Idk who needs to hear this but in the Information age medium of exchange and unit of account don’t matter.

SOV Is the whole game

Login to reply

Replies (50)

peter schiff liked this note, but only because he thought you meant gold

Btw your nip-05 looks invalid.

Would have zapped but wouldn't matter

Sovryn?

stack sats & biochar 4 ur children

Like, technically?

Or like, as a use-case in general?

I kinda see what you’re trying to say

SOV that is gate-kept by government walls right ?

If Bitcoin doesn’t become the UoA, it will never be a long term SOV. It will not go up forever unless it becomes UoA. That is it. That is the note.

Bro what? They're all equally important. You couldnt acquire a SoV if it doesn't function as a MoE/UoA. You have to be able to exchange goods/services in a known amount for it to mean anything as storage🤙🏻

I disagree, bitcoin’s value won’t be as great as if it is adopted with MoE and UoA but bitcoin will still become more and more valuable as miners buy ASICs and electricity for fewer and fewer bitcoins.

Are you able to exchange gold for goods on the grocery store?

No and that's only part of the reason it sucks and failed

Bitcoin in "SOV only" phase is like Mike Tyson in the womb. The most dangerous money on the planet is coming for your moe.

"Medium of Exchange & Unit of Account don't matter" is twice as off base as "Store of Value doesn't matter" from the 20th century

Idk who needs to hear this but in the Information age medium of exchange and unit of account don’t matter.

SOV Is the whole game

View quoted note →

I’m not following my dude. Could you expand?

If we all puss out and let it be

We don’t have a medium of exchange or unit of account problem. The dollar does a pretty good job

We have a SOV problem. Well we had one.

If it becomes a store for more value, the dollar won't be a good unit of account any longer.

Medium of exchange matters if you can't exchange your other MoE for Bitcoin easily and securely/reliably.

It will become UoA by default once other currencies fail, or by proxy if it starts being used to collateralize other currencies.

If it becomes a store for more value, the dollar won't be a good unit of account any longer.

View quoted note →

Store of value is the whole game, for now.

Store or Value is a prerequisite for it to be a Medium of Exchange.

If, over time it is used more widely as a store of value, it will become a preferred MoE eventually.

Medium if Exchange is a prerequisite for it to be a Unit of Account.

If, over time is is used more widely as a medium of exchange, it will become a preferred UoA eventually.

So as long as you hold bitcoin, in the future you'll just be able to get coffee for free because you stored your value on chain? Sign me TF up!

Trust-less and permission-less transferability of the underlying monetary unit is a foundational component of #Bitcoin

I really think people have misunderstood the key limitations that led gold to be so completely captured.

It’s about SCALE of value transfer, not simply that it’s centralized into custodians. The larger the scale, the MORE captured gold is, rather than less. Moving $200 of gold is easy. Moving $2 Trillion is practically impossible. Entire countries neither hold nor settle their own, physical gold during deals.

This is perfectly opposite for bitcoin. The larger the amount the easier. The larger the amount the cheaper and move important and more astonishingly unique the degree of control and ability to safeguard, fine grain control and time for certain actions, to build vaults, to distribute politically, and 1,000 other options can exist to protect and remove trust in EVERY transaction of value above $1 million.

Sure we want this to be given to everybody, but the idea that a small country and stick the middle finger to a large one and keep their capital perfectly safe, is a world shattering shift in the power dynamic.

And there is no central bank in the world that can maintain interest rate manipulation against the market if $1 trillion in value can leave the country in under 10 minutes.

To add to this, it’s a permissionless and open network. In other words, ANY solution, or tool, or protocol we want to run on top of it, it doesn’t matter who has what coins, in which custodians, under what jurisdiction, they still can stop no one from launching their own system payment or cryptographic tool to solve whatever problem they seek.

What happened to gold will not come close to happening with #Bitcoin, even in the worst case scenario.

Whatever a Bitcoin “captured” world would look like, if things decentralize and we get trusted custodians as the dominant platforms and all that re-centralization that we got with the web… it STILL will be orders of magnitude superior to the fiat world we are currently in because even if it *fails* to conquer our entire vision, bitcoin still solves some of the most critical issues of gold merely as a global digital, permissionless currency backing, perfect collateral, and censorship resistant SoV.

IMO, it will be revolutionary no matter what. It is up to us *how* revolutionary we want it to be.

I dig more deeply into those key differences in this show if interested:

Fountain

Bitcoin Audible • Read_795 - Bitcoin is Dead (Long Live IBIT) • Listen on Fountain

"To put it simply, there are now corporations with billions of dollars of investment in not just the asset, but the ecosystem. Mining is a huge eco...

It's not a SOV if you can't money it when you suspect the custodian if fractionally reserve trading it.

What do you mean, I don’t matter?

But we’re comparing it to enough unit of account (typically USD) when transactions are happening right? I don’t necessarily disagree but at the same time the dollar or the medium of exchange we are “pegging it to” for the transaction serves as the UoA for now?

It to another*

That's also the same perspective it functions well as a store of value (because we all know 1BTC=1BTC). They are all linked and cannot function without each other. You cannot acquire a SoV if nobody can transfer (MoE) it to you and the amount to be exchanged must be agreed upon (UoA), even if everyone is simultaneously doing a forex calculator in their head back to dollars to double check🤙🏻

MOE matters for refugees in a hostile nation.

MOE matters for cross-border remittance.

MOE matters for people taking a stand against unjust laws.

MOE matters in a world devoid of paper cash, or the people excluded from the mainstream financial system.

MOE matters for victims of sanctions levied upon them by their own government.

wtf? no!

medium of exchange matters to a lot of people, if not the majority...

WAIT....

Real estate was just getting older and going down all these decades? And that among us, dwell evil beneficiaries of cantillon effect whose wealth increases at rate of nominal money/credit creation that far exceeded what normal people see as "real estate gains"?

Bitcoin has been the first thing to not only normalize the playing field, but also destroy the evil system too?

View quoted note →

It's not even money to start with so yeah, about correct.

This, in my opinion, does not contradict what I said.

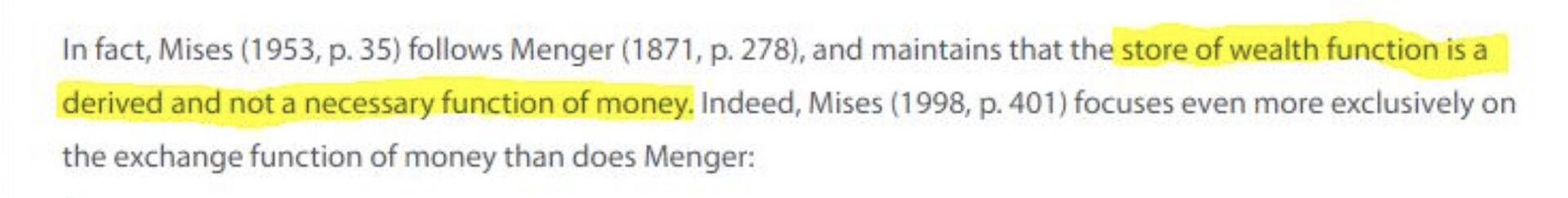

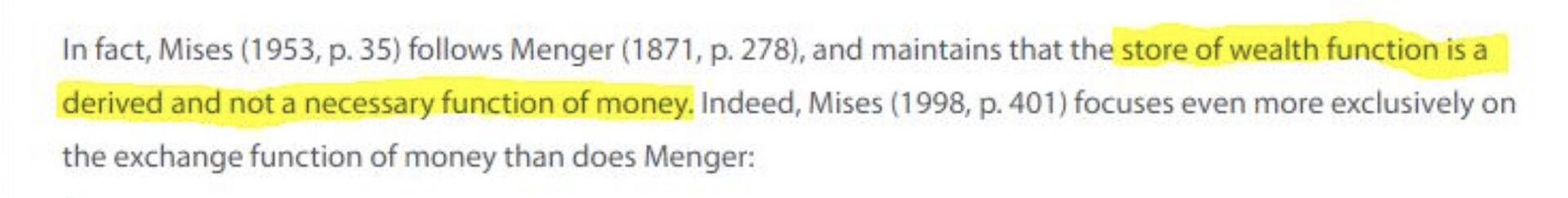

Mises and Rothbard are discussing the emergence of money as a concept. Ie why we transition from barter. It arises from the need to exchange goods and services.

I'm discussing the emergence of a new currency.

In a barter economy, people realize that some commodities are more stable / divisible / liquid, and use them as intermediary goods (money).

And then the market finds harder commodities that are harder to devalue.

And then the market accumulates capital and finds better stores of value.

But Bitcoin enters an established market economy where people's primary monetary needs are already met.

"Store or Value is a prerequisite for it to be a Medium of Exchange." and "store of wealth function is a derived and not a necessary function of money" cannot both be true.

Otherwise, something could be a money without being an MoE and, at least according to Menger and Mises, this isn't possible.

If your position is that you disagree with them then ok

I think the contradiction is surface level.

Something can be a store of wealth and not be money. Eg. real estate.

Money is by definition a medium of exchange, its "primary function."But not everything can be money. Value is a prerequisite, just like divisibility, fungibility, etc.

Language:communicating :: UOA:money?

Maybe ecash mints can prove units of account can be “translated”.

Scale of value transfer makes sense for one of the reasons why gold was captured and vaulted.

💯

🎯

Yes, and the argument is that Bitcoin more resembles digital real estate

Menger/Mises are saying the exact opposite of your last point. According to them store of value *is not* a prerequisite for money. But if you think they are wrong that is okay.

Seems logical that people globally will store long term wealth in Bitcoin, keep medium term savings in USD stable coins to manage Bitcoin’s volatility, and transact for daily needs in their local fiat currencies.

I think you're missing the context of that quote. Anyways, I think what I think.

That's the power of Bitcoin. It's wonderful and so necessary. A sound reserve asset.

It will be accompanied by Monero which is a much better currency, money, medium of exchange and digital cash than Bitcoin

Yup. You either use it or it is by definition a ponzi scheme. TANSTAFL

Value is subjective. See diamond–water paradox.

Also, consumption requires production. We don't live in the metaverse.

Also, consumption requires production. We don't live in the metaverse.

GitHub

Lunar Fallacy

Bitcoin Cross-Platform C++ Development Toolkit. Contribute to libbitcoin/libbitcoin-system development by creating an account on GitHub.

Subjective theory of value - Wikipedia

Paradox of value - Wikipedia

brb gonna eat my information sandwich

![[ARCHIVED] Jay's avatar](https://i.nostr.build/9NquibWjyPXiz2Q4.png)