Replies (43)

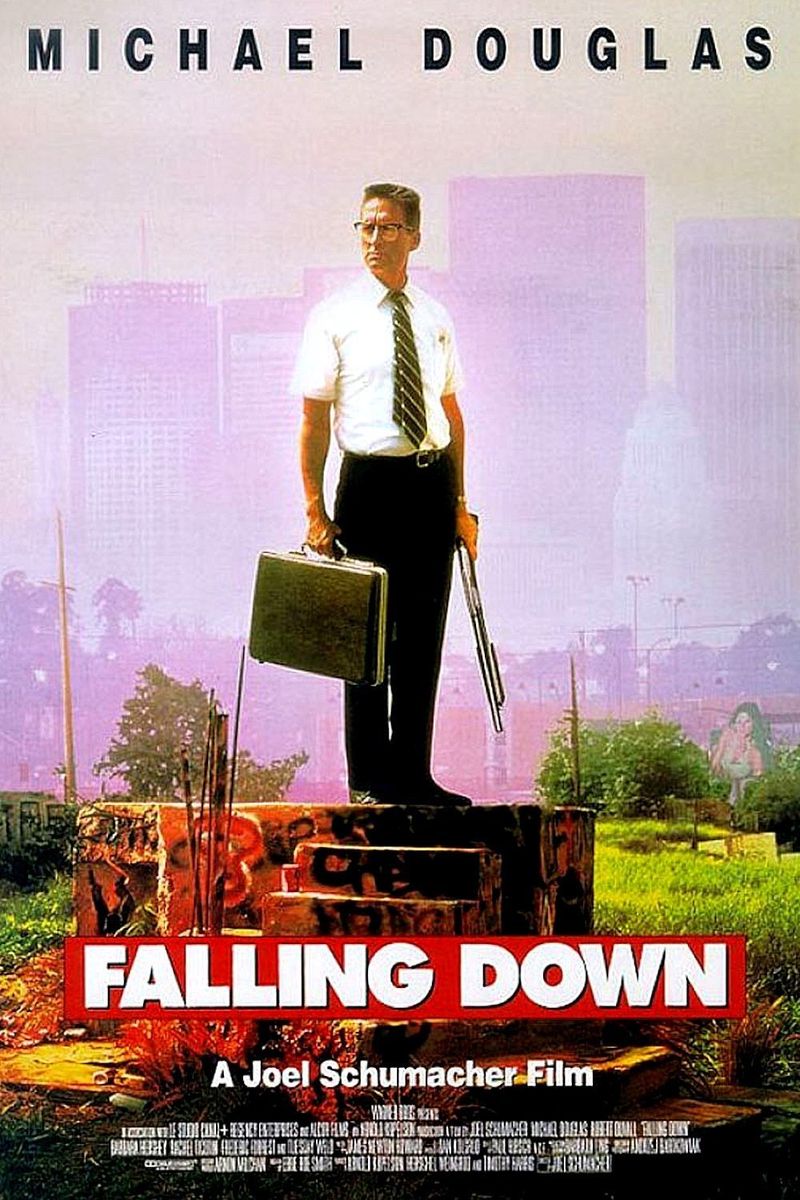

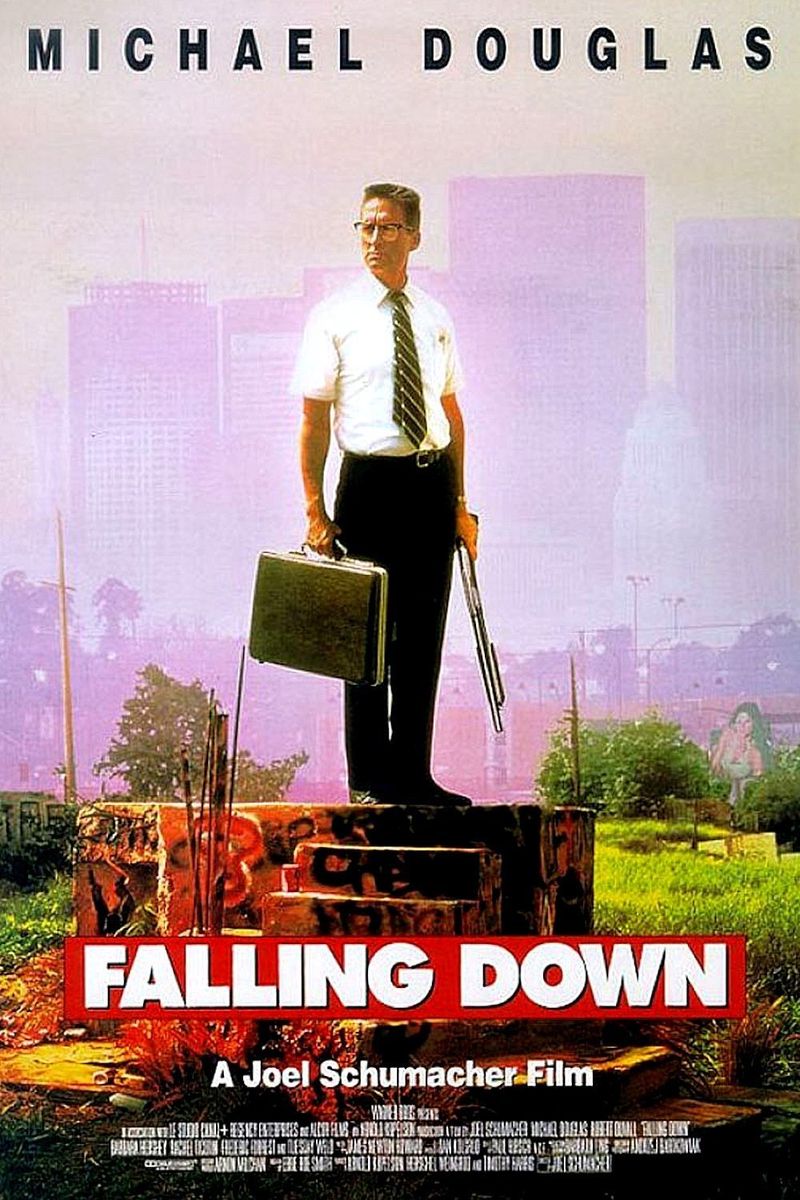

GHAYYYYY BULL MARKET 😤

That’s good writing right there 🚁😁

I'm ok with something like this

bitcarnicoin

bitcarnicoin

Congratulations everyone for being part of the most boring bull market in history. Aren't you glad you gave up having a life to stack sats and witness this incremental improvement in purchasing power. Who needs parabolic runs when you have dwarf pumps with months of consolidation.

I keep saying that I don’t even believe we are in a bull market.

This seems pre bull to me.

View quoted note →There was a lot of market manipulation. We should be happy Bitcoin stood the test, they could not drive it down.

I ain't in this to get rich I believe in better money for better society.

My stack is a future hedge against inflation and I'm trying to spend more sats to help drive adoption.

Watching the price is good for buying dips but if you're not rich with fiat than consistently putting away a little each month is more effective anyway

Bull keeps shifting to the right. You are poor at recognizing patterns. Parabolic 3rd/4th quarter this year

stay humble and stack sats

Lol! Fuck the bull market! Let’s separate money and state! I want to see wall street jumping from the window!

I’m gonna get rich slowly, but not as slowly as people using the S&P.

There is no denying that anyone that got into bitcoin post 2019-2020 must be feeling a bit rug pulled.

Not by Bitcoin, but by the exaggerated expectations set by influencers and their inability to recognize that the paradigm has shifted. They still double down on ridiculous price predictions in the short term. The few that know they were wrong abstain from making price predictions.

If the red line happens this seems fine to me. Same growth, just more stable.

This is good for the network.

antifragilemoney

antifragilemoney

The problem with major custodians Coinbase, BitGo, Fidelity, is that any bitcoin held is tracked in a private, centralized, manipulatable database. Not subject to outside verification & public scrutiny (of entire holdings). This tees up a perfect follow up for the timeline; Mt Gox, FTX, ....

View quoted note →

antifragilemoney

antifragilemoney

The problem with major custodians Coinbase, BitGo, Fidelity, is that any bitcoin held is tracked in a private, centralized, manipulatable database. Not subject to outside verification & public scrutiny (of entire holdings). This tees up a perfect follow up for the timeline; Mt Gox, FTX, ....

View quoted note →

Could be spot on 😂

Both of you delete dis plz

So much algo buying/selling now

That looks like the beginning of a monster parabola to me

It’s about purpose. This is a long term revolution both monetarily and spiritually.

Narrator: the red line did not happen

if you don't get rich from your stack, then bitcoin would not have succeeded and therefore did not society better.

without a massive increase in purchasing power, bitcoin's effect on the world and society will be even more diminished than it already is (via the shift away from self custody to paper IOUs)

Just a continuation.

$1M - 2028

$10M - 2031

$100M - 2034

Possibly higher? Probably measured in oz of Gold by then as there won't be anymore FIAT.

#copium

Bull ant 🐜 cycle

It's a healthy bull market, imo. And now that bitcoin is a $2T+ network, it's normal for it to move like a more liquid asset should.

And it's still up like 8x from the 2022 low. The S&P 500 is up less than 2x.

View quoted note →🥱

So we ready peaked. Worst bull run ever

"Bitcoin is a bad investment cause it's too volatile"

"Bitcoin is a bad investment cause it's not volatile enough"

Retards gonna retard.

Its not about getting rich. Its about being able to actually save for retirement without having to trust the wall st. casino with all your money.

“It’s so boring!” 😫

I guess that means it’s becoming money.

As a retard myself, I say that the last sentence is spot on.

Bitcoin is he like hey I’m sable now see 🤣 Get these SATS.

Love that it's boring!! If it goes up 30% a year for 5 years, it gets us to 500K, and in 10 to 1.6M. I'll take those odds. And 30% is boring. We know it won't JUST do boring for 10 years. It can't.

agree to disagree.

number go up is the best indicator bitcoin is working. at least at this early stage of its life the massive gains are necessary to make any impact at all on the fiat system

$120k and this guy's like "the gainz aren't massive enough!!!1" lol

nope, that isn't what happened. you invented that sentence and quoted yourself.

2.2 trillion is not even a drop in the ocean. if we don't at a minimum surpass gold (another 10x), it won't be impactful. not saying 2.2 trillion isn't great (that is your projection), I was referring to the previous guys comment that he isn't in it to get rich.

my point is, if you're in at this point at any meaningful scale, you will get rich if bitcoin succeeds.

If it takes 50 more years to overtake gold, will you consider Bitcoin a success?

I don't have an answer to your question. If gold market cap dropped to 5 trillion in 50 years or gold market cap grew to 100 trillion in 50 years, the answer would be very different ;)

Bitcoin has yet to be boring.

Investing and getting actually rich is boring.

💯

Boring is good. I'm in it for the long run (which at my age is in fact not too long!👴 Parabolic is suicidal.