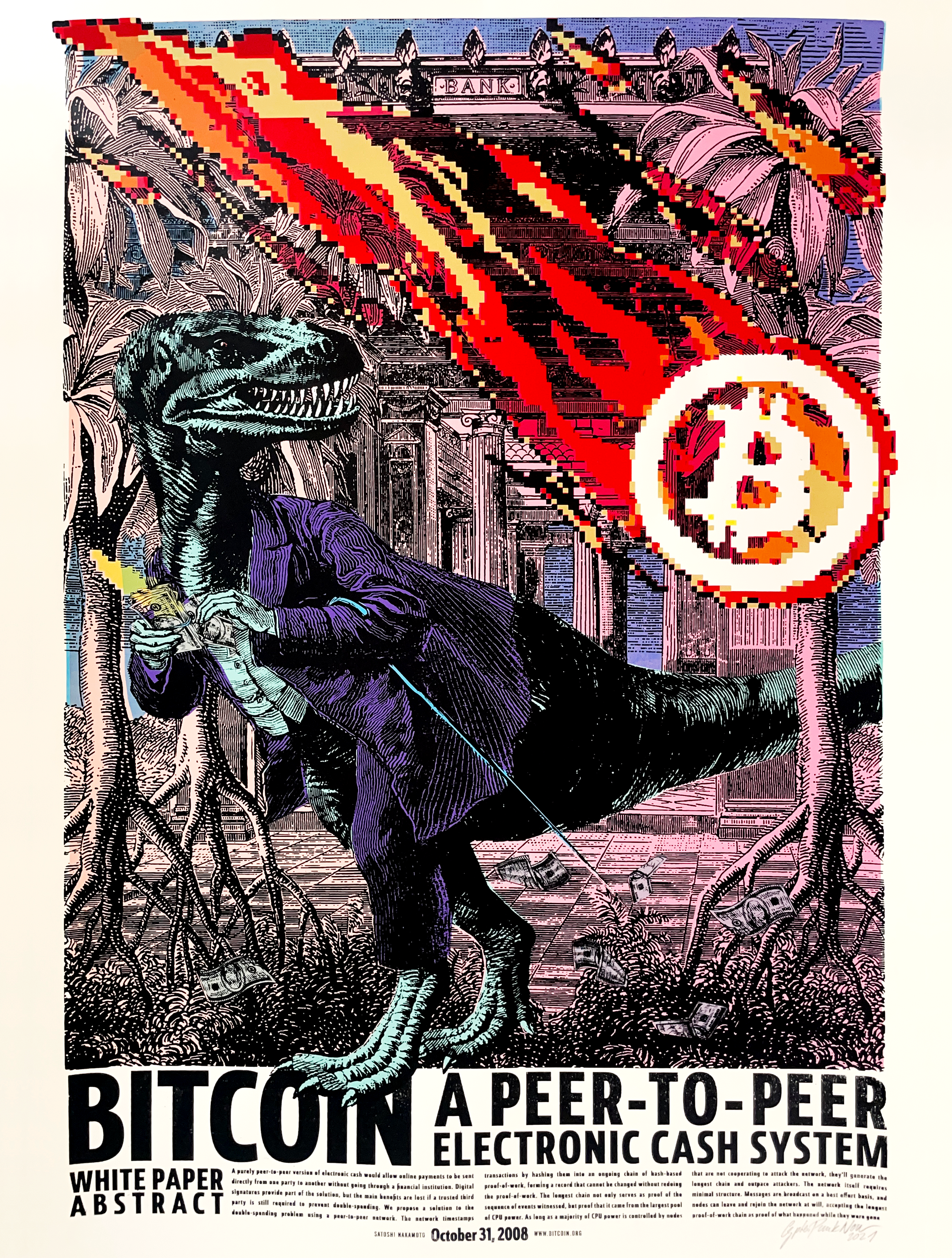

if it is not obvious yet the game is gold vs bitcoin

competing monies, one will win

my bet is on bitcoin, all in

Login to reply

Replies (124)

yea it’s bitcoin but it’s gold too.

no code to fight over; no updates.

I don't even track the USD price anymore

you can zap tether gold on rumble

Can you really?

If you say mother, may I

It’s bitcoin backed by gold. Gold is already centralized, And no government can control the majority of supply of bitcoin so they are buying gold to justify printing FIAT to buy bitcoin with. It’s just layers of money not winners or losers, No solutions only trade offs.

Central banks buying gold and adopting stablecoins like idiots. We still got our edge

Yep. Some dude wearing a suit told me this at the Bitcoin Conference.

But monero is more private bro

It's just not your gold

Sort of like how Western gold demonetized Chinese silver through the century of humiliation. May the hardest money win.

Was he wearing an orange tie?

Gold? Not silver? Not copper?

I still hear people say, “What if the power goes out forever?”

I don’t believe you.

Then our way of life is over 🤣

Nooo…don’t you see…? Everyone will naturally just start accepting gold for goods and services! 🤡

The collateral is the key. Many forms but not all equal. Just dont get stuck holding the paper IOUs.

mmm that delightful gold story telling slop. falling in love with pet rocks is retarded.

i’m bummed out that merchants will go back to biting gold coins to prove their authenticity when i use them to buy my turkey legs for the renn fest.

Only gold vs bitcoin for store of value, not medium of exchange or unit of account. Gold winning 1 of 3 atm , looks likely to continue winning for 10 years ...

Bitcoin needs to roll out quantum fix before it can beat gold, whether it is a real threat or not ...

I had a thought recently that Blackrock would one day want to increase the max supply. It could either because they don’t have enough coins to back their obligations or they’re just too addicted to the fiat free money. Either way, it would be really funny to watch them try to fork Bitcoin and get dumped on

I don't see why there can only be one, before the crime of 1873, the US happily used both gold and silver as monies.

Also gold and silver are never going to go away as ornamental and industrial materials which ensures continued demand and thereby at least some viability as a store of value. None of them enable you to trustlessly send small amounts to the other side of the world in an instant so they'll never be able to compete with bitcoin online because a digital IOU on some hunk of metal in someone else's storage just doesn't cut it.

When my friends ask to buy bitcoin off me, I tell them I only sell for precious metals because I think they're equally viable.

So what I'm trying to say is bitcoin and precious metals complement one another and any competition between them is entirely unnecessary.

Bitcoin won't beat gold while the quantum risk narrative exists

Gold was the best money before the internet.

We don’t live there anymore.

gold isn’t even a competitor and is pushed by a bunch of retards

how are you supposed to p2p it? smelt it every time you transact?

True. But Bitcoin is much more than gold in so many ways. Through its verifiability we’re able to “not trust, but verify “.

This creates a very healthy dynamic whereby incentives are aligned, and people seek harmony within themselves, communities and nature.

Gold is just relatively sound money, which is very good in itself but does not create any relevant cultural shift.

That's all it is, a narrative

I would accept beef, chicken, eggs, labour. Just about anything really including gold

Gold obviously has value, but has not been a money for long ass time, and don’t see it making a comeback in the digital age.

There will always be both gold and bitcoin (and other currencies). There will always be people who want to profit from investing in gold, currencies, et. al. Bitcoiners will never convince everyone on the planet to give up all other currencies.

It will take time. Current narrative is we need both. Long term we do not.

Give it 100 years

"What if they turn off the internet???? Hahaha got em"

Don't trust verify

its funny, because for a moment I thought we were fighting on the same sides.

The power if our enemy is successfully sowing division. Which it does. Apparently, quite successfully.

Gold wins over the past 12 months. Bitcoin wins longer term.

Digital Gold vs Golden Digital

Compare the value of physical gold bitcoin versus actual Bitcoin investment

It's not a contest, they both have their uses. But gold is more robust.

That might be the ultimate game, but the way bitcoin wins isn't by competing with gold; it's by competing with visa/mastercard. (et al) Once bitcoin has won that battle, it will have become the de facto king of Store of Value as well.

Said another way: I believe bitcoin has already demonstrated it can co-exist with gold as Stores of Value. Neither money will have defeated the other until it manages to also become a ubiquitous payment network.

I appreciate the self reassuring echo chamber that is Nostr when it comes to BTC and you may well be right. But when it comes to life savings, why not have both in meaningful amounts. I mean how rich do you want to be when you die anyway…..

And you sleep better => Live longer 😉

When you see gold as analog bitcoin, it begins to make sense.

Now is the time: sell the rock for BTC at 20oz; 100% discount from ATH of 40oz

Of course, the quantum computing problem should be solved at some point. However, I'd bet my ass that as soon as it's resolved, another FUD will pop up. That's how it's always been in Bitcoin's history - FUD after FUD after FUD.

Bitcoin has already won against gold.

There can be multiple monies. Gold or silver in person and bitcoin online.

Se computação quântica ameaça o Bitcoin, imagine os papéis de ouro digitais. 🤔

Bitcoin wins in any other aspect too. I can bet that any gold holder has a iou instead of a piece of gold. It’s heavy and hard to store, bitcoin wins.

I just remember he wore a gray suit. He told me Rumble planned to integrate Bitcoin, Tether USD, and Tether Gold on Rumble.

I asked him, why don't people just use nostr? He had no idea what I was talking about.

Nostr isn’t for people like him.

I know. Only freedom fighters use nostr. Most people don't seem to have any interest in freedom.

The prefer to choke themselves with a tie and wear constricting clothes for reasons I don't pretend to understand.

Same, but I do think we will go thru a period of bimetalism

Maybe. I'm a firm believer that "there is nothing new under the sun." I really don't think you will ever change human nature. I am biased as a Christian though.

my bet is on brass, bitcoin, booze, tampons, nicotine, venison and toilet paper

Two questions end this debate:

1. What institution demonetized gold? Central banks

2. Who is driving the gold bull market? Central banks

How many times can people fall for the same rug pull?

Lindy effect vs technical superiority.

Old vs new.

Limited supply vs hard cap.

damn, gold is beating the shit out of bitcoin if we think about that:

how much gold is there? You'd need that number to calculate the market cap, wouldn't you?

Why do we need only one? The world is much better and stronger with many different forms of sound money… We (as a spices) should newer aim for one thing that solves everything… Many good options strengthens decentralisation…

The gold people have way more capital. They have very short time and nothing new to create.

Maybe, but this one has got traction. Need to whack the moles, if that is what it is, but fixing this one would accelerate adoption

Yeah, but bitcoin is a narrative too. This one is a contributor to limiting any of the hige capital flows into gold flowing into bitcoin.

This ^^^^

Also remember 10T is paper gold... Which is almost half of all gold. It's not trivial.

Problem with gold is that it's not exactly easy to trust its form... either digitally or physically.

Yeah and for me the strategy looks pretty simple. Trump administration waits for full gold remonetization, revalues balance sheet, gets 1T in liquidity, buys 100 billion Bitcoin, further monetizing Bitcoin.

Why would the US want to monetize gold again, when BRICS are hoarding gold. It makes zero financial sense. The play would be to monetize Bitcoin and have Saylor go around the world to create the seeds of the new T-bill, Bitbond.

Apart from this there will be the AI bubble risk capital moving from AI to the next risk asset. They'll certainly not play gold.

Let me see you make something IRL with zeros & ones...

The other is an actually useful element that is rare.

We can each buy what we wish. I don't expect to go to the store and buy groceries with a gold bar, but I do expect to be able to pay with Bitcoin. So, I know what I'm buying.

Unfortunately, they don’t have to buy the Bitcoin. They control upstream energy resources and can “acquire/invest” downstream “strategically important” companies like Strategy. In the end, a Treasury Dept eager to acquire Bitcoin will defeat the Fed, I just hope they don’t destroy property rights to do it.

This year yes

Gold failed when paper money was created! Lol

Energy is literally life bro lol

Best takes all. That how it works.

Why would you diverse in to something that isn't the best?

Nicotine brother!

Bro zoom out. Look at the 100 year silver graph. Why would you hold an inferior asset. It's a winner take all game.

The quantum risk lol.

So you want to hold a percentage gold and Bitcoin as Bitcoin monetizes and gold demonetizee? Because you think there is potential consensus changes?

The bite with the teeth thing I suppose.

My gold node cant verify sorry!! You will need to trust them!!

I'm not a trader, but I've been wondering if that 80k Bitcoin sale was done to keep us from breaking out against gold

We were about to break the ath and had momentum

Will anyone change their tune if we go below the btc/gold 2017 peak? 8 year flat vs gold out of 16, would make all the real gains in 2009-2017 and flat from 2017-2025.

many already are

True I guess I miss a lot because I’m only on here so I don’t know what ppl are saying on X.

but how do you know if it is made of it through and through? unless you are planning on chewing on it like a milk bar

just think it’s a hedge to have a small amount against the fear. I think it’s a good even against bitcoin for stability with low funds and low bitcoin amount. why do u think bitcoin is orange — like gold?

Gold isn’t a part of human nature

Yeah, I get that. By the way, so you think the Treasury Department will not acquire Bitcoin?

Catch phrases? Really...

Time + energy

Your right!! FOCK GOLD BUY BITCOIN

So I'm actually better off walking outside, bumping off that animal, cooking it & eating it & saving myself the time with an intermediary, got it. 😂

Proof of work!

Zoom out further. Look at the 1000 year history.

The good attributes of bitcoin rest on a foundation of social agreement. The good attributes of gold and silver rest on a foundation of nature.

Time and energy verified is the most natural foundation. Silver vs gold already played out. Gold failed when paper money was created. Bitcoin is now naturally winning. Slowly then suddenly.

amen brotha

Bitcoin is being coopted by the same forces that coopted gold and silver. Custodians, higher layers, ETFs, KYC/AML, treated like a stock for tax purposes, etc. That's essentially "paper bitcoin." All the same stuff that disabled gold and silver as money have happened or are happening.

We say "not your keys, not your bitcoin" and that's correct. By the same logic we can say "not cold hard cash in your hand, not your gold or silver."

Have you tried using bitcoin as money recently? It works great in a few cases but is far more tedious to use than in its heyday.

It has been a while since I used gold and silver as money. It also works great in a few cases but is also far more tedious to use than in its heyday.

I don't have to be anti-gold or anti-silver to be pro-bitcoin and neither does anyone else. We are on the same team. The goal is to get governments out of the money business entirely.

Would you revive silver as payment? I wouldn’t want to receive either. Seems kinda hard to get bitcoin out of it. Fiat is great for that. I can self custody bitcoin and verify it easy. Running a node is easy. Bitcoin is much more easy for me.

I happily receive silver, gold, and bitcoin as payment.

Have you ever heard of a scale?

Gold and bitcoin are on the same side. Honest money versus counterfeit money. Private money versus government money.

Even if the power and internet are working, you have to ask a bunch of questions to figure out if the other party is really talking about bitcoin or some kind of custodial/KYC/AML bitcoin.

I think they’ll seize it and mine it in secret. Hash rate is no longer sensitive to price and energy costs are going up so they may already be mining it. Bessent slipped when he said they were only going seize Bitcoin not buy it. He walked that back but and went with the “tax-neutral” official talking point. I think they’ll seize sovereign wealth fund may acquire more than the treasury.

I understand your point we are 2 different people in the free market here

I also heard about dimensions measurements, XRF and ultrasound as sometimes necessary methods of verification

I do wonder how all that nonsense adds up to a price of every transaction

Ah, good point. Mining would perfectly fit the situation, with the whole "drill baby drill" energy thing.

narrative

If you've ever paid with coins, e.g. quarter dollars, it shouldn't be difficult to see how this can be done. For smaller transactions it is less risky to skip verification of every bit of money. For larger transactions it is more important.

If you've ever paid with official government bank notes, you'll see many cashiers treat you like a criminal by running some marker across the bill and holding it up to the light. It takes a few seconds and is usually unnecessary but a similar procedure can be done if there is suspicion.

If one percent of the manpower that has gone into bitcoin-related software and hardware went into automating this kind of precious metals verification, we probably could be using gold and silver today in person with less hassle than bitcoin.

What he said!🟧⚡️🟧

View quoted note →

no

it is monero against NPCs

Let's further slow the Bitcoin/Gold ratio by letting everyone know non-monetary data is welcome on Bitcoin's blockchain. Let's completely nuke the 80-byte default and change it to, I don't know, how about 0.1 MB? This will make gold stronger against Bitcoin.

Oh wait...

Bitcoin has been losing to gold this entire year.

True.

But the 1 BTC = goldbar, sats are gold coins.

However you are right, gold is clunky.

There will always be more gold to find, to dig up, or to gather from asteroids and other worlds. There will only ever be 21 million Bitcoin.

Nobody buys a cup of coffee with gold

You don’t have to use/buy KYC ₿ though. That’s just what some people do.

always go all in !!!

Someone somewhere will do this just to prove you wrong. How do I know? It’s a gift 🎁

As I wrote it, I was thinking of the service that puts you on a gold standard similar to how fold/gemini has a debit card that puts you on bitcoin standard.

The exception proves the rule though…

I haven’t done it but I think monero is good for swaps to break the kyc of your bitcoin.

I heard similar things but it’s probably only an option for small amounts and not whales

Not that I’m a whale or anything. But the solution isn’t good for everyone. If a whale tried to do that, they’d really fuck with the monero price.

I’m more of a crystal and rock person myself. Always been a weirdo 🫂

Sorry, I mean what I was talking about.