I like owning as much bitcoin as possible and no fiat as well… so check this out:

We are working on a line of credit product that will, in real time, extend a credit line against your BTC to make Lightning payments, pay bills, etc. This way, you don’t have to part with your bitcoin OR own fiat to live in today’s society. Hoard bitcoins, borrow fiat paper for payments.

You can manage the line of credit and pay it down via your direct deposit or any other funding method. It works just like a credit card today, except it’s secured with BTC, so the terms and everything else about it is way better.

This will allow living on bitcoin and speculative attacking fiat at a massive scale for all. A true suite of bitcoin banking services that feel natural and easy.

I cannot wait to launch everything we are building

View quoted note →

Login to reply

Replies (129)

Phenomenal work, mate

Wen usdt/bisq liquidity, ser?

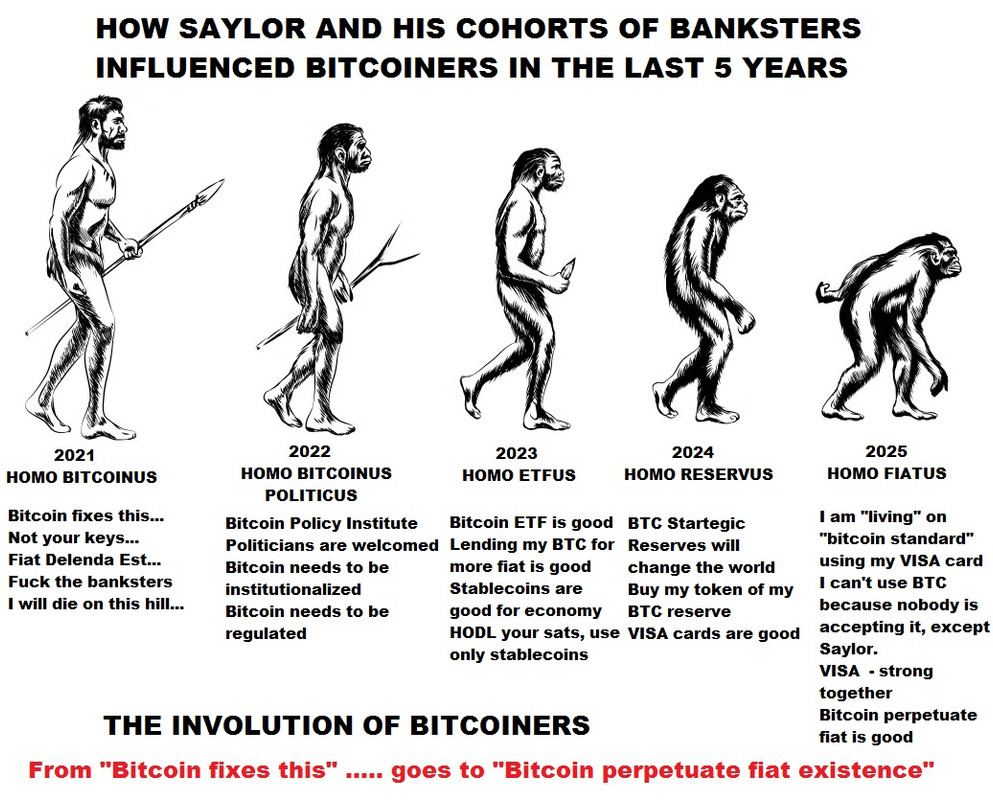

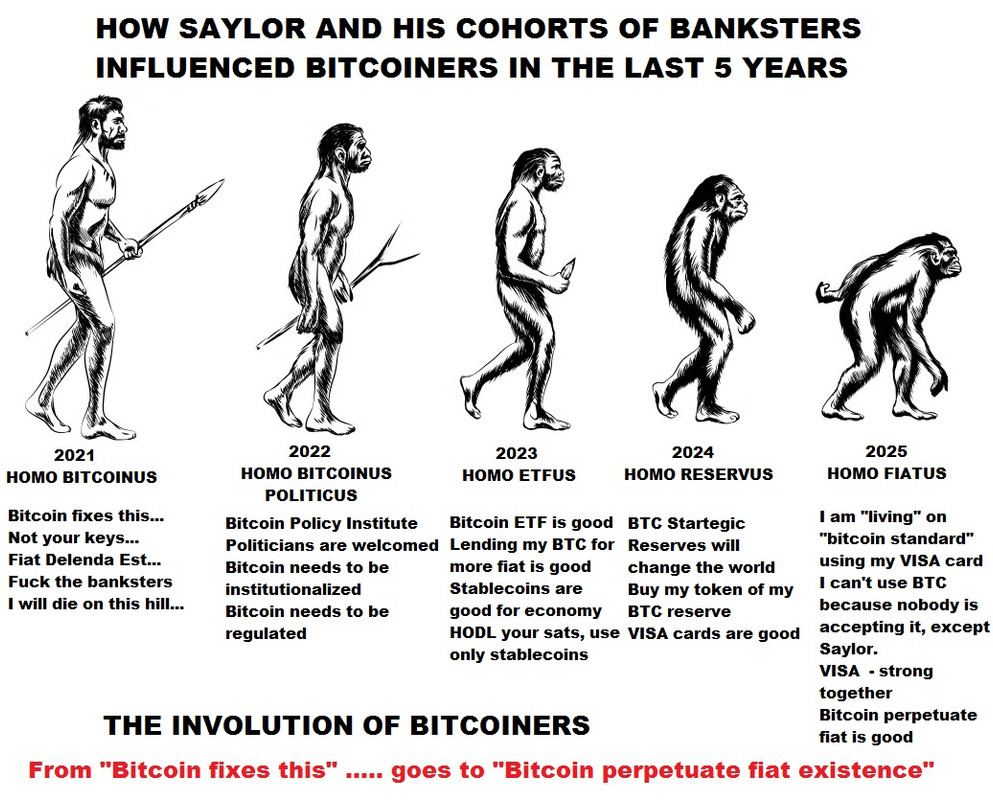

This is the end of Bitcoin.

Few understand.

They make you believe you live on Bitcoin while actually you are still supporting the fiat system slowly pulling the plug on Bitcoin.

Nicely worded as "live in today's society".

Real adoption has no place for middlemen, be they CEX, ETF, custodians, payment processors.

Strike, BullBitcoin,... Nobody is in it for real adoption as it would be anti business.

Them being state licenced company doesn't really help with privacy/KYC either.

I like owning as much bitcoin as possible and no fiat as well… so check this out:

We are working on a line of credit product that will, in real time, extend a credit line against your BTC to make Lightning payments, pay bills, etc. This way, you don’t have to part with your bitcoin OR own fiat to live in today’s society. Hoard bitcoins, borrow fiat paper for payments.

You can manage the line of credit and pay it down via your direct deposit or any other funding method. It works just like a credit card today, except it’s secured with BTC, so the terms and everything else about it is way better.

This will allow living on bitcoin and speculative attacking fiat at a massive scale for all. A true suite of bitcoin banking services that feel natural and easy.

I cannot wait to launch everything we are building

View quoted note →

View quoted note →

You own no fiat because you use it all to service your debt. You own bitcoin because without it you can’t justify people giving you fiat to service your debt. Wealthy people don’t advertise.

Probably the latter. Though I'd love a Strike debit card that sells BTC for cash in the unfortunate cases when I need to withdraw cash from an ATM. Or that leverages the LOC. nonetheless, an easier way to withdraw cash while living on the BTC standard

I'd rather use a stripe credit card than anything re: fiat land

Bitcoin loans in the 3rd green year.

This can only end poorly.

Except for the people calling in over extended loans collecting all those sats during the bear market, works great for them. I can't be the only person to notice no one was launching Bitcoin loan products at $20k last bear. Just at $60k last bull and now again at $120k this bull. December launch right at the top incoming.

Disgusting

At this point, there is quite literally no point in holding fiat. Can’t wait.

⚡️⚡️⚡️⚡️

Jack you and the team at Strike are doing God’s work

Like a fold card with sats back?

What about car loans and mortgage payments? Some bills don’t allow you to use a credit card. What do you typically do in those situations?

Next year when we bottom out?

If the price bottoms out anymore this asset has failed!

Are you saying we have nearly peaked?

When Strike in Canada? 🇨🇦😩

Ask your lawmakers

Short it or your opinion is weak

Asking for a friend.

When Bitcoin reaches $1,000,000 USD + and you want to buy a home by either A) getting a loan against your Bitcoin or B) selling your Bitcoin how will you do this?

(Playing devils advocate)

In 5 years time, online surveillance tech is going to be so evil and powerful it will sniff out KYC free 🌽 from a mile away. Exchanges won’t want it, normies won’t want it, lenders will reject it, mixing services will be non-existent and if you can mix em the surveillance tech will pick up on it.

Have you got a future proof plan to use those sweet freedom KYC free sats?

When this thing rips to a milli everyone needs a plan on how to spend it (peer to peer) or borrow against it or barter with it in an incredibly hostile and surveillance saturated world. The freedom tools that work today are likely not going to exist tomorrow.

Holy shit

Take a lookatdis! Mallers Making Moves

View quoted note →

If you think we are in a bull market you are delusional.

Measure from ATH to ATH in each cycle to truly work out if it’s a bear or a bull.

2013 - 2017: $1,000 to $20,000 🐂 (20 x)

2017 - 2021: $20,000 to $69,000 🐂 (3.5 x)

2021 - 2025: $69,000 to $108,000 🐻 (1.6 x)

A 1.6x over 4 years (2021 ATH to NOW) is bearish as fuck.

Everyone can make their own decisions, but borrowing at all is not something we should regularly do. And additionally, the interest rate that one is likely to get on this borrowing will probably not competitive enough to consider it a "speculative attack". Rather, it will set at a rate that most likely makes it considered irresponsible borrowing in nearly all cases.

Unless there is some tax advantage to this borrowing that makes it all justified...

Just my two cents. DYOR!

View quoted note →

Legend 🫡🧡🫂

Sounds good, full demo is needed!

Nice to see more options. Be careful everyone using these products.

Good question. You would use the account and routing number in your Strike app and provide that information to the biller. When the bill comes due, you pay those bills with your bitcoin.

I don’t know why I didn’t think of that. 🫡

How are you handling taxes? I know Strike will provide accounting information each month/year, but you are paying capital gains taxes if it goes up, correct?

126k was the top, yes. BTC has died MANY times over the past 16 years.

Strike will provide a1099-DA for taxes during tax time. Yes, I expect to pay capital gains if I sell my bitcoin at a profit. But this is a good thing! It means you beat debasement at the time of sale. 😊

To go a bit further, in the near term we probably have 2 more really good shake outs to go. With the biggest, causing deepest pull back once everyone learns just how much paper BTC there is (on Binance mostly, but also likely on Coinbase)…that will be the biggest test of those holding in cold storage if they buy THAT dip or throw in their final towel.

I know it would be more convenient. But whats the selling point for using strike for my daily fiat payments instead of my regular bank account?

Maybe I misunderstood but I guess the line of credit comes with fees / interest

3 green 1 red. I didn't make the rules and I won't be gambling my sats that the pattern finally fails.

If you wanna gamble your sats go ahead. The entire point of my post is that I don't. Not that it will go up and not that it will go down. I buy sats and put them in cold storage. Simple, dumb, effective, safe.

>extend a credit line against your BTC

In other words: give me your BTC and I will give you fake money that I can create from thin air...

If you think $69,000 to $107,000 is a bullish move for the *hardest* money in the world over a 4+ year timeline - more power to you.

Record ETF inflows

Record BTC treasury company BTC accumulation

Record pleb stacking

Record mining hash rate

Record positive legislation

FASB accounting changes

1.6x from 2021 ATH - NOW in 2025???

🐻 🐻 🐻 🐻 🐻 🐻 🐻 🐻

Jajajaj Jack already being manipulated by his owners. Sad. 30 years old.

Those who don't understand a word you say outnumber you by a factor of x5 even here on Nostr.

I like the idea of a network with completely anonymous transactions but in practice you really shouldn't need them for everyday purchases, as long as the network is permissionless.

If you have a situation where you need to hide transactions there are other specialized networks for that.

Old scams: send me 1BTC and I will give you 2BTC back

New scams: extend a line of credit with me (in fiat, aka fake money) against your BTC

So, you want to buy a home using millions of dollars of Bitcoin in ~5 years.

All the Bitcoin was purchased with BISQ, robosats, mining, HODL HODL and p2p purchases.

Chain surveillance is 100x more insidious than today.

How would you buy a house?

Just happy credit cycles will continue, always nice to accumulate after 80% decline. Network is stronger after the shake out.

When bitcoin is 1m, everyone will want it. They're not going to say "no thanks, we don't want your non kyc bitcoin".

Hardcore Bitcoiners and OGs say they’ll never sell. They’ll borrow against it.

Goodluck trying to get a loan from *most* exchanges in 2030 and beyond if your 🌽 UTXO has been *muddied*. Especially in the millions. The median house price for many places will be 2-3 million due to rampant inflation.

I wouldn’t put faith into the *she’ll be right mate!* mentality in a highly adversarial near future.

Plan accordingly.

Saylor is fucking spook city man

I won't need to sell it. I'll be able to use it.

Sounds awesome! Looking forward to the launch!

You haven't been paying attention and aren't good at math.

First of all 20x to 3.5x is an acceptable drop but 3.5x to 1.6x isn't?

2nd. Leverage junkies and custodians papering instead of buying set the price, not buy and hold folks. Bears happen because a dip catches a paper custodian out cascade killing longs which catches the next paper custodian and so on.

Only 1.6x with all those new buyers and markets. You really wanna bet none of the custodians is papering? You really want to bet we won't hit a dip big enough to run their reserves dry?

Every cycle brings more true believers but it also brings more cheats out to use a name to line their pockets. I'm not a bear. I'm just not a moonboi with rocket emojis in my eyes. We will get there but only with the repeated sacrifices of the over confident. I'll be buying when the dip comes tomorrow or whenever it gets here just like I bought all the way down and all the way up before.

With real world daily Bitcoin usage at ~0.1% of the global population, do you really think you’ll be able to go to a realestate agent in 5 years, slip them a #opendime and get the keys to a house?

In the exact country, state and city you want?

Hey, if we can, I’m here for it :)

Hello sorry, we’re trying to boost our Geyser, any help is greatly appreciated 🙏🏻 have a blessed day! Anything helps 🙏🏻

Hi guys, please check out my @Geyser 🙏🏻 it’s for my son 🙏🏻 thanks so much

#GM #nostr #helps #thanks GM

https://geyser.fund/project/helpingoursongetspinalsurgery/?hero=gfdurably432

View quoted note →

They used to have to promise Bitcoin. Now bitcoiners are lining up for the promise of dollars.

3.5x to a 1.6x after record ETF inflows, record pleb accumulation, record treasury accumulation, FASB rule changes, record nation state adoption and favourable US legislation for Bitcoin is DOG SHIT 💩.

DCAing is the way. Buy the dips indeed.

I’m still not convinced this is a bull market because over the last 308 days we have seen zero price action.

Stay humble and stack sats for 12 years (2.5 cycles).

Sounds awesome! Looking forward to using it to slow my satoshi spend.

Because paper. The poor performance this cycle is central to my expectations and reasoning.

Most of those buyers are just lining up for Coinbase paper, aka mtgox 2.0. Crash is gonna be unbelievable if I'm right.

Thanks for explaining your rationale.

Hopefully 1 last cleansing of the degens and a 1 way ticket to the promised land for the patient sat stackers.

Same. Doing it daily

By secured do you mean as a personal balance or given over as collateral? Would be more intetested if credit line was a card with a rate based on both my credit score and simply a personal sats balance. It would be nice to have credit score mean something to Strike given it is regulated/kyc.

wanna know more details

Legendary

View quoted note →

I’d like a Strike Credit Card and keep 100% of my banking/finance needs on Strike

Does Strike show if you sold it at a profit on a 1099-DA?

I would assume so. I’ve only been with Strike for a couple months so I will know more during tax season next year.

You goddam crazy bastard, I'm in!

Can stacks face a margin call? If yes, which would most likely be the case for this to work, I’d suggest shying away and staying humble.

Borrow fiat, hodl sats, living the dream 😎

We are addicted to credit (which is debt from the lenders point of view)

Financial companies need this to make money, we need it if we wish to live a life we can't yet afford.

I do wonder if loading debt onto Bitcoin, will be the end of the Bitcoin Standard we have yet to adopt?

View article →

View quoted note →

God despises Usury, it's a grave sin. Be careful when you invoke His name and speak on His behalf.

On you go ! Great work

Maybe this is a stupid question, can the BTC stay in my hardware wallet while having this credit line open?

Impossible. This way they don't hold the collateral thus you can just leave with the money.

Exactly. KYC free networks are not practical on a large scale.

They have specific use cases.

Why would you want to pay it down? Wouldn't the ideal be a revolving line of credit with no maturity? With the right amount of BTC against the expenses, the LTV would trend down forever.

Seems that most big players are cooked. Bitcoin only have the Plebs🤝

I would not call myself a "pleb". Pleb means slave.

Plebeians, or lower class “commoners”, are controlled by Roman Common Law to become the debtors. Patricians were the upper class who benefited from the credit of the people by making them both the creditors and the debtors.

Note: the origin of the name “court” is a place to trade debt and bonds; this has been going on for over 2000 years, and has not changed to this day.

A real bitcoiner is not a pleb, is a full sovereign individual. NOBODY is above him.

@wave.space 🇪🇺 Any idea 😉 ?

I emailed Strike this morning and confirmed that they will have a 1099-DA forms this year. 👍🏽

it took a week to transfer from my bank to my Alby hub ..until now it hasn't arrived . and even the developer alby hub didn't know what to do when asked for support regarding received transfer .

we have no power over our money cause when the money transfer arrived in 3rd party like Mt.Pelerin , Bitpocket or Bluemoon or rampant , then we can only hope the money arrived , cause the apps developer like Alby Hub , strike , zeus , bitpay, monero , or cashu or whatever they are not working together with the developer from the finance institution . that authenticate the transfer

they are separate entities that connected only with so called integrates system. ( indeed API ) so when the transfer stuck in those third party apps most likely Apps dev can not help to resolve the problem . this is something need to work on for in future . I pray and hope my transfer arrived

I would say it will took awhile before the big player like Apple Pay and google pay want to adapt the bitcoin payment system 😇

Admittedly I’m not a religious scholar. But I just read the gospels, and I didn’t see Jesus say anything about charging interest being despotic. In the parable of the talents, the master is actually angry with the servant

who burys the talents and gives it back, telling him he could have at least deposited it and gotten back interest. Interest and lending money are not usury, they are productive actions humans partake in voluntarily. Usury is like loansharking, taking advantage of the uninformed and poor. As far as saying Strike is doing God’s work, maybe the Lord won’t agree with me, but IMO fiat currency is humans attempting to act as God. Fiat is a manipulation of time, an abuse of the laws of God, the silver becoming dross so to speak. Any entity pushing sound money and providing solutions in that arena to combat the current debt slave monetary system is alright by me, and I hope God would approve as well

would be cool if there was a no kyc strike wallet

like it used to be, i dont need all of the extras

We have something similar on the roadmap as well. The wavecard already allows you to spend Bitcoin anywhere globally, by selling it at the last possible second and funding the fist payment for a merchant.

You can either connect your LN wallet to spend from self-custody (via NWC) or store BTC on the wavecard custodially.

Technically, the custodial BTC balance could be collateralized for a loan that is also then folded back into the same BTC on the card, essentially working like a “boosted” Bitcoin position that is partly spendable without capital gains.

We’re on the same mission to not hold any fiat whatsoever, and to automate all liquidations into fiat at the recipient level, so that you, as a Bitcoiner, wouldn’t ever need to even care about any fiat balances.

I doubt it. Human nature to be lazy and look for the most familiar path. Right now that is IBIT and treasury companies, both coinbase custody. Someone else will come along with a new "easy" way that let's them fractional reserve.

I don't support legal interventions but I suspect that custodian reserves regulations are in the future if Master and Blackrock get burned.

That makes sense.

By plebs i mean all the people who believe in it, and run bitcoin, and see it as money and a tool for freedom

But i agree we are sovereign individuals not slaves. Mybe we should replace that "pleb" term

I think this influencers and CEO,s of big companys even in the bitcoin space want us to believe that we need their help and services to adopt bitcoin when we don't.

They clearly have an agenda and are not in our side

Real bitcoiners understand that the only way out is to live as much as one can(hopfully 100%) in a bitcoin standard and dont take part in the fiat circus and use their trash currency by any means

>They clearly have an agenda and are not in our side

100% You put the dot on i

Do you have any plan to launch Strike in Thailand?

@jack mallers - I've been trying to signup since Monday to your app. I cannot get past KYC. Apparently living on a sailboat and traveling around the world isn't part of the 'normal' way of life. I'm born US citizen, only a US resident, but currently don't have a US Cellphone or IP. Any help? Again, I'm fully legit and only USA on all documentation, permanent address is still US.

I get an email once each night from your support team suggesting things that haven't helped.

Thanks!

I’ve been asking for this at least for a year!!! Yes!!!

Can you hint at a timeline for launch?

Nope

Holy shit

View quoted note →

what email are you registering with? i’ll take a look

Other exchanges are still thinking in terms of fiat.

Strike is building for bitcoiners. 🔥🔥

View quoted note →

Still see no problem in this KUC crap, when Bitcoin and Monero without third parties done need it?

@jack mallers - Thanks so much, I'll send you a DM.

I'm not understanding what you are saying.

I think you are saying I don't need to KYC, so how do I get my USD into a coin?

@jack mallers - Just sent you a message in Primal

We're playing the same games in Bitcoin now 🥹

View quoted note →

Yep, that boy is a banker

who made this. are you the source?

yes. all me

Been waiting for a product like this 🫡

Excellent work

Babyface Mallers, sweetest hoore in town.

I wish I could put inside more fiat maxis stupidities, but wasn't enough space 😄

🔥🔥🔥

Ok deal

So Excited!

When proof of reserves?

Amazing lol

Of course they can. LTV baby. Usually 50% so when the dip hits hard you bleeeed!

Credit line that lets you earn sats for paying with direct deposit would be perfection. Airline miles are fiat…

Nice. Now see if you can outperform Bitcoin for 2 years straight.

Already did in 2023 and 2024

Good shit. You may be part of the .01% that can time markets consistently.

Oh boy. More power to you

Haha I wish I was 0.01% I’m really not that good.

I like how you try to pack lots of details into my general statements.

If you use Bitcoin as collateral for a fiat loan like @jack mallers, does it remain 'Sound Money' or does this function relegate it purely to an asset class?

View quoted note →

Via P2P markets like Bisq, Retoswap, Robosats, Vexl,...

Right, I'm aware of those, but how do I get USD onto them. Right now they only have offers accepting Zelle and it is limited on the amount, so would take months to aquire a coin.

"funding the fist payment" We call it the hard way ? 😄

Anyway, I love your service, and will continue to use it on a daily basis as long as I 'need' to spend my sats and use these bloody fiat

Nice catch 😂

When the government can basically print fiat out of fresh air.

Everyone should study Bitcoin.

View quoted note →

i'd want to get rid of my other cards and just use the Strike one for LOC.

A line of credit would be a God send.

Sounds bad ass. Looking forward to it

Dude the part about interest on cash is awesome. Not only good payout, but lending cash to bitcoiners is a lot more enticing than giving a bank my cash so they can buy treasuries. I don’t want to be a part of that

Jack “ the good goy” Mallers plan @jack mallers