Instagram

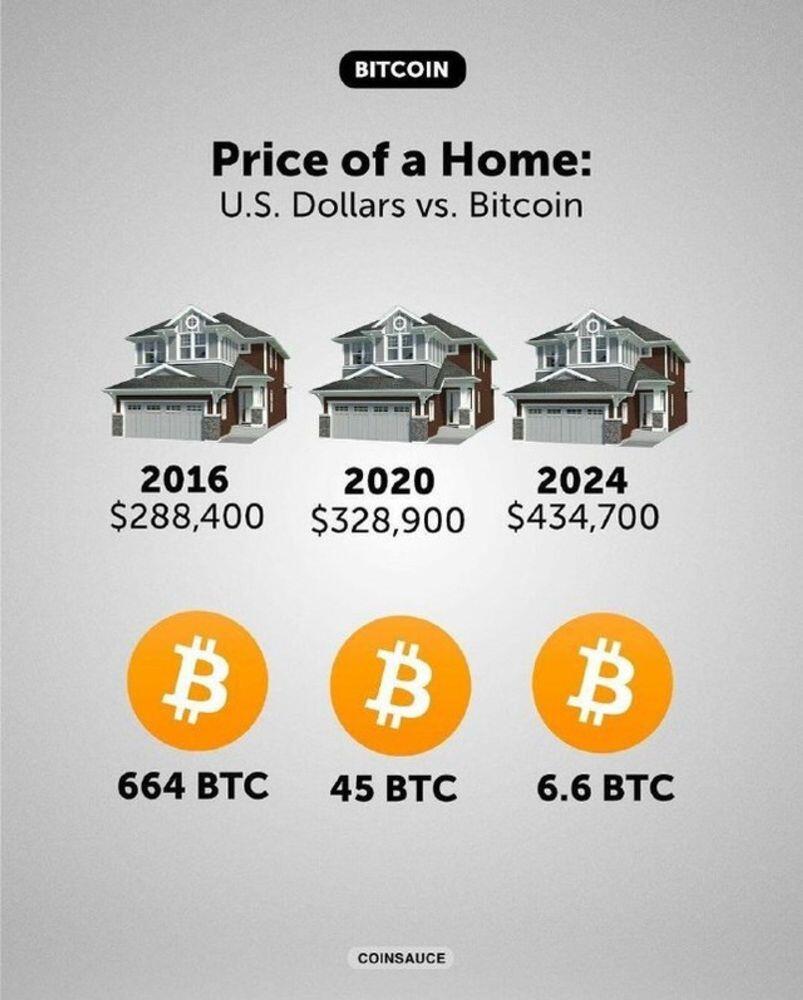

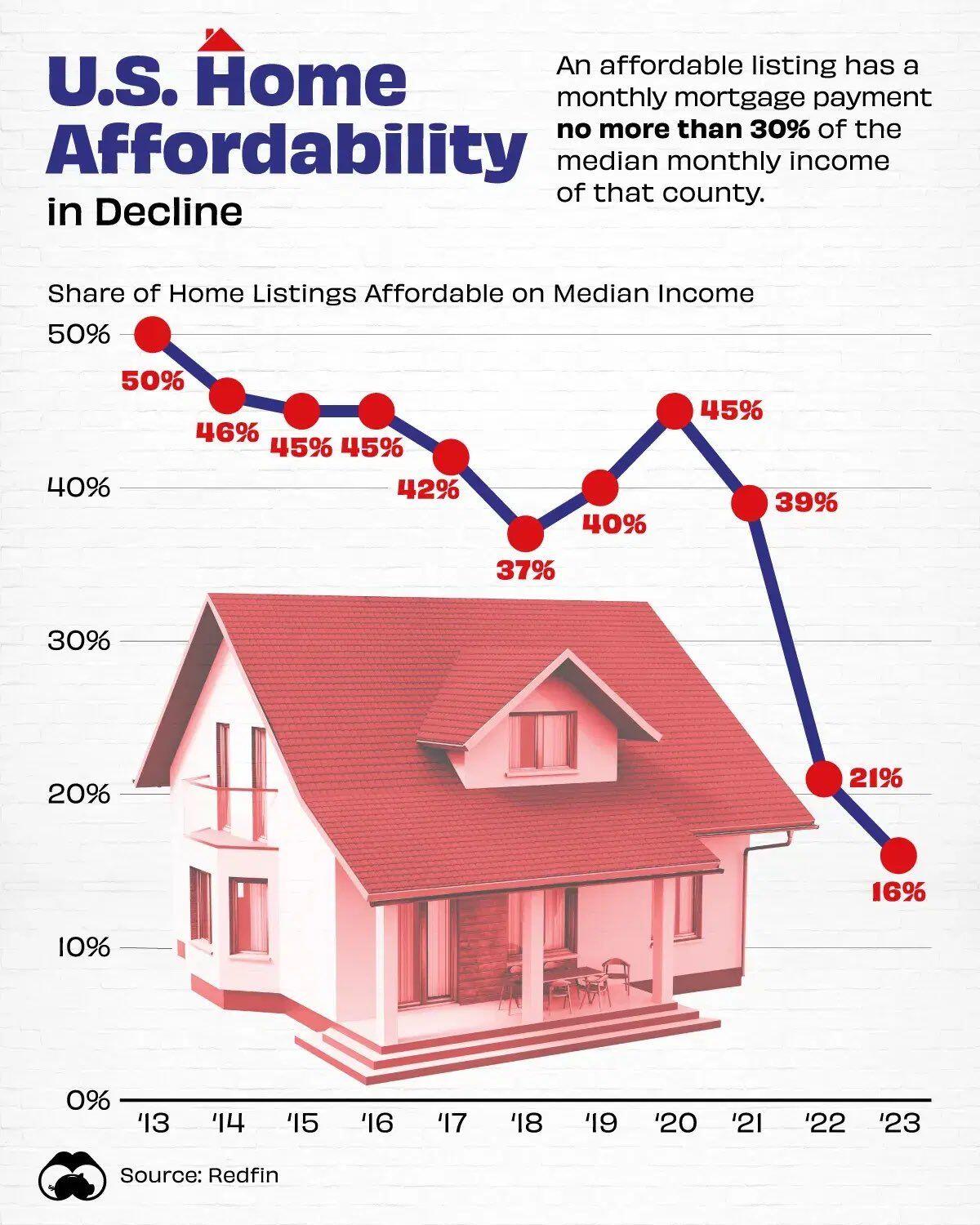

𝐂𝐡𝐫𝐢𝐬𝐭𝐢𝐚𝐧 𝐆𝐢𝐯𝐞𝐧𝐬 | REALTOR® on Instagram: "Yesterdays price is not todays price 😂

-

-

#realestatemarket #expensivehomes #dcrealestate #marylandrealestate #virginiarealestate #dmvrealestate #realtorhumor #realestatehumor"

49K likes, 967 comments - christiangrealtor on May 7, 2024: "Yesterdays price is not todays price 😂

-

-

#realestatemarket #expensivehomes ...

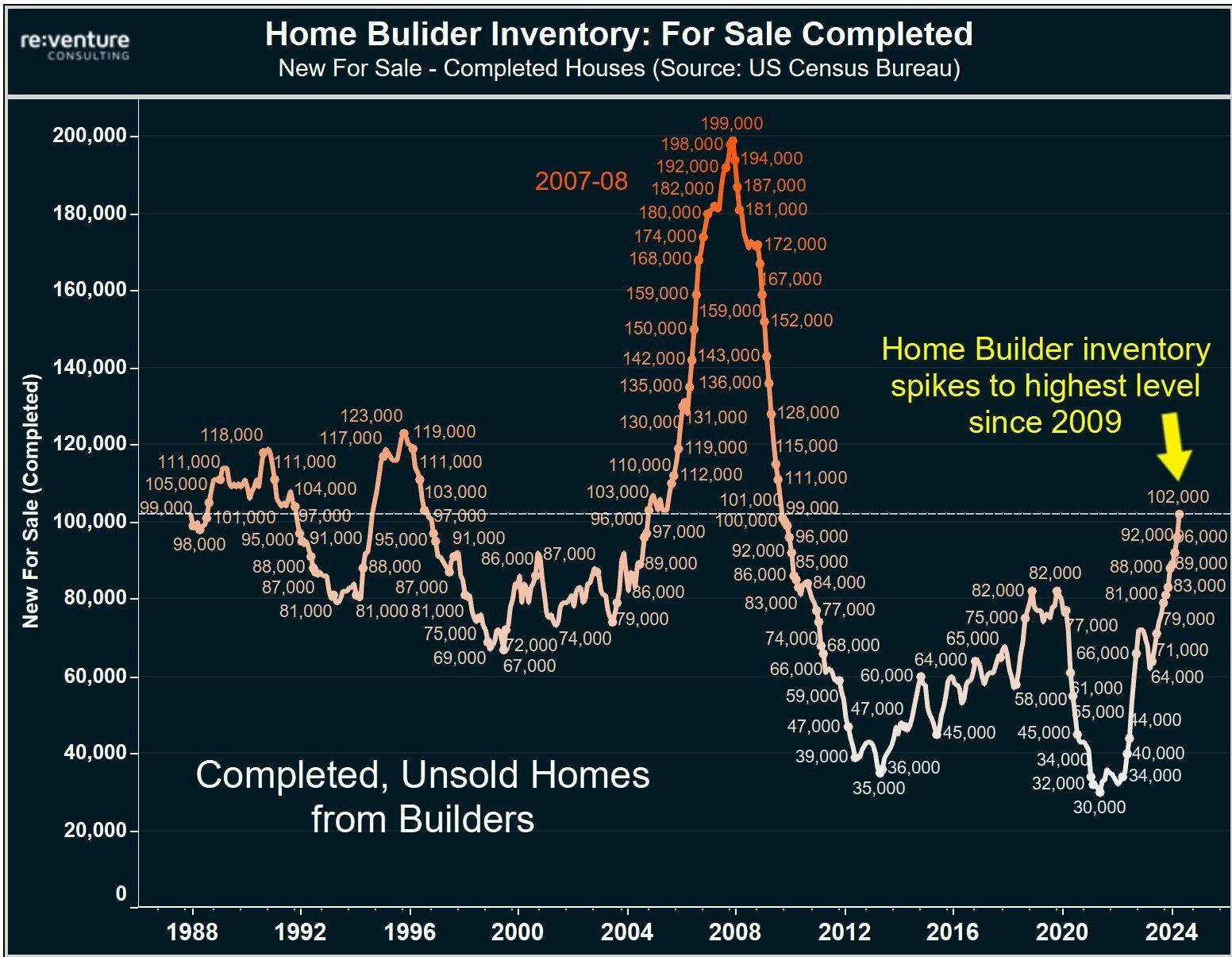

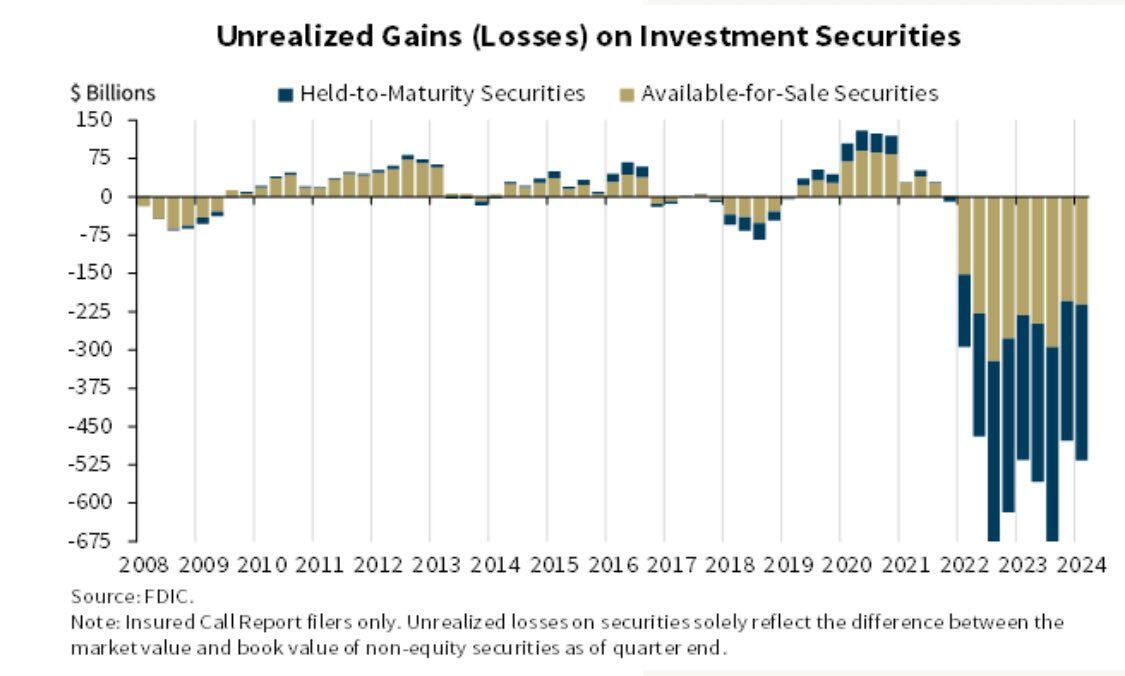

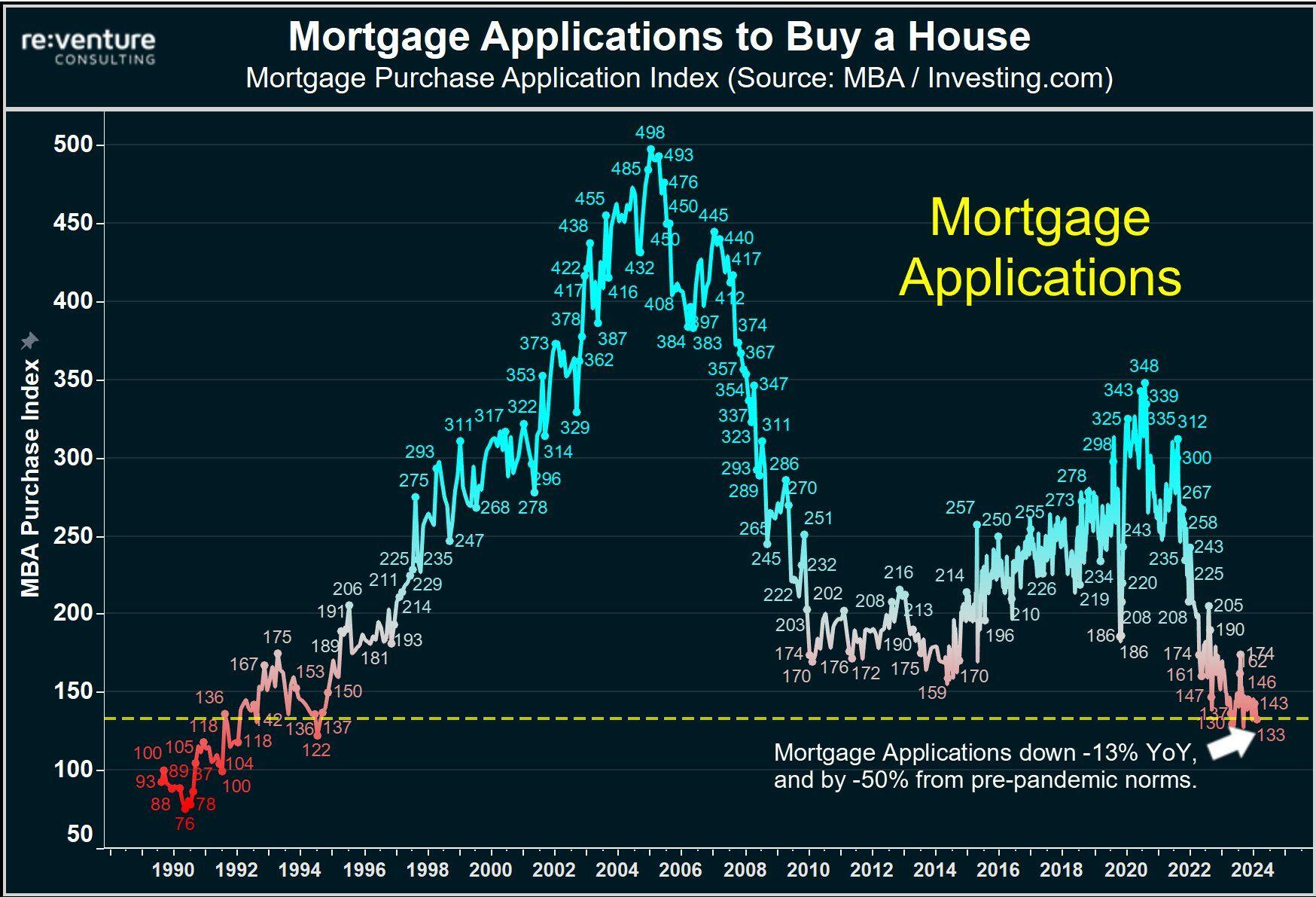

the rise!

the rise!

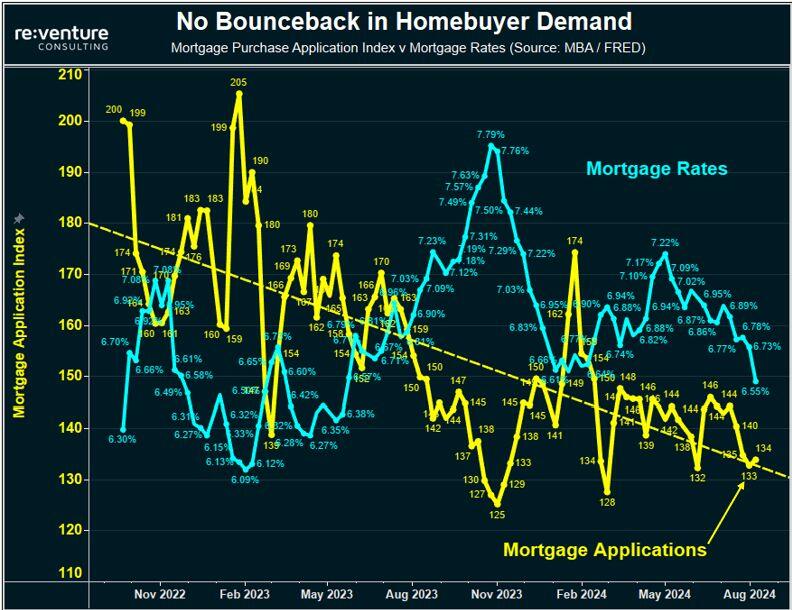

t yet moving the needle.

t yet moving the needle.