How The U.S. Treasury Can Cash In Big Using Its Gold Revaluation Account https://www.moneymetals.com/news/2025/02/14/how-the-us-treasury-can-cash-in-big-using-its-gold-revaluation-account-003838

Jan Nieuwenhuijs

npub1w96q...2qj7

Gold Analyst. I write stuff about gold, economics, and financial markets.

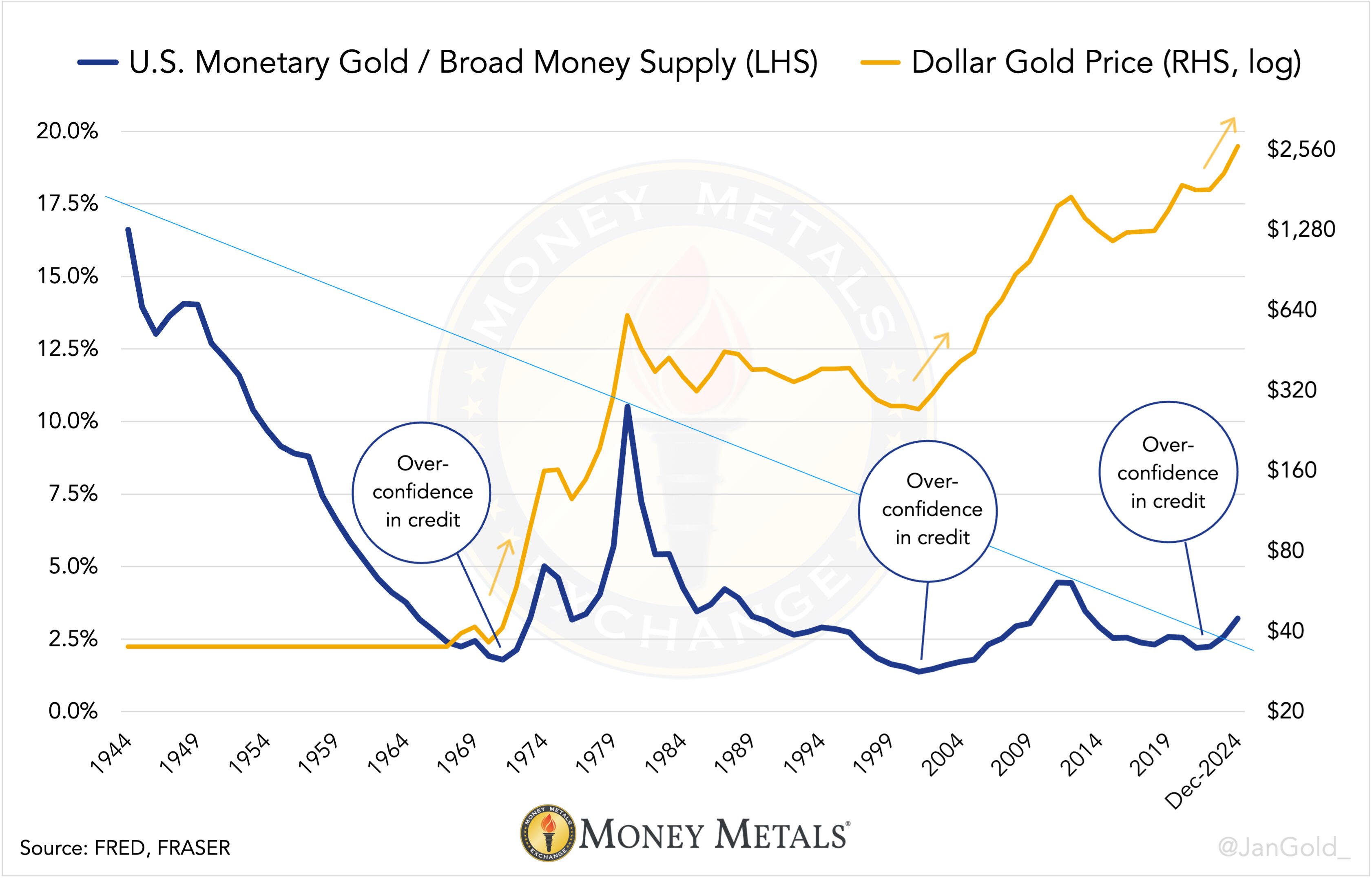

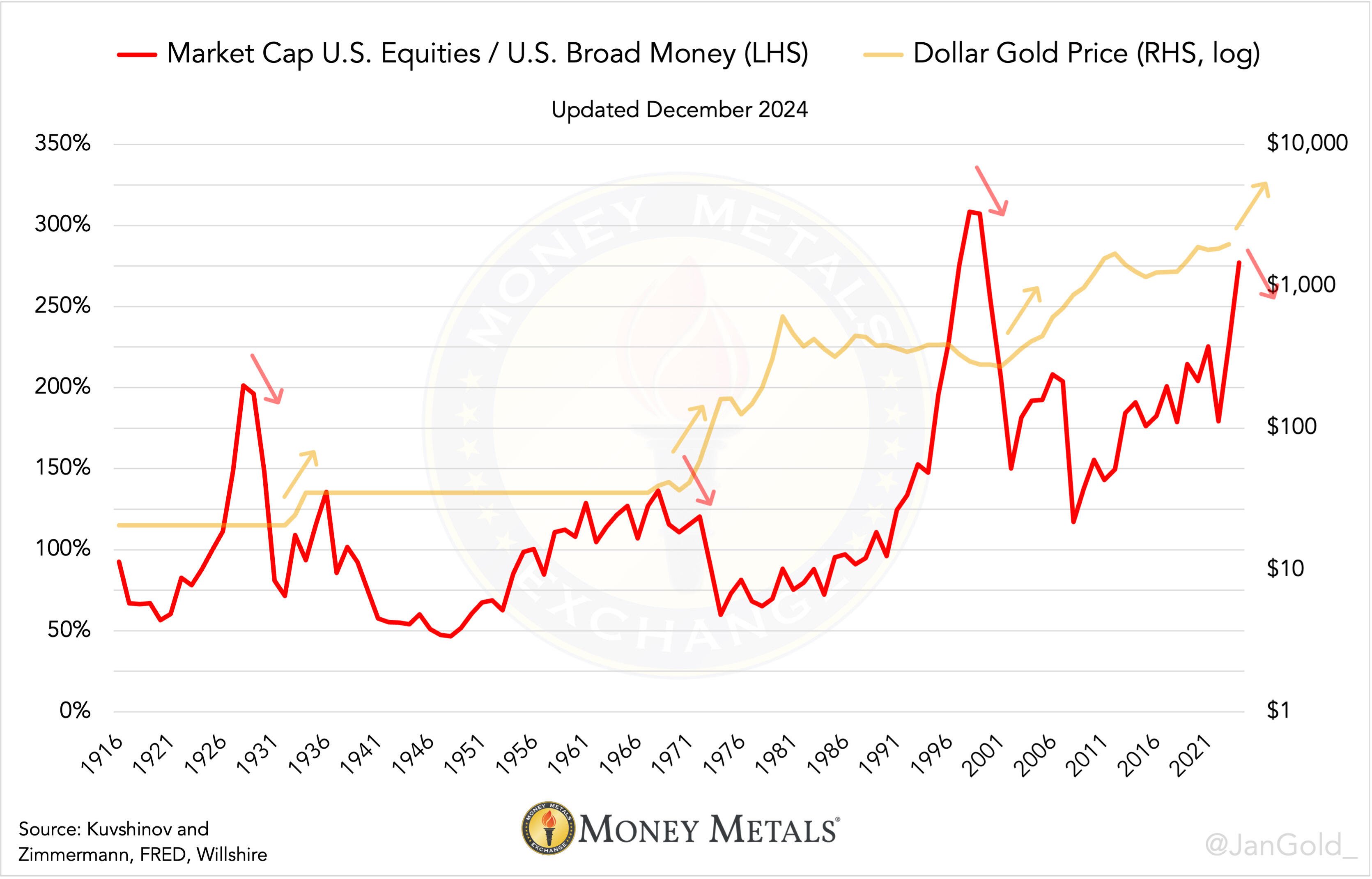

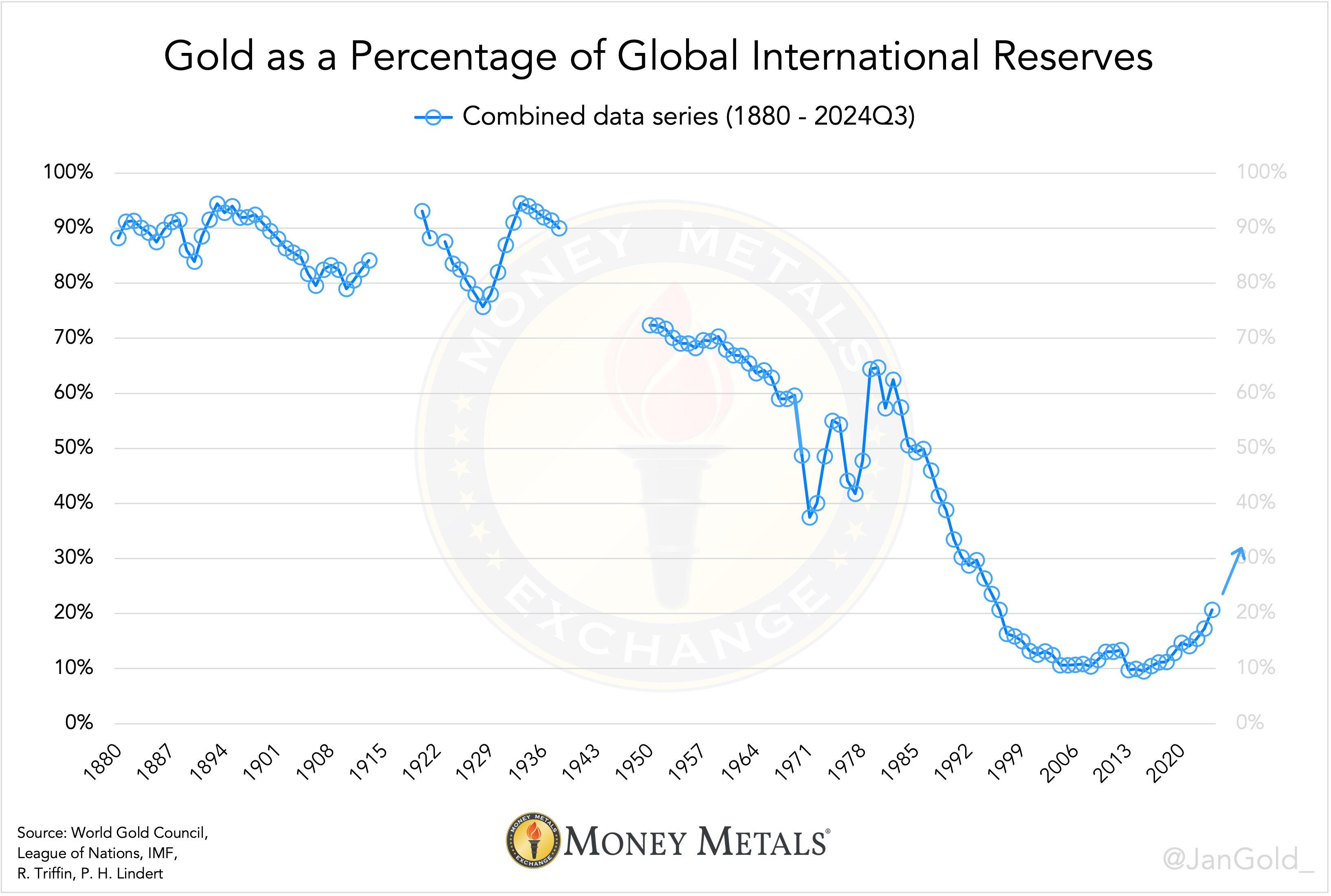

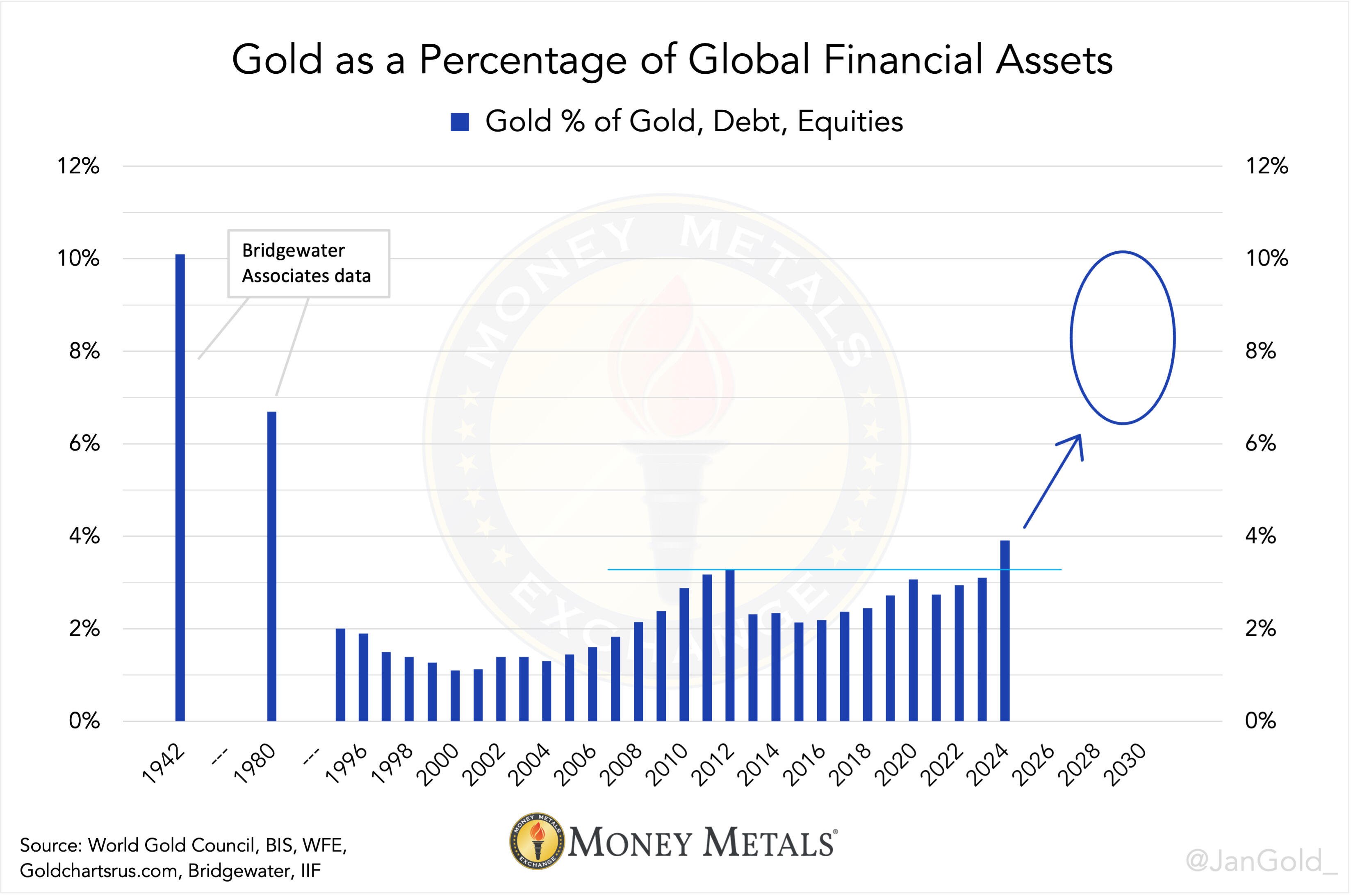

Why Gold Will Continue to Shine in 2025 and Beyond

https://www.moneymetals.com/news/2025/01/17/why-gold-will-continue-to-shine-in-2025-and-beyond-003764

Europe Is Finalizing Preparations for a Gold Standard

Countries outside the eurozone but inside the European Union, i.e., those that one day might join the eurozone—like Poland, Hungary, and the Czech Republic, are positioning for a new gold standard.

To prepare for a monetary system based on gold, they are buying gold to equalize their reserves to the eurozone average. This balancing of gold reserves in Europe is a key topic I have written about extensively.

And now, additional evidence of these plans has come out, this time from Konrad Raczkowski, former Minister of Finance of Poland.

Raczkowski recently argued official gold reserves in Europe must be evenly distributed relative to GDP, which “in the near future … will be the new gold standard.” His statement adds to a vast body of proof regarding Europe’s preparations for a gold standard.

Full article: https://www.moneymetals.com/news/2024/11/08/europe-is-finalizing-preparations-for-gold-standard-003609

Major Shift Revealed As Western Investors Suddenly Run to Gold

In the past two years, the East has been responsible for a momentous move upward in the gold price, decoupling it from the West’s pricing model. But Western investors have taken back the baton and have been driving gold higher since June 2024.

Tellingly, Western investors are abandoning their old pricing model, too. Instead of participating in the gold market for speculative reasons, they are now buying gold as a safe haven. This is highly bullish because Wall Street has little exposure to gold.

Meanwhile, on a net basis, the East is not selling. In this tight market, the gold price is sharply rising: year-to-date, it’s up more than 30%.

Full article: https://www.moneymetals.com/news/2024/10/22/major-shift-revealed-as-western-investors-suddenly-run-to-gold-003554

How France Secretly Repatriated All Its Gold Before Nixon's Dollar Devaluation

President de Gaulle of France initiated the secret operation “Vide-Gousset” and repatriated 3,313 tonnes of gold reserves from the vaults of the Federal Reserve in New York and the Bank of England in London from 1963 until 1966. De Gaulle feared America’s deficit in its balance of payments would rupture Bretton Woods and lead to a devaluation of the dollar against gold.

All France’s dollars were converted into gold and to avoid treachery the metal was repatriated over the course of three years. It took 44 boat trips and 129 flights to bring home more than three thousand tonnes of gold to the Banque de France in Paris.

France’s decision turned out extremely well. As was foreseen by the French, the price of gold in dollars increased sharply, from $35 to $800 dollars an ounce from 1968 until 1980—the dollar lost 96% of its value against gold. Countries that held on to their dollars were less fortunate.

More recently, after the Great Financial Crisis, the Banque de France repatriated 211 tonnes, upgraded all its bars to current wholesale standards, overhauled its vaults, revived Paris as a trading hub for institutional investors, and history repeats itself as we are in a gold bull market presently.

Full article: https://www.moneymetals.com/news/2024/10/05/why-france-repatriated-3313-tonnes-from-new-york-and-london-in-the-1960s-003516

PBoC Gold Conduit Revealed—Chinese Central Bank Did Not Stop Buying Gold in May

This article is an analysis of how the Chinese central bank (PBoC) buys gold in London from Western bullion banks. Because the bullion banks take care of the gold transport for the PBoC, the shipments from London to Beijing are disclosed in UK customs data. The customs data reveals that the PBoC continued to buy gold in May—when it communicated to the market it discontinued buying—at a rate of 53 tonnes. The PBoC stated it stopped buying to dampen the gold price so it could acquire more gold.

PBoC Gold Conduit Revealed—Chinese Central Bank Did Not Stop Buying Gold in May

This article is an analysis of how the Chinese central bank (PBoC) buys gold in London from Western bullion banks. Because the bullion banks take c...

Swaps, Leases, and Forwards—A Deep Dive into the Gold Wholesale Market

To gain a comprehensive understanding of the mechanics of the gold wholesale market, it's essential to be familiar with its key building blocks: swaps, leases, and forwards. In this article, we will explore these components and their interactions to be better equipped to evaluate developments in the gold market.

Read more:

Swaps, Leases, Forwards—Deep Dive into Gold Wholesale Market

In this article, we will explore swaps, leases, and forwards and their interactions to be better equipped to evaluate developments in the gold market.

Today, on July 2, 2024, the central bank of the Netherlands (DNB) invited 12 journalists to have a look inside its new gold vault at the Dutch army base near Zeist. DNB stores 190 tonnes (one third) of its gold in this vault. The central bank states it invited the journalists to show the gold is there, how it is safeguarded and serves as the asset of last resort ("insurance"). Journalists couldn't bring cameras but video images were provided by DNB. rb.gy/dzyd85

Earlier, in May 2023, DNB said "gold is the ultimate anchor of trust. If the entire financial system collapses, you still have the gold and the gold retains its value." rb.gy/fduoz4

In October 2022, DNB Governor Klaas Knot mentioned, "the balance sheet of the Dutch central banks is solid because we also have gold reserves and the gold revaluation account is more than 20 billion euros," in response to a question about DNB's losses due to unconventional monetary policy. rb.gy/vcxpgx

In April 2019 it read on DNB's website: "Gold is the perfect piggy bank – it's the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again." Although this statement was removed several years later, it can still be read on the Internet Archive. rb.gy/tekm3i

DNB allowed journalist with their own cameras in its previous vault in Amsterdam in April 2016. rb.gy/g9fbpz This was a little while after DNB had repatriated 120 tonnes from Federal Reserve Bank of New York in November 2014. shorturl.at/Ur1ZI

DNB (as well as other European and Asian central banks) is clearly pro gold and prepared for a new gold standard. rb.gy/ex9flx

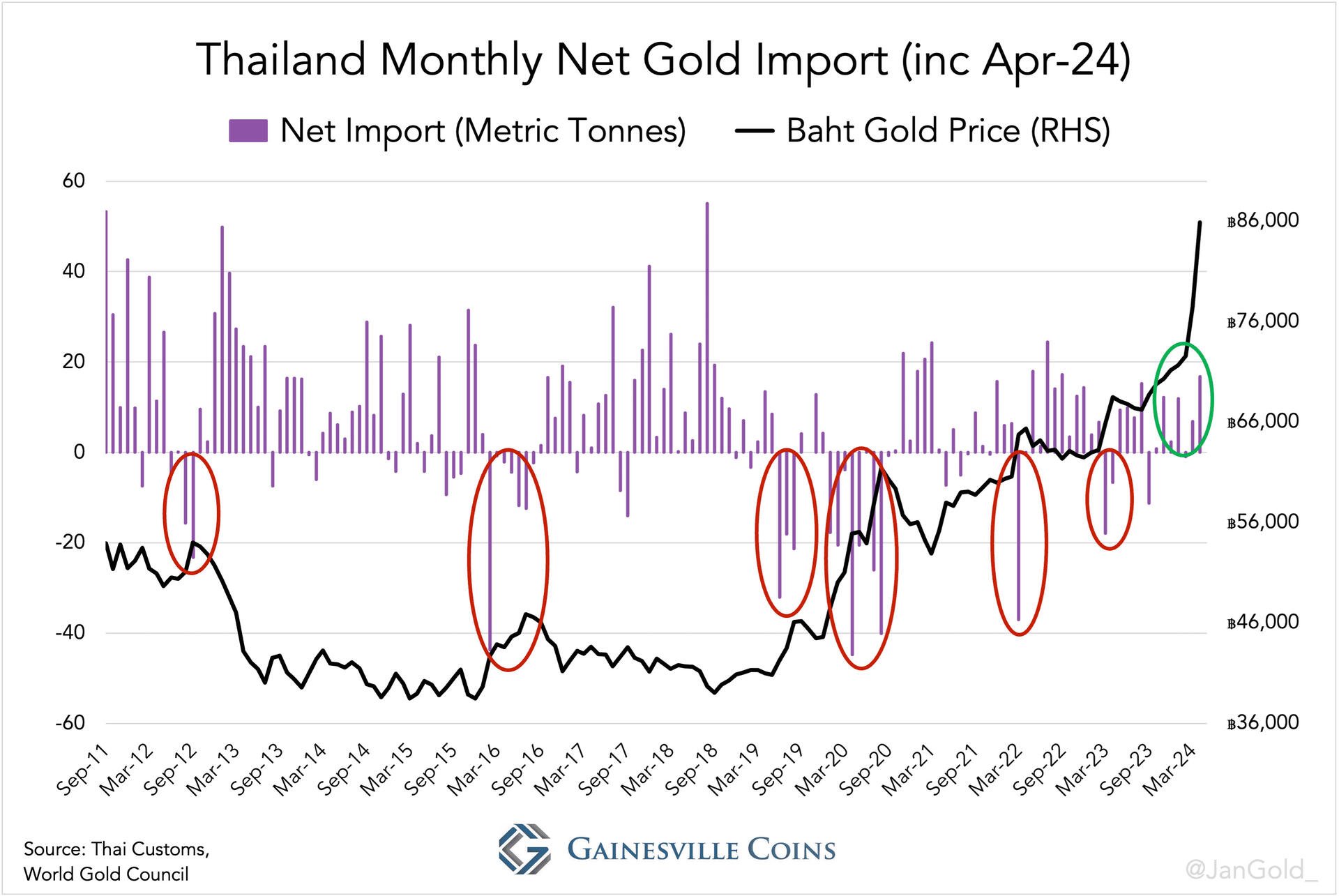

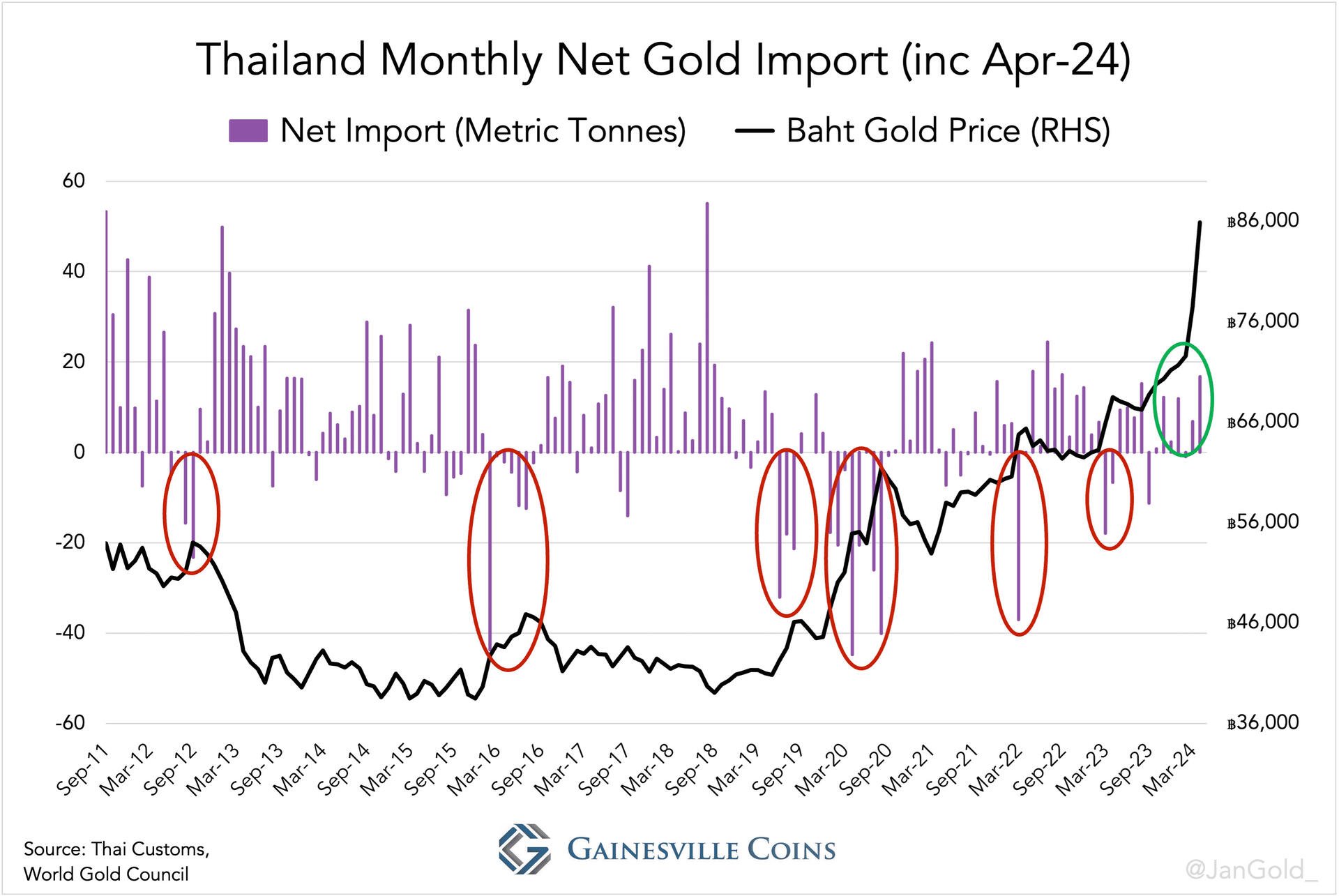

Thailand Joins China in Driving Gold Bull Market

Shedding its long-standing price sensitivity to the price of gold, Thailand is currently a gold buyer driving the price up, just like China. Present changes in the global gold market, in which pricing power is shifting East, could be a precursor to a transformation in the international monetary order. Possibly, trade in the East will settle through a system connecting local CBDCs, while any remaining imbalances are transferred in gold.

Thailand Joins China in Driving Gold Bull Market

Thailand is currently a gold buyer driving the price up, like China does. This could be a precursor to a transformation in the international moneta...

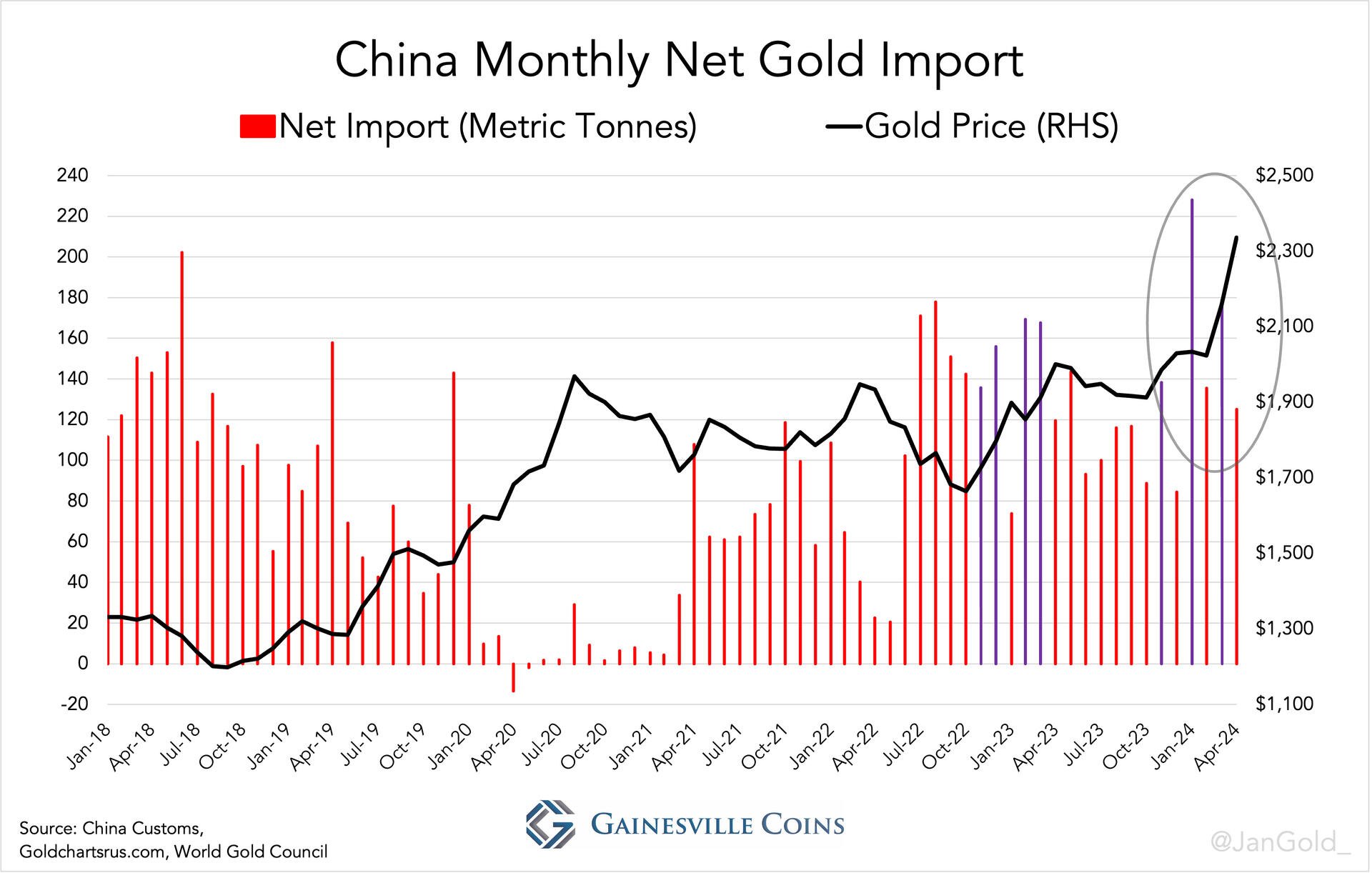

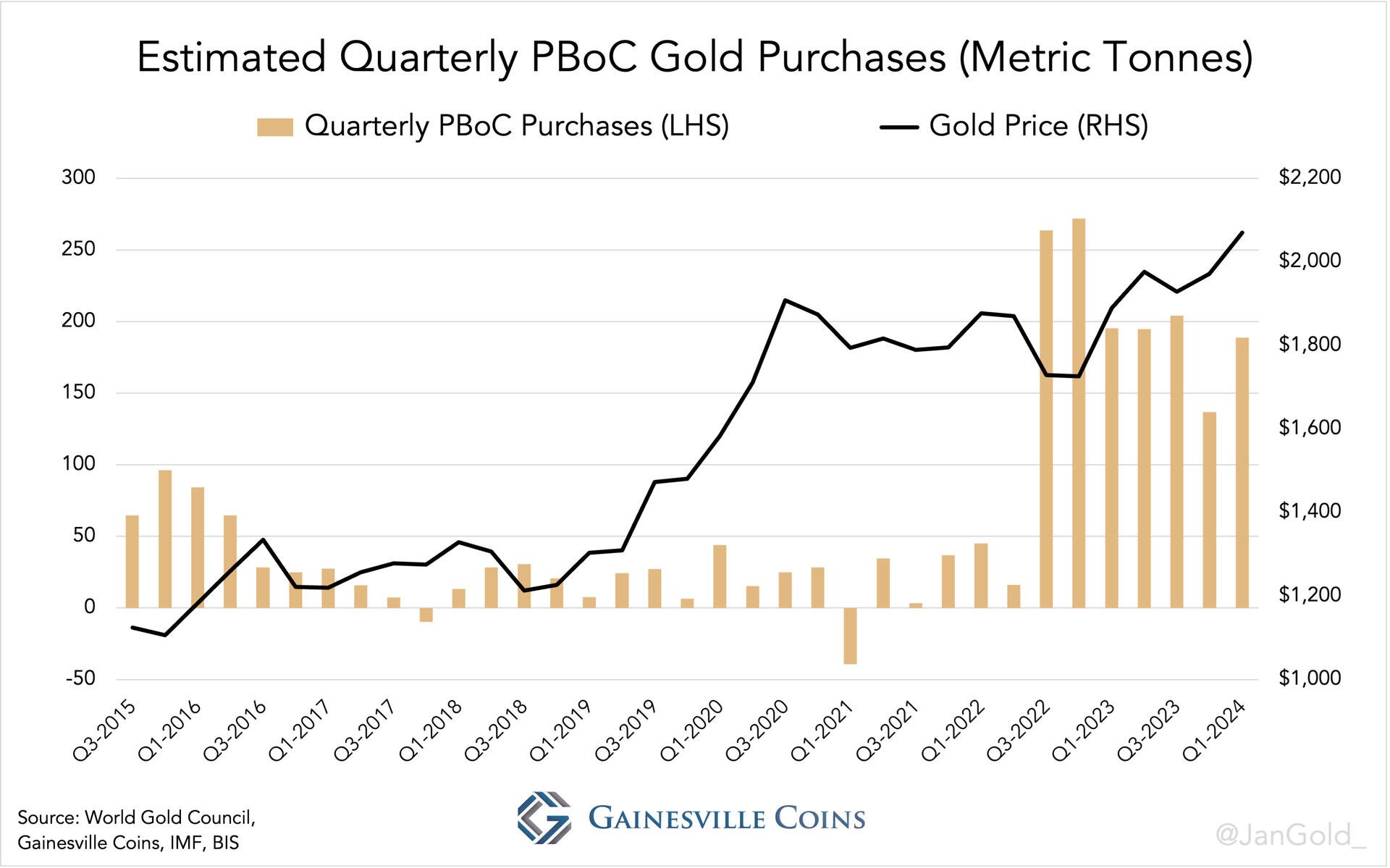

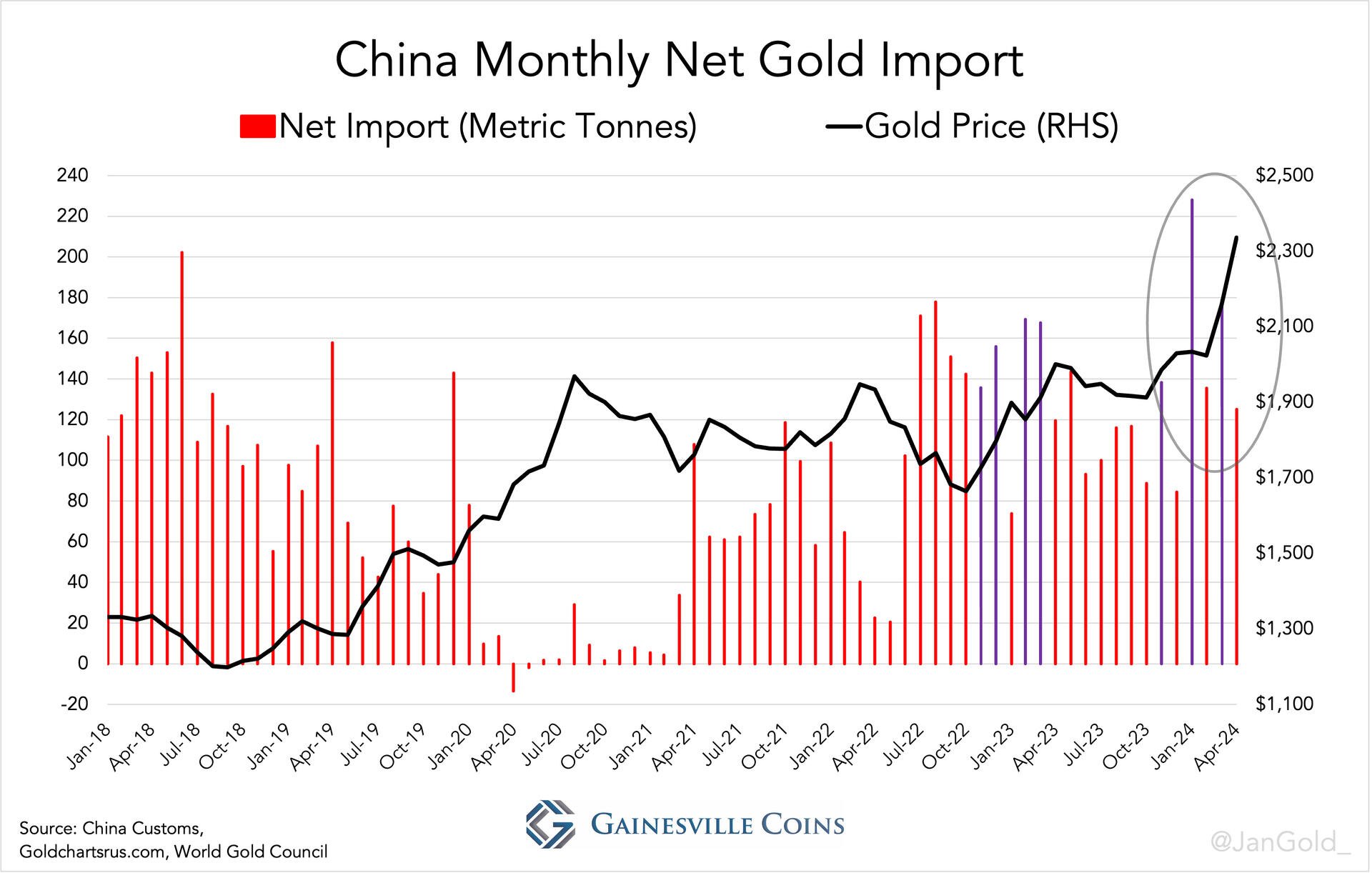

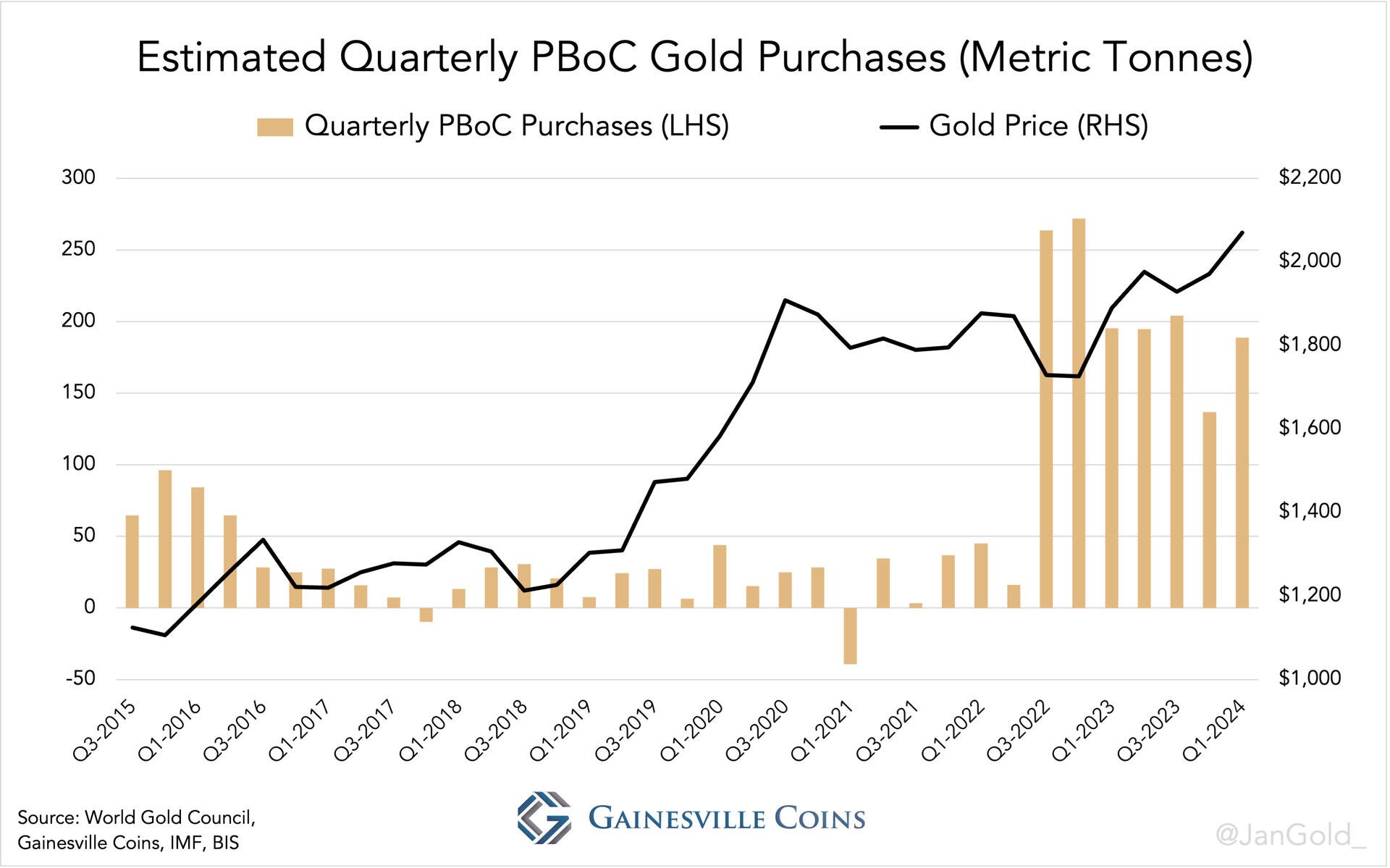

Chinese private sector gold imports accounted for 543 tonnes in the first quarter, while the People’s Bank of China (PBoC) added 189 tonnes to its reserves. Most of the PBoC’s purchases are “unreported.” China continues to be the marginal buyer in the gold market, driving up the price. I expect that China will remain a robust buyer of gold going forward in support of the price.

Exceptionally Strong PBoC and Chinese Private Sector Buying Continues to Boost Gold Price

China continues to be the marginal buyer in the gold market, driving up the price. Chinese private sector gold imports were 543 tonnes in Q1 while ...

China Has Taken Over Gold Price Control from the West

China Has Taken Over Gold Price Control from the West

The People’s Bank of China (PBoC) bought 735 tonnes of gold in 2023, most it bought covertly. This new trend has set the stage for a powerful gol...

Gold Wars: the US versus Europe During the Demise of Bretton Woods

The story on the emergence of the US dollar hegemony.

Gold Wars: the US versus Europe During the Demise of Bretton Woods

The story on the emergence of the US dollar hegemony. The United States didn’t manage to phase out gold from the system altogether, but it did su...

Polish Central Bank Buys Gold According to Secret EU Plan

Dutch Central Bank Admits It Has Prepared for a New Gold Standard

Interview reveals Dutch central bank (DNB) has equalized its gold reserves to the eurozone and rest of world. Could official gold reserves underpin...

Dutch Central Bank Admits It Has Prepared for a New Gold Standard

Dutch Central Bank Admits It Has Prepared for a New Gold Standard

Interview reveals Dutch central bank (DNB) has equalized its gold reserves to the eurozone and rest of world. Could official gold reserves underpin...

Occasionally someone is sending me 1 sat. Is that to tease me?

How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

“Central banks can use entries in their gold revaluation accounts to turn into capital, pay for expenses, or transfer it to their respective Treasuries.”

How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

In this article we will examine how central banks' gold revaluation accounts can offer solace in challenging financial environments, such as high p...

PBoC in a Hurry to Buy Gold: Covertly Bought 593t of Gold YTD

The PBoC is in a hurry to buy enormous amounts of gold, indicating it’s preparing for substantial changes in the dollar-centric international monetary system.

PBoC in a Hurry to Buy Gold: Covertly Bought 593t of Gold YTD

The PBoC is buying enormous amounts of gold, +80% year-on-year, indicating it’s preparing for changes in the dollar-centric international monetar...

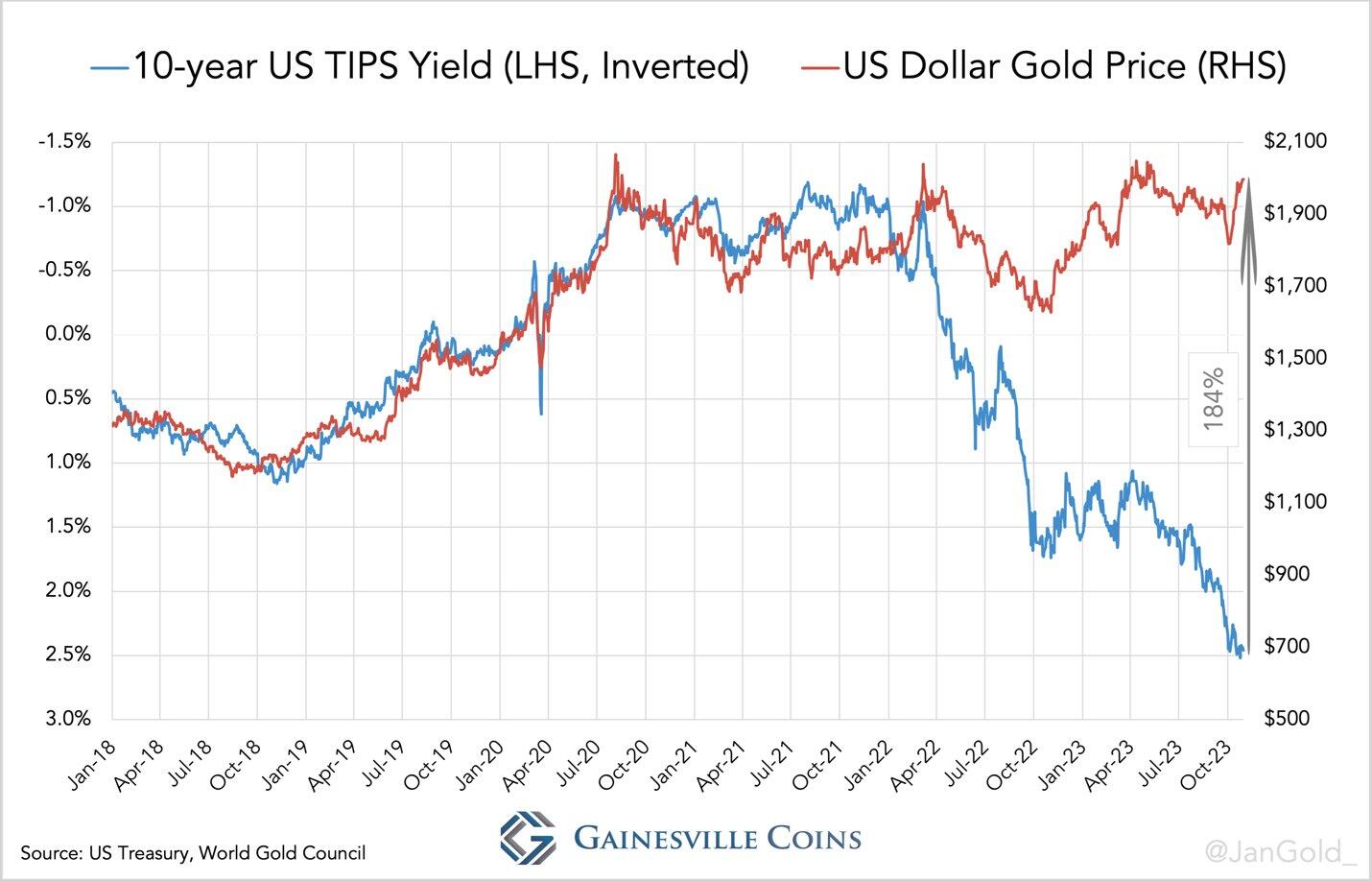

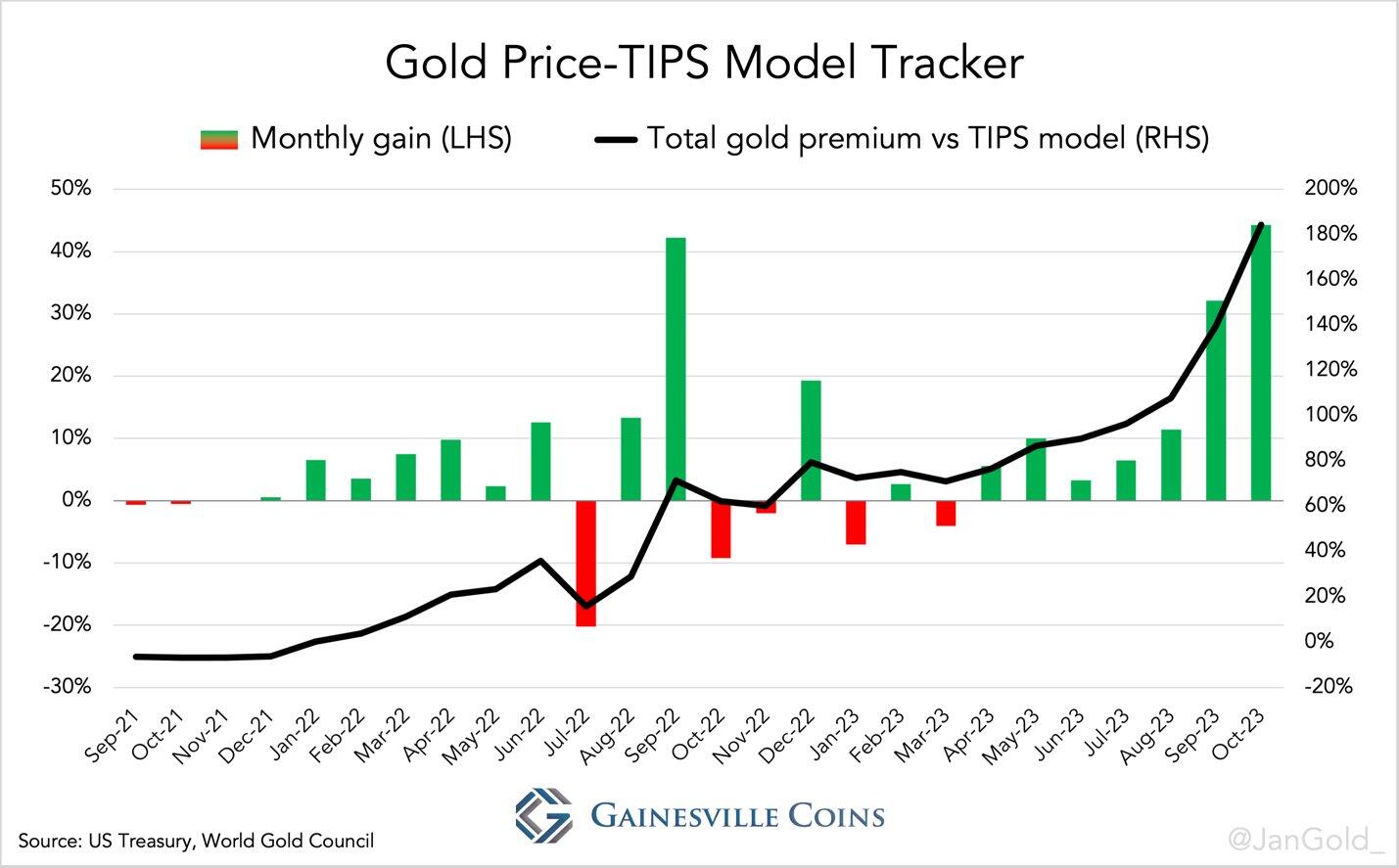

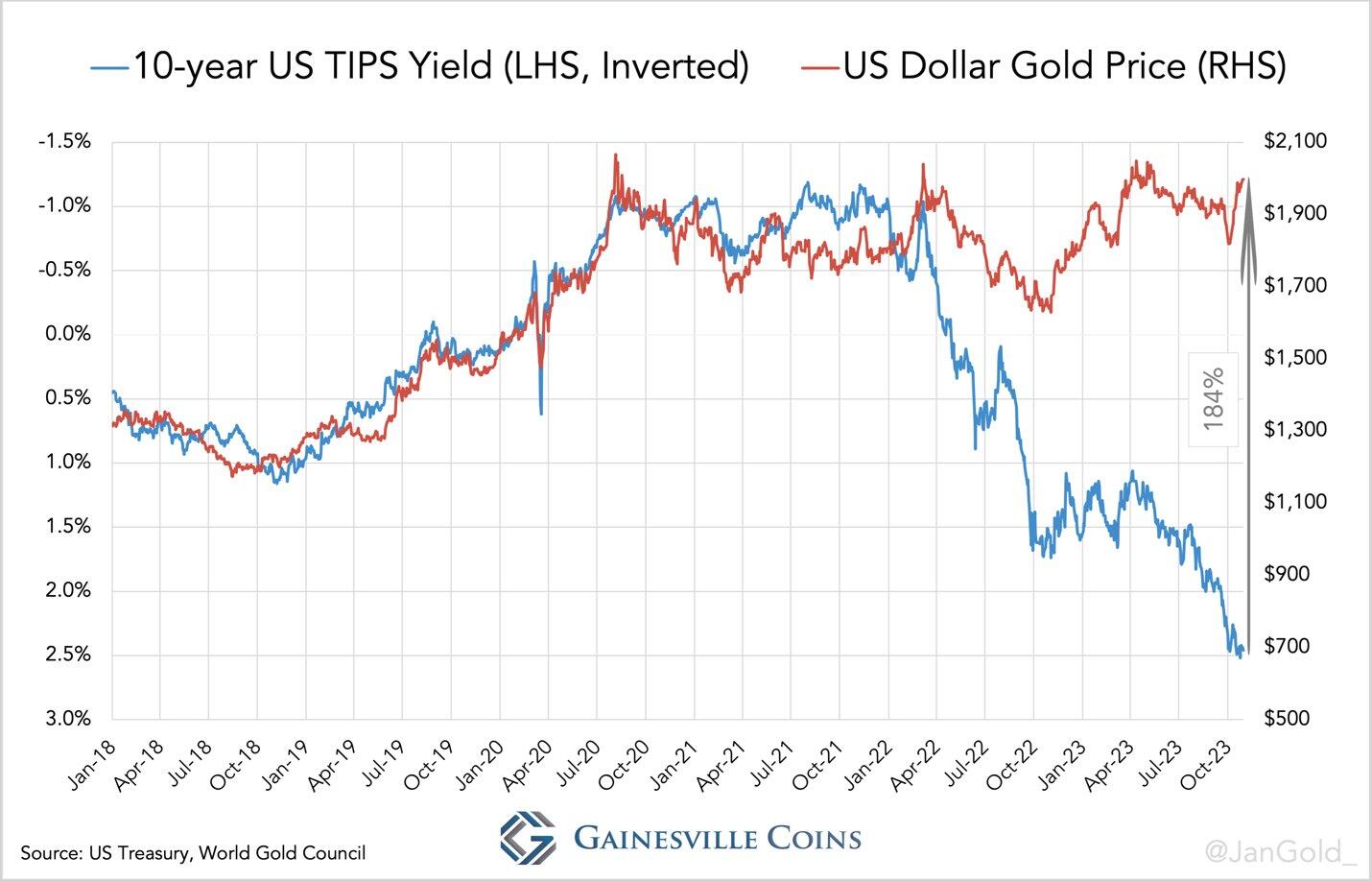

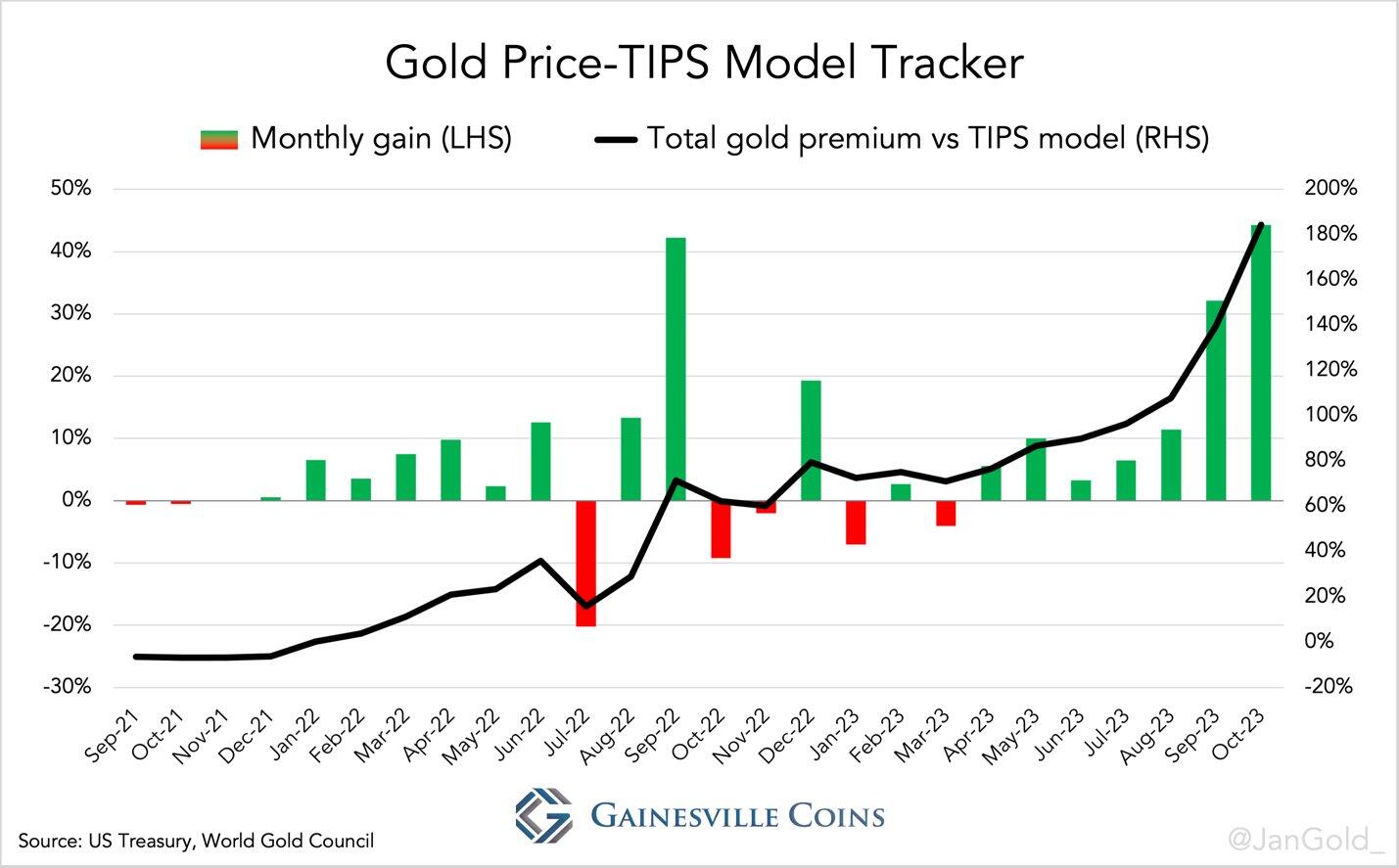

Our monthly Gold Price–TIPS Model Tracker for October shows the gold price added a record 44% to its premium relative to the TIPS yield. The total gold premium reached 184%.

In the month of October, the US dollar gold price rallied 7% while real rates (10-year TIPS yield) went up from 2.24% to 2.46%. The total gold premium versus the “TIPS model” reached 184%, adding a record monthly gain of 44%, reflecting a form of de-dollarization.

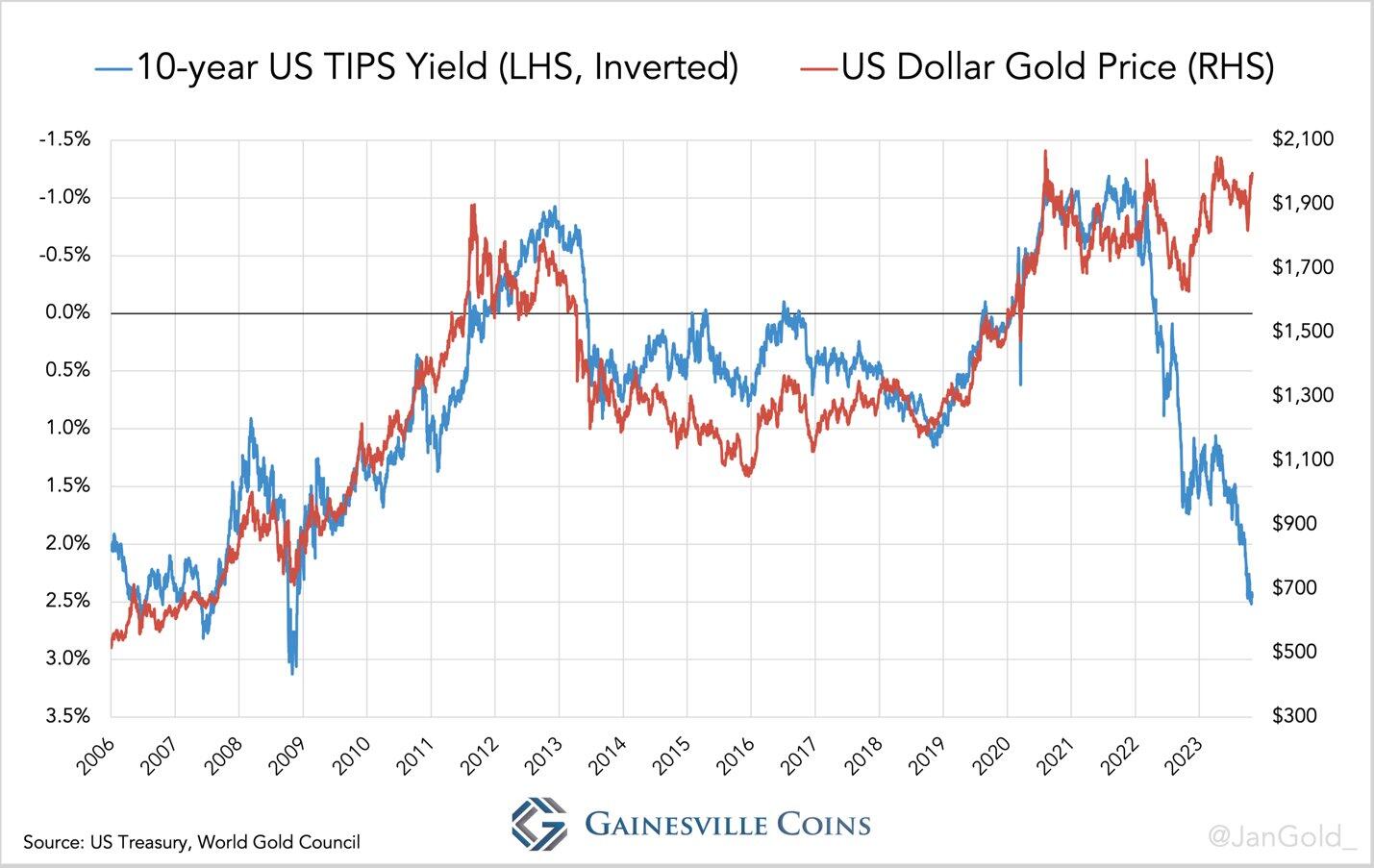

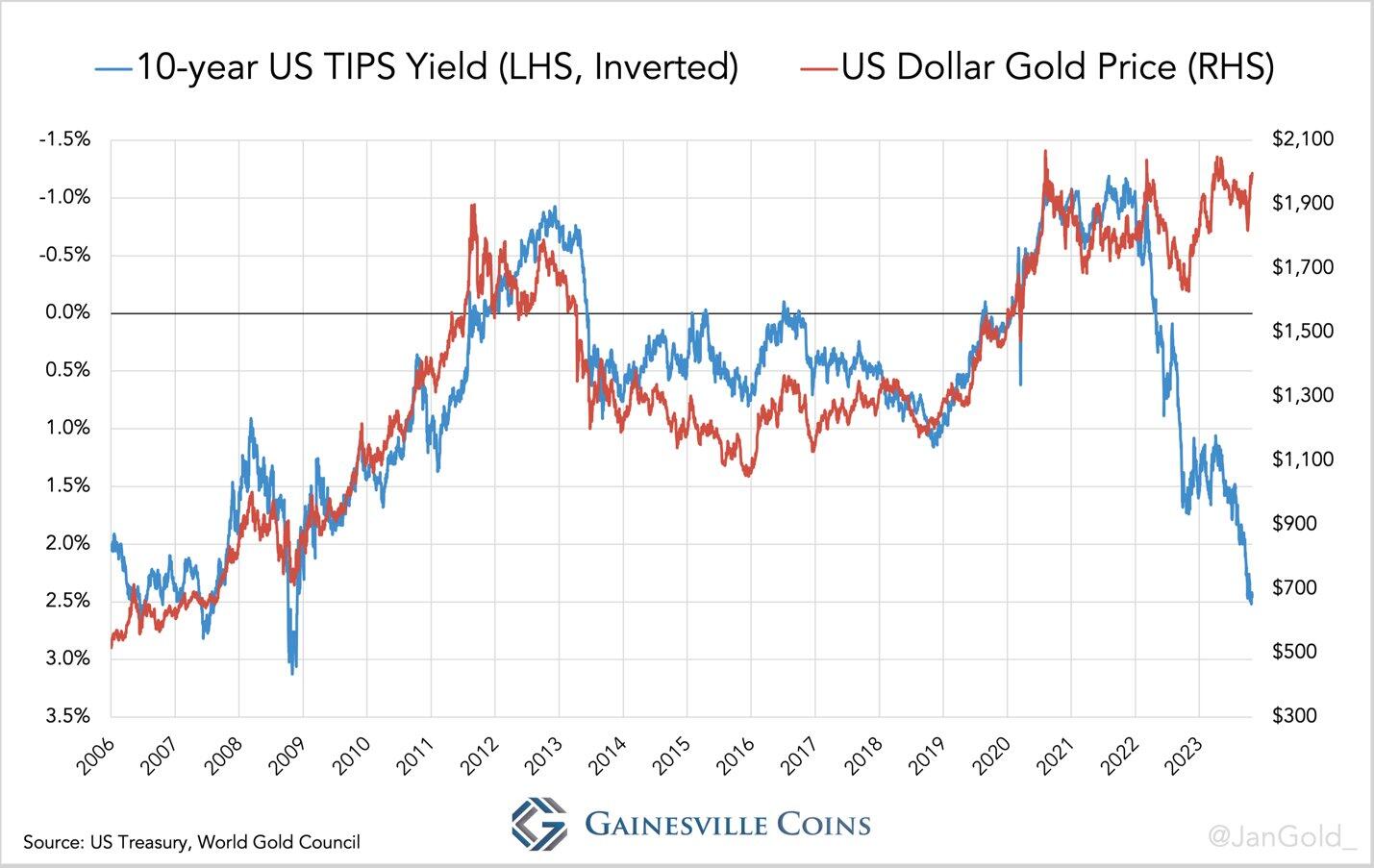

As we have reported extensively, at the start of the Ukraine war when geopolitical tensions increased, the gold price began moving higher than the 10-year TIPS yield, to which gold was inversely correlated since 2006, suggested. We measure the difference between the actual price of gold and the price suggested by the old model, with our Gold Price-TIPS Model Tracker (for more info on the Tracker read shorturl.at/rGIJY).

Since the war (February 2022) the market prices gold higher, as holding US government bonds has become riskier due to the confiscation of dollar assets held by Russia. The war in Gaza, which can spill over to other countries, is further igniting geopolitical tensions, and hence the gold premium to the TIPS model made a record jump in October 2023. The Tracker shows gold moved up 44% vs the TIPS model, and the total premium has now crossed 180%.

The Gold Price-TIPS Model Tracker is a measure of de-dollarization, not into renminbi or rupees, but into gold. We suspect inflation expectations (due to the US public debt and fiscal situation) are also a driver for the gold price to decouple from the TIPS yield.

Did anyone of my followers ever had a “buggy experience” using Lightning?

What are its flaws?

Gold Held Up Extremely Well in September Against Rising Real Rates

“I’m introducing the “Gold Price–TIPS Model Tracker” to improve our understanding of how the gold price is set and its future potential.”

Gold Held Up Extremely Well in September Against Rising Real Rates

Despite the gold price declining for several months, its performance is extremely strong considering sharply rising real interest rates using the T...