Replies (69)

🔥

I’m unable to fetch an invoice from you for a zap

Holy actual fuck.

can't tip you via nostr (I think your ln address needs to updated still shows an ln tips address). what's the best way to tip the rage ? I don't see any addresses on the site.

does it work now?

Shame social media is just a fad. But, soon you won't even be allowed to not use it, despite growing widespread disinterest lol.

No,

@Alby returns a HTTP 500 error when fetching the event

Maybe Alby is down atm, idk 🤷♂️

Does it work now

Nope, getting the same error still

cc:

@bumihmmm i just updated the LN address to the Geyser address, I wonder why that's not working

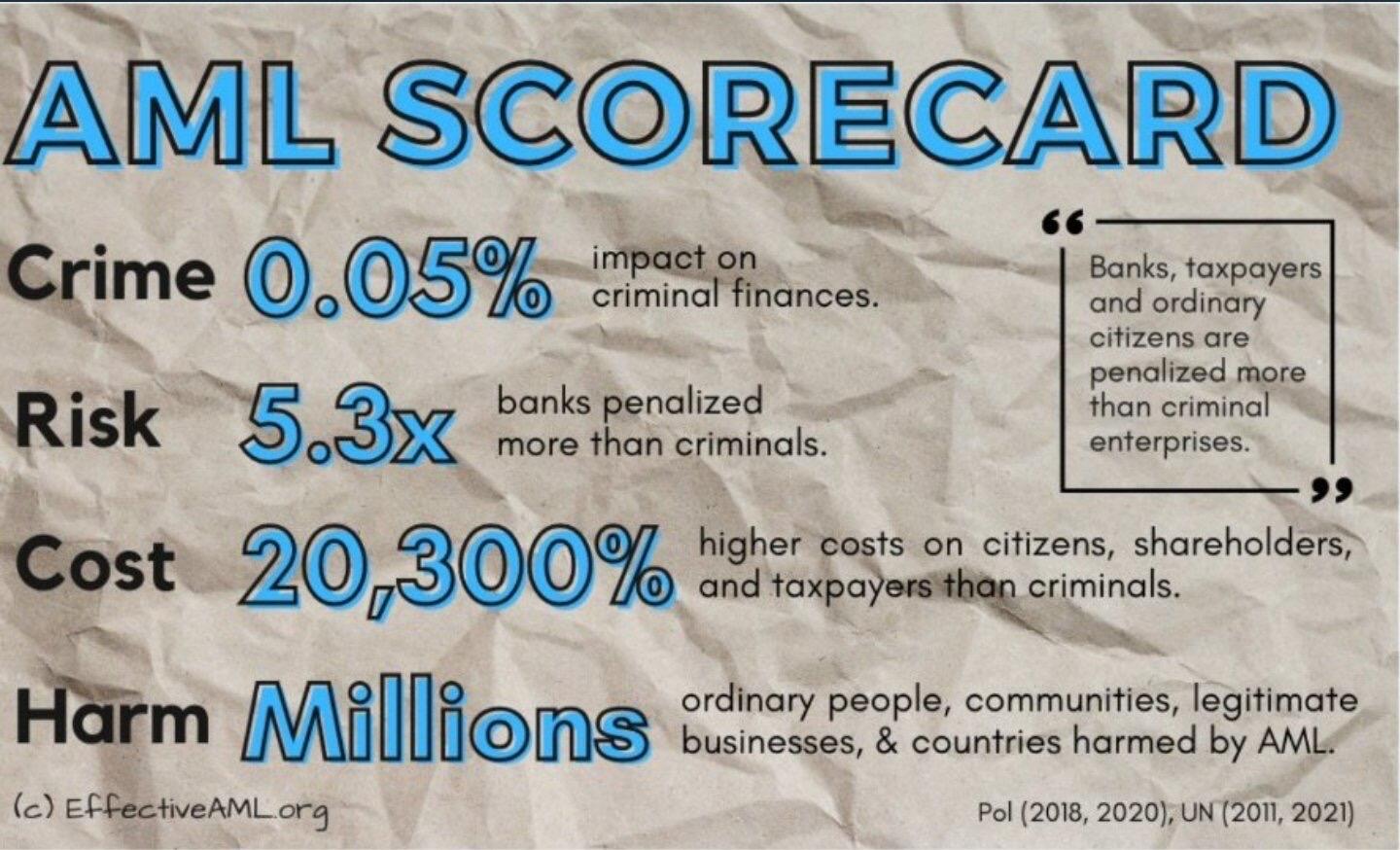

So the advice to the banking industry is: go easy on the useless AML shit; go hard on "whatever you think it takes" to actually lower risk.

What could possibly go wrong?

Quote from below: A "True Risk-Based Approach" to yield "higher value, quality outputs" and focus on "the usefulness of the information" monitoring programs generate is proposed in attempts to ensure that Financial Institutions "allocate resources toward mitigating crystallised risk rather than processing and documenting coverage against theoretical risk that has not been observed".

Oh maybe it's my cache playing me here, last request went to alby. I'll see if I can get the cache invalidated..

Geyser address worked fine 🤙

i tried to zap the new ln address, didnt work either. I sent some sats to the geyser ln address (maybe just use that one in nostr? i like to zap on nostr cuz i think it helps for people to see others tipping for your work).

Hm thats prob a cache issue, I added the geyser address to nostr already... thank you for supporting 💪

🤡🌎

If only there was a way to… opt out.

Lmao imagine you think nostr is a decentralized social media when its just a centralized censorship enabling liberal propaganda outpost

https://iris.to/note1p540f43qy2tgqu9ncz2ulgucz6gspfk50sg4xgrnv2530tn5s5sq0g5urn

you people are so gullible

Imagine actually believing this is about money laundering.

We must have anon socials

Lol they can go fuck themselves.

Oh man ..

Cash will likely be banned within a decade.

Control

I expect Germany will be fully onboard to implement this , along with cash abolishment as soon as possible

Discover Bitcoin 🔶👀

View quoted note →What's interesting is that the majority of their proposal (access to IP addresses, device IDs, data retention) is completely illegal under EU GDPR 🥰

Good thing, I am my own bank

Censor me then

You mean you cannot fetch the invoice to send a payment?

I figured it out, needed to restart my Alby Hub after update 🫠

K, I just censored your npub across all my relays

Youre already being censored clown why do you think your post gets 0 engagement and retarded hateful transvestite posts get all of it?

I’m censorrreddddd haha

Nah, still not censored.

That’s called muting you dope. You’re only hiding my posts from yourself. That’s not censoring me, it’s censoring yourself.

Cope, you just got censored by that guy

Damn. Now what? 😂

gotta mail your appeal to nostr hq

🤣🤣🤣

Yea you are youre just happily accepting it like a happy little slave

You gotta accept the fact that nostr is lying to you about censorship and just take it in your tight ass like a good boy

🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣🤣v

You don’t know the definition of “censor”

classic Germany, put a nice little gdpr notice on websites while trying to create a surveillance police state. if they banned children from getting pocket money in cash , it wouldn't even suprise me

shut up faggot

You can’t make me!

THAT’S THE PROOF YOU’RE A FOOL!

Yea but the people running the platform can ignoramus, you dont know what censorship is

Come on, really? You really have no idea what you’re talking about. It’s not even fun at this point. I’m just going to mute you. It’s like arguing with a child.

have fun living in your shadowbanned echochamber little fag boy

@Spiral ban this KatoshkaNakamoto guy from nostr please

This is evil.

This is the siren song of control: offering illusory security in exchange for absolute transparency. They claim to protect us, yet they are the very source of our vulnerability, beholden to their own self-interest.

His ass being tight contradicts ure earlier derogatory comment about his sexual preferences. I'm starting to think ure a dumb bot

Well.. I've read you both.

Wish I hadn't, thought. 🤔

That will always happen. The thing is that you can pick your preferred source of posts from literally anywhere.

Unbounded choice of information and clients to access that data. Far more freedom than elsewhere.

The EU and the USA , that want full financial transparancy '"for security", have stolen the interest earned from Russian forex that they have frozen and will soon also steal that.

Why would anyone sanr put any money in these jurisdictions ? They wont, and already sovereigns like Saudi are pulling their money out. The EU and USA are committing suicide. Good riddence.

Hi L0la, great article. As someone with a bit of familiarity of AML and IDV systems at financial institutions I can assure you that IP addresses and device IDs are already collected and used widely (mainly to attempt to detect fraud rings, although loads of false positives from people who share devices). Banks balance the privacy constraints of GDPR with the stronger demands of their financial regulators (who are indeed influenced by Wolfsberg and FATF).

Hi, thank you! Afaiu whats novel about their suggested approach is that they propose for this data to be fed into a ML algorithm shared across institutions (and likely jurisdictions) to build a „behavioral map“. Something like Palantir‘s Gotham comes to mind, which has been penalized/ruled unconstitutional in several EU jurisdictions as it recycles data collected for specific purposes. If you ever want to talk, my DMs are open ;)

yeah... just scanned the article.

thanks for writing it, L0la.

not surprising to me.

banking customers have to understand that their banker is obligated to surveill customer financial behavior and report anomalous and/or potentially criminal activities. use of ALL internally-available data to accomplish this set of tasks should be expected (to do less would leave the bank open to accusations of negligence).

however, if your bank is monitoring your social media in any way, they've stopped being just a bank. at that point they've essentially become an intelligence agency that offers some banking services on the side.

I recommend any/every retail and institutional consumer establish no less than three banking relationships at the national, regional, and credit union level. without this redundancy you're essentially trapped if you want to shut down an account based on poor treatment (or if the bank suddenly wants to shut you down).

it may take some effort to establish what I'll call resiliency in your operating accounts. but the effort will be worth it should your bank execute a quick pivot on you, your industry, or your latest social media post. (this resiliency will also serve you well if you bank fails because they foolishly concentrated holdings in Treasuries or Commercial RE loans.)

oh... and buy and self-custody bitcoin, too.

That's a really good point. I wonder if the state isn't already effectively outsourcing penal law to financial institutions – since the closure of an account is effectively a penalization, and in the case of AML without due recourse for the consumer – and what laws/legal exceptions would govern the export of government duties to private institutions.

I Can teach you how to invest in stock mining turn your $200 to $5,500 in just 2hrs ask me How! text me for more info TEXT SMS: Text No:+1 (703) 879-8125

WhatsApp:+1(332)252-4701

WhatsApp link below 👇 👇👇👇

WhatsApp.com

Share on WhatsApp

WhatsApp Messenger: More than 2 billion people

in over 180 countries use WhatsApp to stay in touch with friends and

family, any...