooling systems is likely to raise Power Usage Effectiveness (PUE) from best-in-class levels of 1.08 to 1.35-1.40, representing a 35%-40% energy overhead versus 8% in evaporative systems. Although innovations such as direct-to-chip liquid cooling and higher-temperature water cooling could enable more efficient heat transfer in more geographic locations, co-location data centers are likely to remain committed to chiller-based designs given their diverse customer base and need to commit to cooling architecture early in construction. Regardless of any diminishing share of overall data center cooling solutions, according to Mr. Monroe the demand for chillers is expected to continue to see a material increase over the next decade, driven by overall growth in data center capacity.

3. Labor: Skilled labor shortage could become the next gating factor for data center deployment. Data centers are differentiated from generic industrial buildings by the specialized electrical and mechanical systems required, making electricians and pipefitters critical to the continued data center build out. According to Mr. Monroe, the skilled labor shortage represents the next major constraint after power. Industry organizations, in collaboration with technical universities and colleges, are actively developing training programs to address this gap, while attempting to reach students as early as middle school to make skilled trades more attractive career paths. We estimate the US will require >500,000 net new workers across manufacturing, construction, ops & maintenance, and transmission and distribution to deploy all the power to meet demand by 2030.

Related coverage:

Goldman Warns DRAM Shortage Not The Only Bottleneck In AI Data Center Buildouts | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Goldman: Local Resistance Against Data Centers "Are Not Slowing Development" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Behind The $500 Billion Data Center Boom: Here's Who Makes All The Key Components | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

SpaceX In Advanced Talks To Combine With xAI: Report | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Tyler Durden | Zero Hedge

Zero Hedge

Three Key Constraints That Could Derail The Data Center Buildout Story | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

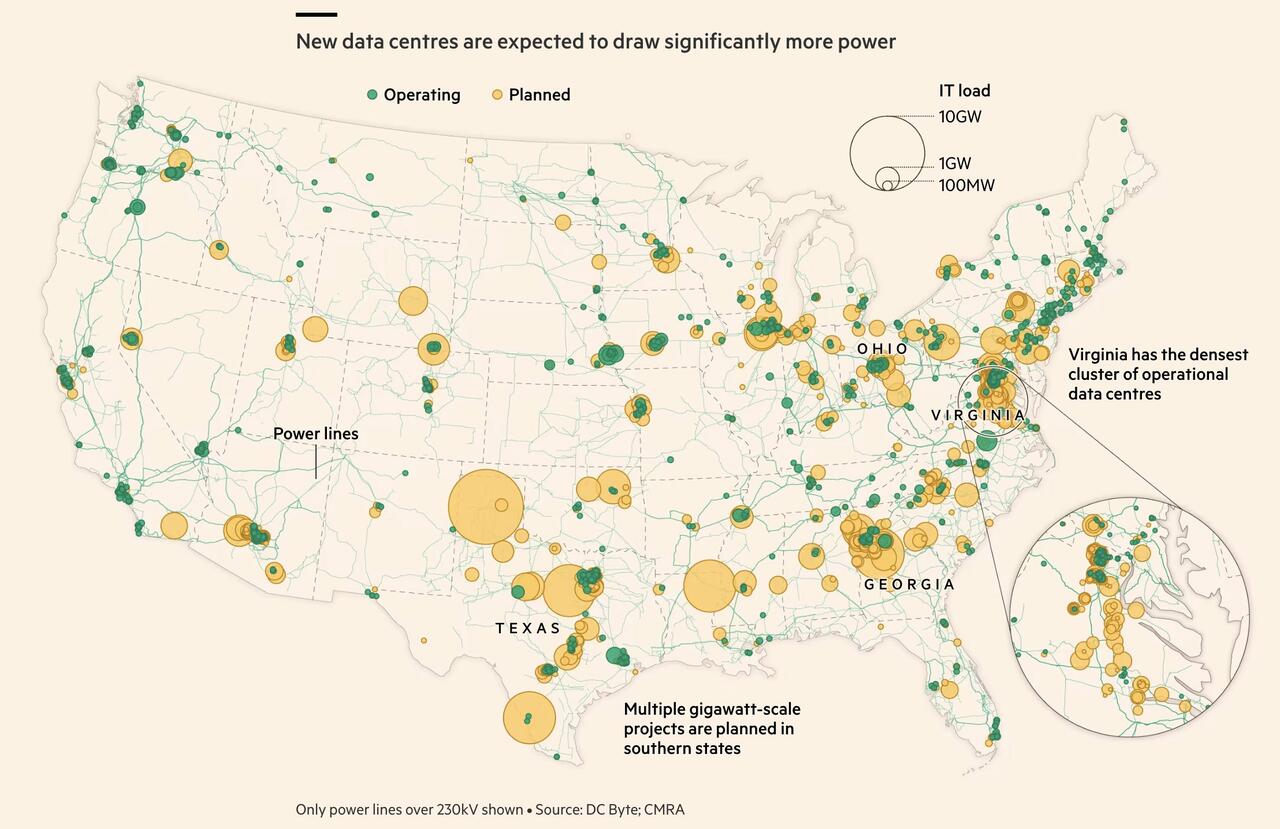

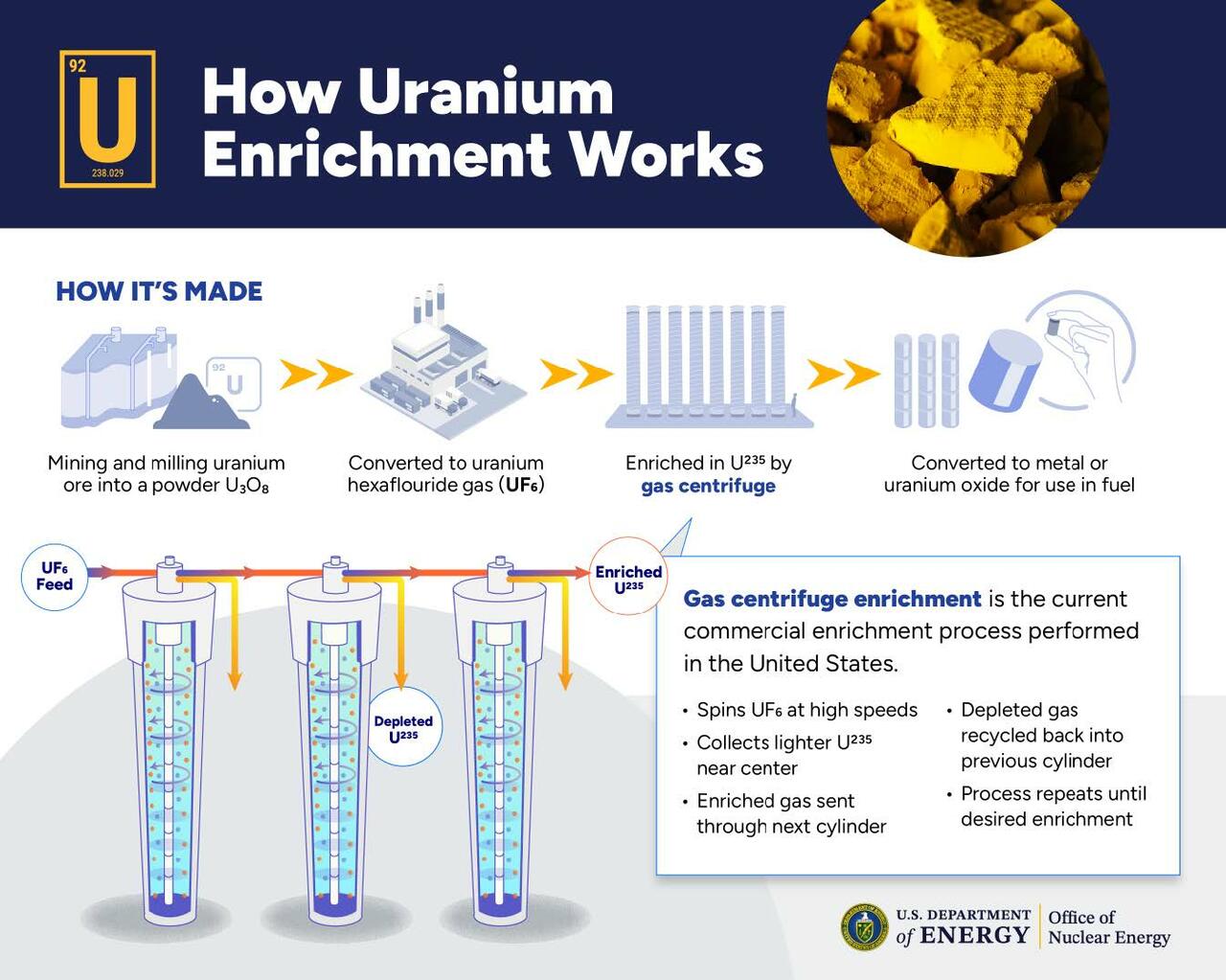

Laser enrichment technology is considered the third generation of uranium enrichment methods. The first was gaseous diffusion, which was only used back in the day of the Manhattan Project. Due to its extreme power consumption, newer technology was developed for the second generation – gas centrifuge. Centrifuges are still in use across the world today. For third generation technology, laser enrichment is currently under development by multiple companies including LIST, ASPI, Hexium, and GLE.

Laser enrichment technology is considered the third generation of uranium enrichment methods. The first was gaseous diffusion, which was only used back in the day of the Manhattan Project. Due to its extreme power consumption, newer technology was developed for the second generation – gas centrifuge. Centrifuges are still in use across the world today. For third generation technology, laser enrichment is currently under development by multiple companies including LIST, ASPI, Hexium, and GLE.

We recently detailed some of the major announcements from LIST regarding their newly

We recently detailed some of the major announcements from LIST regarding their newly  With the company now initiating the formalities of pursuing an NRC license for handling nuclear material and technology, “show me the money” will certainly start coming to the front of investors' minds. With the recent funding round

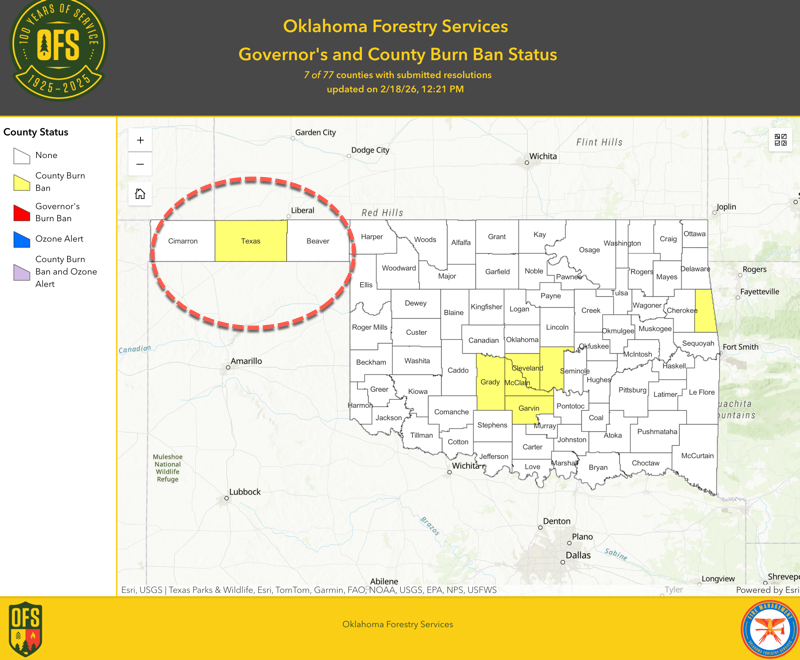

With the company now initiating the formalities of pursuing an NRC license for handling nuclear material and technology, “show me the money” will certainly start coming to the front of investors' minds. With the recent funding round  Latest from the Oklahoma Department of Agriculture:

Ranger Road Fire: 145,000 acres, 0% contained

Stevens Fire: 5,500 acres

Side Road Fire: 3,300 acres, 25% contained

43 Fire: 2,200 acres, 20% contained

The Oklahoma Department of Agriculture shared this update on wildfires:

Ranger Road Fire: 145,000 acres, 0% contained

Stevens Fire: 5,500 acres, 25% contained

Side Road Fire: 3,300 acres, 25% contained

43 Fire: 2,200 acres, 20% contained

🎥Tammy Lawrence

Follow our live blog:…

Latest from the Oklahoma Department of Agriculture:

Ranger Road Fire: 145,000 acres, 0% contained

Stevens Fire: 5,500 acres

Side Road Fire: 3,300 acres, 25% contained

43 Fire: 2,200 acres, 20% contained

The Oklahoma Department of Agriculture shared this update on wildfires:

Ranger Road Fire: 145,000 acres, 0% contained

Stevens Fire: 5,500 acres, 25% contained

Side Road Fire: 3,300 acres, 25% contained

43 Fire: 2,200 acres, 20% contained

🎥Tammy Lawrence

Follow our live blog:…

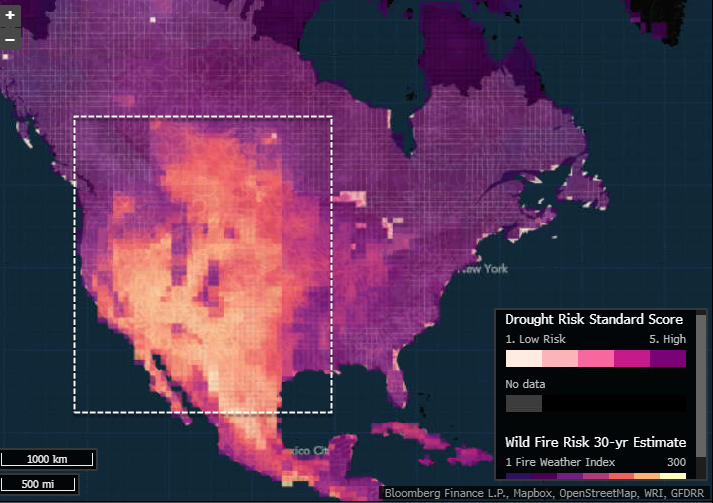

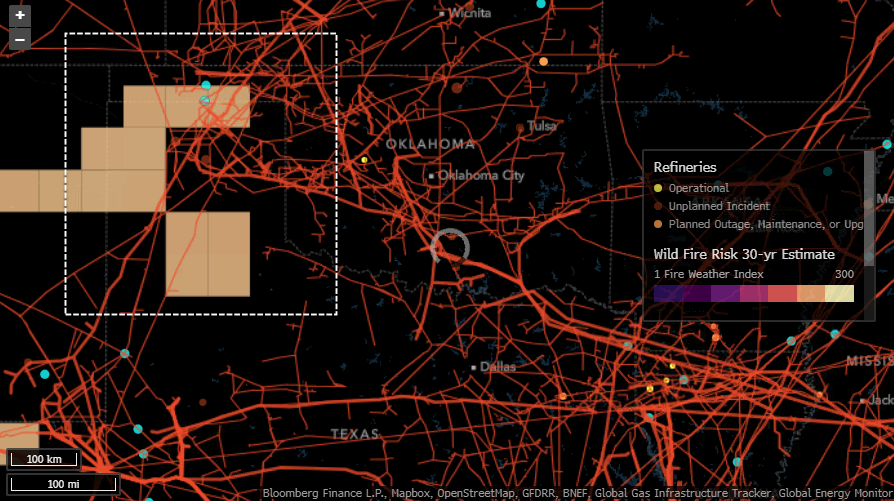

Here are some high-value energy infrastructure assets, including refineries, natural gas hubs, and power plants, that are either near the wildfires or in areas with elevated wildfire risk.

Here are some high-value energy infrastructure assets, including refineries, natural gas hubs, and power plants, that are either near the wildfires or in areas with elevated wildfire risk.

So far, there has been no official word on fire-related damage to Oklahoma's cattle industry. The state is a top cattle producer, ranked No. 2 nationally, with roughly 4.6 million cattle and calves and nearly 2 million beef cows, making it a very critical part of the U.S. beef supply chain.

So far, there has been no official word on fire-related damage to Oklahoma's cattle industry. The state is a top cattle producer, ranked No. 2 nationally, with roughly 4.6 million cattle and calves and nearly 2 million beef cows, making it a very critical part of the U.S. beef supply chain.

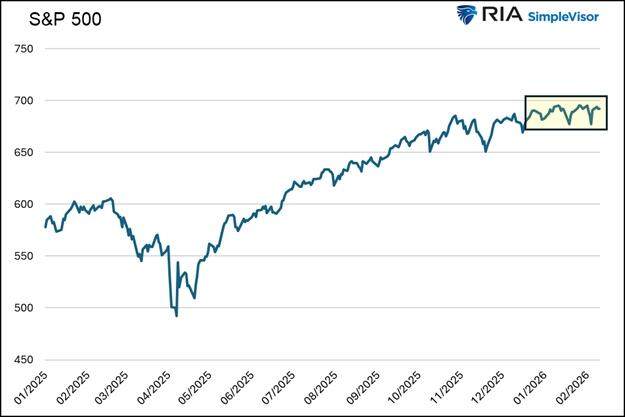

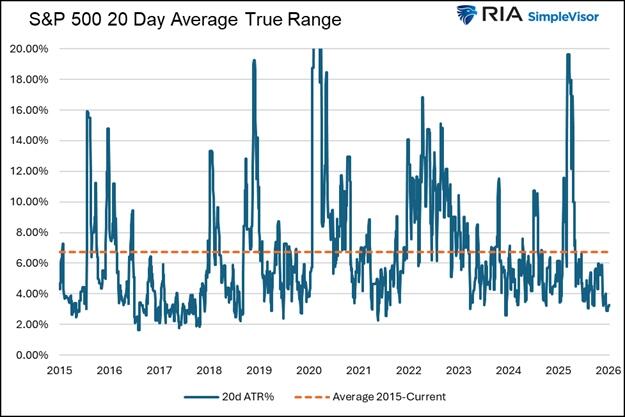

The next graph shows the average true range (ATR) for the index. ATR is a measure of realized volatility. As we define it, ATR is the percentage difference between the highest and lowest intraday prices over a rolling 20-day period. The current ATR is only about 3%, near the bottom of the range since 2015. It is also less than half the ten-year average.

The next graph shows the average true range (ATR) for the index. ATR is a measure of realized volatility. As we define it, ATR is the percentage difference between the highest and lowest intraday prices over a rolling 20-day period. The current ATR is only about 3%, near the bottom of the range since 2015. It is also less than half the ten-year average.

Both charts point to a relatively calm market with limited volatility. It’s worth noting that implied volatility (expected volatility) on the S&P 500 is around 20. While not low, it doesn’t suggest that investors expect significant volatility in the weeks ahead.

The Markets Undercurrent

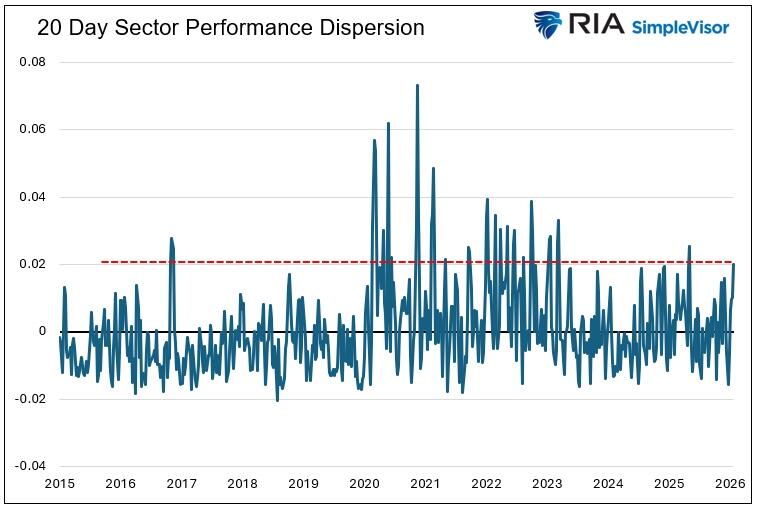

While the broad S&P 500 market index is relatively calm, its undercurrent is anything but tranquil. Significant rotation trades, characterized by heavy trading activity in and out of various sectors and factors, have led to large daily divergences in the performance of certain sectors and stock factors.

We use the dispersion of returns to quantify the market’s fierce undercurrent. For this article, we take the 20-day percentage price changes for sector and factor groups and then calculate the standard deviation of those changes. The more divergent the returns, the higher the standard deviation.

The first graph below shows that the current standard deviation of returns across all sectors is at its second-highest level since early 2023.

Both charts point to a relatively calm market with limited volatility. It’s worth noting that implied volatility (expected volatility) on the S&P 500 is around 20. While not low, it doesn’t suggest that investors expect significant volatility in the weeks ahead.

The Markets Undercurrent

While the broad S&P 500 market index is relatively calm, its undercurrent is anything but tranquil. Significant rotation trades, characterized by heavy trading activity in and out of various sectors and factors, have led to large daily divergences in the performance of certain sectors and stock factors.

We use the dispersion of returns to quantify the market’s fierce undercurrent. For this article, we take the 20-day percentage price changes for sector and factor groups and then calculate the standard deviation of those changes. The more divergent the returns, the higher the standard deviation.

The first graph below shows that the current standard deviation of returns across all sectors is at its second-highest level since early 2023.

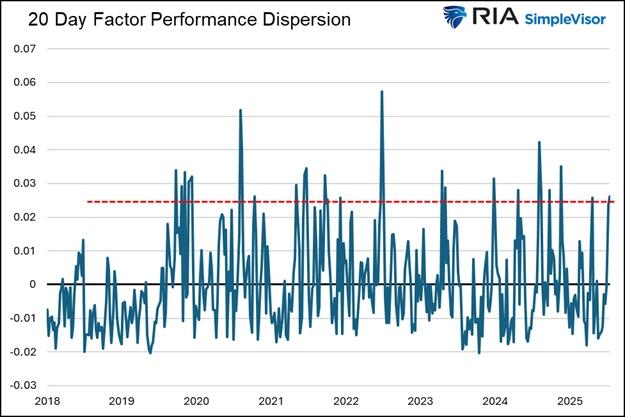

The following graph uses factors such as growth and value, market cap, and momentum. It also shows that returns among various factors are highly dispersed.

The following graph uses factors such as growth and value, market cap, and momentum. It also shows that returns among various factors are highly dispersed.

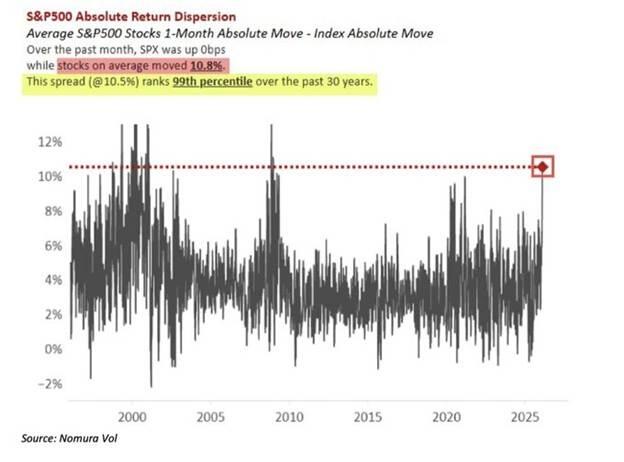

Next, we share a graph, courtesy of Nomura, that delves deeper into the recent dispersion. It compares the average move for all S&P 500 stocks over the last 20 days to that of the S&P 500 index. As the graph shows, the relative volatility of individual stock returns versus the market is now at levels last seen during the financial crisis and the dotcom crash.

Next, we share a graph, courtesy of Nomura, that delves deeper into the recent dispersion. It compares the average move for all S&P 500 stocks over the last 20 days to that of the S&P 500 index. As the graph shows, the relative volatility of individual stock returns versus the market is now at levels last seen during the financial crisis and the dotcom crash.

Cross-Sector Correlation

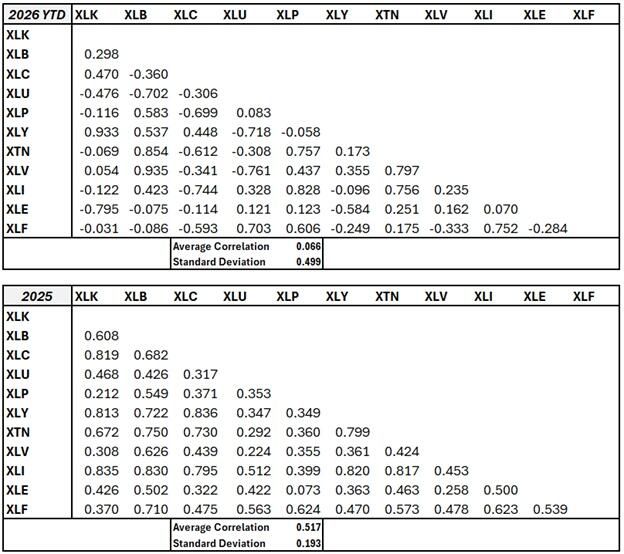

To further quantify the market’s strong undercurrent, we examine the correlation of returns among the S&P 500 sectors. The first table shows the correlation between the weekly returns thus far this year. The second table is for 2025.

Cross-Sector Correlation

To further quantify the market’s strong undercurrent, we examine the correlation of returns among the S&P 500 sectors. The first table shows the correlation between the weekly returns thus far this year. The second table is for 2025.

In 2026, the average correlation among all sectors is a mere 0.066, compared to the statistically significant 0.517 in 2025. Moreover, the standard deviation of the correlations is much greater this year than last year. This, as with the graphs above, further indicates that the various sectors are currently showing a large divergence in weekly returns compared to last year.

We also ran the average correlation from 2019 through 2025, including the tumultuous pandemic sell-off and sharp recovery, and arrived at an average correlation of .68 and a standard deviation of .175.

Our Takeaway

The market’s surface may look calm, but beneath it, passive investors are actively shifting between narratives, valuations, and risk exposures. This reflects changing sentiment among investors about economic growth, inflation, monetary and fiscal policy, and the current political leadership.

Historically, periods of elevated sector dispersion tend to occur during market transitions rather than steadily trending bull or bear markets. However, high dispersion after a long bullish trend is not automatically bearish. It may just represent the market searching for its next regime rather than distress.

Furthermore, as we shared, high sector and factor dispersion is occurring alongside low cross-sector correlations. Typically, correlations between stocks are high during periods of crisis. As the old saying goes, “correlations go to one during a crisis.”

Therefore, if correlations begin to rise and the market heads lower, the recent bout of high dispersion may not be a lasting shift in investor preferences but an omen of a downward trend.

Summary

Periods of high return dispersion are an opportunity for investors. As return performance gaps widen and valuation spreads develop, the ability to quantify the current rotation regime and anticipate the next one can deliver outperformance relative to the broader index.

While the calm market undercurrent is fierce, it is in and of itself not of great concern. But, as we noted earlier, if we start to see returns among sectors and factors become more aligned, especially downwardly, our concern will heighten.

In 2026, the average correlation among all sectors is a mere 0.066, compared to the statistically significant 0.517 in 2025. Moreover, the standard deviation of the correlations is much greater this year than last year. This, as with the graphs above, further indicates that the various sectors are currently showing a large divergence in weekly returns compared to last year.

We also ran the average correlation from 2019 through 2025, including the tumultuous pandemic sell-off and sharp recovery, and arrived at an average correlation of .68 and a standard deviation of .175.

Our Takeaway

The market’s surface may look calm, but beneath it, passive investors are actively shifting between narratives, valuations, and risk exposures. This reflects changing sentiment among investors about economic growth, inflation, monetary and fiscal policy, and the current political leadership.

Historically, periods of elevated sector dispersion tend to occur during market transitions rather than steadily trending bull or bear markets. However, high dispersion after a long bullish trend is not automatically bearish. It may just represent the market searching for its next regime rather than distress.

Furthermore, as we shared, high sector and factor dispersion is occurring alongside low cross-sector correlations. Typically, correlations between stocks are high during periods of crisis. As the old saying goes, “correlations go to one during a crisis.”

Therefore, if correlations begin to rise and the market heads lower, the recent bout of high dispersion may not be a lasting shift in investor preferences but an omen of a downward trend.

Summary

Periods of high return dispersion are an opportunity for investors. As return performance gaps widen and valuation spreads develop, the ability to quantify the current rotation regime and anticipate the next one can deliver outperformance relative to the broader index.

While the calm market undercurrent is fierce, it is in and of itself not of great concern. But, as we noted earlier, if we start to see returns among sectors and factors become more aligned, especially downwardly, our concern will heighten.

Vontobel analyst Jean-Philippe Bertschy told clients, "The pressure is enormous ... and full-year results have become almost anecdotal, as investors are now squarely focused on the robustness of quality controls in the infant nutrition case and on the strategic update pledged by the new management team."

Investors' attention now shifts to Thursday, when the Swiss giant reports full-year results and is expected to unveil its turnaround plan.

Bloomberg noted, "Thursday's strategy update may include a reorganization to streamline businesses. Navratil has signaled that he wants to focus on four core divisions — pet care, coffee, nutrition and health, and food and snacking — while centralizing functions such as marketing, an area the company did not invest enough in during years of short-term margin expansion."

Vontobel's Bertschy said, "It will be crucial that we receive an update on some of the under-performing units, how they want to reduce the net debt level and how they plan to accelerate the free cash flow. The market will look for a precise roadmap rather than another broad reassurance – a plan that is clearly underpinned by concrete actions, milestones and measurable commitments."

Vontobel analyst Jean-Philippe Bertschy told clients, "The pressure is enormous ... and full-year results have become almost anecdotal, as investors are now squarely focused on the robustness of quality controls in the infant nutrition case and on the strategic update pledged by the new management team."

Investors' attention now shifts to Thursday, when the Swiss giant reports full-year results and is expected to unveil its turnaround plan.

Bloomberg noted, "Thursday's strategy update may include a reorganization to streamline businesses. Navratil has signaled that he wants to focus on four core divisions — pet care, coffee, nutrition and health, and food and snacking — while centralizing functions such as marketing, an area the company did not invest enough in during years of short-term margin expansion."

Vontobel's Bertschy said, "It will be crucial that we receive an update on some of the under-performing units, how they want to reduce the net debt level and how they plan to accelerate the free cash flow. The market will look for a precise roadmap rather than another broad reassurance – a plan that is clearly underpinned by concrete actions, milestones and measurable commitments."

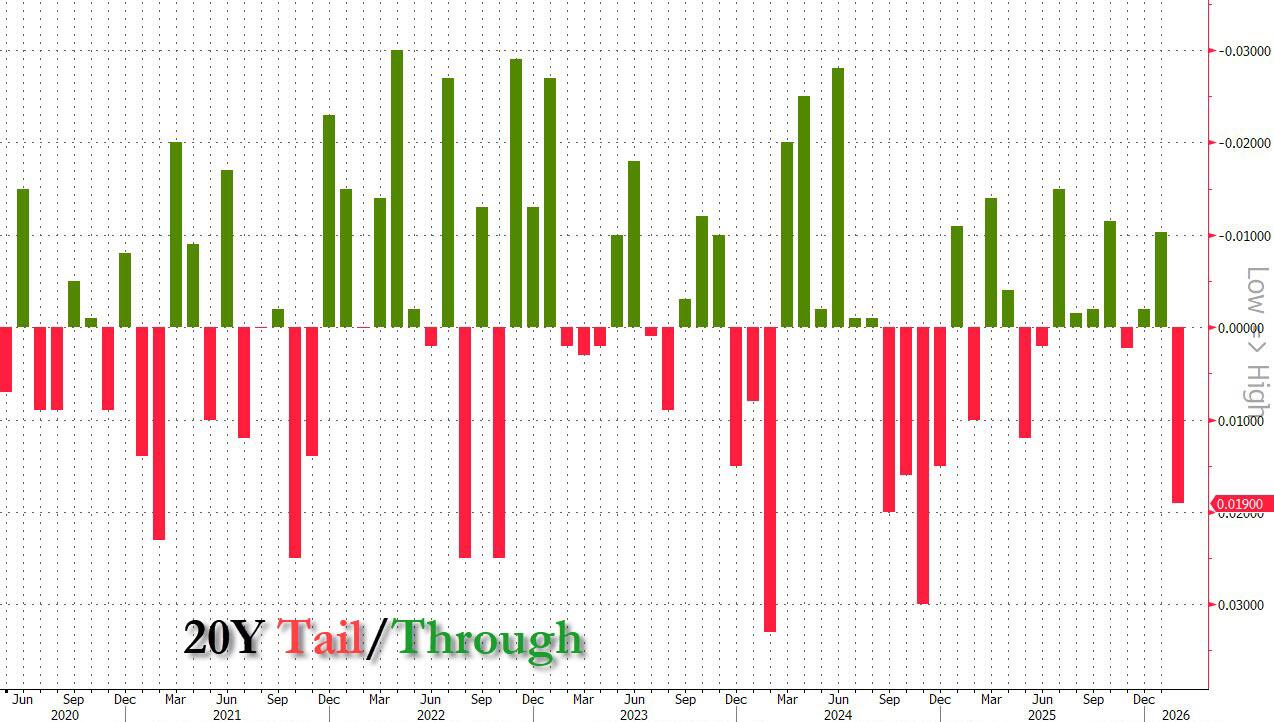

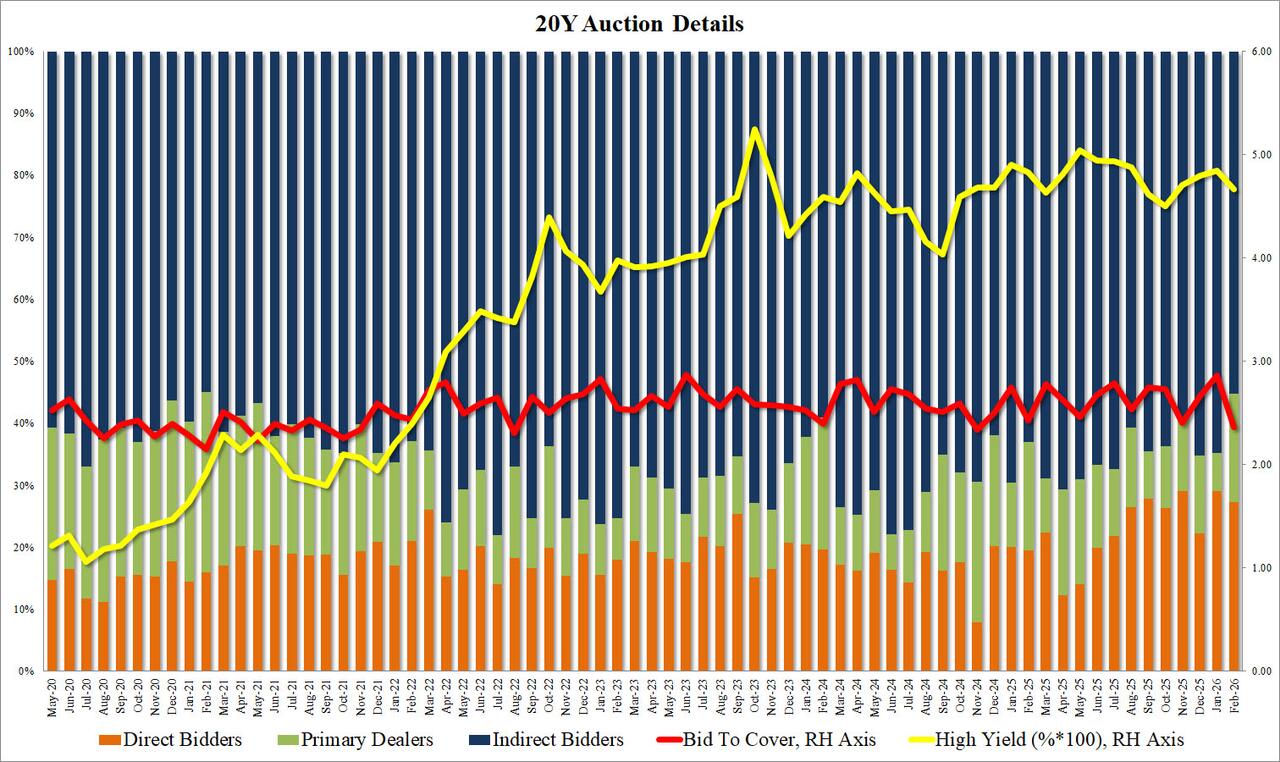

Going down the list, the Cid to Cover tumbled to 2.36 from 2.86 (one of the highest on record), the lowest btc since (also) November 2024.

The internals were also dismal, as foreign buyers fled. Indirects took down just 55.167%, down from 64.715% in January and the second lowest on record (only Feb 2021 was worse).

Going down the list, the Cid to Cover tumbled to 2.36 from 2.86 (one of the highest on record), the lowest btc since (also) November 2024.

The internals were also dismal, as foreign buyers fled. Indirects took down just 55.167%, down from 64.715% in January and the second lowest on record (only Feb 2021 was worse).

And with Directs awarded 27.2%, down from 29.1% in January but above the recent average of 26.9%, Dealers were left with 17.6%, the highest since December 2024.

And with Directs awarded 27.2%, down from 29.1% in January but above the recent average of 26.9%, Dealers were left with 17.6%, the highest since December 2024.

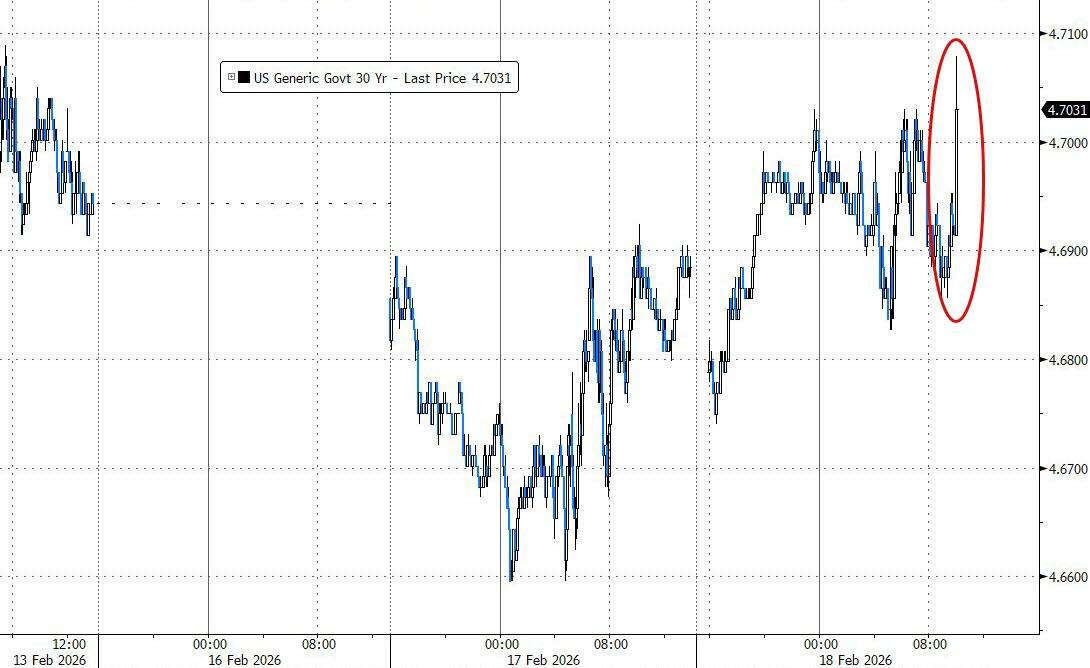

Overall, this was an extremely ugly auction, and one which dragged both 10Y and 30Y yields to session highs after the break.

Overall, this was an extremely ugly auction, and one which dragged both 10Y and 30Y yields to session highs after the break.

Cardinal Pietro Parolin, the Holy See Secretary of State, told a press briefing that the Vatican is left "perplexed" by some points of the plan - meaning that "critical issues" must be resolved for the Vatican to seriously consider it.

Leo's invitation was first extended by the US administration last month. The plan is for Trump himself chair the board on an indefinite basis - and Washington's deep investment involvement has raised eyebrows across the Arab world. Many Arab officials and especially the Palestinians see it as a 'neo-colonial project' aimed at further solidifying Israel's hold over the Strip, and toward finally pushing the native inhabitants out forever.

A chief concern of the Roman Catholic Church "is that at the international level it should above all be the UN that manages these crisis situations. This is one of the points on which we have insisted."

The Vatican will not "participate in the Board of Peace because of its particular nature, which is evidently not that of other States" - the statement indicated, while Italy and the European Union will participate as mere observers.

Some other key European states agree with the Pope's

Cardinal Pietro Parolin, the Holy See Secretary of State, told a press briefing that the Vatican is left "perplexed" by some points of the plan - meaning that "critical issues" must be resolved for the Vatican to seriously consider it.

Leo's invitation was first extended by the US administration last month. The plan is for Trump himself chair the board on an indefinite basis - and Washington's deep investment involvement has raised eyebrows across the Arab world. Many Arab officials and especially the Palestinians see it as a 'neo-colonial project' aimed at further solidifying Israel's hold over the Strip, and toward finally pushing the native inhabitants out forever.

A chief concern of the Roman Catholic Church "is that at the international level it should above all be the UN that manages these crisis situations. This is one of the points on which we have insisted."

The Vatican will not "participate in the Board of Peace because of its particular nature, which is evidently not that of other States" - the statement indicated, while Italy and the European Union will participate as mere observers.

Some other key European states agree with the Pope's

Last November, the IEA

Last November, the IEA

A fresh Wednesday report in The Wall Street Journal suggests the answer is yes - and the report goes so far as to describe that a key record-breaking $11.1 billion arms sale package to Taiwan, first announced in December of last year, is currently in limbo.

"A major U.S. arms-sales package for Taiwan is in limbo following pressure from Chinese leader Xi Jinping and concerns among some in the Trump administration that greenlighting the weapons deal would derail President Trump’s coming visit to Beijing, according to U.S. officials," WSJ writes.

The report

A fresh Wednesday report in The Wall Street Journal suggests the answer is yes - and the report goes so far as to describe that a key record-breaking $11.1 billion arms sale package to Taiwan, first announced in December of last year, is currently in limbo.

"A major U.S. arms-sales package for Taiwan is in limbo following pressure from Chinese leader Xi Jinping and concerns among some in the Trump administration that greenlighting the weapons deal would derail President Trump’s coming visit to Beijing, according to U.S. officials," WSJ writes.

The report  Vs.

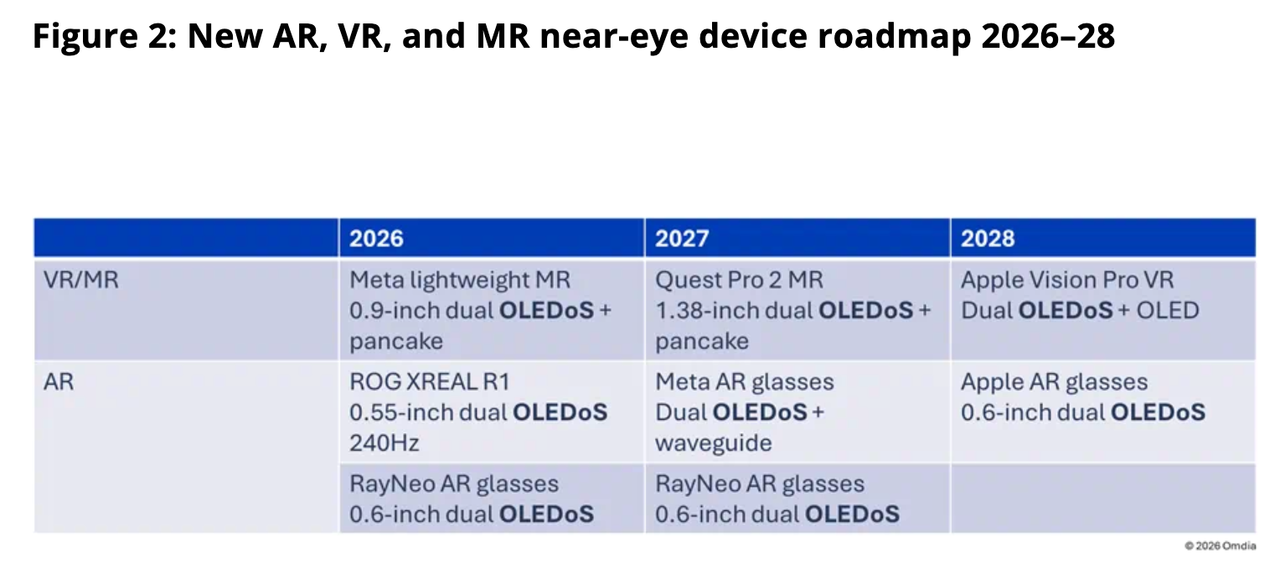

Meta smart glasses

Vs.

Meta smart glasses

Bloomberg’s Mark Gurman, citing people familiar with Apple’s product roadmap, reports that the company is accelerating work on three new wearables: smart glasses, a pendant-style device, and AirPods with expanded AI features, all centered around the Siri assistant.

However, Bloomberg reported last week that the latest upgraded version of Siri has encountered development headwinds, potentially delaying the release of several highly anticipated features.

Gurman’s report on new Apple smart glasses to take on Meta’s glasses follows a recent

Bloomberg’s Mark Gurman, citing people familiar with Apple’s product roadmap, reports that the company is accelerating work on three new wearables: smart glasses, a pendant-style device, and AirPods with expanded AI features, all centered around the Siri assistant.

However, Bloomberg reported last week that the latest upgraded version of Siri has encountered development headwinds, potentially delaying the release of several highly anticipated features.

Gurman’s report on new Apple smart glasses to take on Meta’s glasses follows a recent  We've

We've

In a note cited by CNBC, Wells Fargo analyst Ohsung Kwon said the coming refund wave may help bring back the so-called “YOLO” trade, with as much as $150 billion potentially flowing into equities and Bitcoin by the end of March. Kwon said the extra cash could be most visible among higher-income consumers.

“Speculation picks up with bigger savings…we expect YOLO to return,” wrote Wells Fargo analyst Ohsung Kwon in a Sunday

In a note cited by CNBC, Wells Fargo analyst Ohsung Kwon said the coming refund wave may help bring back the so-called “YOLO” trade, with as much as $150 billion potentially flowing into equities and Bitcoin by the end of March. Kwon said the extra cash could be most visible among higher-income consumers.

“Speculation picks up with bigger savings…we expect YOLO to return,” wrote Wells Fargo analyst Ohsung Kwon in a Sunday

Smart money trader positions through the Hyperliquid exchange, top tokens. Source: Nansen

Smart money traders were net short on Bitcoin for a cumulative $107 million, along with most of the leading cryptocurrencies excluding Avalanche, according to crypto intelligence platform Nansen.

Still, whales acquired over $41.9 million worth of spot Ether tokens across 22 wallets during the past week, marking a 1.7-fold increase in the spot purchases of this cohort.

Smart money trader positions through the Hyperliquid exchange, top tokens. Source: Nansen

Smart money traders were net short on Bitcoin for a cumulative $107 million, along with most of the leading cryptocurrencies excluding Avalanche, according to crypto intelligence platform Nansen.

Still, whales acquired over $41.9 million worth of spot Ether tokens across 22 wallets during the past week, marking a 1.7-fold increase in the spot purchases of this cohort.

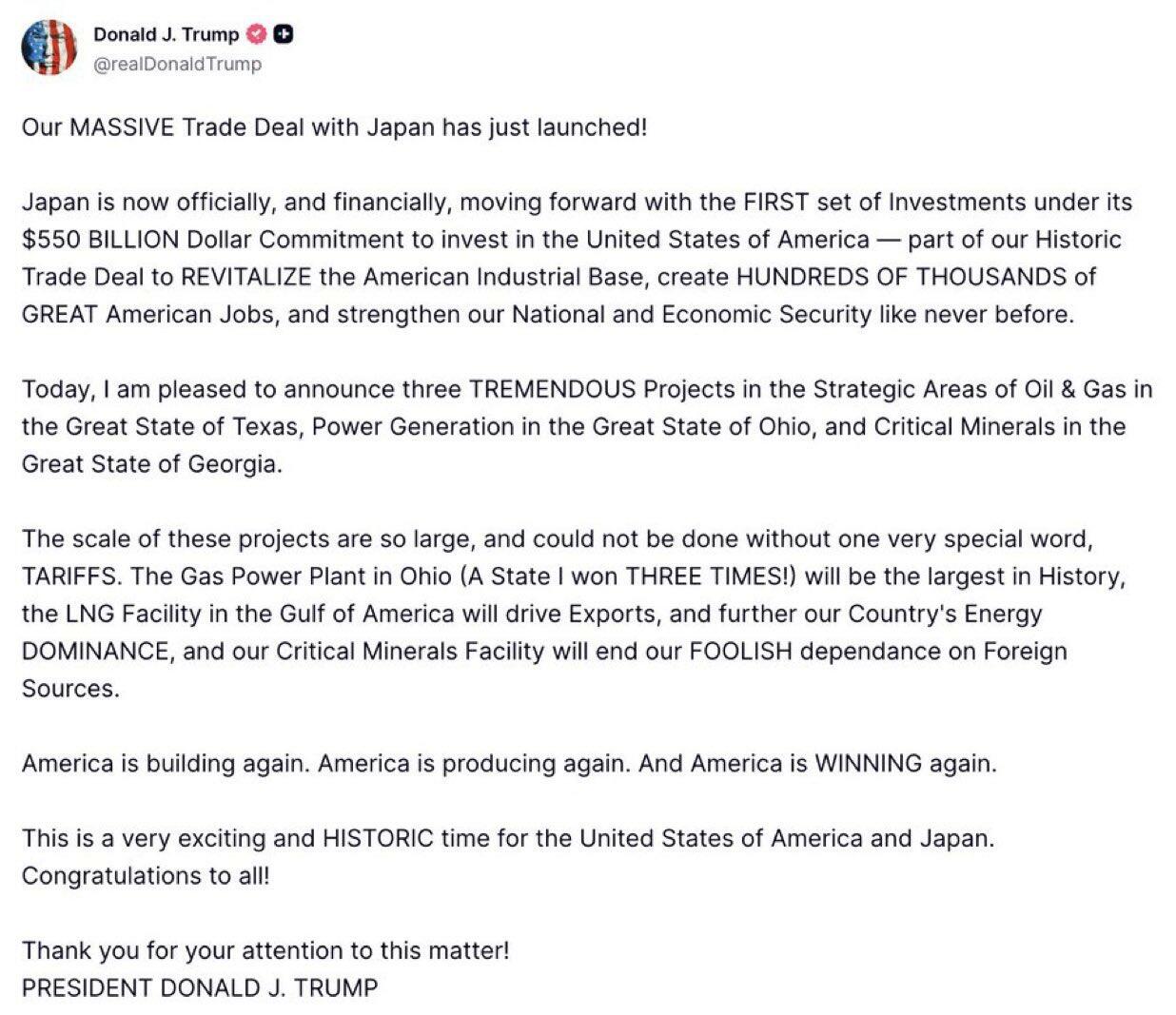

This is to include a synthetic industrial diamond manufacturing facility located in the US state of Georgia. According to a newly published

This is to include a synthetic industrial diamond manufacturing facility located in the US state of Georgia. According to a newly published  President Trump had first announced in mid-July that he reached a "massive" trade deal with Tokyo that will set tariffs on Japanese imports at 15%. This weeks marks the first time that specific large projects have been confirmed as central to the deal.

Meanwhile, Rabobank comments that the rollout of these initial three projects "is much more significant than it looks: it’s proof of concept that the US can tell trade and security partners where to place their capital back into the US, rather than them just pushing it into US stocks or bonds. Some may knock this in the same way they do US non-FTA trade deals – but they are still paying those tariffs, so will likely invest as asked."

China has been watching this unfold closely, given this for sure means deeper and deeper US military commitments to Japan - as has been a growing trend - at a moment Tokyo has been less 'neutral' regarding contested Taiwan's status and what it might be willing to do to defend the self-ruled island.

President Trump had first announced in mid-July that he reached a "massive" trade deal with Tokyo that will set tariffs on Japanese imports at 15%. This weeks marks the first time that specific large projects have been confirmed as central to the deal.

Meanwhile, Rabobank comments that the rollout of these initial three projects "is much more significant than it looks: it’s proof of concept that the US can tell trade and security partners where to place their capital back into the US, rather than them just pushing it into US stocks or bonds. Some may knock this in the same way they do US non-FTA trade deals – but they are still paying those tariffs, so will likely invest as asked."

China has been watching this unfold closely, given this for sure means deeper and deeper US military commitments to Japan - as has been a growing trend - at a moment Tokyo has been less 'neutral' regarding contested Taiwan's status and what it might be willing to do to defend the self-ruled island.

On which note, India and France just upgraded their ties to a strategic partnership – which is a win for France but complicates the EU moving as one on foreign policy as we move towards a possible multi-tier Europe. It also has interesting implications given India’s closeness to Russia, and steely relations with Pakistan, which is in turn close to Saudi and Turkey. That’s as the UK PM, who gave a pugnacious speech in Munich and returned to push for 3% of GDP defense spending by 2029, suffered his latest of blow as Chancellor Reeves blocked that move.

The US also hardened its allegations that China just conducted a secret nuclear test, speaking to our tense geopolitical backdrop. In Peru, Congress ousted President Jeri after just four months in office because of China-linked meetings: another win for the Donroe Doctrine, it seems.

In geoeconomics, the US announced the first three projects under Japan's $550bn trade deal, which will include around $33bn for an LNG-powered plant, a crude oil facility and a synthetic industrial diamonds plant. This is much more significant than it looks: it’s proof of concept that the US can tell trade and security partners where to place their capital back into the US, rather than them just pushing it into US stocks or bonds. Some may knock this in the same way they do US non-FTA trade deals – but they are still paying those tariffs, so will likely invest as asked.

The recent Trump-Milei trade pact is placing pressure on the EU to act on its Mercosur FTA, now only being applied provisionally. The Trump deal with Argentina overrides it in some places, underlining the argument that Donroe Doctrine > technocratic FTA when push comes to shove.

The EU is stating it could move ahead with a Russian oil services ban without G7 support, but Malta and Greece won't back the measure unless the US also gets on board – so how does the EU ignore their lack of support?

In terms of key political developments, New York Mayor Mamdani just warned of a nearly 10% property-tax increase if he can’t soak the wealthy instead; Sergey Brin is backing a group trying to undercut California’s proposed billionaire tax; and the UK’s HMRC has hired 1,000 valuation officials ahead of its imposition of a ‘mansion tax’.

Also telling given AI hasn’t started to wreak havoc yet, Politico reports that ‘1 in 5 Europeans say dictatorship might be preferable’ – with the caveat that many don’t dislike it in principle, just how it works in practice. That’s OK then. The same media talks of ‘Macron’s mission: Le Pen-proof France before the 2027 election’, while warning that this undermines the neutrality of the institutions that will need to be seen as such if current political polarisation continues to grow.

Finally, the ‘rules-based order’ cheerleader Financial Times also has an op-ed arguing ‘Perhaps we should all be banned from social media’ because “Focusing only on under-16s obscures the lack of internet safeguards for everyone else”. One can start to pick up a certain Luddite-ism in the zeitgeist. That’s both understandable, and predictable. Yet it surely won’t apply globally, which will only increase the growing differences within and between our societies and economies.

Markets should prepare for far greater volatility – and not just because two people at the Fed don’t buy the Warsh case for lower rates.

On which note, India and France just upgraded their ties to a strategic partnership – which is a win for France but complicates the EU moving as one on foreign policy as we move towards a possible multi-tier Europe. It also has interesting implications given India’s closeness to Russia, and steely relations with Pakistan, which is in turn close to Saudi and Turkey. That’s as the UK PM, who gave a pugnacious speech in Munich and returned to push for 3% of GDP defense spending by 2029, suffered his latest of blow as Chancellor Reeves blocked that move.

The US also hardened its allegations that China just conducted a secret nuclear test, speaking to our tense geopolitical backdrop. In Peru, Congress ousted President Jeri after just four months in office because of China-linked meetings: another win for the Donroe Doctrine, it seems.

In geoeconomics, the US announced the first three projects under Japan's $550bn trade deal, which will include around $33bn for an LNG-powered plant, a crude oil facility and a synthetic industrial diamonds plant. This is much more significant than it looks: it’s proof of concept that the US can tell trade and security partners where to place their capital back into the US, rather than them just pushing it into US stocks or bonds. Some may knock this in the same way they do US non-FTA trade deals – but they are still paying those tariffs, so will likely invest as asked.

The recent Trump-Milei trade pact is placing pressure on the EU to act on its Mercosur FTA, now only being applied provisionally. The Trump deal with Argentina overrides it in some places, underlining the argument that Donroe Doctrine > technocratic FTA when push comes to shove.

The EU is stating it could move ahead with a Russian oil services ban without G7 support, but Malta and Greece won't back the measure unless the US also gets on board – so how does the EU ignore their lack of support?

In terms of key political developments, New York Mayor Mamdani just warned of a nearly 10% property-tax increase if he can’t soak the wealthy instead; Sergey Brin is backing a group trying to undercut California’s proposed billionaire tax; and the UK’s HMRC has hired 1,000 valuation officials ahead of its imposition of a ‘mansion tax’.

Also telling given AI hasn’t started to wreak havoc yet, Politico reports that ‘1 in 5 Europeans say dictatorship might be preferable’ – with the caveat that many don’t dislike it in principle, just how it works in practice. That’s OK then. The same media talks of ‘Macron’s mission: Le Pen-proof France before the 2027 election’, while warning that this undermines the neutrality of the institutions that will need to be seen as such if current political polarisation continues to grow.

Finally, the ‘rules-based order’ cheerleader Financial Times also has an op-ed arguing ‘Perhaps we should all be banned from social media’ because “Focusing only on under-16s obscures the lack of internet safeguards for everyone else”. One can start to pick up a certain Luddite-ism in the zeitgeist. That’s both understandable, and predictable. Yet it surely won’t apply globally, which will only increase the growing differences within and between our societies and economies.

Markets should prepare for far greater volatility – and not just because two people at the Fed don’t buy the Warsh case for lower rates.

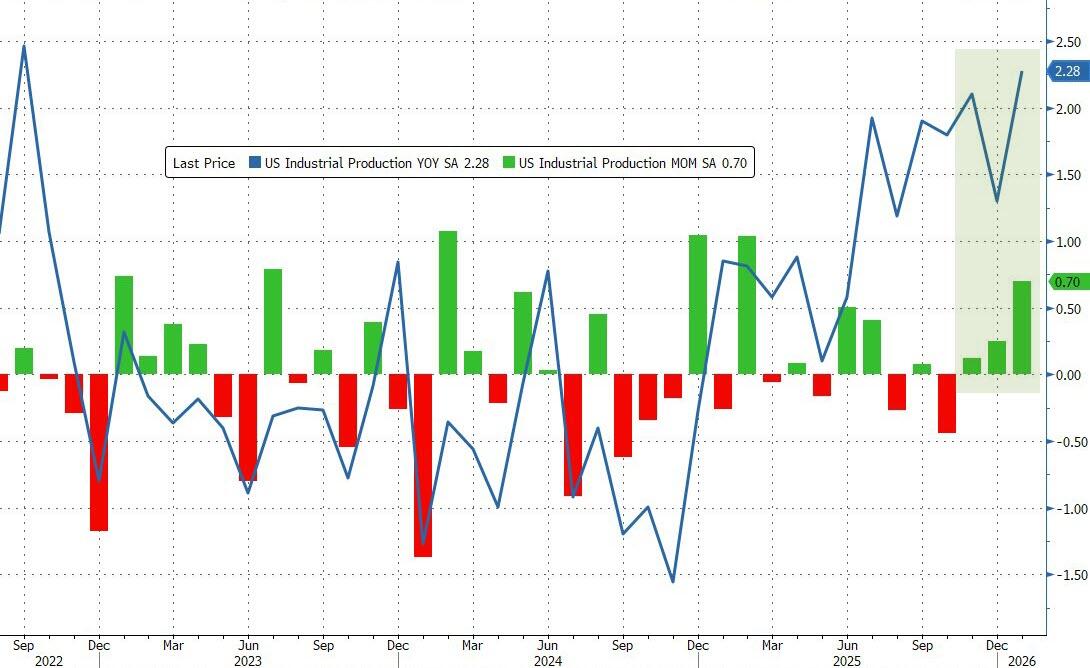

Source: Bloomberg

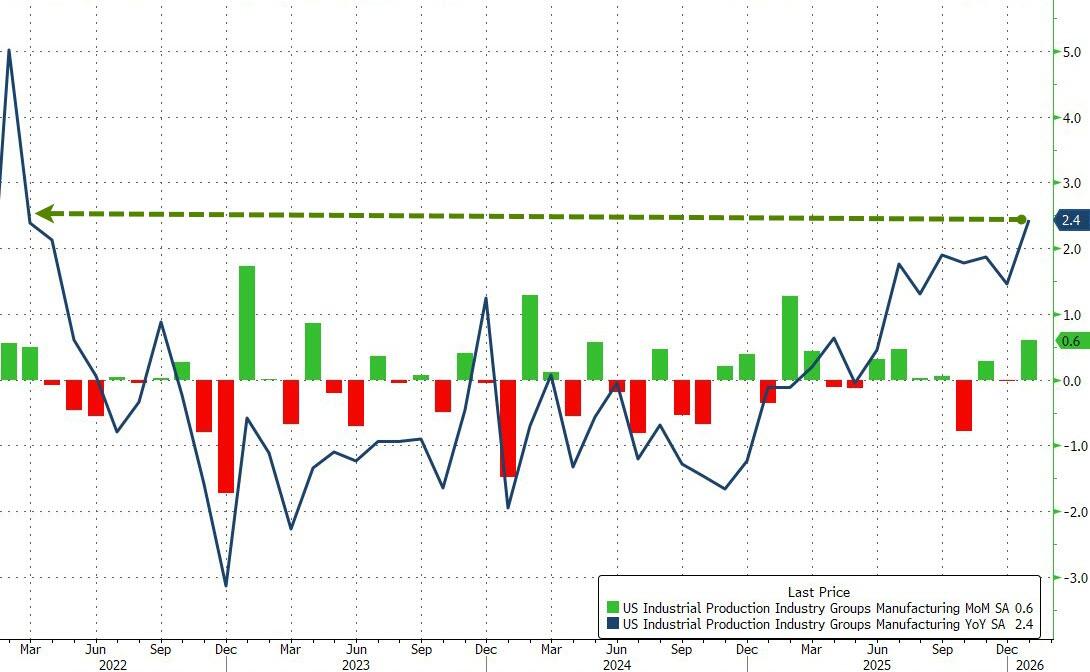

Under the hood, US Manufacturing output rose 0.6% MoM (better than the +0.4% MoM expected and best monthly gain since Feb 2025)...

Source: Bloomberg

Under the hood, US Manufacturing output rose 0.6% MoM (better than the +0.4% MoM expected and best monthly gain since Feb 2025)...

Source: Bloomberg

That is the fast annual growth in manufacturing since Feb 2022.

Capacity Utilization rose to 76.2% (below expectations),m extending the positive trend since the start of Trump's term...

Source: Bloomberg

That is the fast annual growth in manufacturing since Feb 2022.

Capacity Utilization rose to 76.2% (below expectations),m extending the positive trend since the start of Trump's term...

Source: Bloomberg

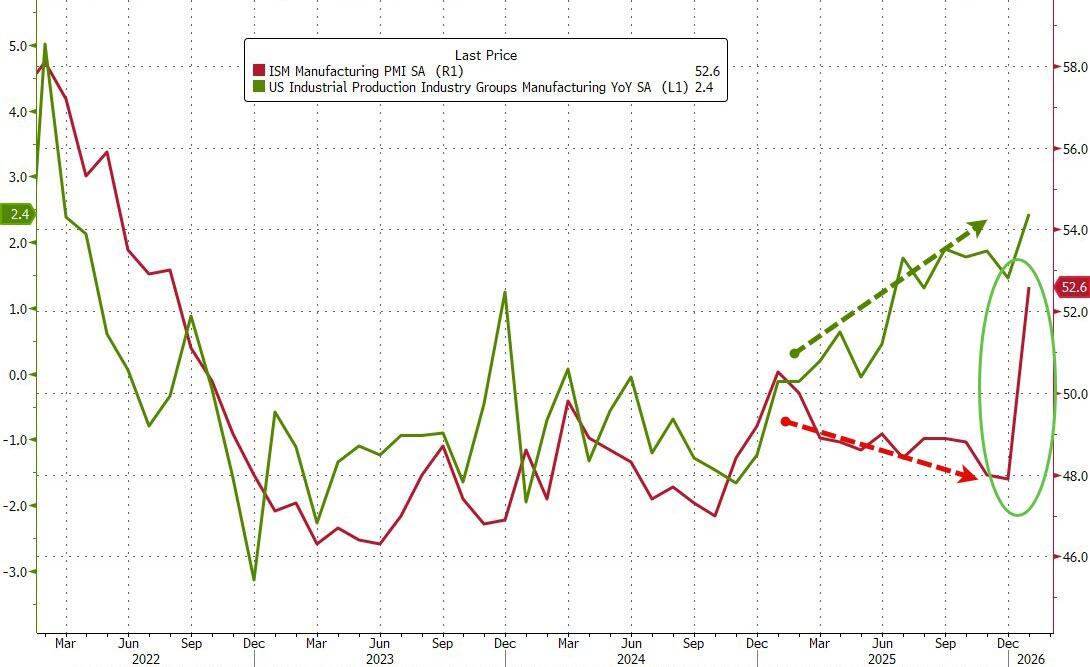

Finally, circling back to the 'soft' survey data we noted at the beginning, we note that ISM Manufacturing exploded higher in January (after decoupling from hard data all year)...

Source: Bloomberg

Finally, circling back to the 'soft' survey data we noted at the beginning, we note that ISM Manufacturing exploded higher in January (after decoupling from hard data all year)...

Does make you wonder whether any of these surveys are real? Or did the Democrats being interviewed finally throw in the towel on the doomsaying?

Does make you wonder whether any of these surveys are real? Or did the Democrats being interviewed finally throw in the towel on the doomsaying?

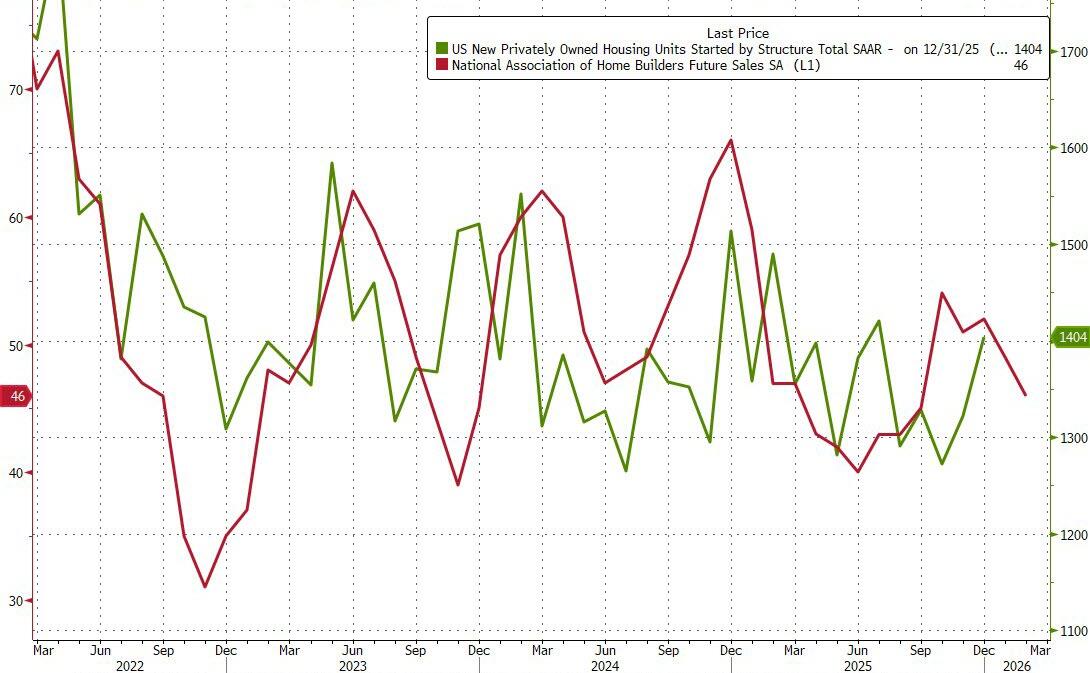

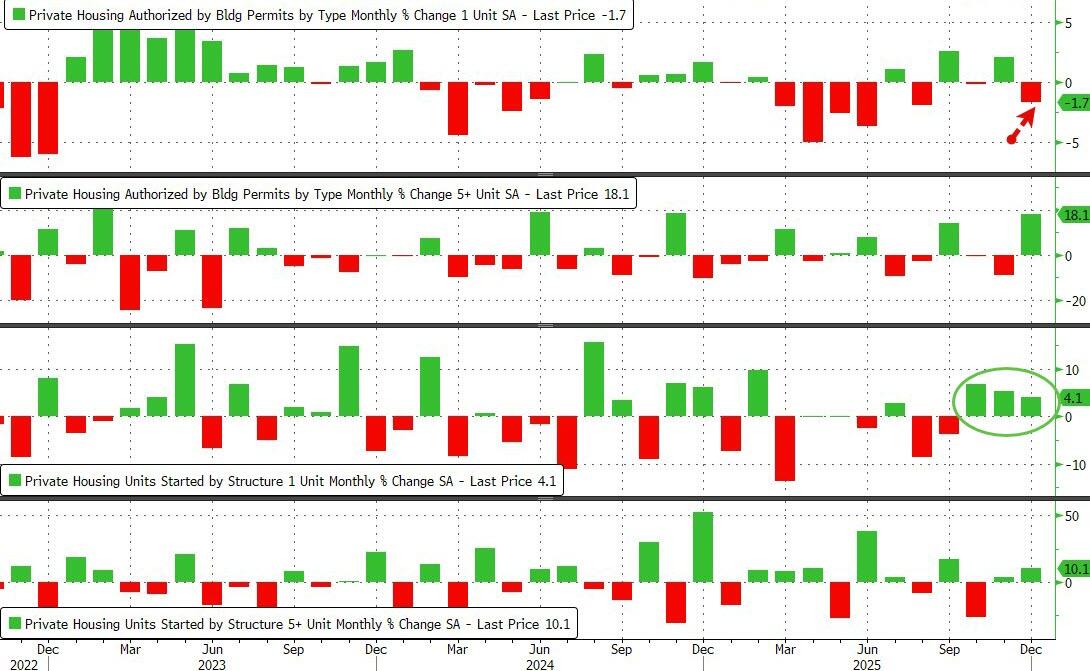

Additionally, Housing Starts rose as Home Builders confidence crumbled (and Future Sales expectations dropped)...

Additionally, Housing Starts rose as Home Builders confidence crumbled (and Future Sales expectations dropped)...

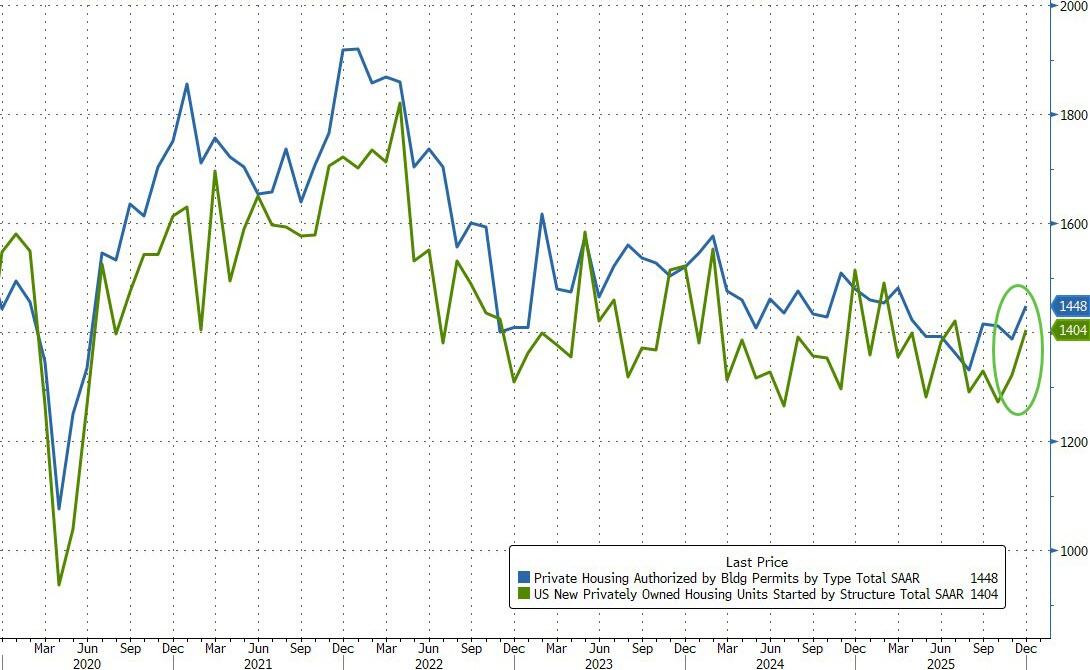

The surprise monthly surge lifted the SAAR totals for both housing sector data points to multi-month highs...

The surprise monthly surge lifted the SAAR totals for both housing sector data points to multi-month highs...

Breaking down the headline data shows that multi-family building permits and housing starts soared (+18.1% MoM and +10.1% MoM respectively) while Single-Family Building Permits tumbled 1.7% MoM while single-family starts rose for the 3rd straight month...

Breaking down the headline data shows that multi-family building permits and housing starts soared (+18.1% MoM and +10.1% MoM respectively) while Single-Family Building Permits tumbled 1.7% MoM while single-family starts rose for the 3rd straight month...

However, the pace of construction continues to decline on a year-over-year basis.

Growth in permit demand was most robust in the Northeast and West, two of the more volatile regions.

Finally, the inventory of new homes for sale remains a significant headwind for residential construction activity.

However, the pace of construction continues to decline on a year-over-year basis.

Growth in permit demand was most robust in the Northeast and West, two of the more volatile regions.

Finally, the inventory of new homes for sale remains a significant headwind for residential construction activity.

While mortgage rates have fallen, perhaps prompting the homebuilders to take advantage...

While mortgage rates have fallen, perhaps prompting the homebuilders to take advantage...

...the fact that rate-cut expectations have tumbled suggests they 'they will not come' anytime soon, no matter how much you build.

...the fact that rate-cut expectations have tumbled suggests they 'they will not come' anytime soon, no matter how much you build.

In the “dumbed-down” environment that we find ourselves in today, it should be no surprise that “nude cruises”

In the “dumbed-down” environment that we find ourselves in today, it should be no surprise that “nude cruises”

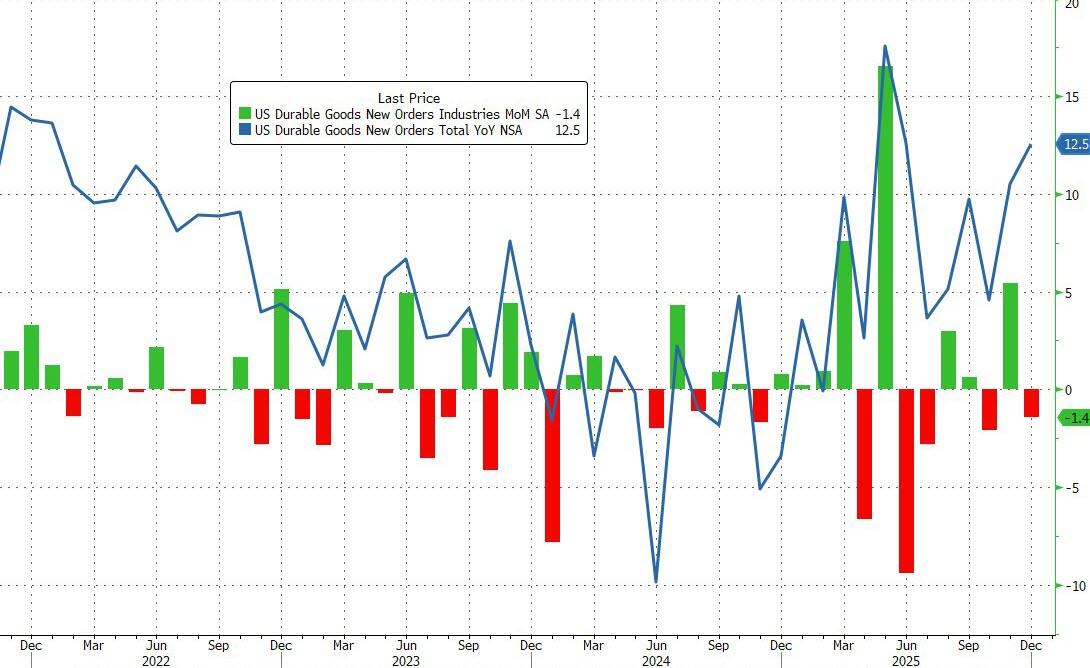

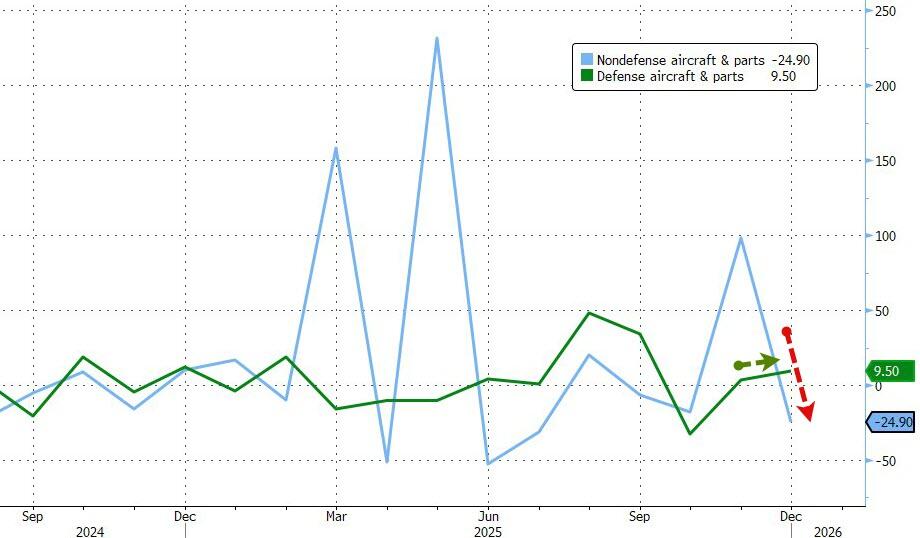

Source: Bloomberg

The headline orders print was restrained by a decline in orders for aircraft.

Source: Bloomberg

The headline orders print was restrained by a decline in orders for aircraft.

Boeing said it received more orders for its planes in December than a month earlier, but the data don’t always correlate with the planemaker’s monthly figures.

That leaves Durable Goods Orders up 12.5% YoY in 2025 - one of the biggest annual increases ever.

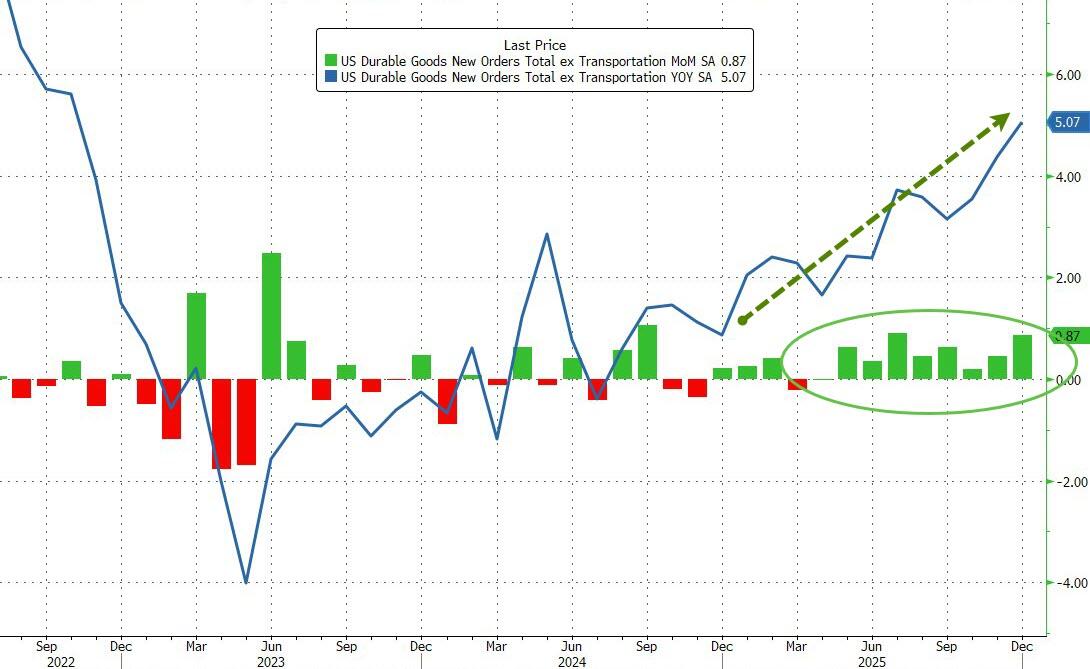

Meanwhile, Core Durable Goods Orders (ex Transports) rose 0.9% MoM (triple the +0.3% MoM expected) and the ninth straight monthly increase...

Boeing said it received more orders for its planes in December than a month earlier, but the data don’t always correlate with the planemaker’s monthly figures.

That leaves Durable Goods Orders up 12.5% YoY in 2025 - one of the biggest annual increases ever.

Meanwhile, Core Durable Goods Orders (ex Transports) rose 0.9% MoM (triple the +0.3% MoM expected) and the ninth straight monthly increase...

Source: Bloomberg

Core Orders are up over 5% YoY in 2025 - the best YoY gain since Oct 2022.

Today's data also showed the value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, surged by dramaticallly larger-than-forecast 0.9%.

Source: Bloomberg

Core Orders are up over 5% YoY in 2025 - the best YoY gain since Oct 2022.

Today's data also showed the value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, surged by dramaticallly larger-than-forecast 0.9%.

“He was basically doing anything he wanted in this state without any accountability whatsoever,” New Mexico state Representative Andrea Romero, a Democrat who co-sponsored the probe, told

“He was basically doing anything he wanted in this state without any accountability whatsoever,” New Mexico state Representative Andrea Romero, a Democrat who co-sponsored the probe, told

According to the

According to the

Epstein bought the property in 1993 and owned it until he died in a New York prison cell. In 2023, Epstein's estate sold the ranch to the family of

Epstein bought the property in 1993 and owned it until he died in a New York prison cell. In 2023, Epstein's estate sold the ranch to the family of

Early individual taxpayer refunds are moving sluggishly because of the PATH Act, which required the IRS to hold tax returns from filers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) until Feb. 15, the federal tax agency

Early individual taxpayer refunds are moving sluggishly because of the PATH Act, which required the IRS to hold tax returns from filers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) until Feb. 15, the federal tax agency

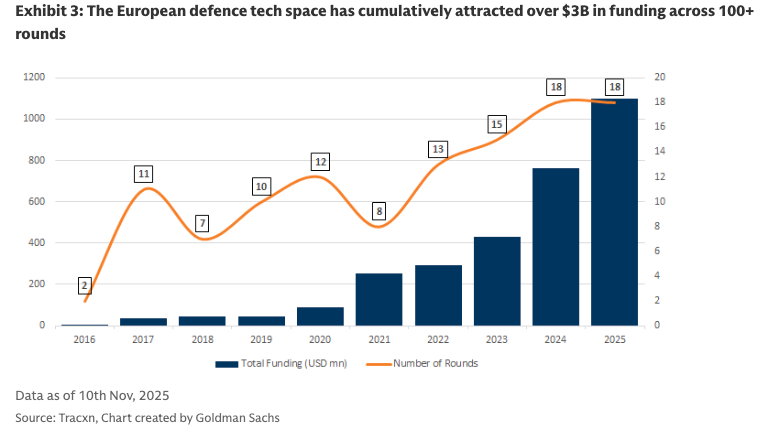

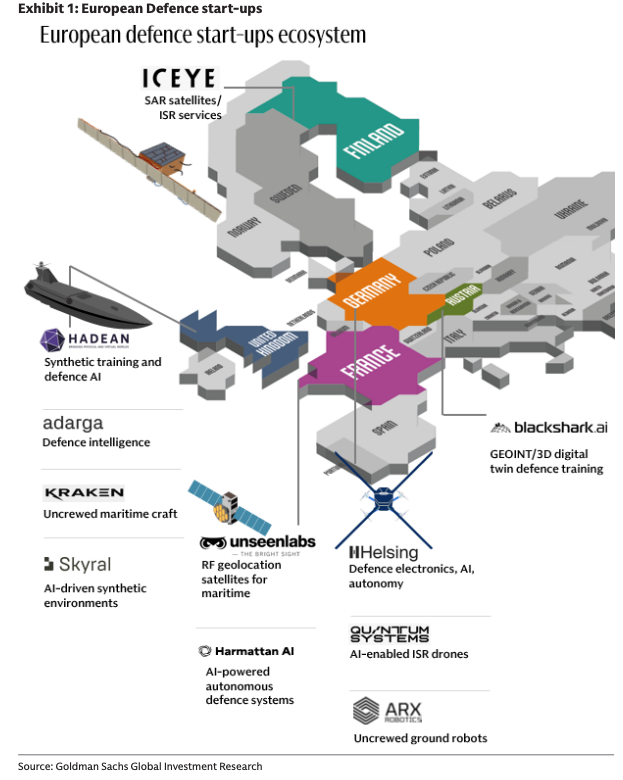

He said these startups are clustered around major innovation hubs in London, Munich, Stockholm, Paris, and Helsinki, backed by early-stage investors and public programs, including the NATO Innovation Fund and the EIF Defense Equity Facility.

Here's a visual breakdown of the EU defense startups ecosystem:

He said these startups are clustered around major innovation hubs in London, Munich, Stockholm, Paris, and Helsinki, backed by early-stage investors and public programs, including the NATO Innovation Fund and the EIF Defense Equity Facility.

Here's a visual breakdown of the EU defense startups ecosystem:

"Recent conflicts, particularly the war in Ukraine, have underscored the need for rapid technological iteration, multi-domain integration, and a digitally enabled battlefield," Burgess said.

Burgess' note is exactly on point and follows our view of the rise of war unicorn startups as big defense primes face an "adapt or die" moment, as the war in Ukraine and a surge in dual-use technologies (drones, ground bots, and AI kill chains) have pushed Secretary of War Pete Hegseth to recently announce a move to accelerate the fielding of this new technology.

Translation: The DoW under Hegseth and the rest of the procurement process are moving away from bloated legacy defense primes toward defense tech startups, creating a boom as we've characterized by the rise of war unicorns like Palmer Luckey's Anduril Industries.

The shift away from big defense primes in the DoW's procurement process comes as the war in Ukraine has given military planners and strategists an uncomfortable preview of what conflict in the 2030s could look like. It's not just about expensive stealth jets, bombers, and big, fancy missiles and cannons. It's about ground robots, drones, and consumer-grade products that can easily be weaponized.

"Recent conflicts, particularly the war in Ukraine, have underscored the need for rapid technological iteration, multi-domain integration, and a digitally enabled battlefield," Burgess said.

Burgess' note is exactly on point and follows our view of the rise of war unicorn startups as big defense primes face an "adapt or die" moment, as the war in Ukraine and a surge in dual-use technologies (drones, ground bots, and AI kill chains) have pushed Secretary of War Pete Hegseth to recently announce a move to accelerate the fielding of this new technology.

Translation: The DoW under Hegseth and the rest of the procurement process are moving away from bloated legacy defense primes toward defense tech startups, creating a boom as we've characterized by the rise of war unicorns like Palmer Luckey's Anduril Industries.

The shift away from big defense primes in the DoW's procurement process comes as the war in Ukraine has given military planners and strategists an uncomfortable preview of what conflict in the 2030s could look like. It's not just about expensive stealth jets, bombers, and big, fancy missiles and cannons. It's about ground robots, drones, and consumer-grade products that can easily be weaponized.