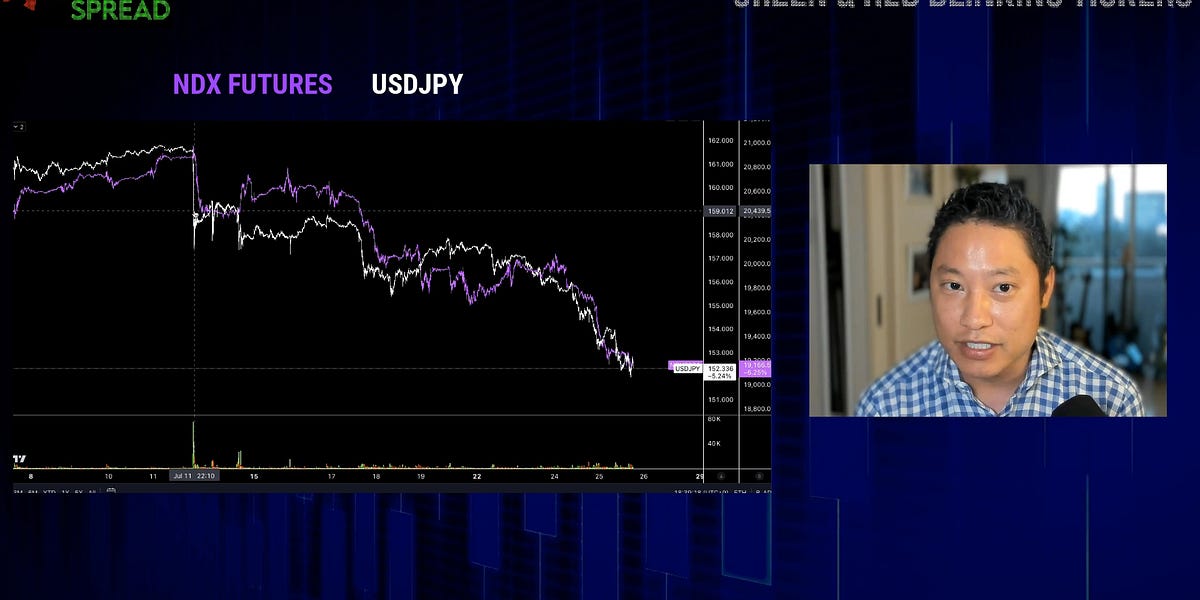

The Nikkei is gearing up for a big drop today (their Monday morning). We'll see how it closes, but it's seemingly the largest 2-day drop in Nikkei history given what happened on Friday.

There's a lot of financial plumbing stuff going on currently. As Japan hikes rates from -0.10% to now 0.25%, they're disrupting the global carry trade, where a lot of global capital is borrowed from Japan and elsewhere in Asia and stuffed into U.S. large cap stonks.

Bitcoin caught up.

Login to reply

Replies (31)

It's all noise..... buy the fucking CORN.

Hold the fucking Corn........

Keep working for toilet paper (fiat)

Wait as their game erodes.

Does anything stop *this* train?

Liquidity event, these things happen quick but can also turn around faster than expected

This is in need of a global rebalancing anyway. And to the extent that it does start to rebalance, it accelerates the US fiscal train.

They can do it anytime they want, but it's a bad look if they do. It's a higher bar to do it mid-meeting because it's an acknowledgement of a crisis.

Looks like that's exactly what's going on. Bitcoin is getting hammered, too. Lots of peole looking for liquidity. Last time (2007) it took about a year to turn into a major financial crisis. This time, things are already pretty shakey globally. I smell emergency rate cuts comming.

👍🏾 you rock, Lyn. You…rock 🤘🏾

Choo choo! 🚂

What I don't understand is how a move to 0.25% is triggering the trade to unwind. Is the carry trade based on the delta between US rates and Japanese rates? If so there is still a pretty big difference between the US and JPY rates so why now? I'm sure there is nuance I'm missing.

キャリトレ(低金利での資金調達が世界経済を支えていたとも)大混乱。旅人には円高傾向は大歓迎。

The Nikkei is gearing up for a big drop today (their Monday morning). We'll see how it closes, but it's seemingly the largest 2-day drop in Nikkei history given what happened on Friday.

There's a lot of financial plumbing stuff going on currently. As Japan hikes rates from -0.10% to now 0.25%, they're disrupting the global carry trade, where a lot of global capital is borrowed from Japan and elsewhere in Asia and stuffed into U.S. large cap stonks.

Bitcoin caught up.

View quoted note →

I think the nuance you’re not appreciating is the scale. It’s not a trade between Yen and USD, it’s between Yen and US stocks. Even a small increase in your borrowing cost makes a big difference if the position size is big enough.

I can’t. The JCB isn’t going to backpedal now and the Fed isn’t going to be worried about a 5% drop in the S&P, let alone the Nikkei

Plenty of cash on the sidelines.

Yes, you read that right: Japan had negative interest rates.

That's such an obviously batshit crazy idea that it's no wonder everything is going haywire.

The Nikkei is gearing up for a big drop today (their Monday morning). We'll see how it closes, but it's seemingly the largest 2-day drop in Nikkei history given what happened on Friday.

There's a lot of financial plumbing stuff going on currently. As Japan hikes rates from -0.10% to now 0.25%, they're disrupting the global carry trade, where a lot of global capital is borrowed from Japan and elsewhere in Asia and stuffed into U.S. large cap stonks.

Bitcoin caught up.

View quoted note →

What do you mean by Bitcoin caught up?

Caught wind so to speak.

Got it. Bitcoin trade 24/7 so market response show on Bitcoin quickly 🔥🫡

I think, I’m no Lyn Alden!

Lyn Alden is no Peace of Bitcoin 💜🫂

It’s only a matter of time

money printer go brrrrr again?

The omen of the world financial crisis depends on Japan. If the yen appreciates, it means that the world's safe-haven funds will return to Japan. Japan is the country with the largest overseas assets in the world and the largest creditor of the United States. Its financial policies will trigger a global financial crisis.

“ I heard a joke in the United States. An American and a Japanese were walking in the rainforest, and suddenly a hungry lion rushed over. Seeing this, the Japanese immediately squatted down and started to change his running shoes.

"Do you think you can outrun a lion that is eager for a full meal? What a stupid guy!" The American sneered.

The Japanese replied: "I don't need to run faster than a lion, I just need to run faster than you." ——Akio Morita

it’s funny/sad that these calamities in the market are so expected/inevitable these days. I will admit I was lulled to sleep with the relative calmness over the past few months

I could never!

The change might seem insignificant, but it basically means that the borrowing cost more than doubled.

It's akin to being able to pay $2,000 a month for your mortgage, but now, with a rate change, your mortgage is $4,000 a month.

Is this the liquidity event that some have predicted would happen?

I can't remember if it was George Gammon or someone else, but I'm sure I heard someone talk about it happening, before the Fed would be forced to drop rates.

The carriage trade from Japan was going to get disrupted at some point because in order to save the yen, Japan will have to normalize interest rates. This was a mere 35 bps rise. To normalize rates there will need to be many more such raises. How will markets react then? An example of how markets have gotten untethered from reality.

Honey Badger does not gaf.

No, but they will be worried when the knock on effects become apparent. Banks are already insolvent. The housing market is shakey. Commercial realestate is a mess. The government is spending like a drunen sailor. War is looming in the middle east. There are an alarming number of things that just need a little push to fall off a cliff. It just takes one.

annnnnd she way right