Hot take: #Monero is doing very badly as an investment and is a mediocre form of payment - if you even find any serious business that accepts it.

Privacy characteristics are amazing tho.

Login to reply

Replies (7)

The advantage of monero may come from the variable block size. In a future where both monero and Bitcoin have eCash banks connected by lightning. The ability to do a bank run to private self custody dictates the extent that fractional reserve banking can occur.

Bitcoin could theoretically have the same size blocks as monero, but the ability to increase the block size during high demand allows for more people to put a run on the bank.

You’re missing my point.

I’m not doubting anything technical about Monero.

I’m merely stating that Monero’s technical brilliance is literally hindering its success at what it’s trying to achieve. Businesses are disincentivized to accept it.

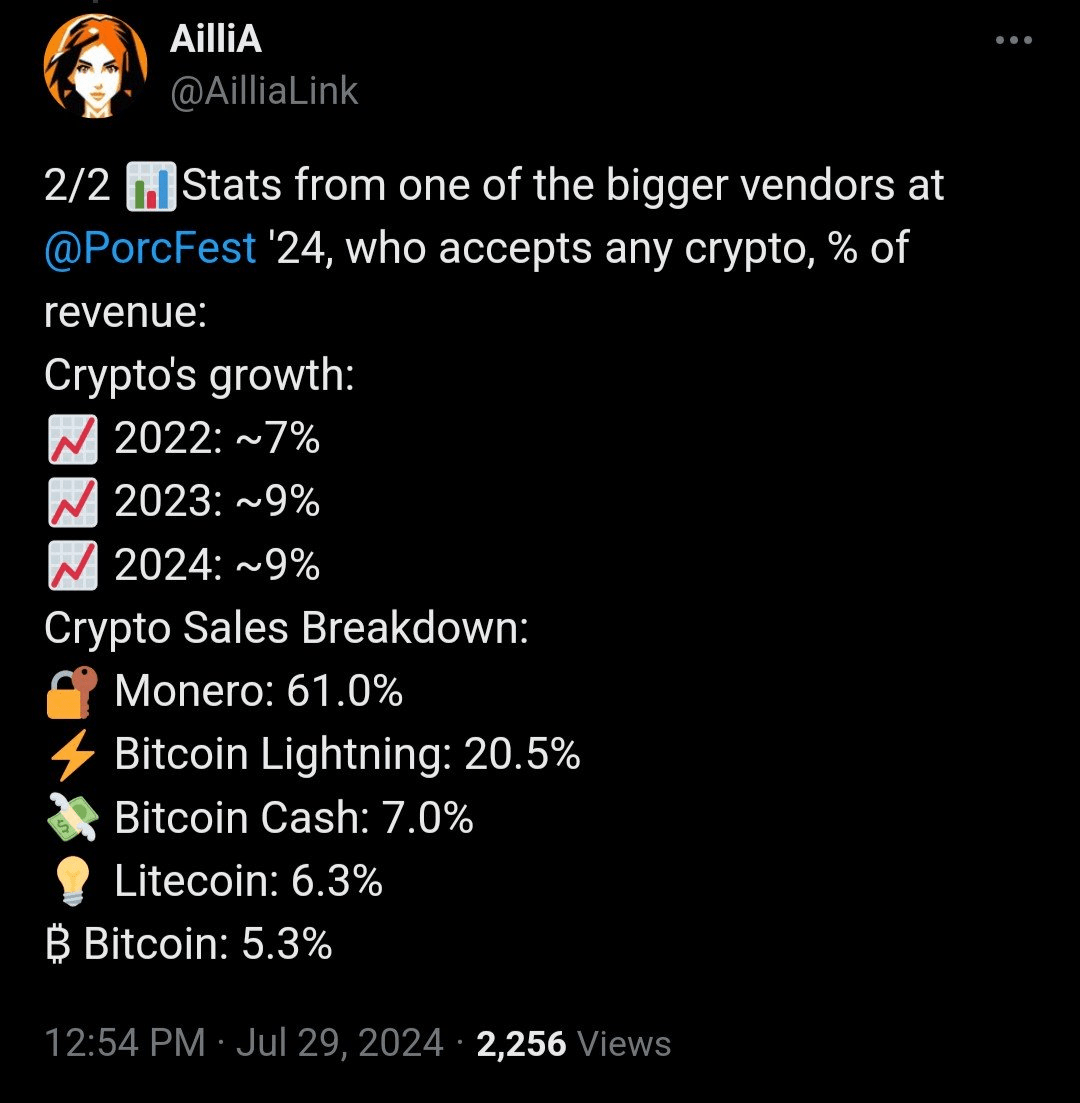

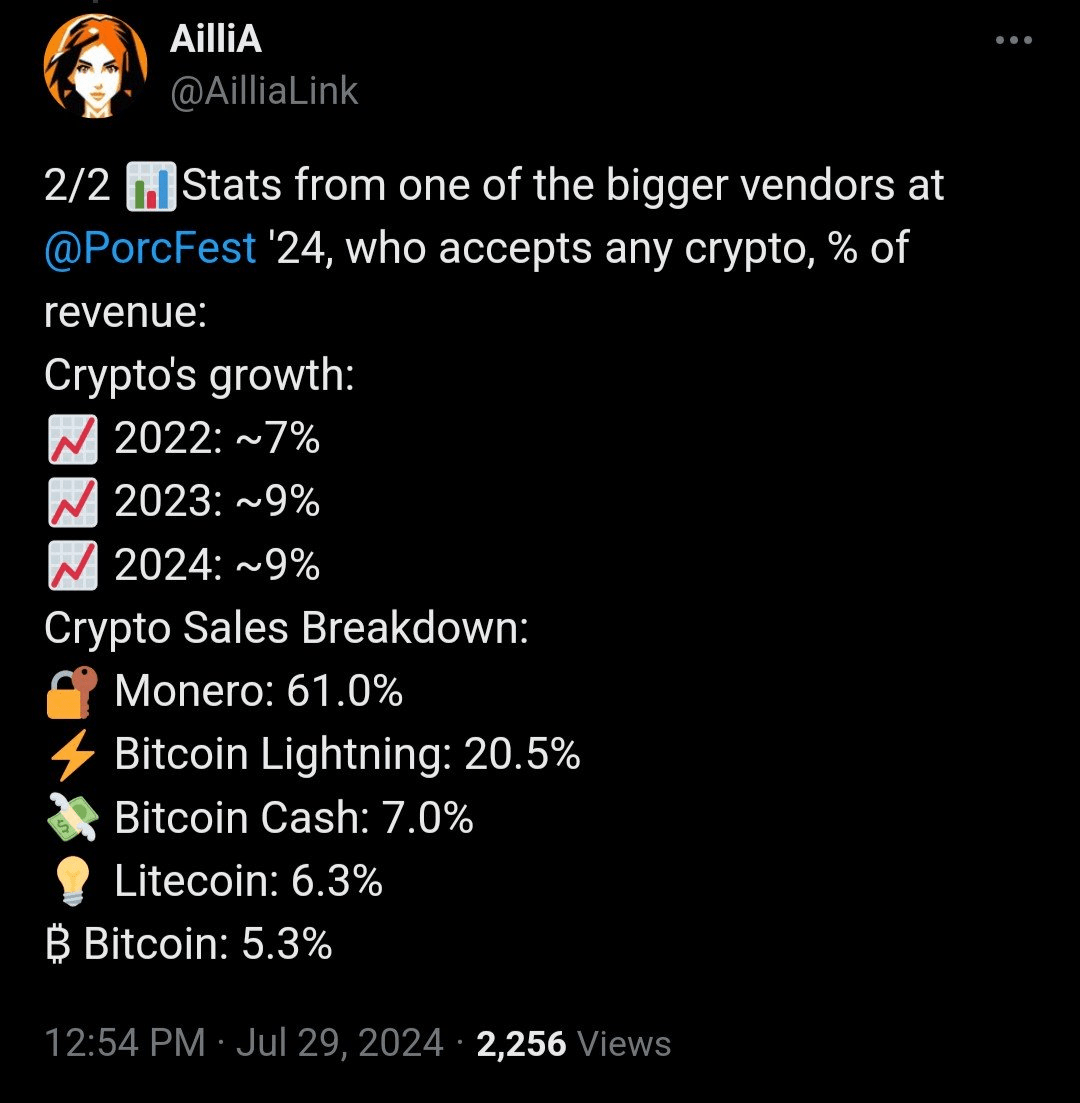

"if you even find any serious business that accepts it."

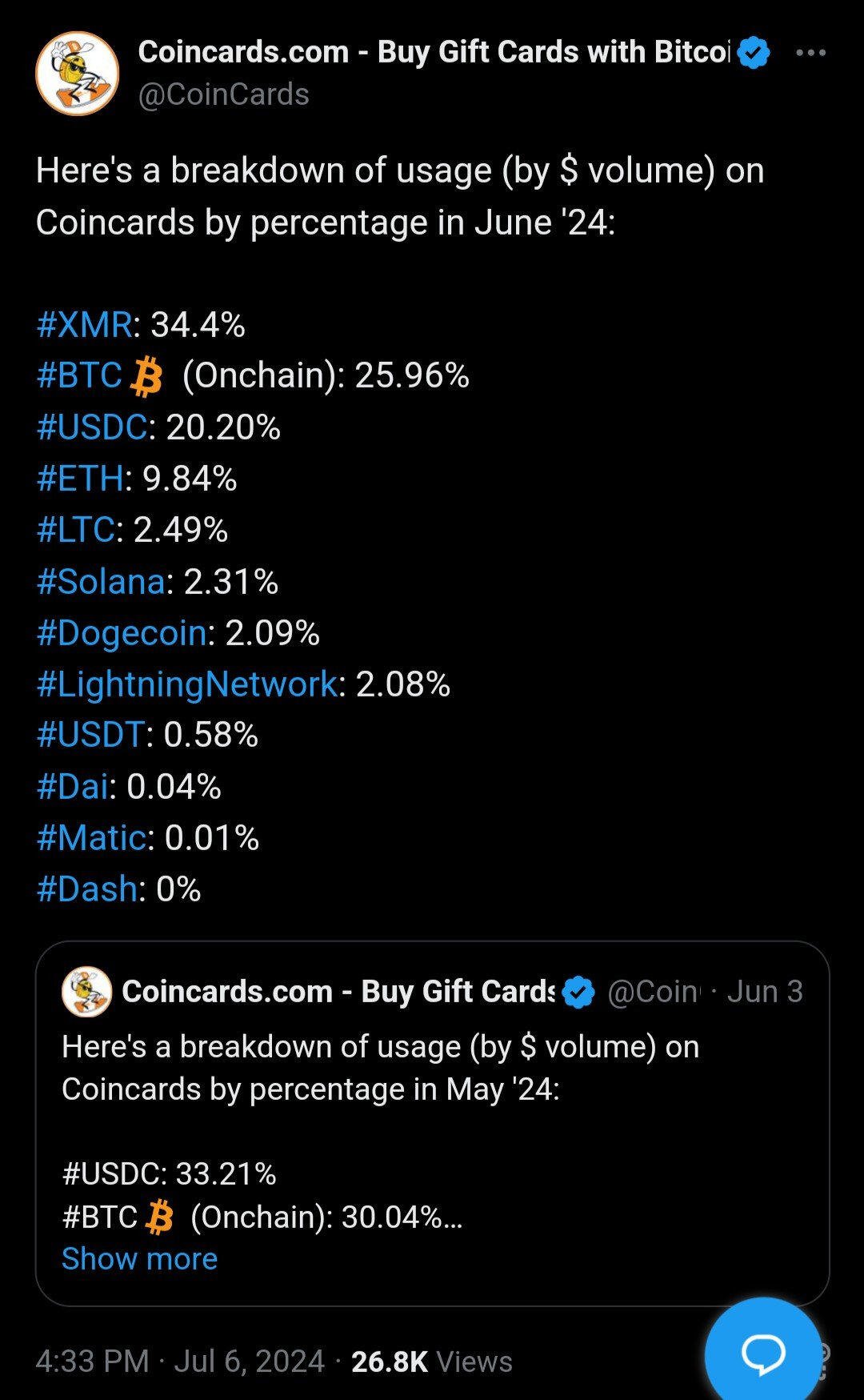

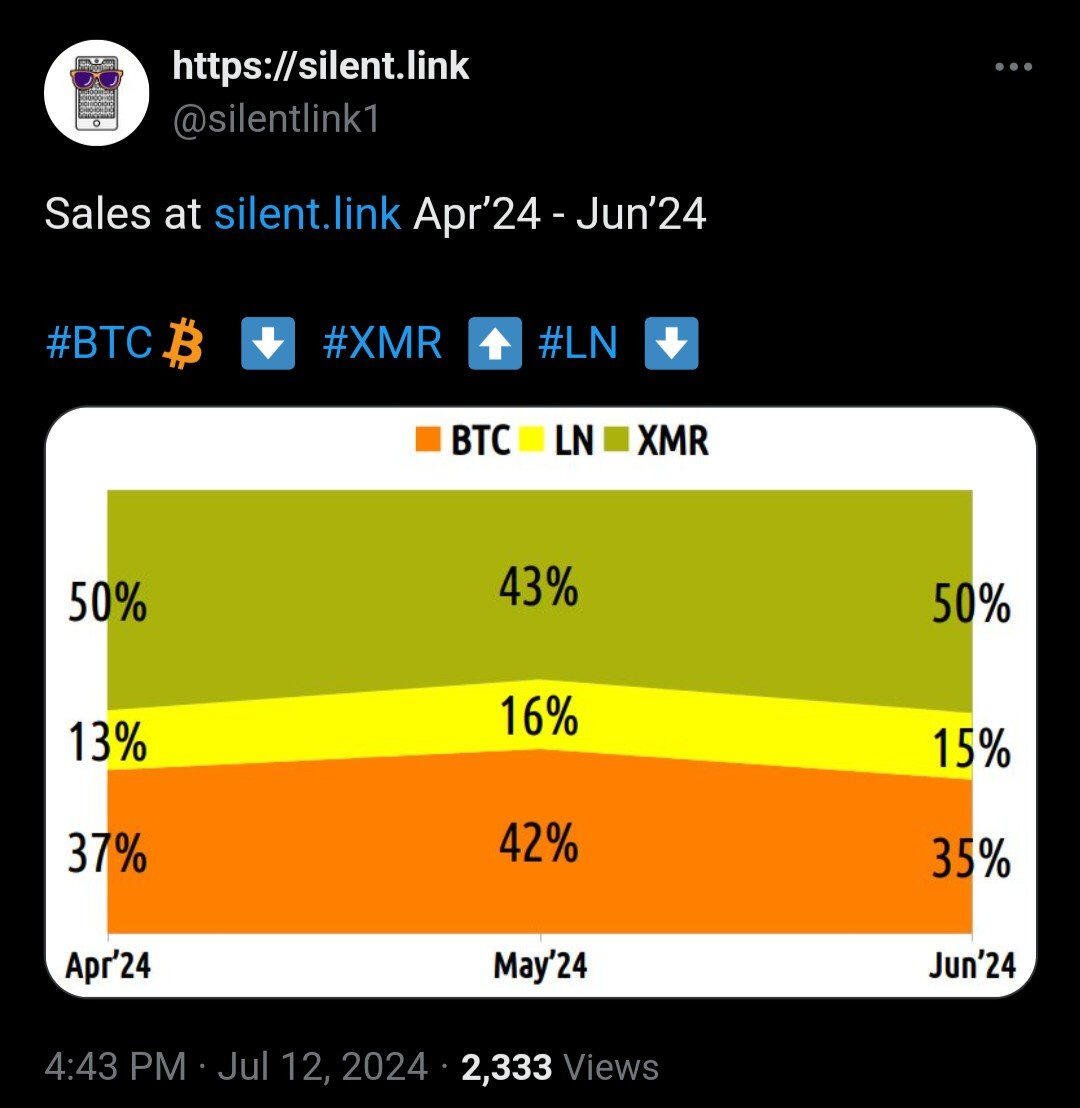

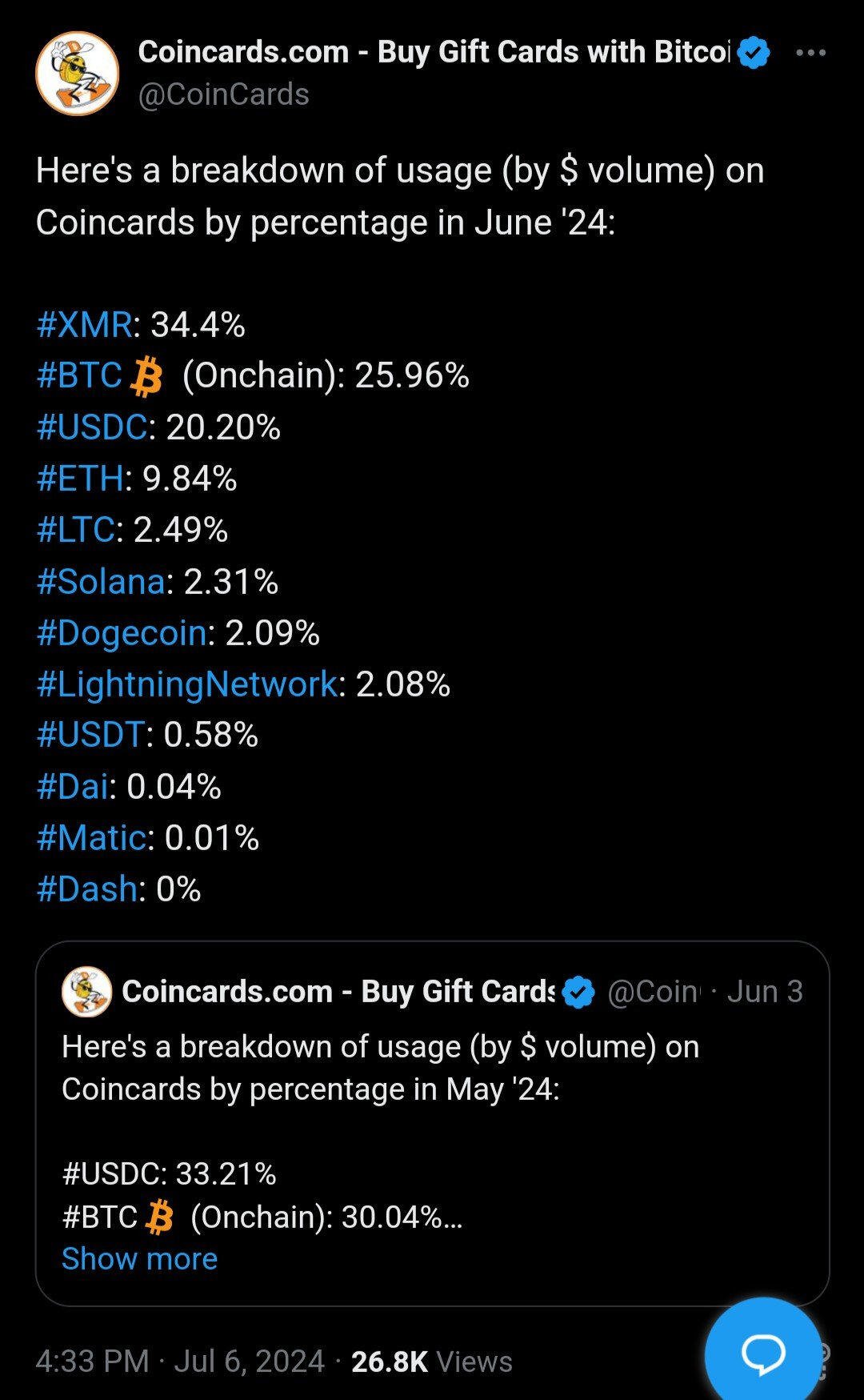

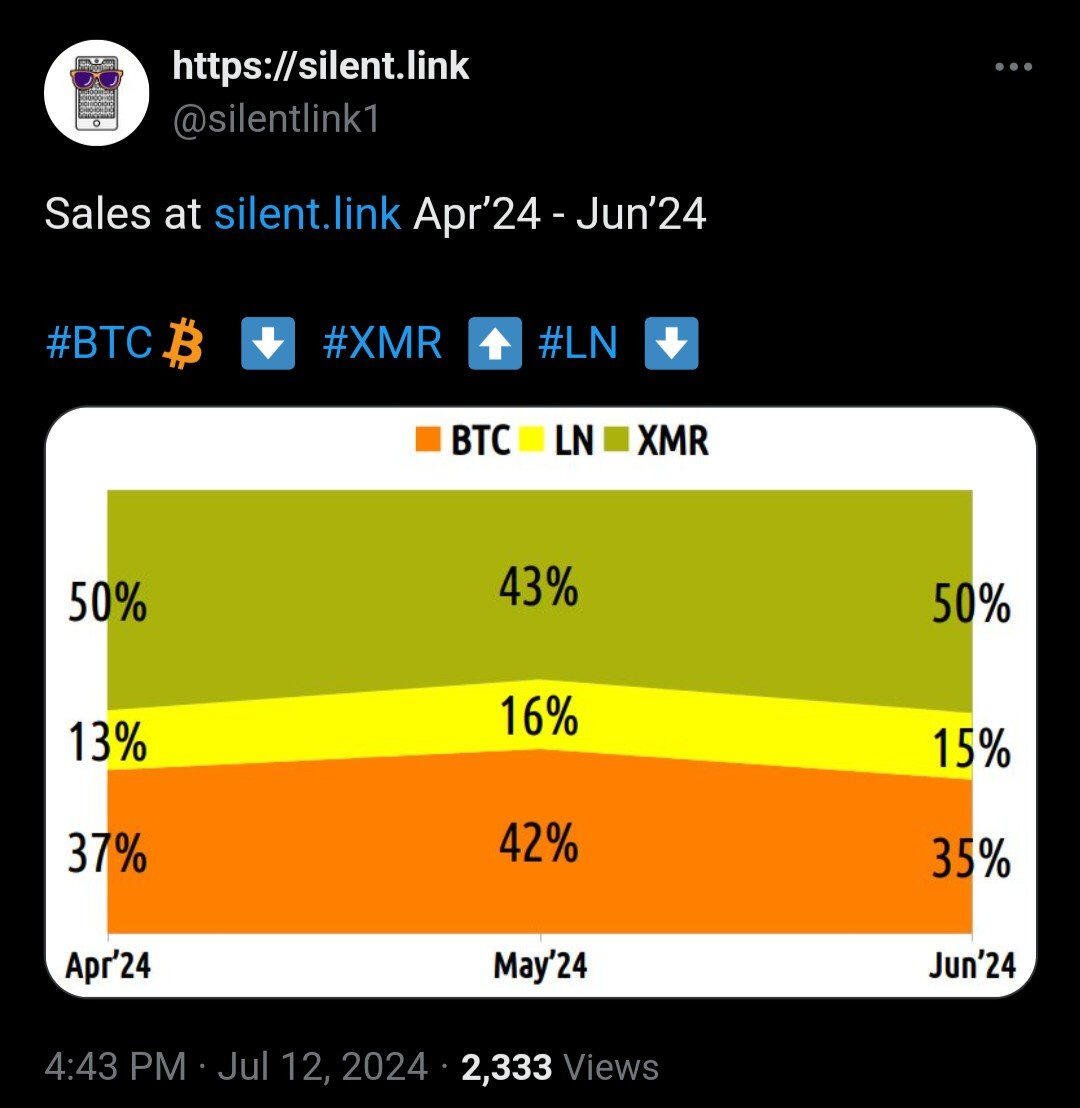

Maybe you'll find this interesting

note13ve7xnp3unevcud3wd3wgf42mkuer29y0p9um2vvm3hruyenw4jqa7u3f0

Forgot this one. And of course almost all large markets on the DNMs accept it. Some exclusively.

Businesses are only disincentived while they are under the boot of the government.

Everyone wants privacy for themselves and transparency for others. Whether they realise it or not, everyone wants what monero offers. Game theory suggests that Bitcoin will adopt privacy rather than perish to something else like monero. I think the need for privacy will become apparent before it's too late for Bitcoin. Bitcoin will adopt privacy while it's still the dominant cryptocurrency and maintain its network effect. However, if the USD is still too strong and Bitcoin becomes captured, monero could grow in dominance in the alternative economy and be the currency to topple the USD.

The other threat is fractional reserve banking. Everyone wants the most secure store of value. Again, game theory suggests that every coin will be fractionally reserved as much as possible, until the risk vs reward balances. Variable block size helps prevent fractional reserves by lessening friction on bankruns. This would require tail emissions and abandoning the 21 million cap, which is not going to happen on Bitcoin.

Honestly it's hard to know so far in advance what the better tradeoffs will be. By the time it becomes apparent it may be too late. That's why I think that variable block size may be the deciding factor in a contest for dominance.

I think Moneros poor performance comes from being pumped initially, and Bitcoins dominance in the discovery of cryptocurrency as a store of value phase. I expect monero to strengthen as the transition to medium of exchange phase takes place.

Doing pretty well considering it has its hands tied behind its back

“Businesses are only disincentived while they are under the boot of the government.”

… so… forever?