Guys, Something VERY strange is afoot

This is the strangest thing I’ve seen seen in a loooong time.

Im being serious when I say that COMEX might not exist next month.

This price action highlights a VERY CLEAR signal the "divorce" between paper and physical.

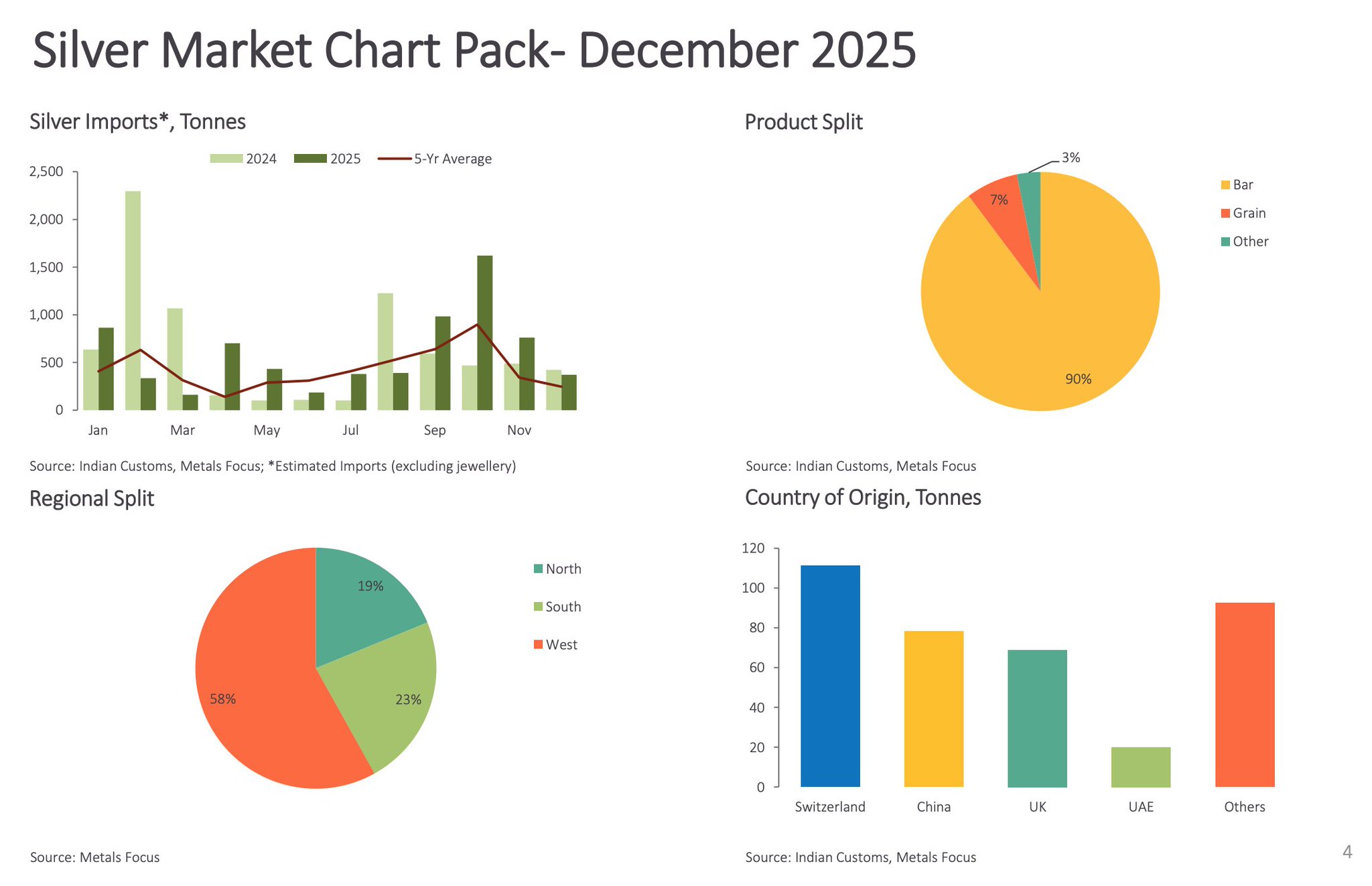

Comex (and LBMA) prices are heavily influenced by futures (paper) contracts so when Comex crashes or drops to $78–$92 while Shanghai holds or surges to $120–$135+

it shows the paper market can be slammed independently of real-world demand.

The Arbitrage is officially broken.

Normally, a big premium would trigger massive buying on Comex to redirect to China, compressing the gap.

—But it's not happening.

because nobody trusts them anymore.

This week is gonna be nuts.

Buckle up.

🧡👊🏻🍻