Replies (62)

Hermosa gráfica

@jack ITS TIME TO UP THE BITCOIN TREASURY FOR THE BENEFIT OF SHAREHOLDERS

OMG

Nothing stops this train

👌

Is it true that coinbase custodys a large chunk of MSTR's BTC?

Bitcoin is the way✅

GM, very interesting graph 🧐.

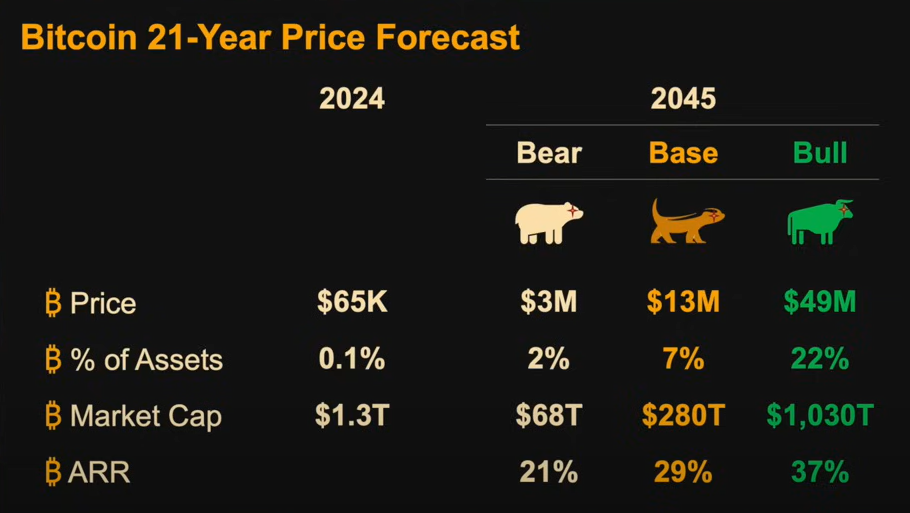

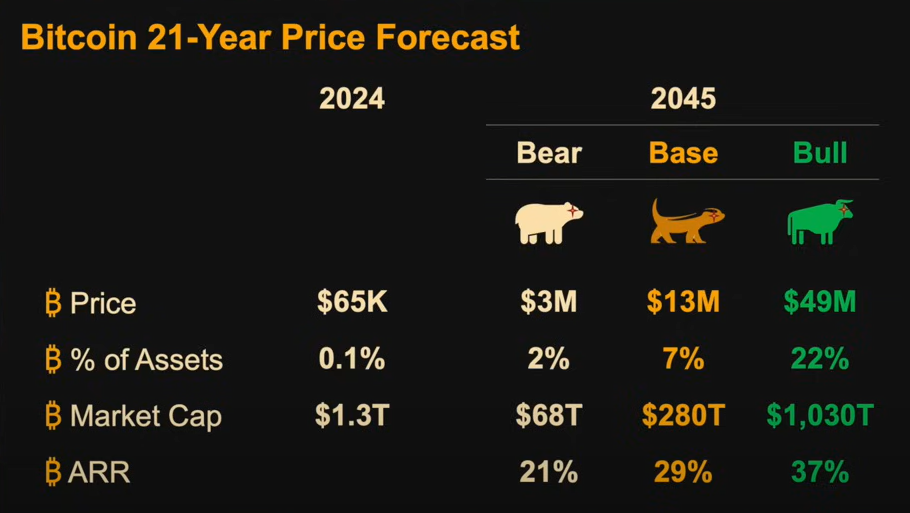

On Damus, I can’t zoom in on the pic. What’s the story?

I can 🤷♂️

GM :Thailand: Triple Maxi

Hmm 🤔 I don’t know what that means but I like the sounds of it.

Yeah. That’s the word.

I just updated the Test Flight version to correct the issue. Looks like iOS 18 made some items unclickable. ✌️

Crazy

45.762 B COIN

45.516 B MSTR

44.92 B SQ

Purple ☮️💜💟

Thank you! Story: own bitcoin to grow your market cap.

Yesterdays MSTR move was truly something to behold. This will be analyzed for decades to come.

You’re welcome & Truth

What’s your take here?

merge

To learn from MSTR is to learn to win

👀

THE ULTIMATE GOAL OF EVERY INDIVIDUAL, COMPANY, AND GOVERNMENT IS TO ACCUMULATE AS MUCH BITCOIN AS POSSIBLE.

THAT IS THE MEASURING STICK. EVERYTHING ELSE IS MEANS TO THAT END.

MOST DO NOT REALIZE THIS YET.

THE HARD PART IS NOT GETTING REKT DURING THE VOLATILITY THAT INHERENTLY OCCURS DURING THIS TRANSITION TO A BITCOIN STANDARD.

SAYLOR SEEMS TO BE EXECUTING BEST IN PUBLIC MARKETS BUT HAS BEEN TAKING ON INCREASING RISK SO THAT COULD BLOW UP IN HIS FACE.

STAY HUMBLE AND STACK SATS.

Say more about the risks he is taking

How does that compare to risks VCs take?

I personally prefer holding wealth in a geographically separated multisig

You should add BTC to the chart. I hold BTC and MSTR.

THIS IS THE WAY.

THERE IS NO SECOND BEST.

WE TAKE CALCULATED RISK AT TEN31 TO SUPPORT EARLY STAGE BITCOIN COMPANIES WITH MASSIVE UPSIDE POTENTIAL.

OUR INVESTORS ARE AWARE OF THESE RISKS. MOST HAVE SIGNIFICANTLY MORE BITCOIN THAN THEIR INVESTMENTS IN US. WE RECOMMEND THAT CONSISTENTLY.

BITCOIN MARKET CAP IS OVER $1T - IT WOULD MAKE THE CHART UNREADABLE.

It wasn’t personal. I was curious about the risk comparison between a public company taking on debt to buy bitcoin vs betting on startups.

If we are actually trying to operate on the Bitcoin Standard, new ideas should have solid business model so that day one it makes revenue is not debt or donor dependent.

liabilities lead

MUCH EASIER FOR A PUBLIC COMPANY TO GET ACCESS TO CHEAP DEBT THAN A STARTUP, FUND, OR INDIVIDUAL.

I THINK MOST VC FUNDS ARE GOING TO GET REKT.

THEY MOSTLY OPERATE ON AN EASY MONEY EXPECTATION AND MONEY IS GETTING HARD QUICKLY.

not possible for me but it is a good practice

YOU COULD STILL HIDE YOUR MULTISIG IN MULTIPLE SPOTS WHERE YOU LIVE, NO? (NOT FINANCIAL ADVICE)

Block began buying btc to have on their books last six months or so

I thought they would have made a lager commitment to it. something to rival MSTR, but the performance has fell short

I’m actively funding

@ODELL through $SQ, you’re welcome

They first bought bitcoin four years ago via a smash but started staying humble and stacking sats everyday 6 months ago

The Coinbase Fumble will be studied for millennia. Imagine being so early, with that kind of lead, and then fumbling dynastic wealth this badly. Impressive stuff, really

Yea I think it’s %10 of the revenue they make from their Bitcoin services

One drives madness of the crowd to pump, milks it out of everyone else’s hard work. The other builds people up globally - advancing transformational innovations - to enable decentralized models for anyone to build upon. I think when Web5 (and Nostr) hits mainstream it's gonna be epic - the long term strategy is brilliant - it is both ethical and expands global growth exponentially in ways that put people first. Its good for companies to have Bitcoin on balance sheet if possible, but extreme version of profiteering from pumps is not something I would hail as an all-glorifying pursuit.

Many bet on MSTR blowing up a year ago, but it didn't happen.

I've learned to be humble and recognize that some people are smarter than I am.

Their roles as wealthy founders serve as a good proxy for understanding this and getting exposure to their endeavors.

Agree. I noticed where in Dec 2022 at the bottom he had to sell 700 BTC. I assume there was effectively a margin call due to drawdown. He’s doing alluded to this in the Saif podcast too.

He’s doing it well but people don’t fully understand the inherent margin risk even when you do it well.

Seems to me that at this point $MSTR is a lot like GBTC was when that arb was a “no brainer”. All the HFs and funds that abused the arb ended up blowing it up due to their leverage. This could easily be the case, seen again, after the fact??

Based on estimates there is about $78 of bitcoin per MSTR share. The company stock (pre-#bitcoin) typically traded at $10-$16 a share (for pretty much 20 years).

Adding $78 of BTC would get you to about $94-95 bucks per share. Also, Saylor has been pretty vocal that MSTR pre-Bitcoin was dead in the water. So, it would seem investors probably shouldn’t assign much value to the company then, right?

Granted, I do think his play is to turn it into a bitcoin bank, lend off the stack and convert the software to BTC software and analytics, so there could eventually be hidden value there.

See GBTC, IMO. As potential risk associated based on other players impacting price of locked up bitcoin.

so many things wrong with this post... but we'll start with "dead in the water" which is not even close to true. Microstrategy was netting 100 million a year before they adopted Bitcoin. Pretty far from dead.

next thing wrong with it is "people don’t fully understand the inherent margin risk". Not a lot of risk when your leverage is 0% over a long time period when your business cashflow can more than cover it and/or it converts to stock. It's not even really fair to call this leverage. This is just normal use of debt that any public corporation uses, the only difference is they are using it to buy bitcoin instead of expand their business or do an aquisition.

I don’t disagree. However, Saylor himself said they were close this last bear and had to move some Bitcoin around. Additionally, you can see a 700 BTC sell around that time (12/22/22). Just putting 2 and 2 together.

Borrowing to buy (converts is still a form of leverage). I’m not 💩 it. Just pointing out it still takes planning.

BitcoinTreasuries.com

Track Bitcoin Treasuries of companies, miners and countries at BitcoinTreasuries.com.

Saylor himself said multiple times over the last few years MSTR was a dead company. It wasn’t innovating and he was trying to figure out how not to have to wind it down or just let it die a slow death or sell.

His earliest mentions were when framing around what he noticed with FANG and he saw it again with Bitcoin so he bought it as a means to save the company… I.e. “dead in the water”.

yes his company was going to have a hard time competing with Microsoft. But he had decades of runway left. Saying it was a dead company is a massive exaggeration he uses to justify his bitcoin purchases. It was highly profitable when he started buying Bitcoin and still is today based on it's business-intel software

Can you please cite your source for the allegation that MSTR sold bitcoin?

Click the links.

Maybe I’m wrong… a negative purchase -700 would mean a sale and it would go match the podcast reference. Both sources previously provided.

Ugggh… *sell and *go with/match

Sell 704 on the 22nd and buy back 810 on the 24th? that doesn't make much sense. If you are actually cash strapped enough to sell your bitcoin, then you won't have it all straightened out 2 days later.

Hrm, not sure what's going on with that.

“Move some Bitcoin around”?

yeah doesn't make much sense that his company would need 700 bitcoin worth of cash for 2 days. Something doesn't add up.

Another good one that will get skimmed over; people will miss all associated leverage that’s discussed/shed light on.

Around the 45 min mark Saylor discusses all the easy to see associated risk. Before that, the discussion around premium equity and issuing premium converts at premium equity, is a key point. The *potential* risk is the 6 year mark. Not sure if that’s an actual number or just an example. But, he walks through it all.

At 1:05:ish he calls MSTR a “levered” Bitcoin play.

And goes over a few examples MSTY and MSTX + options which are additional ways of levering MSTR (a Bitcoin derivative effectively). So these are effectively two and three derivatives of spot. That’s a lot of leverage and a lot of ways to break - see GBTC; the arb and premium discount issues.

Putting it altogether brings some of the points we went back and forth on, to light.

Additionally, it exposes the reasoning why (IMO) MSTR trades at a premium to NAV. The MSTX and degenerate TradFi options/leverage is not all that dissimilar to the GBTC arb trade that eventually broke once the NAV got out of whack and the trade became crowded. When interest waned and big players stepped aside or actually realized the risk, the trap door opens and exponentially declined as a bear unfolded.

It’s totally fine and happens in securities but people don’t always understand the risk and think NgU until they are “blindsided”.

GBTC was just fine. Traders got upside down but the trust was just fine. Likewise MSTR will be just fine. They way they are using debt is extremely same, and extremely smart. I'd do the same if I could get 0% money like they do. You'd be a fool not to

I would encourage you to go back and read the legal docs of Genesis and Grayscale. The BTC held was not perceived to be an issue the borrow/lend relationships that encumbered it was an issue and did cause problems, specifically when the broader market got tight. This is typical during liquidity events, regardless of the asset class.

Did not cause any problems for the trust. Indeed it still exists, now as an ETF. Everything was just fine. Those people who tried to arb trade it, locking their funds in it for 6 months, got burned but that's part of the risk of being a trader. People might get burned going leveraged long on MSTR but Microstrategy will be just fine.