Yesterday's first Digital Assets Subcommittee hearing has us down bad for privacy, my guys.

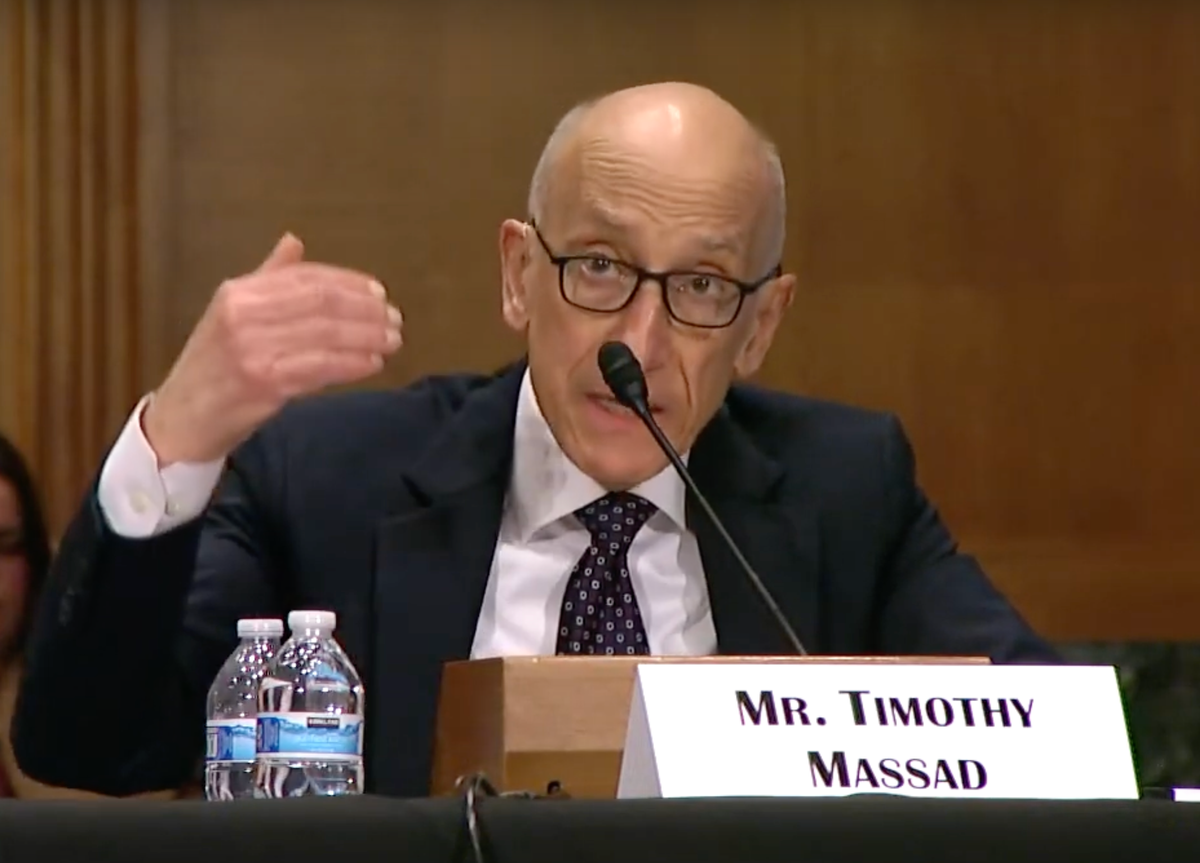

As stated by former CFTC Chair Timothy Massad, self-custodial wallets are the reason we are seeing digital assets used for sanctions evasion, money laundering and Hamas financing, with other witnesses piling on the lack of KYC.

Going purely on vibes, it seems plausible that we may see Congress attempt to rewrite IEEPA and US Code to apply KYC/AML/CFT requirements to self-custodial wallets and decentralized services as suggested by the Fifth Circuit's Tornado Cash sanctions reversal as well as Financial Action Task Force virtual asset guidance.

S/o to the retards calling this administration the "Bitcoin President"

Full Story:

The Rage

First Digital Asset Hearing: Self-Custodial Wallets Are Hamas

At the first Digital Assets Subcommittee hearing, terrorist financing, KYC requirements and sanctions compliance loomed over possible stablecoin re...